Ghee Market in India Size, Share, Trends and Forecast by Type, Sales Channel, and Region, 2025-2033

Market Overview:

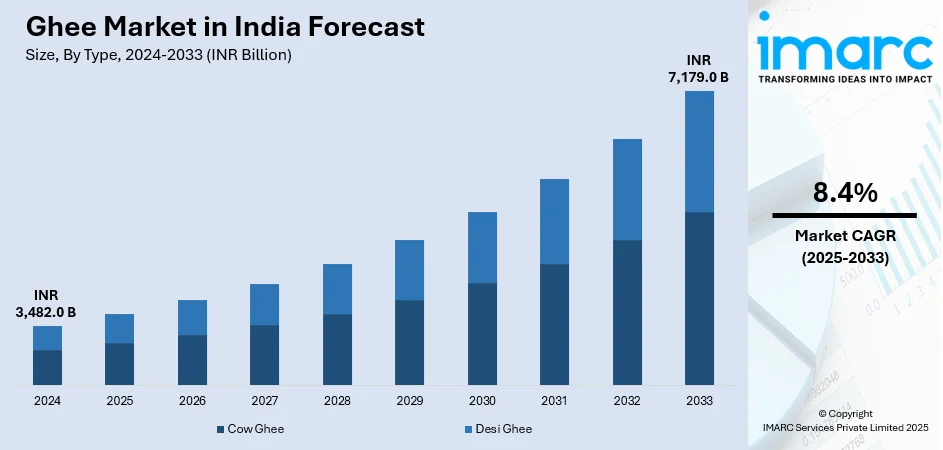

The ghee market in India size reached INR 3,482.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 7,179.0 Billion by 2033, exhibiting a growth rate (CAGR) of 8.4% during 2025-2033. The growing consumption of ghee among the masses, the escalating shift towards organic food products due to the rising health consciousness, and rapidly growing the e-commerce sector are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 3,482.0 Billion |

|

Market Forecast in 2033

|

INR 7,179.0 Billion |

|

Market Growth Rate 2025-2033

|

8.4% |

Ghee is a type of clarified butter that originates from the Indian subcontinent and is widely utilized in South Asian and Middle Eastern cuisines, traditional medicine, and religious rituals. To prepare ghee, butter is heated until the milk solids separate and are then removed, leaving behind a golden, aromatic fat. Unlike regular butter, ghee is lactose-free, making it suitable for those with lactose intolerance. It has a high smoke point, which means it can be used for frying and sautéing without breaking down into harmful compounds. Ghee is rich in healthy fats, fat-soluble vitamins, including A, E, and K, and other essential nutrients. Additionally, it is known for its potential health benefits, such as promoting heart health and aiding digestion. However, as with all fats, it should be consumed in moderation as part of a balanced diet.

To get more information on this market, Request Sample

The rising food services sector in India has significantly contributed to the growth of the ghee industry. Ghee is an integral part of various Indian dishes, and its use in restaurants, hotels, and other foodservice outlets has increased exponentially. Along with this, the exploration of fusion cuisine has led to the creative application of ghee in non-traditional dishes, thereby expanding its usage and popularity. As the food service industry continues to grow, so too will the demand for ghee. In addition, the shift towards organic food products has been a prominent trend in recent years. Consumers are increasingly seeking out organic ghee due to perceived health benefits and environmentally friendly production processes. Organic ghee is free from pesticides and other harmful chemicals, and its production supports sustainable farming practices. The rise in consumer awareness about these benefits, along with the expansion of retail channels selling organic products, is a major driver for the growth of the organic ghee segment in India. Moreover, the e-commerce sector in India has witnessed massive growth, providing a significant boost to various industries, including the ghee industry. Online platforms offer a larger variety of products, including niche organic and artisanal ghee, often not available in traditional stores. The convenience of home delivery and often competitive pricing have attracted a large number of consumers to purchase ghee online.

Ghee Market in India Trends/Drivers:

Growing Health Consciousness Among Consumers

Over the years, the consumption of ghee in India has been witnessing a remarkable increase due to the growing awareness of its health benefits. Traditionally, ghee has been a central component of Indian diets, particularly for its high nutritional value and medicinal properties, such as aiding digestion and improving heart health. Recent years have seen a revival in the popularity of traditional eating habits and the increasing endorsement of ghee as a healthier alternative to butter and other cooking oils by health and wellness experts. Today's consumers are more health-conscious than ever, seeking foods that not only satiate their hunger but also contribute to their overall well-being. This heightened focus on healthy eating and the nutritional benefits associated with ghee is a significant driver for the ghee industry in India.

Increasing Preference for Packaged Ghee

With the advent of modern retail formats, such as supermarkets and e-commerce platforms, consumers' buying patterns have evolved. Along with this, consumers are preferring packaged ghee over loose ghee for reasons such as assurance of quality, hygiene, longer shelf-life, and convenience. Therefore, it is significantly supporting the market. In addition, packaged ghee manufacturers often maintain stringent quality checks to ensure that the products are free from adulteration and meet the specified standards, providing an edge over loose ghee. This shift in consumer preference towards packaged ghee, driven by the promise of quality and convenience, is fuelling the growth of the ghee industry in India.

Ghee Market in India Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India ghee market report, along with forecasts at the country and state levels from 2025-2033. Our report has categorized the market based on type and, sales channel.

Breakup by Type:

- Cow Ghee

- Desi Ghee

Desi ghee represents the most widely used type

The report has provided a detailed breakup and analysis of the market based on the type. This includes cow ghee and desi ghee. According to the report, desi ghee represented the largest segment.

The India ghee industry experiences several market drivers that contribute to the demand for desi ghee. Additionally, cultural preferences play a pivotal role, as desi ghee holds a longstanding significance in Indian culinary traditions and rituals. Along with this, the perceived health benefits associated with desi ghee, such as its rich nutrient profile and potential medicinal properties, drive consumer preferences towards this type of ghee. In addition, the growing awareness of the importance of locally sourced and traditional products among consumers has led to an increased demand for authentic desi ghee, further fueling the market. Furthermore, the expanding market for ethnic and traditional foods both domestically and internationally has provided a significant boost to the India ghee industry. In conclusion, the market drivers for desi ghee in the India ghee industry encompass cultural heritage, health considerations, consumer preferences for traditional products, and the rise in demand for ethnic foods.

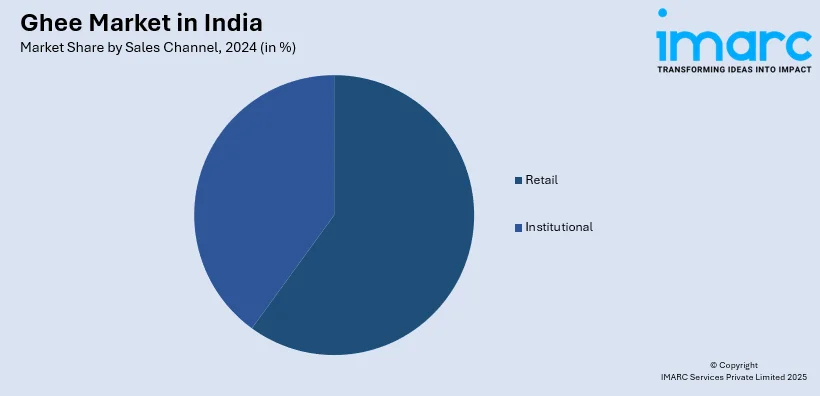

Breakup by Sales Channel:

- Retail

- Institutional

A detailed breakup and analysis of the market based on the sales channel has also been provided in the report. This includes retail and institutional.

The India ghee industry experiences several market drivers that significantly impact retail sales. Additionally, the ever-increasing population and rising disposable incomes in the country contribute to higher consumer spending on food products, including ghee. As a staple in Indian households, ghee enjoys consistent demand, ensuring a steady flow of retail sales. Along with this, the growing urbanization and modernization trends have led to an increase in the convenience-oriented lifestyle, prompting consumers to opt for packaged and easily accessible ghee products from retail outlets. In addition, the aggressive marketing and promotional strategies employed by numerous leading ghee manufacturers in an attempt to position their products as healthy and premium choices have effectively influenced consumer purchasing decisions, further driving retail sales.

On the contrary, institutional sales involves the widespread use of ghee in the foodservice sector, including hotels, restaurants, and catering services, drives substantial institutional demand. As ghee remains an integral part of traditional Indian cuisines, its incorporation in various dishes contributes to its consistent use in the foodservice industry. Apart from this, the thriving hospitality and tourism sectors in India play a crucial role in boosting institutional sales of ghee. With a growing number of domestic and international tourists exploring the diverse culinary offerings of the country, the demand for ghee in the hospitality sector continues to rise.

Breakup by Region:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

Uttar Pradesh exhibits a clear dominance, accounting for the largest share for India ghee market

The report has also provided a comprehensive analysis of all the major regional markets, which includes Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, and Orissa. According to the report, Uttar Pradesh accounted for the largest market share.

The ghee industry in Uttar Pradesh is driven by its rich agricultural landscape ensuring a steady supply of high-quality milk, which serves as the primary raw material for ghee production. The abundance of dairy farms and cooperatives in the state fosters a robust dairy industry, supporting the ghee manufacturing process. Along with this, Uttar Pradesh's cultural heritage and culinary traditions deeply integrate ghee into the daily diet of its residents, bolstering consistent demand for this traditional product. The state's large population, combined with a steady increase in disposable incomes, further drives consumer spending on ghee products.

In addition, the state's strategic location, with well-established transportation networks, facilitates the efficient distribution of ghee to both domestic and international markets. Furthermore, the government's support through various initiatives and incentives for dairy farmers and ghee manufacturers further strengthens the industry's growth. In conclusion, the market drivers for the ghee industry in Uttar Pradesh encompass the abundant supply of milk, cultural significance, growing consumer base, favorable geographical positioning, and government support, all of which contribute to the industry's success and expansion in the region.

Competitive Landscape:

The key players in the market are offering variants, such as flavored ghee, organic ghee, and value-added ghee products. Ghee companies are investing in marketing and branding initiatives to establish their brands as reliable and premium choices among consumers. Effective marketing campaigns are being used to highlight the nutritional benefits and cultural significance of ghee. Along with this, the implementation of strict quality control measures and adherence to food safety standards are positively influencing the market. In addition, the growing focus on optimizing distribution and supply chain networks to ensure their products are readily available to consumers across various regions in India is significantly supporting the market. Apart from this, the accelerating investments in research and development to innovate and create new ghee products that align with evolving consumer preferences, health trends, and sustainability concerns is favorably impacting the market. Furthermore, strategic collaborations and partnerships with dairy farmers, cooperatives, and other stakeholders in the dairy industry are contributing to the market.

The report has provided a comprehensive analysis of the competitive landscape in the ghee market in India. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Gujarat Co-operative Milk Marketing Federation Ltd

- Mother Dairy Fruits and Vegetables Pvt. Ltd.

- SMC Foods Limited

- Bhole Baba Dairy Industries Ltd.

- Rajasthan Cooperative Dairy Federation Ltd (RCDF)

- Parag Milk Foods Ltd.

Ghee Market in India Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion, Million Kg |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Cow Ghee, Desi Ghee |

| Sales Channel Covered | Retail, Institutional |

| States Covered | Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Orissa |

| Companies Covered | Gujarat Co-operative Milk Marketing Federation Ltd, Mother Dairy Fruits and Vegetables Pvt. Ltd., SMC Foods Limited, Bhole Baba Dairy Industries Ltd., Rajasthan Cooperative Dairy Federation Ltd (RCDF), Parag Milk Foods Ltd. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ghee market in India from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the ghee market in India.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ghee market in India and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ghee market in India was valued at INR 3,482.0 Billion in 2024.

We expect the ghee market in India to exhibit a CAGR of 8.40% during 2025-2033.

The growing consumer awareness towards numerous health benefits of ghee in improving digestion, enhancing muscular strength, curing eye disorders, etc., is currently driving the ghee market in India.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of ghee.

Based on the type, the ghee market in India can be segmented into cow ghee and desi ghee. Currently, desi ghee holds the majority of the total market share.

On a regional level, the market has been classified into Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, and Orissa, where Uttar Pradesh currently dominates the Indian market.

Some of the major players in the ghee market in India include Gujarat Co-operative Milk Marketing Federation Ltd, Mother Dairy Fruits and Vegetables Pvt. Ltd., SMC Foods Limited, Bhole Baba Dairy Industries Ltd., Rajasthan Cooperative Dairy Federation Ltd (RCDF), and Parag Milk Foods Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)