Flavoured and Frozen Yoghurt Market in India: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033

Market Overview:

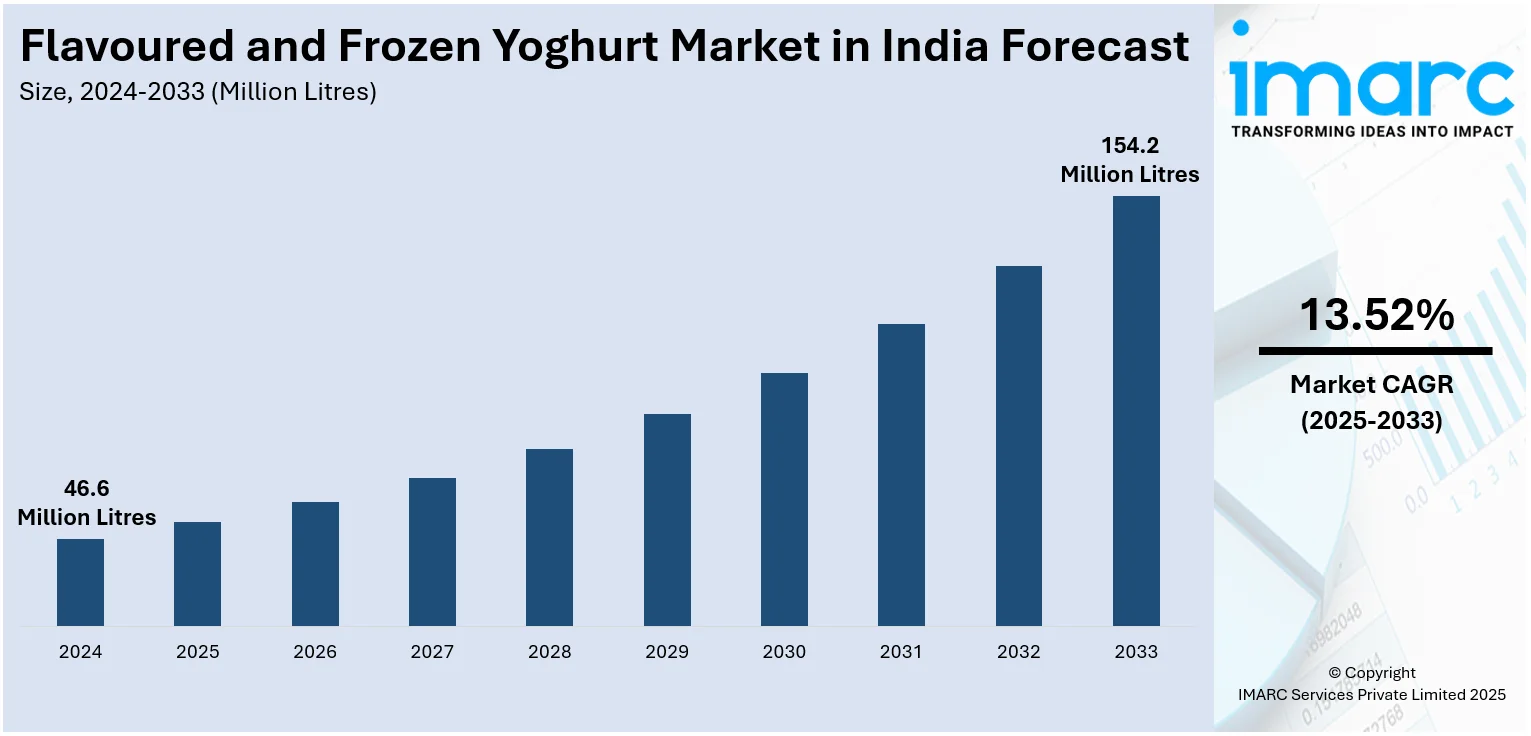

The flavoured and frozen yoghurt market in India size reached 46.6 Million Litres in 2024. Looking forward, IMARC Group expects the market to reach 154.2 Million Litres by 2033, exhibiting a growth rate (CAGR) of 13.52% during 2025-2033. The rising consumption of low-calorie and healthy desserts, the growing availability of vegan frozen yoghurt with natural flavorings, and increasing number of initiatives by the Government of India to empower the dairy industry represent some of the key factors driving the market in India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 46.6 Million Litres |

| Market Forecast in 2033 | 154.2 Million Litres |

| Market Growth Rate (2025-2033) | 13.52% |

Flavoured and frozen yoghurt is a sweet dessert prepared by fermenting milk with various bacteria, such as lactobacillus bulgaricus and streptococcus thermophilus. It is available in a wide variety of flavors, such as mango, peach, pineapple, berries, chocolate, and butterscotch. It comprises stabilizers and flavorings to enhance and retain its taste for an extensive time period. It has a thick creamy texture and is often consumed as a healthy alternative to ice cream. Flavoured and frozen yoghurt offers protein, carbohydrates, fats, calcium, vitamins A and C, zinc, copper, magnesium, potassium, and iron. It also contains probiotics necessary for maintaining proper gut health, strengthening the immune system, improving lactose metabolism, and preventing the occurrence of diarrhea. It possesses a low glycemic index, which aids in reducing blood sugar levels, losing weight, and decreasing the risk of type 2 diabetes. As it is utilized in the preparation of smoothies, shakes, and yoghurt bowls, the demand for flavoured and frozen yoghurt is rising in India.

To get more information on this market, Request Sample

India Flavoured and Frozen Yoghurt Market Trends:

At present, there is an increase in the demand for low-calorie, high-protein, and healthy desserts due to changing consumer preferences. This, coupled with the rising adoption of a healthy lifestyle to maintain fitness levels and reduce the occurrence of chronic diseases, is propelling the growth of the market in India. Besides this, the growing consumption of healthy protein shakes and smoothies among fitness enthusiasts to facilitate muscle repair and increase metabolism is offering a favorable market outlook. In addition, key players operating in the country are introducing flavoured and frozen yoghurts made from various plant-based milk, such as almonds, oat, rice, and soy milk, for vegans and lactose-intolerant individuals. They are also manufacturing flavoured and frozen yoghurts with natural sweeteners instead of processed sugars for diabetic and obese individuals. Apart from this, the rising availability of frozen yoghurt with various organic natural flavorings and fruit extracts is contributing to the growth of the market in India. Additionally, the increasing number of frozen yoghurt chains, along with standalone retailers offering premium quality flavoured and frozen yoghurt in the country, is supporting the growth of the market. Moreover, the rising number of bakeries and cafes serving customers a wide range of flavorful desserts is strengthening the growth of the market. Furthermore, the Government of India is launching various schemes and providing financial assistance to farmers for improving dairy processing and infrastructure development. They are also providing cutting-edge technologies to farmers for genetically enhancing the cattle population and conserving indigenous cattle breeds.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the flavoured and frozen yoghurt market in India, along with forecasts at the country and state levels from 2025-2033.

Regional Insights:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

The report has also provided a comprehensive analysis of all the major regional markets that include Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, and Orissa. According to the report, Maharashtra was the largest market for flavoured and frozen yoghurt market in India. Some of the factors driving the Maharashtra flavoured and frozen yoghurt market are the growing health awareness among the masses, increasing demand for dairy products, rising availability of exotic flavoured frozen yoghurt, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the flavoured and frozen yoghurt market in India. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Amul (GCMMF), Mother Dairy, Danone and Nestlé. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion, Million Litres |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| States Covered | Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Orissa |

| Companies Covered | Amul (GCMMF), Mother Dairy, Danone and Nestlé |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the flavoured and frozen yoghurt market in India from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the flavoured and frozen yoghurt market in India.

- The study maps the leading as well as the fastest growing regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the flavoured and frozen yoghurt industry in India and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flavored and frozen yoghurt market in India reached a volume of 46.6 Million Litres in 2024.

We expect the flavored and frozen yoghurt market in India to exhibit a CAGR of 13.52% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of flavored and frozen yoghurt across the nation.

The rising consumer preference towards low fat content and high nutritious value food item, along with the increasing availability of flavored and frozen yoghurt in several flavors, such as strawberry, banana, vanilla, etc., is primarily driving the flavored and frozen yoghurt market in India.

On a regional level, the market has been classified into Maharashtra, Uttar Pradesh, Andhra Pradesh and Telangana, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, and Haryana, where Maharashtra currently dominates the flavored and frozen yoghurt market in India.

Some of the major players in the flavored and frozen yoghurt market in India include Amul (GCMMF), Mother Dairy, Danone and Nestlé.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)