Indian Diabetes Market Report: Patients, Prevalence, Oral Antidiabetics, Insulin and Diagnostics

Market Overview:

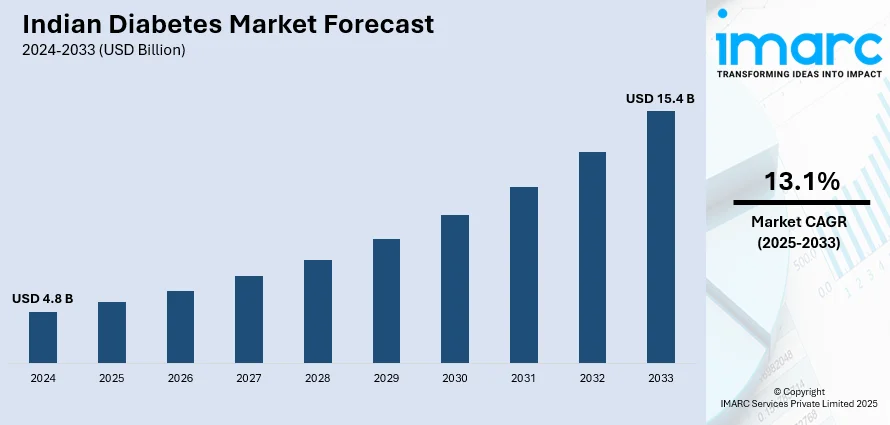

The Indian diabetes market size reached USD 4.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.4 Billion by 2033, exhibiting a growth rate (CAGR) of 13.1% during 2025-2033. The growing number of people with unhealthy dietary patterns and adoption of sedentary lifestyles, increasing investments by the Government of India in improving healthcare facilities and producing various novel drugs, and rising construction of hospitals, nursing homes, and clinics represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.8 Billion |

|

Market Forecast in 2033

|

USD 15.4 Billion |

| Market Growth Rate 2025-2033 | 13.1% |

Growing Adoption of Unhealthy Lifestyle Habits Impelling Market Growth

Unhealthy lifestyle habits, such as rising consumption of fast food and processed food, sleep deprivation, not exercising or indulging in any kind of physical activity, drinking and smoking regularly, and taking excessive stress on account of numerous reasons, can induce multiple chronic disorders, which including diabetes. At present, these habits are primarily seen among the young generation and the working population. The young and working population tend to consume processed and packaged food products that do not require cooking due to excessive work stress and develop an irregular sleep cycle, which ultimately makes them obese and diabetic. Apart from this, the constant urge to binge eat or order junk food online among the masses is further propelling the incidence of diabetes across India.

To get more information of this market, Request Sample

Rising Diagnosis and Treatment Rates Augmenting Market Growth

The rising awareness about the symptoms and adverse effects of diabetes is propelling people to take immediate action for curing or manage diabetes. People are now aware of the fact that detection of diabetes at an early stage and adaptation of adequate treatment measures can significantly delay the onset and progression of the complications associated with the disease. Moreover, the Government of India is taking initiatives to implement cost-effective measures for treating diabetes to make it affordable for all income groups and increase the availability of anti-diabetics easy in various rural locations within the country. In addition, result-oriented organized programs involving patient education, as well as updating the medical fraternity on various developments in the management of diabetes, are increasing the diagnosis and treatment rates of the diseases, thereby bolstering the growth of the diabetes market in the country.

The market for oral antidiabetic drugs is fragmented whereas the market for insulin is concentrated in nature with top players dominating the majority of the industry. The volume of new entrants in the patented oral antidiabetics and insulin market is low while in generic oral antidiabetics market it is comparatively higher. The product differentiation rate is high in patented oral antidiabetics and insulin market. However, product differentiation is low in generic oral antidiabetics market.

What is Diabetes?

Diabetes is a chronic disease that occurs either when the pancreas does not produce enough insulin hormone or when the body is not capable of effectively utilizing the insulin produced. It is differentiated into three types, including type 1, type 2, and gestational diabetes, which occurs during pregnancy in women. It propels the body to attack the islet cells in the pancreas that produces the insulin hormone. It raises blood sugar levels that hampers the functions of various organs and damages nerves and blood vessels. It shows the symptom of polyuria, which is a condition of excessive excretion of urine and polydipsia with a constant feeling of thirst. It also causes constant hunger, damaged vision, and fatigue in individuals. Diabetes can develop cardiovascular complications and increases the risks of heart attacks and stroke. It also assists in causing kidney failure, cataracts, retinopathy, and glaucoma. It disturbs the balance of fluid in the lens of the eyes, which ultimately makes it swell and causes blurred vision. It weakens the immune system, which produces an increased number of infections in the body, which include foot infections, yeast infections, urinary tract infections (UTIs), and surgical site infections, and takes longer to cure the infections. It is also capable of developing periodontal diseases, which is an inflammation of the tissue surrounding and supporting the teeth and enhances the formation of plaque around the teeth. Diabetes causes various skin diseases, scaly dry patches, bacterial and fungal infections, boils, and ulcers. It develops leg and foot diseases in individuals due to the degradation of large and small blood vessels in that area. It is diagnosed by finding the glucose level in urine or conducting a blood test to examine the levels of sugar. It is also detected by carrying out a fasting plasma glucose test or oral glucose tolerance test. Diabetes is primarily managed by controlling the consumption of sugar and carbohydrates and incorporating fiber into the diet. It is also managed by injecting insulin or using an insulin pump to deliver a regular dose to make up for the insulin, which is not produced by the body, especially in type 1 diabetes. It can be cured by taking certain medications, including biguanides (metformin), sulfonylureas (glyburide and tolazamide), glitazones (rosiglitazone), pramlintide, and alpha-glucose inhibitors.

Indian Diabetes Market Trends:

At present, increasing incidences of diabetes due to the rising consumption of unhealthy diets and the adoption of sedentary lifestyle habits represents one of the primary factors propelling the growth of the market in India. Besides this, the growing advancement in treatment and diagnosis to provide quality healthcare services to patients is offering a favorable market outlook. In addition, increasing investments by the Government of India in improving healthcare facilities and producing numerous novel drugs for the treatment of various chronic disorders are contributing to the growth of the market in the country. Apart from this, the rising construction of hospitals, nursing homes, and clinics is supporting the growth of the market in India. Additionally, the wide availability of blood glucose monitors for tracking blood sugar levels throughout the day is strengthening the growth of the market. Moreover, the growing prevalence of obesity among the working population is positively influencing the market in India. Furthermore, the increasing consumption of alcohol and rising smoking habits among the masses in the country is bolstering the growth of the market.

Key Market Segmentation:

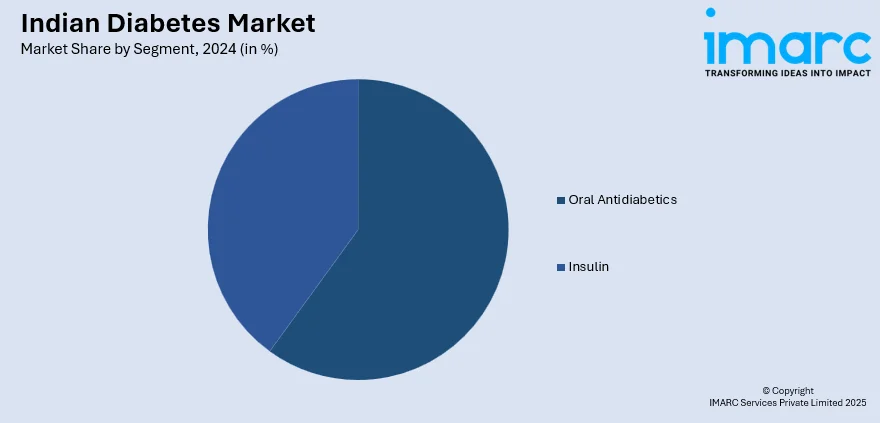

IMARC Group provides an analysis of the key trends in each segment of the Indian diabetes market report, along with forecasts at the country level from 2025-2033. Our report has categorized the market based on segment.

Segment Insights:

- Oral Antidiabetics

- Insulin

The report has provided a detailed breakup and analysis of the Indian diabetes market based on the segment. This includes oral antidiabetics and insulin.

Oral antidiabetics refer to medications, such as sulfonylureas (glipizide, glyburide, gliclazide, and glimepiride), meglitinides (repaglinide and nateglinide), metformin, thiazolidinediones, and alpha-glucosidase inhibtors (acarbose, miglitol, and voglibose). These medications can maintain blood glucose levels and facilitate weight loss in obese individuals. They are also capable of stimulating insulin secretion and reducing hepatic glucose production in diabetic patients. They do not cause any complications in patients and can be purchased from pharmacies after consulting a doctor. Furthermore, as oral antidiabetics are available at affordable pricing and are effective, their demand is increasing in India.

Insulin is a hormone that is naturally produced by the pancreas to metabolize sugar for energy. Insulin resistance is one of the major symptoms of type 2 diabetes, whereas, in type 1 diabetes, the pancreas does not produce insulin at all. In both cases, patients require insulin shots that are injected into their body. The externally provided insulin helps in moving sugar from the blood into other body tissues, wherein it is used for generating energy. Apart from this, the rising incidence of insulin resistance in obese individuals and women with polycystic ovarian disease (PCOD) is positively influencing the insulin market in India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Indian diabetes market.

Key Questions Answered in This Report:

- How has the Indian diabetes market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the Indian diabetes market?

- What is the impact of each driver, restraint, and opportunity on the Indian diabetes market?

- What is the breakup of the market based on the segment?

- Which is the most attractive segment in the Indian diabetes market?

- What is the competitive structure of the Indian diabetes market?

- Who are the key players/companies in the Indian diabetes market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian diabetes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian diabetes market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian diabetes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)