Sorbitol Market Size, Share, Trends and Forecast by Application, Type, Feedstock, and Region, 2025-2033

Sorbitol Market Size and Share:

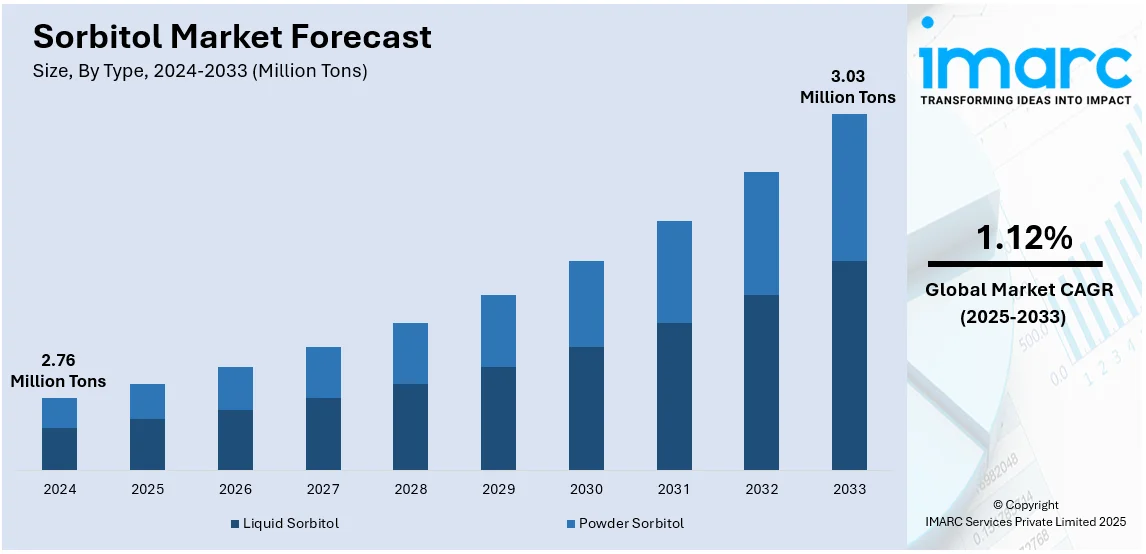

The global sorbitol market size was valued at 2.76 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 3.03 Million Tons by 2033, exhibiting a CAGR of 1.12% from 2025-2033. China currently dominates the market, holding a market share of over 32.5% in 2024. The rising demand for sugar-free products, growing usage in cosmetics and pharmaceuticals, increasing adoption in food preservation, expanding applications in industrial sectors, and health-conscious consumer trends. are some of the major factors prolling the sorbitol market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

2.76 Million Tons |

|

Market Forecast in 2033

|

3.03 Million Tons |

| Market Growth Rate (2025-2033) |

1.12%

|

The global sorbitol market is experiencing growth due to rising health awareness and the increasing prevalence of lifestyle-related diseases, such as diabetes and obesity, which are driving demand for low-calorie and sugar-free products. Sorbitol’s role as a natural sweetener, humectant, and stabilizer makes it ideal for sugar-free confectioneries, baked goods, beverages, and diabetic-friendly products. The pharmaceutical sector also contributes significantly, with sorbitol widely used in syrups, tablets, and oral solutions for its excipient properties. Additionally, its use in personal care and cosmetic products, such as moisturizers, shampoos, and toothpaste, is expanding due to consumer preferences for natural and sustainable ingredients. Industrial applications, including its use in surfactants and adhesives, further boost market demand.

The growth of the sorbitol market in the United States is driven by increasing consumer demand for low-calorie and sugar-free products, prompted by rising health consciousness and the prevalence of diabetes and obesity. Sorbitol, a sugar alcohol, serves as a popular sugar substitute in various food and beverage applications, including sugar-free confectioneries, baked goods, and dietetic products. The U.S. food and beverage industry, a significant consumer of sorbitol, continues to expand, further propelling market growth. Additionally, sorbitol's applications extend to the pharmaceutical sector, where it is utilized as an excipient in syrups and oral care products, and the personal care industry, where it functions as a humectant in cosmetics and toiletries. The convergence of these factors contributes to the robust expansion of the sorbitol market in the United States.

Sorbitol Market Trends:

Significant growth in food and beverage (F&B) industry

Sorbitol is increasingly used as a bulking and thickening agent in the preparation of sugar-free food products and beverages such as chocolate, shakes, jam, jellies, ice cream, candies, smoothies, cookies, bread, cake, pizza, and biscuits to provide sweetness, texture enhancement, and shelf life. This, with the growing customer preferences for low-calorie processed food products and beverages due to the surging prevalence of diabetes, constitutes one of the significant factors augmenting the growth of the market worldwide. The absolute number of people suffering from diabetes is predicted to grow up to 643 Million by 2030, says International Diabetes Federation. Moreover, increasing numbers of the commercial outlet or eateries, such as restaurants, cafes, hotels, and QSRs that are serving food products with the help of sorbitol catering to the health-conscious consumer segment are taking this market ahead.

Expansion of the pharmaceutical industry positively influences sales of sorbitol

The usage of sorbitol as an excipient has been on the rise, particularly in liquid formulations, including syrups, suspensions, and oral solutions. It is also used for giving cohesive properties when used as a binder or filler in tablet formulations. Besides these, sorbitol is used as cryoprotective agent in cell, tissue, and organ preservation technique, which will save the biological specimen from freeze/thaw induced damages due to the suppression of ice crystal formation and osmostress thereby acting in favor positively and along with the prescription demand of the drugs to satisfy the current sharp incidence rates of diseases and disorder such as diabetes and obesity. As reported by the World Obesity Atlas 2023, 38% of the global population is currently either overweight or obese.

Growing use of personal care products and cosmetics

Sorbitol is used in the manufacturing of personal care and cosmetic products, such as moisturizers, shampoos, conditioners, shower gels, body washes, lip balms, toners, serums, lotions, face masks, face wash, cleansers, and foundations. The global beauty and personal care products market was valued at USD 529.5 Thousand Tons in 2024 as per the IMARC Group. This can be attributed to the rising physical consciousness among individuals. It aids in hydrating the skin, improving its elasticity, preventing skin dryness, maintaining skin softness, and providing a smoother appearance.

Sorbitol Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sorbitol market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application, type, and feedstock.

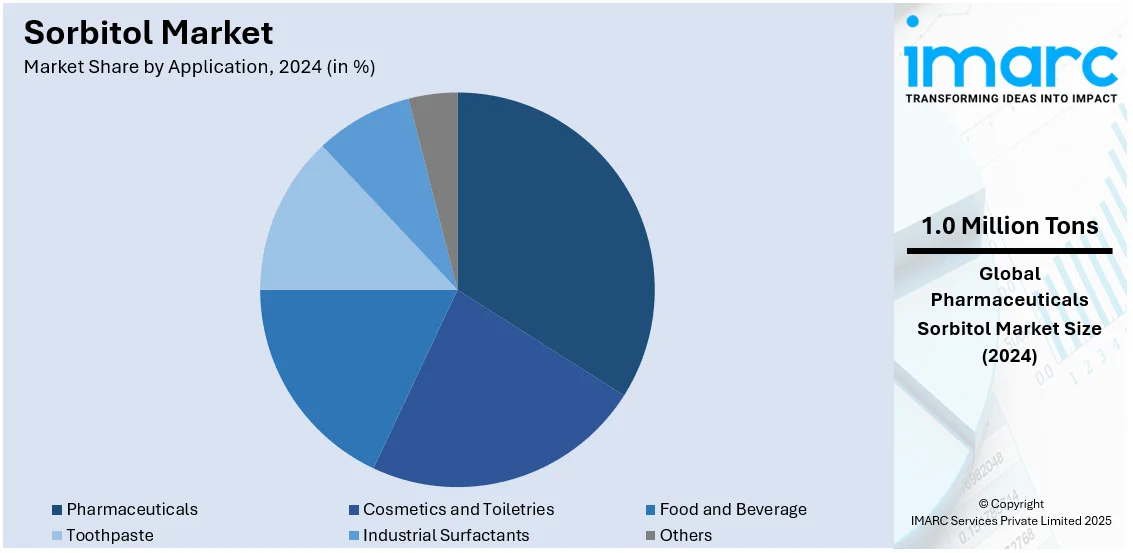

Analysis by Application:

- Cosmetics and Toiletries

- Food and Beverage

- Pharmaceuticals

- Toothpaste

- Industrial Surfactants

- Others

Pharmaceuticals stands as the largest component in 2024, holding around 33.7% of the market. The report states that pharmaceuticals was the largest market because sorbitol acts as a stabilizer in many tablets and syrups for maintaining the stability and integrity of drugs. It also helps in enhancing the taste, mouthfeel, and palatability of the drug, thus making it more attractive and easier to administer. Sorbitol is also used in the creation of drug delivery systems, like controlled release formulations. It prevents the oxidation, moisture, or temperature degradation of the sensitive APIs. The following is a multi-purpose active ingredient in parenteral formulation, such as intravenous solutions and injectable drugs. This may adjust tonicity as well as osmolality so that compatibility with body fluids is ensured and irritation at the injection site is reduced or avoided.

Analysis by Type:

- Liquid Sorbitol

- Powder Sorbitol

Liquid sorbitol is dominating with about 77.7% of the market share during 2024. Liquid sorbitol is a clear, viscous liquid used in various applications such as food and beverage products, pharmaceutical formulations, personal care products, etc. It is used as sweetener, humectant, stabilizer, etc., in various liquid formulations.

Analysis by Feedstock:

- Corn

- Wheat

- Cassava

- Others

In 2024, corn accounts for the majority of the market. Corn is a commonly used variant and widely available in the market. Sorbitol derived from corn, also known as sorbitol corn, is obtained by extracting and processing the starch from corn kernels. Its abundant availability, cost-effectiveness, and renewable nature makes corn an ideal raw material, supporting sorbitol production for food, pharmaceutical, and industrial applications globally.

Regional Analysis:

- China

- United States

- Europe

- Indonesia

- India

In 2024, China accounted for the largest market share of over 32.5%. China held the biggest market share due to the increasing health consciousness among people. Moreover, the rising prevalence of diabetes and obesity among individuals in China is catalyzing the demand for sorbitol as it has low glycemic index properties, which makes it suitable for diabetic friendly and weight management products. Besides this, initiatives undertaken by governing authorities of the country to promote the use of low calorie sweeteners like sorbitol and reduce sugar consumption is creating a positive outlook for the market.

Key Regional Takeaways:

United States Sorbitol Market Analysis

The United States sorbitol market is driven by several key factors across diverse industries. As a versatile sugar alcohol derived from glucose, sorbitol is an excellent sweetener, humectant, and stabilizer in food, pharmaceutical, personal care, and various other industrial segments. An increasing need for low-calorie and sugar-free products leads to the surge in markets. Sorbitol is the go-to sweetener for diabetic as well as the health-conscious individuals because of low glycemic indexes. The obese and diabetic cases occurring within the populace of the nation are pushing demands for sorbitol. Data from the National Center for Health Statistics reveals a total prevalence of 15.8% diabetes diagnosed among U.S. adults over the period between August 2021 and August 2023. As per this, in the pharmaceutical industry, sorbitol acts as a stabilizer, excipient, and sugar substitute in liquid medication and syrups, and therefore the demand for the same increases. Increasing the incidence of chronic diseases and innovative formulations of medicines is promoting the demand for sorbitol. Apart from that, increasing usage of sorbitol because of its humectant property is encouraging the growth of the market. Sorbitol is one of the most favorite ingredients for toothpaste, mouthwash, and moisturizing lotions, which are in accordance with the growth in clean-label and sustainable personal care products. Approvals from the Food and Drug Administration (FDA) and Generally Recognized as Safe (GRAS) status for use in food and pharmaceuticals have also strengthened market growth.

Europe Sorbitol Market Analysis

The Europe sorbitol market is growing at a steady pace due to increased health consciousness among consumers, industrial advancements, and regulatory support. In the F&B segment, the increase in demand for low-calorie and sugar-free products is mainly driving the industry. European consumers are looking towards alternatives to white sugar due to increased awareness by people regarding their health and wellbeing. Sorbitol has the low glycemic index and friendly dental properties as a sweetener and is used primarily in sugar-free confectionaries, baked foodstuffs, and beverages with special emphasis in diabetic-friendly and weight-management products. Additionally, the increasing usage of sorbitol with the expansion of the pharmaceutical sector is driving the market. In addition, there is a growing demand for excipients, stabilizers, and sugar substitutes. Sorbitol is widely used in liquid medication, syrups, and vitamin C production, which find applications in conformity with the increasing demand for over-the-counter medicines and dietary supplements in the region. The aging population and rising incidence of chronic diseases are also driving the growth of the sector. As of 1 January 2023, the EU population was approximately 448.8 Million people, and more than one-fifth (21.3 %) of it was aged 65 years and over, according to the reports. Moreover, the move toward natural and sustainable personal care solutions is in line with the plant-based origin of sorbitol, thus supporting its growing application.

China Sorbitol Market Analysis

The China sorbitol market is driven by several key factors. The main application of sorbitol as a sweetener in the F&B industry is gaining popularity due to increased consumer demand for low-calorie and sugar-free products. With health consciousness on the rise, the demand for natural and alternative sweeteners, such as sorbitol, is growing steadily. The role of sorbitol as a humectant and stabilizer in personal care and cosmetics products adds to its demand, especially in skincare formulations that require moisture retention. In addition, economic factors, such as the availability of raw materials like corn for sorbitol production and advancements in manufacturing technologies, aid in enhancing the production efficiency and cost-effectiveness. In addition, regulatory approval of sorbitol as a food additive and its classification as safe by global health authorities is supporting its widespread use. Environmental factors coupled with the demand for biodegradable and sustainable alternatives in the industries among themselves contribute to making sorbitol a preferred choice. The pharmaceutical industry is another crucial one, mainly because the syrupy and tablet form, along with oral care products, require sorbitol for sweetening and textural purposes. In addition to these factors, rising Chinese middle class and urbanization will intensify these factors by forcing the demand for packaged food items, soft drinks, and personal care products. According to the CIA, the urban population of China, excluding Hong Kong and Macau, was 64.6% of the total population in 2023.

India Sorbitol Market Analysis

The India sorbitol market is primarily driven by its extensive application across diverse industries, such as F&B, pharmaceuticals, personal care, and cosmetics. One of the prominent drivers for F&B is consumer health awareness. Because it is a sugar substitute in confectioneries, chewing gums, and beverages which are sugar-free and diabetic friendly, and thus has low calorific value, non-cariogenic in nature, etc. The increasing prevalence of diabetes and obesity in the region is accelerating the adoption of functional and health-oriented food products. According to the Indian Council of Medical Research–India Diabetes (ICMR INDIAB) study published in 2023, the prevalence of diabetes was 101 Million. The pharmaceutical industry in the country is also contributing to the growth of the sorbitol market. Liquid formulation, syrups, and tablets of sorbitol, used as an excipient, stabilizer, and sweetener, are impelling the growth of the market. Furthermore, industrial application also grows through resins, adhesives, and surfactants and consequently strengthens the growth of the market. Another area where sorbitol is gaining acceptance is through eco-friendly and biodegradable products, which also promotes its usage because it is biodegradable and causes very little damage to the environment. Further, Indian government agencies have formulated policies that have helped promote industrial development, while at the same time offering low-cost raw materials such as corn.

Indonesia Sorbitol Market Analysis

The key driving force is the growing demand for low-calorie and sugar-free products among health-conscious consumers. Sorbitol, being a commercial sugar substitute, provides sweetness with fewer calories, thereby being suitable for diabetic and health-aware products. The expanding F&B sector in Indonesia further increases the demand for sorbitol, where it is used as a humectant, texturizer, and stabilizer in confectioneries, baked goods, and beverages. Additionally, the rising employment of sorbitol because of the thriving pharmaceutical industry is supporting the market growth in Indonesia. The pharmaceutical industry has contributed stably to the upward trend in GDP, reaching 1.75% of GDP in 2023, as reported by the Business Indonesia. Sorbitol is used as an excipient in syrups, tablets, and other formulations because it does not have toxicity and stabilizes. The sustainability trend and the demand for bio-based products also support the market, as sorbitol is derived from natural sources such as corn and cassava, which aligns with consumer preferences for eco-friendly solutions. Collectively, these factors underscore the growing importance of sorbitol across diverse sectors in Indonesia.

Competitive Landscape:

The competitive landscape of the global sorbitol market is characterized by the presence of several established players actively expanding their production capacities and portfolios to meet rising demand across diverse applications. Key companies are driving innovation and increasing efficiency through strategic investments in advanced production technologies. For instance, Gulshan Polyols has expanded operations with ethanol and sorbitol plants, while Gujarat Ambuja Exports has scaled production to become India's largest sorbitol manufacturer. Companies are also exploring partnerships and collaborations to enhance their market reach. Regional players are investing in bio-based sorbitol production to align with the growing demand for sustainable products. Additionally, the market is witnessing product diversification, with innovations like Sunsorb® Sorbitol Powder targeting specialized uses. Regulatory approvals and certifications also play a critical role, enabling players to strengthen their presence in key markets like food, pharmaceuticals, and personal care.

The report provides a comprehensive analysis of the competitive landscape in the sorbitol market with detailed profiles of all major companies.

Latest News and Developments:

- August 2024: Turkish starch industry leader selected RHEWUM's cutting-edge technology for the production of sorbitol. The RHEsono vibrating screening machine uses an electromagnetic drive principle specifically designed for extraordinary efficiency when sieving sugar substitutes like sorbitol and sugar alcohols.

- June 2024: Gulshan Polyols Limited (GPL) announced the commencement of commercial operations at its new grain-based ethanol plant in Assam, which has a daily production capacity of 250 thousand litres. This step marks the completion of the plants as ethanol-prepared capacities in the region, fostering regional ethanol production capacities, thus building sustainability in fuel production.

- February 2024: Gujarat Ambuja Exports successfully commissioned a 100 tonnes per day (TPD) sorbitol unit at the company's existing unit in Hubli, Karnataka. With this the company becomes the largest Sorbitol manufacturer in India with a cumulative capacity of 500 TPD at 4 locations.

- August 2022: Psaltry International Company Limited inaugurated Africa’s first and world’s second cassava-based sorbitol factory. The facility has the production capacity of 25 tons per day and is second to the one in Indonesia.

- March 2022: Sunar Misir declared that it has added Sunsorb® Sorbitol Powder to its line of products through an investment in a high-tech production facility in Turkey.

Sorbitol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | ‘000 Mt, Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Cosmetics and Toiletries, Food and Beverage, Pharmaceuticals, Toothpaste, Industrial Surfactants, Others |

| Types Covered | Liquid Sorbitol, Powder Sorbitol |

| Feedstock Covered | Corn, Wheat, Cassava, Others |

| Regions Covered | China, United States, Europe, Indonesia, India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sorbitol market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sorbitol market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sorbitol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global sorbitol market was valued at 2.76 Million Tons in 2024.

The global sorbitol market is estimated to reach 3.03 Million Tons by 2033, exhibiting a CAGR of 1.12% from 2025-2033.

The market is driven by the rising demand for low-calorie products, increasing prevalence of diabetes, expanding pharmaceutical applications, and the growing use in personal care products.

China currently dominates the sorbitol market, holding a market share of over 32.5% in 2024. The dominance is driven by its large-scale production capacity, abundant availability of raw materials like corn, strong demand from the food and pharmaceutical industries, and government support for the expansion of sugar alternatives in various applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)