Laser Diode Market Report by Product Type (Injection Laser Diode (ILD), Optically Pumped Semiconductor Laser (OPSL)), Application (Optical Storage and Communication, Industrial Applications, Medical Applications, Military and Defence Applications, Instrumentation and Sensor Applications, and Others), and Region 2025-2033

Market Overview:

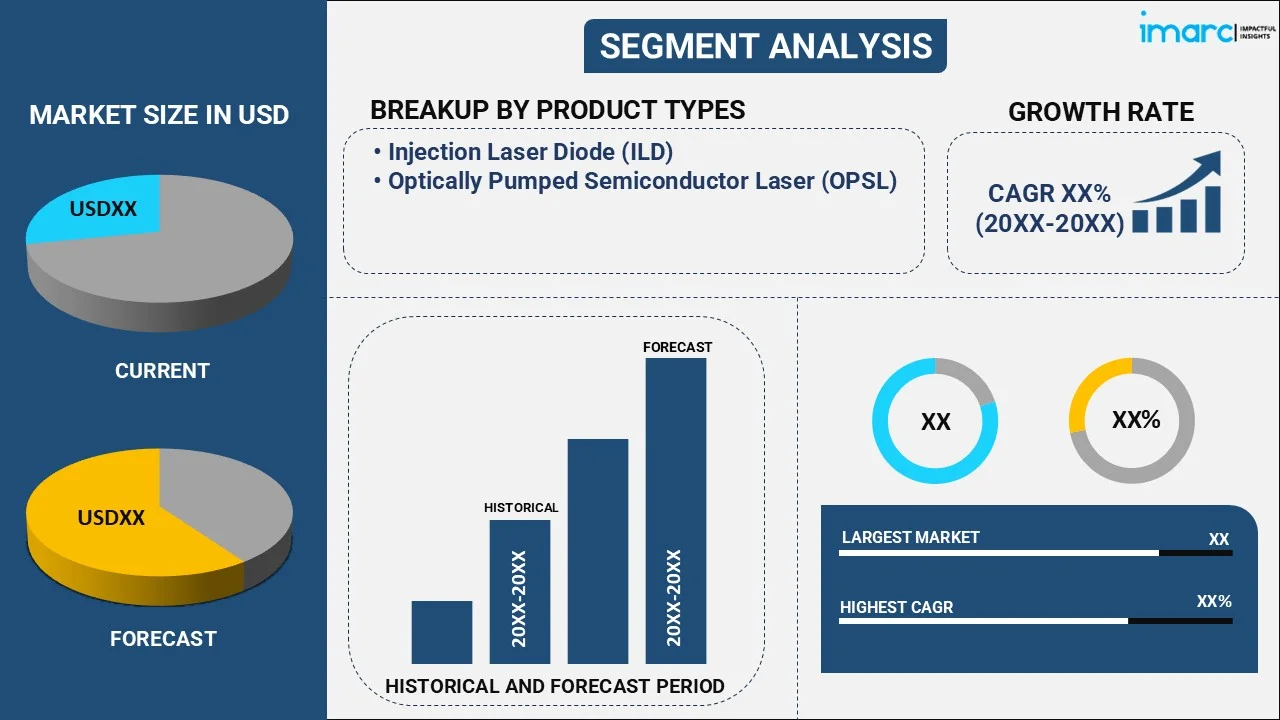

The global laser diode market size reached USD 12.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 31.4 Billion by 2033, exhibiting a growth rate (CAGR) of 9.92% during 2025-2033. The increasing product demand in the healthcare industry, the rising product utilization in material processing, rapid innovations in the laser diode industry, and the growing product usage in the manufacturing of automotive headlamps are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.8 Billion |

|

Market Forecast in 2033

|

USD 31.4 Billion |

| Market Growth Rate 2025-2033 | 9.92% |

A laser diode is a compact semiconductor device that emits coherent light through stimulated emission. It consists of a p-n junction, typically made of gallium arsenide (GaAs) or other semiconductor materials. When a forward voltage is applied to the diode, electrons and holes, recombine, releasing energy in photons. This process is amplified through optical feedback, resulting in a highly focused, narrow light beam. Laser diodes are widely utilized in various applications, including telecommunications, laser printing, barcode readers, optical storage devices, and laser pointers. They offer advantages such as small size, low power consumption, high efficiency, and fast modulation capabilities. Laser diodes have revolutionized industries and technologies by providing reliable, affordable, and versatile sources of coherent light for various purposes.

The laser diode market is experiencing significant growth, driven by numerous factors across various industries. In the telecommunications sector, there is a rising demand for laser diodes due to the need for high-speed data transmission as they provide efficient and reliable performance. Similarly, the consumer electronics industry has witnessed the growing adoption of laser diodes in applications like laser displays and laser pointers, enhancing user experiences and enabling advanced functionalities. Moreover, the expansion of the automotive industry has fueled the demand for laser diodes, particularly in advanced driver-assistance systems (ADAS) and autonomous vehicles, where they play a critical role in sensing and guidance. Furthermore, laser diodes have found extensive usage in the medical field, specifically in devices and treatments like laser surgery, ophthalmology, and dermatology. Their precision and effectiveness have led to increased demand for improved medical procedures. Technological advancements have also played a vital role in the market growth, with laser diode technology witnessing developments such as increased power output and enhanced efficiency, making them more reliable and versatile. Due to their accuracy and speed, the industrial sector has expanded the market, employing laser diodes in laser cutting, welding, and material processing applications. Additionally, the defense and aerospace sectors utilize laser diodes for target acquisition, rangefinding, and guidance systems, enhancing their capabilities and ensuring better accuracy. Other sectors driving the market growth include barcode scanning, optical storage, printing applications, and the semiconductor and electronics manufacturing industries, where laser diodes are used in lithography and inspection systems. The adoption of laser diodes in scientific research, spectroscopy, and bioimaging applications has also witnessed a considerable rise due to their precise and reliable performance.

Laser Diode Market Trends/Drivers:

Rising demand for miniaturized laser diodes

The rising demand for miniaturized laser diodes is a significant driving factor behind the growth of the laser diode market. As technology advances, there is a growing need for smaller and more compact laser diodes that can be integrated into various devices and applications. The miniaturization of laser diodes enables their incorporation into smaller electronic devices, wearable technology, and portable devices without compromising performance or efficiency. The demand for miniaturized laser diodes is evident in various industries. In consumer electronics, like smartphones, tablets, and wearable devices, the compact size of laser diodes allows for integrating features like laser autofocus for cameras or gesture recognition systems. Additionally, miniaturized laser diodes are increasingly used in healthcare for applications like point-of-care diagnostics, minimally invasive surgery, and wearable medical devices.

Expansion of the energy and power sector

The expansion of the energy and power sector is a key driving factor behind the growth of the laser diode market. Laser diodes are finding increasing applications in solar energy harvesting and laser-based power transmission systems, contributing to developing more efficient and sustainable energy solutions. In solar energy, laser diodes are used in photovoltaic systems for solar cell manufacturing and testing. Laser diodes enable precise cutting, scribing, and structuring of solar cells, improving their efficiency and performance. Laser-based power transmissions systems, such as laser wireless power transfer and laser energy transmission, are emerging technologies in the energy sector. The expansion of the energy and power sector, focusing on renewable and sustainable energy solutions, is driving the demand for laser diodes. As the sector continues to grow and invest in advanced energy technologies, the demand for laser diodes is expected to increase, thus stimulating the market growth further.

Increasing use of laser diodes in fiber optic communication networks

The increasing use of laser diodes in fiber optic communication networks is a major driving factor for the laser diode market. Fiber optic networks have become the backbone of modern communication systems as they transmit large volumes of data over long distances with less signal loss. Laser diodes are essential in these networks as they provide a light source for transmitting data through optical fibers. Laser diodes offer advantages such as high-speed modulation, high power output, and a wide wavelength range, making them ideal for long-distance, high-bandwidth data transmission. They provide the necessary intensity and stability to carry data over fiber optic cables, ensuring efficient and reliable communication. The growing demand for faster and more reliable communication networks, driven by increased internet usage, cloud computing, and the rise of streaming services, has led to a significant expansion of fiber optic infrastructure. As a result, the demand for laser diodes used in these networks has also increased.

Laser Diode Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global laser diode market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product type and application.

Breakup by Product Type:

- Injection Laser Diode (ILD)

- Optically Pumped Semiconductor Laser (OPSL)

Injection Laser Diode (ILD) dominates the laser diode market

The report has provided a detailed breakup and analysis of the laser diode market based on the product type. This includes injection laser diode (ILD) and optically pumped semiconductor laser (OPSL). According to the report, injection laser diode (ILD) represented the largest segment.

The Injection Laser Diode (ILD) segment is experiencing significant growth in the laser diode market, driven by several key factors. The expanding telecommunications industry is fueling the demand for ILDs. These diodes are widely used in fiber optic communication systems for their ability to generate coherent and high-intensity light. With the increasing adoption of high-speed data transmission and the growing demand for bandwidth, ILDs play a crucial role in enabling efficient data transfer over long distances.

The injection laser diode segment is benefitting from advancements in laser diode technology. Ongoing research and development efforts have improved the performance characteristics of ILDs, such as higher output power, enhanced efficiency, and narrower spectral line widths. These advancements make ILDs more reliable, versatile, and suitable for a wider range of applications.

Breakup by Application:

- Optical Storage and Communication

- Industrial Applications

- Medical Applications

- Military and Defence Applications

- Instrumentation and Sensor Applications

- Others

Industrial applications hold the largest share in the laser diode market

A detailed breakup and analysis of the laser diode market based on the application have also been provided in the report. This includes optical storage and communication, industrial applications, medical applications, military and defence applications, instrumentation and sensor applications, and others. According to the report, industrial applications accounted for the largest market share.

The industrial applications segment is experiencing significant growth in the laser diode market due to several driving factors. The increasing adoption of laser diodes in industrial processes such as laser cutting, welding, and material processing is fueling the market growth in this segment. Laser diodes offer precise and efficient energy delivery, allowing for precise control and customization of industrial operations. This results in improved productivity, reduced material waste, and enhanced quality in manufacturing processes.

The rising demand for miniaturized and portable laser diode systems is driving growth in industrial applications. Compact laser diode modules are being integrated into handheld devices, robotic systems, and portable inspection equipment, enabling flexibility and ease of use in industrial environments.

Moreover, continual advancements in laser diode technology, including higher power output, improved beam quality, and wavelength versatility, are expanding the potential applications in the industrial sector. Furthermore, the growing focus on automation and Industry 4.0 initiatives is driving the demand for laser diodes in industrial robotics and smart manufacturing systems.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest laser diode market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America; Europe; Asia Pacific; Latin America; and the Middle East and Africa.

Asia Pacific is leading in the global laser diode market, primarily driven by the constant demand for material processing in various industries. The automotive sector, heavy industries, and regional manufacturing consistently need laser diodes for applications such as laser cutting, welding, and surface treatment. These industries rely on laser diodes for their precision, efficiency, and versatility in handling various materials. The automotive industry in Asia Pacific is witnessing substantial growth, and laser diodes play a crucial role in automotive manufacturing processes, including precision cutting of components and welding of body parts.

Furthermore, the general manufacturing sector in Asia Pacific relies on laser diodes for various applications, such as marking, engraving, and micromachining. The region's thriving electronics manufacturing industry also contributes to the demand for laser diodes in PCB (printed circuit board) manufacturing, microelectronics production, and semiconductor fabrication. These factors have led to Asia Pacific's dominant position in the laser diode market. The region's robust industrial activities and the constant demand for material processing in automotive, heavy industries, and general manufacturing contribute significantly to the market growth in Asia Pacific.

Competitive Landscape:

The global laser diode market is experiencing significant growth as the major companies are investing in research and development to advance laser diode technology, focusing on improving power output, efficiency, and beam quality. By continually pushing the boundaries of innovation, they are expanding the range of applications and driving market growth. Additionally, top companies actively engage in strategic partnerships and collaborations to strengthen their market presence and expand their customer base. They are forming alliances with key players in industries such as telecommunications, automotive, and healthcare, allowing for the integration of laser diodes into cutting-edge solutions. Moreover, top companies are actively investing in marketing and promotional activities to raise awareness about the benefits of laser diodes. They conduct extensive market research to identify emerging trends and customer demands and tailor their product offerings accordingly.

The report has provided a comprehensive analysis of the competitive landscape in the global laser diode market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Coherent

- IPG Photonics

- OSRAM Licht AG

- TRUMPF GmbH + Co. KG

- Jenoptik AG

Recent Developments:

- In June 2023, Coherent introduced its new PH20 SmartWeld+ laser processing heads optimized for precision control of welding depths that are ideal for electric vehicle (EV) manufacturing applications.

- In Jan 2023, IPG Photonics Corporation announced the launch of six high-efficiency diode laser solutions providing numerous advantages over thermal ovens in industrial heating and drying applications.

- In April 2023, OSRAM Licht AG launched a 905 nm edge-emitting laser diode from Ams OSRAM features a low-cost plastic package for consumer and industry applications.

Laser Diode Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Injection Laser Diode (ILD), Optically Pumped Semiconductor Laser (OPSL) |

| Applications Covered | Optical Storage and Communication, Industrial Applications, Medical Applications, Military and Defence Applications, Instrumentation and Sensor Applications, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Coherent, IPG Photonics, OSRAM Licht AG, TRUMPF GmbH + Co. KG and Jenoptik AG |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the laser diode market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global laser diode market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the laser diode industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The laser diode market was valued at USD 12.8 Billion in 2024.

We expect the global laser diode market to exhibit a CAGR of 9.92% during 2025-2033.

The increasing adoption of laser diode across various industries, such as healthcare, industrial, automotive, etc., as it is offers high monochromaticity, coherence, and directionality as compared to ordinary light sources, is primarily driving the global laser diode market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for laser diodes.

Based on the product type, the global laser diode market has been divided into Injection Laser Diode (ILD), and Optically Pumped Semiconductor Laser (OPSL). Among these, Injection Laser Diode (ILD) currently exhibits a clear dominance in the market.

Based on the application, the global laser diode market can be segmented into optical storage and communication, industrial applications, medical applications, military and defence applications, instrumentation and sensor applications, and others. Currently, industrial applications hold the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global laser diode market include Coherent, IPG Photonics, OSRAM Licht AG, TRUMPF GmbH + Co. KG, Jenoptik AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)