Copper Sulphate Market Size, Share, Trends and Forecast by End-Use and Region, 2025-2033

Copper Sulphate Market Size and Share:

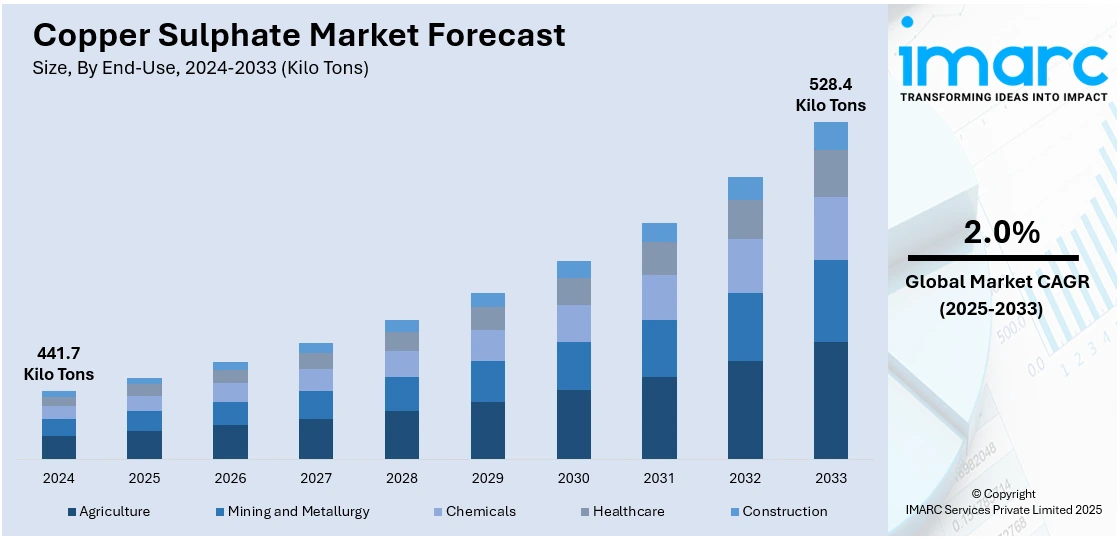

The global copper sulphate market size was valued at 441.7 Kilo Tons in 2024. Looking forward, IMARC Group estimates the market to reach 528.4 Kilo Tons by 2033, exhibiting a CAGR of 2.0% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 42.1% in 2024. The market is witnessing steady growth, driven by rising demand across agriculture, mining, water treatment, and industrial sectors. Increased focus on sustainable farming practices and expanding infrastructure projects are supporting its wider adoption. Continuous advancements in product quality and application techniques are also strengthening its presence across global markets, contributing to the overall copper sulphate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

441.7 Kilo Tons |

|

Market Forecast in 2033

|

528.4 Kilo Tons |

| Market Growth Rate 2025-2033 | 2.0% |

The copper sulphate market is driven by strong demand from agriculture, where it is widely used as a fungicide and micronutrient fertilizer. Growth in mining activities, where copper sulphate is used in flotation processes, also supports market expansion. Rising investments in animal feed additives, combined with industrial applications like electroplating and chemical manufacturing, further stimulate demand. Additionally, increased focus on crop protection and the need for higher agricultural yields are encouraging greater adoption of copper sulphate products across key global markets.

To get more information on this market, Request Sample

The United States copper sulphate market is supported by steady demand from agriculture, especially for use in fungicides, herbicides, and soil nutrient management. Expansion in industrial sectors like chemical processing and electroplating also contributes to market growth. Rising awareness about plant disease management and sustainable farming practices strengthens copper sulphate usage across farms. Additionally, its role in animal feed supplements and algae control in water treatment facilities boosts demand. Regulatory support for crop protection products further sustains copper sulphate consumption across the country. For instance, in March 2024, Sym-Agro® announced that the U.S. EPA approved expanded uses for Instill® Bactericide & Fungicide on Coffee, Potato, Hazelnut, and Sugar Beet. The product effectively utilizes copper sulfate for disease management, offering up to 21 days of protection. This development provides growers with a strong solution for high-value crop disease control.

Copper Sulphate Market Trends:

Increased Demand from the Mining Industry

The mining sector continues to fuel the copper sulphate market, particularly through its use in flotation processes for ore extraction. Copper sulphate acts as an activating agent, making it essential for separating valuable minerals like zinc, lead, and gold from their ores. For instance, In January 2025, India's mines ministry announced its plans to invest nearly $2 billion (Rs 16,300 crore) in its critical minerals sector, focusing on 30 key minerals, including lithium. Initial approval of over $300 million is expected soon. The government aims to reduce import reliance and develop local lithium processing capabilities through international collaboration. Copper suplhate effectiveness in improving recovery rates and operational efficiency is leading to higher consumption across mining operations. Expanding mineral exploration activities and rising global demand for metals are creating a positive copper sulphate market outlook across the world.

Growing Use in Animal Feed Additives

Copper sulphate is increasingly being incorporated into animal feed to help maintain the overall health and productivity of livestock. It provides a necessary source of copper, which supports vital biological functions like enzyme activity, bone development, and immune system strength. As livestock farming practices evolve to focus more on animal welfare and nutrition, the use of copper sulphate in feed formulations is rising. This steady growth is helping expand its role beyond traditional agricultural and industrial applications.

Rising Adoption in Sustainable Agriculture

The rising adoption of sustainable farming practices is strengthening demand in the copper sulphate market. As growers seek alternatives to harsh chemical treatments, copper sulphate is increasingly used to manage fungal infections and supply essential micronutrients to crops. It supports healthier plant growth while aligning with environmental standards. The copper sulphate market forecast suggests continued growth as organic farming gains traction and food producers focus on improving yield quality without compromising soil health, boosting the material’s agricultural application across key markets. For instance, in March 2025, the Tamil Nadu government is promoting organic farming with Rs 12 crore allocated for 37 districts. A two-year program will benefit 7,500 farmers, while 38,600 students will visit organic farms. Financial incentives and a 'Nammazhvar Award' of Rs 2 lakh for top farmers will also be introduced, alongside four quality control labs.

Copper Sulphate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global copper sulphate market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on end-use.

Analysis by End-Use:

- Agriculture

- Mining and Metallurgy

- Chemicals

- Healthcare

- Construction

Agriculture stands as the largest end-use in 2024, holding around 43.6% of the market. According to the report, agriculture represented the largest segment due to the rising use of copper sulphate as fungicides, herbicides, and insecticides to improve overall crop output. In addition to this, the rising population, the expanding demand for organic products, and extensive investments and favorable government initiatives are positively impacting the copper sulphate market growth.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 42.1%. Asia-Pacific accounted for the largest market share in the copper sulphate market, driven by significant demand in agriculture for crop protection and soil enrichment. The region's growing industrial sectors, particularly mining and electroplating, also contribute to its dominance. Additionally, the increasing focus on sustainable farming practices and advancements in water treatment applications, including algae control, further enhance market growth. With vast agricultural landscapes and a rapidly expanding industrial base, Asia-Pacific remains a key driver of global copper sulphate consumption.

Key Regional Takeaways:

North America Copper Sulphate Market Analysis

North America's copper sulphate market is experiencing steady growth, supported by its wide-ranging applications across agriculture, industrial manufacturing, and water treatment sectors. Agricultural demand remains a primary driver, with copper sulphate used extensively to manage crop diseases and address micronutrient deficiencies. Industrial uses, including electroplating, chemical production, and mining processes, contribute further to the market's resilience. Ongoing advancements in sustainable farming practices and growing environmental awareness are encouraging the adoption of copper-based solutions. Additionally, the region's focus on improving water management and sanitation systems strengthens the role of copper sulphate in algae control and water treatment. Continuous innovation and product refinement are enhancing the quality and versatility of copper sulphate, expanding its applications across traditional and emerging sectors. The combination of agricultural modernization, industrial development, and infrastructure improvements is shaping a favorable outlook for the copper sulphate market across North America.

United States Copper Sulphate Market Analysis

In 2024, the United States accounted for over 85.10% of the copper sulphate market in North America. The United States copper sulphate market has witnessed steady growth, driven by its extensive application in agriculture, chemical industries, and water treatment. The demand is particularly high in the agricultural sector, where it is used as a fungicide, herbicide, and soil additive to correct copper deficiencies. Additionally, increasing adoption in industrial processes, such as electroplating and mining, further boosts market growth. The U.S. Geological Service estimates there are over 11,000 active mines in the United States. Rising investments in research and innovation have led to the development of high-purity copper sulphate, enhancing its utility in diverse applications. Market expansion is also supported by the growing focus on sustainable agricultural practices and increased use of copper-based compounds in animal feed additives. This highlights the strategic role of copper sulphate in various sectors and its contribution to the overall mineral economy.

Europe Copper Sulphate Market Analysis

The European copper sulphate market size is expanding due to increased demand in agriculture for crop protection and soil enrichment. Copper-based fungicides and micronutrient fertilizers are being adopted due to sustainable farming practices. These compounds address nutrient deficiencies in crops and align with Europe's environmental goals. Copper sulphate also finds industrial uses in electroplating, textile manufacturing, and chemical processing. According to Water Europe, a socio-economic study has called for USD 273.85 Billion in water-related investments over the next six years from 2024, emphasizing the importance of protecting Europe's economy and advancing environmental sustainability. As water quality and soil health become central to sustainable agriculture and industrial growth, the role of copper sulphate as both a micronutrient and a functional industrial agent is expected to expand further within this strategic framework.

Latin America Copper Sulphate Market Analysis

The Latin American copper sulphate market is expanding due to its use in agriculture, particularly in crop protection and livestock nutrition, and its application in industrial sectors like mining and chemical processing. The market's growth is further supported by the rising adoption of modern farming techniques. Notably, the Government of Brazil (GoB) announced a nominal record in funds for the 2024/25 Crop Plan at Rs 475.5 Billion (USD 88.2 Billion), according to the U.S. Department of Agriculture. This significant investment in agricultural credit and financing underscores the commitment to boosting productivity and modernizing agricultural practices, further enhancing the demand for copper sulphate in the region.

Middle East and Africa Copper Sulphate Market Analysis

In Middle East and Africa region, copper sulphate demand is driven by expanding water treatment infrastructure and its role in algae control for irrigation systems. Moreover, its use in small-scale farming and growing awareness of modern crop care techniques are contributing to gradual market development. Notably, the African Water Facility has secured 12 Million euros to invest in urban sanitation across Africa, as reported by the African Development Bank. This investment aims to enhance water management and sanitation infrastructure, potentially increasing the copper sulphate market demand in water treatment applications and further supporting market growth.

Competitive Landscape:

The copper sulphate market is characterized by the presence of numerous regional and international producers competing on product quality, pricing, and supply reliability. Manufacturers are focusing on enhancing production efficiency, developing high-purity grades, and expanding distribution networks to strengthen their market positions. Strategic collaborations with agricultural, industrial, and chemical sectors are becoming increasingly common to secure long-term demand. Continuous investment in research and development is driving innovation in product formulations and application methods. Market competition is further shaped by the growing emphasis on sustainability, with companies offering eco-friendly solutions to meet evolving regulatory standards and consumer preferences.

The report provides a comprehensive analysis of the competitive landscape in the copper sulphate market with detailed profiles of all major companies, including:

- Acuro Organics Limited

- Allan Chemical Corporation

- JX Advanced Metals Corporation

- Noah Chemicals

- Norkem Limited

- Old Bridge Minerals

- ProChem, Inc

- Sumitomo Metal Mining Co., Ltd.

Latest News and Developments:

- April 2024: ProChem Inc. has expanded its Rockford, IL facility, increasing manufacturing space and capabilities as part of its 5-year growth plan. This expansion aligns with the increasing demand for onshore manufacturing of critical raw materials, driven by the US's computer chip production boost and the CHIPS Act.

Copper Sulphate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, ‘000 Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Agriculture, Mining and Metallurgy, Chemicals, Healthcare, Construction |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Acuro Organics Limited, Allan Chemical Corporation, JX Advanced Metals Corporation, Noah Chemicals, Norkem Limited, Old Bridge Minerals, ProChem, Inc, Sumitomo Metal Mining Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the copper sulphate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global copper sulphate market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the copper sulphate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The copper sulphate market was valued at 441.7 Kilo Tons in 2024.

The copper sulphate market is projected to reach 528.4 Kilo Tons by 2033, exhibiting a CAGR of 2.0% from 2025-2033.

Key factors driving the copper sulphate market include increasing demand in agriculture for crop protection and soil enrichment, growing adoption in industrial sectors like electroplating and mining, rising focus on sustainable farming practices, advancements in product quality, and expanding water treatment applications, particularly for algae control.

Asia Pacific dominates the copper sulphate market, accounting for 42.1% of the market share, driven by high agricultural demand, expanding industrial applications, and growth in mining and water treatment sectors.

Some of the major players in the copper sulphate market include Acuro Organics Limited, Allan Chemical Corporation, JX Advanced Metals Corporation, Noah Chemicals, Norkem Limited, Old Bridge Minerals, ProChem, Inc, Sumitomo Metal Mining Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)