GCC UHT Milk Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033

Market Overview:

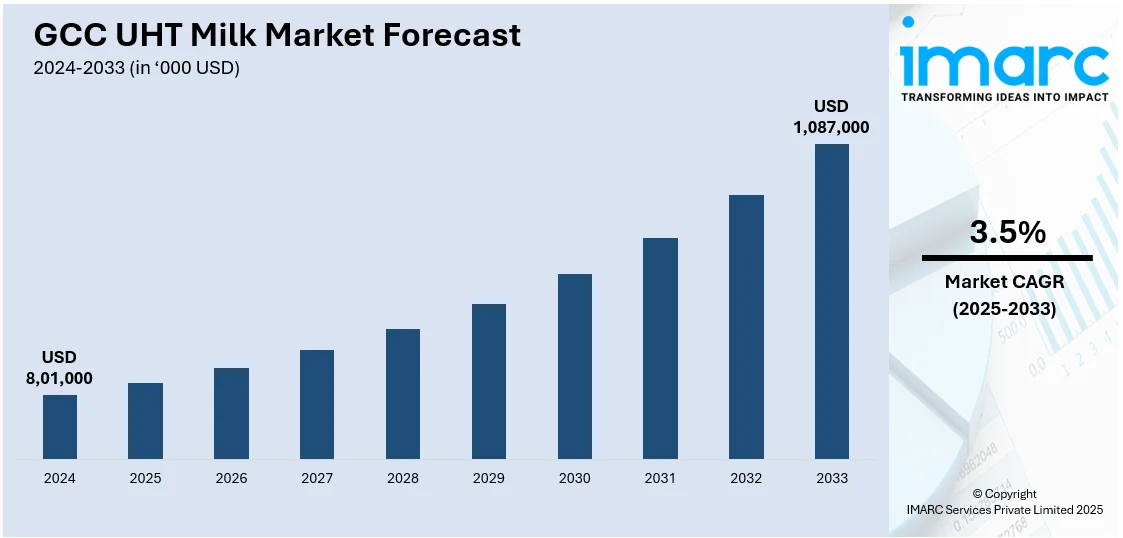

The GCC UHT milk market size reached USD 8,01,000 in 2024. Looking forward, IMARC Group expects the market to reach USD 1,087,000 by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8,01,000 |

|

Market Forecast in 2033

|

USD 1,087,000 |

| Market Growth Rate (2025-2033) | 3.5% |

In the GCC region, the market for UHT milk has been expanding as an increasing number of consumers have become aware about its advantages. UHT milk can be stored for up to 6 months at room temperature without the need for refrigeration. This helps in the transportation of UHT milk to regions without proper cold chain facilities. It can also be consumed without being heated or boiled which suits the busy lifestyle of working consumers. As a result of the ease of storage and use offered by UHT milk, its demand has been increasing in the region. IMARC Group’s latest report titled, “GCC UHT Milk Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”

The market for UHT milk in the GCC region is being driven by a number of favourable factors. On account of hectic lifestyle coupled with a growing health awareness, consumers are shifting towards healthy and easy-to-use products. Since UHT milk is a natural and nutrient-rich product, its demand has been on a rise.

The report has segmented the GCC UHT milk market on the basis of type covering UHT fresh milk, and UHT recombined and reconstituted milk. Currently, UHT recombined and reconstituted milk accounts for the majority of the consumption in the region. The report has analysed the market on the basis of countries of the GCC region, providing historical and future consumption trends of UHT milk for each country. Currently, Saudi Arabia represents the largest market for UHT milk in the region. The report has further analysed the competitive landscape of the market and provides the profiles of the key players operating in the market. Some of the major players include SADAFCO, Almarai, FreislandCampina, Al Ain Dairy and Al Safi Danone.

This report provides a deep insight into the GCC UHT milk industry covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. The report also provides a comprehensive analysis for setting up a UHT milk manufacturing plant. The study analyses the processing and manufacturing requirements, project cost, project funding, project economics, expected returns on investment, profit margins, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the GCC UHT milk industry in any manner.

Key Questions Answered in This Report:

- How has the GCC UHT milk market performed so far and how will it perform in the coming years?

- What are the key regional markets in the GCC UHT milk industry?

- What has been the impact of COVID-19 on the GCC UHT milk market?

- What are the price trends of UHT milk in the GCC region?

- What are the various stages in the value chain of the GCC UHT milk industry?

- What are the key driving factors and challenges in the GCC UHT milk industry?

- What is the structure of the GCC UHT milk industry and who are the key players?

- What is the degree of competition in the GCC UHT milk industry?

- What are the profit margins in the GCC UHT milk industry?

- What are the key requirements for setting up an GCC UHT milk manufacturing plant?

- How is UHT milk manufactured?

- What are the various unit operations involved in an UHT milk manufacturing plant?

- What is the total size of land required for setting up an UHT milk manufacturing plant?

- What are the machinery requirements for setting up an UHT milk manufacturing plant?

- What are the raw material requirements for setting up an UHT milk manufacturing plant?

- What are the packaging requirements for UHT milk?

- What are the transportation requirements for UHT milk?

- What are the utility requirements for setting up an UHT milk manufacturing plant?

- What are the manpower requirements for setting up an UHT milk manufacturing plant?

- What are the infrastructure costs for setting up an UHT milk manufacturing plant?

- What are the capital costs for setting up an UHT milk manufacturing plant?

- What are the operating costs for setting up an UHT milk manufacturing plant?

- What will be the income and expenditures for an UHT milk manufacturing plant?

- What is the time required to break-even?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)