Agriculture Industry in India Size, Share, Trends and Forecast by Subsectors, 2026-2034

Agriculture Industry in India Summary:

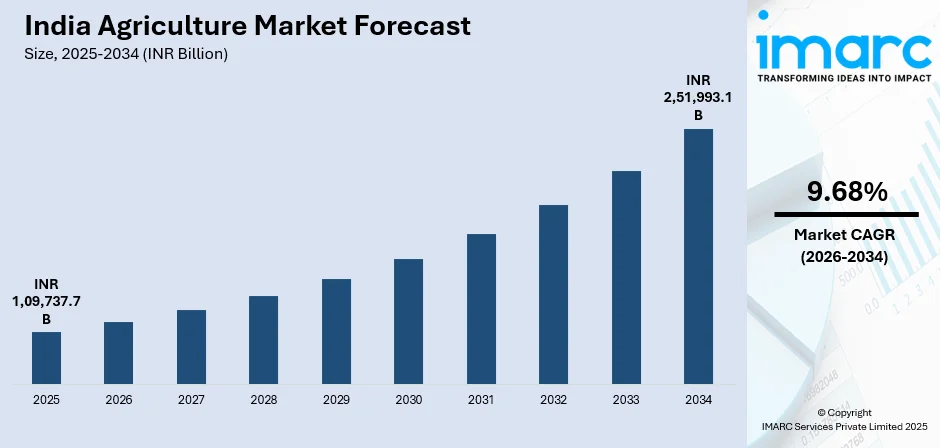

The agriculture industry in India size was valued at INR 1,09,737.7 Billion in 2025 and is projected to reach INR 2,51,993.1 Billion by 2034, growing at a compound annual growth rate of 9.68% from 2026-2034.

This growth is driven by government initiatives promoting precision agriculture, expanding irrigation infrastructure under Pradhan Mantri Krishi Sinchayee Yojana providing INR 21,968.75 crore to states, and rising adoption of digital farming technologies supported by India's agritech market. Apart from this, the sector achieved record foodgrain production, demonstrating resilience despite climate challenges and supporting the India agriculture industry share expansion across diverse agricultural segments.

Key Takeaways and Insights:

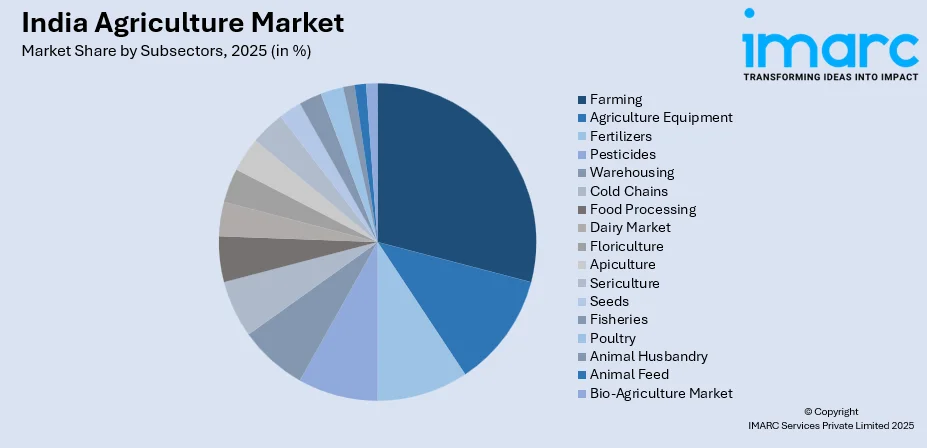

- By Subsectors: Farming dominates the market with a share of 18% in 2025, driven by assured government procurement under Minimum Support Price mechanism and strong domestic demand for various grains and pulses.

- Key Players: Leading Indian agribusinesses invest in digital advisory platforms, precision farming, and artificial intelligence (AI)-led supply chains. They partner with startups, expand contract farming, improve cold storage and logistics, promote sustainable inputs, and use data-driven credit and insurance to deepen farmer engagement nationwide. Some of the key players in the market include DuPont India, Rallis India Limited (Tata Chemicals Limited), Nuziveedu Seeds Limited, Godrej Agrovet Limited, Nestle India Limited, Advanta Seeds, Parle Products Pvt. Ltd., Britannia Industries Limited, and IFFCO.

To get more information on this market Request Sample

India's agriculture industry stands as the backbone of the nation's economy, contributing 17.8% to GDP in 2023-24 and employing 46% of the workforce. India’s agriculture sector is expanding beyond traditional farming into technology-led value creation. Farmers and firms are adopting soil and weather analytics, mobile advisory apps, and digital marketplaces to cut wastage and boost incomes. Crop aggregation models link smallholders with processors and retailers, increasing quality and market access. Supply chain gaps are being tackled through more cold storage, transparent pricing platforms, and targeted logistics funding. One notable example is the partnership between the government and private players on e-NAM, a unified market platform where farmers can compare prices and sell produce across markets electronically. This has helped reduce local price disparities and attract more buyers to smaller mandis. Input providers are promoting climate-adapted seeds and pest management tools, while agritech startups offer micro-credit and insurance products tailored to seasonal risk. Together, these shifts are improving efficiency and resilience for millions of farm enterprises across India.

Agriculture Industry in India Trends:

Digital Transformation and Precision Agriculture Adoption

India's agriculture sector is experiencing rapid digital transformation driven by precision farming technologies that optimize resource utilization and enhance productivity. Government-backed initiatives demonstrate strong commitment, exemplified by the September 2024 announcement of INR 6,000 crore investment in precision farming technologies including artificial intelligence, drones, and data analytics under the Mission for Integrated Horticulture Development, aimed at covering 15,000 acres and benefiting 60,000 farmers over five years. The establishment of 22 Precision Farming Development Centers nationwide facilitates technology testing and local adaptation. Internet of Things (IoT)-enabled farm management systems and AI-driven analytics platforms are providing real-time crop health monitoring through satellite imagery and NDVI technology, empowering farmers with data-driven decision-making capabilities that reduce input costs while maximizing yields.

Government-Led Modernization and Infrastructure Development

Unprecedented government investment and policy support are transforming agricultural infrastructure and farmer welfare across India. The Union Budget 2025-26 increased the agriculture budget from INR 21,933.50 crore in 2013-14 to INR 1,27,290.16 crore, reflecting sustained commitment to agricultural development. Direct income support under PM-Kisan Samman Nidhi transferred INR 3.70 lakh crore to over 11 crore farmers through 20 instalments. Digital Agriculture Mission implementation spans 400 districts in FY 2024-25, bringing 6 crore farmers under formal land registry systems through Digital Public Infrastructure, while Jan Samarth-based Kisan Credit Cards are being enabled in five states.

Climate-Resilient Sustainable Farming Practices

India's agriculture sector is increasingly prioritizing climate resilience and sustainable practices to address environmental challenges and ensure long-term productivity. Natural and organic farming expanded significantly, with 59.12 lakh hectares brought under organic farming during 2021-22, ranking India fourth globally in certified organic area. The government announced plans in Union Budget 2024-25 to introduce 1 crore farmers to natural farming over the next two years, supported by certification, branding assistance, and establishment of 10,000 bioinput resource centers. Moreover, renewable energy adoption under PM-KUSUM expanded solar pump coverage, with Union Agriculture Minister proposing field-mounted solar panels to transform farmers into renewable-energy suppliers in 2025. Horticulture production demonstrated remarkable growth trajectory, climbing from 280.70 million tonnes in 2013-14 to 367.72 million tonnes in 2024-25, driven by diversification into high-value fruits and vegetables.

Market Outlook 2026-2034:

The India agriculture industry is poised for transformative growth driven by continued technology integration across precision farming, artificial intelligence, and IoT-enabled systems, coupled with robust government policy support through enhanced MSP mechanisms, expanded irrigation infrastructure, and digital agriculture initiatives covering remaining districts. Agricultural exports are expected to maintain strong momentum, with processed food exports continuing to increase value addition. The market generated a revenue of INR 1,09,737.7 Billion in 2025 and is projected to reach a revenue of INR 2,51,993.1 Billion by 2034, growing at a compound annual growth rate of 9.68% from 2026-2034. The sector's evolution toward data-driven, resource-efficient management systems, supported by private sector investments and foreign direct investment inflows, positions Indian agriculture for sustained productivity growth, enhanced global competitiveness, and improved farmer incomes throughout the forecast period.

Agriculture Industry in India Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Subsectors | Farming | 18% |

Subsectors Insights:

Access the comprehensive market breakdown Request Sample

- Farming

- Agriculture Equipment

- Fertilizers

- Pesticides

- Warehousing

- Cold Chains

- Food Processing

- Dairy Market

- Floriculture

- Apiculture

- Sericulture

- Seeds

- Fisheries

- Poultry

- Animal Husbandry

- Animal Feed

- Bio-Agriculture Market

Farming dominates with a market share of 18% of the total agriculture industry in India in 2025.

The farming subsector dominates India's agriculture industry, marking substantial growth over previous year's output. This segment encompasses cultivation of cereals alongside pulses and coarse cereals production. Kharif foodgrain production projected at record levels demonstrates robust performance, supported by above-normal monsoon providing favorable growing conditions. Digital Crop Survey implementation in major states covering complete districts enhanced area estimation accuracy, leading to substantial rise in cultivated area particularly for rice in northern regions. Assured procurement under Minimum Support Price mechanism provides income security encouraging continued high-productivity cultivation, with rice procurement exceeding previous year levels and wheat procurement maintaining stable volumes supporting domestic food security objectives.

Oilseeds demonstrated remarkable performance, driven by soybean and groundnut production during Kharif season reaching substantial levels. Horticulture cultivation expanded significantly with production increasing, reflecting successful diversification beyond traditional food grains into high-revenue specialty crops including fruits, vegetables, spices, and floriculture. Indian Council of Agricultural Research projects food grain consumption will reach substantial levels requiring continued productivity enhancements. Self-Reliance in Pulses Mission launched for multi-year implementation aims achieving domestic self-sufficiency through enhanced production and assured MSP procurement for tur, urad, chana, and moong providing farmers with income security.

Market Dynamics:

Growth Drivers:

Why is the Agriculture Industry in India Growing?

Expanding Export Markets and Value Addition Opportunities

India's agricultural sector is experiencing robust growth through enhanced global market access and value chain development driving revenue expansion beyond traditional domestic markets. Agricultural exports reached impressive levels exceeding fifty billion dollars annually, with Agricultural and Processed Food Products Export Development Authority contributing majority share demonstrating enhanced international competitiveness. Government statistics indicate that the worth of agricultural product exports from April to September 2025 reached $25.9 billion, marking an 8.8% increase compared to the $23.8 billion for the same six months in 2024. Food processing sector transformation is evident through rising share of processed products in total agri-food exports, climbing from modest baseline to nearly quarter of exports within six years, reflecting successful value addition and quality improvement initiatives.

Enhanced Farmer Income and Rural Prosperity Initiatives

Comprehensive initiatives targeting farmer income enhancement and rural economic development are catalyzing agricultural sector growth through improved livelihoods and increased purchasing power in rural markets. Direct income support mechanisms provide crucial financial stability to farming households, enabling consumption smoothing and investment in productivity-enhancing inputs without distress asset liquidation during lean periods. Minimum Support Price revisions ensure remunerative returns across diverse crop categories, with recent adjustments favoring pulses and oilseeds showing remarkable increases over weighted average production costs, encouraging farmers to diversify beyond traditional rice-wheat systems into high-value crops aligned with nutritional security objectives. A unique Krishi event took place at the Indian Agricultural Research Institute (IARI), New Delhi, on 11 October 2025, during which Prime Minister Shri Narendra Modi inaugurated the Mission for Aatmanirbharta in Pulses (Dalhan Aatmanirbharta Mission) with a total budget of ₹11,440 crore.

Private Sector Investments and Agritech Innovation Ecosystem

Burgeoning private sector participation and vibrant agritech innovation ecosystem are transforming agricultural value chains through technology-enabled solutions, entrepreneurial ventures, and strategic partnerships addressing longstanding sectoral challenges. Venture capital investment in Indian agrifoodtech demonstrated remarkable surge with record funding across numerous deals during peak investment year, reflecting strong investor confidence in sector's digital transformation potential and scalability of technology-driven agricultural solutions. Foreign direct investment inflows totaling billions in agriculture sector and substantially higher amounts in food processing between extended period demonstrate growing international investor interest in India's agricultural modernization journey. Strategic partnerships between established agricultural companies and technology providers are revolutionizing traditional practices, exemplified by collaborations integrating advanced soil analytics, climate-resilient solutions, and precision farming technologies into mainstream farming operations. In 2025, The Asian Development Bank (ADB) sanctioned a $460 million results-oriented loan intended to upgrade rural electricity infrastructure, encourage distributed renewable energy production, and enhance agricultural efficiency by offering farmers dependable daytime solar power for irrigation in Maharashtra, India.

Market Restraints:

What Challenges the Agriculture Industry in India is Facing?

Climate variability and water stress

Indian agriculture depends heavily on the monsoon, which has become less predictable over the years. Irregular rainfall, longer dry spells, floods, and rising temperatures disrupt sowing cycles and reduce crop yields. Many regions face groundwater depletion due to excessive extraction for irrigation, while others lack proper irrigation coverage and rely only on rain. Small farmers are the worst affected, as they have limited capacity to absorb losses or invest in water-saving methods. Crop failures linked to weather shocks increase debt levels and income uncertainty, making farming a risky livelihood.

Small landholdings and low productivity

Most Indian farmers operate on small and fragmented landholdings, which limits economies of scale. Mechanization becomes expensive and inefficient on tiny plots, leading to higher production costs and lower output per hectare. Limited access to quality seeds, modern equipment, soil testing, and extension services further affects productivity. Traditional farming practices still dominate in many regions, slowing the adoption of improved techniques. Low productivity reduces farm income and discourages younger generations from entering agriculture, creating long-term concerns about workforce sustainability in the sector.

Market access, price volatility, and income instability

Farmers often struggle with unstable prices and weak bargaining power in agricultural markets. Dependence on local traders and middlemen reduces their share of the final consumer price. Price fluctuations caused by oversupply, imports, or policy changes make income planning difficult. Many farmers lack access to storage, cold chains, and processing facilities, forcing them to sell produce immediately after harvest at low prices. Delays in payments, limited awareness of market prices, and uneven implementation of support schemes add to financial stress and income uncertainty.

Competitive Landscape:

India's agriculture industry features diverse competitive landscape spanning multinational corporations, domestic conglomerates, cooperative societies, and emerging agritech startups driving innovation across input supply, farm mechanization, advisory services, and market linkages. Traditional players dominate fertilizer and crop protection segments, while domestic companies lead farm mechanization markets. Cooperative structures like AMUL demonstrate successful farmer-centric models in dairy sector. Emerging agritech ecosystem attracts significant venture capital, with startups disrupting traditional value chains through technology-enabled solutions spanning precision agriculture, supply chain optimization, and digital marketplaces. Foreign investment grows through strategic partnerships and technology collaborations, while government initiatives supporting Farmer Producer Organizations strengthen collective bargaining power and market access for smallholder farmers. Some of the key players in the market include:

- DuPont India

- Rallis India Limited (Tata Chemicals Limited)

- Nuziveedu Seeds Limited

- Godrej Agrovet Limited

- Nestle India Limited

- Advanta Seeds

- Parle Products Pvt. Ltd.

- Britannia Industries Limited

- IFFCO

Recent Developments:

- In December 2025, FMC India unveiled three new innovations in agricultural products during a launch event in Hyderabad, which saw attendance from the company’s leadership team in India and various customers. The recent introductions consist of an insecticide, a fungicide, and a crop nutrition solution, designed to tackle significant issues in rice farming and agricultural yield.

- In August 2025, Insecticides (India) Limited (IIL) has unveiled Sparcle in partnership with Corteva Agriscience, a worldwide frontrunner in agricultural advancements. Sparcle is a wide-range insecticide designed to tackle brown plant hoppers (BPH) and enhance rice production. Developed with cutting-edge chemistry from Corteva and IIL’s broad network and connections with farmers, Sparcle seeks to assist farmers in enhancing crop yield, quality, and profitability.

- In May 2025, Union Agriculture and Farmers Welfare Minister Shri Shivraj Singh Chouhan announced today the creation of two genome-edited rice varieties in India at Bharat Ratna C. Subramaniam Auditorium, NASC Complex, New Delhi. This signifies a fresh start in the realm of scientific inquiry and advancement.

Agriculture Industry in India Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Subsectors Covered | Farming, Agriculture Equipment, Fertilizers, Pesticides, Warehousing, Cold Chains, Food Processing, Dairy Market, Floriculture, Apiculture, Sericulture, Seeds, Fisheries, Poultry, Animal Husbandry, Animal Feed, Bio-agriculture Market |

| Companies Covered | DuPont India, Rallis India Limited (Tata Chemicals Limited), Nuziveedu Seeds Limited, Godrej Agrovet Limited, Nestle India Limited, Advanta Seeds, Parle Products Pvt. Ltd., Britannia Industries Limited, IFFCO, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The agriculture industry in India size was valued at INR 1,09,737.7 Billion in 2025.

The agriculture industry in India is expected to grow at a compound annual growth rate of 9.68% from 2026-2034 to reach INR 2,51,993.1 Billion by 2034.

Farming subsector held the largest share at 18%, driven by increasing demand for nutritious and diverse food options, achieving record foodgrain production supported by government procurement mechanisms, favorable monsoon conditions, and expanded irrigation infrastructure coverage.

Key drivers include technological integration through precision agriculture and digital infrastructure development, strong government policy support providing direct income transfers to farmers under PM-Kisan, expanded irrigation infrastructure under Pradhan Mantri Krishi Sinchayee Yojana, rising food demand from growing population, and agricultural diversification into high-value horticulture segments.

The agriculture industry in India faces challenges like climate uncertainty, water scarcity, small and fragmented landholdings, low productivity, price volatility, weak market access, and limited adoption of modern farming practices, affecting farmer incomes and sector sustainability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)