Silica Sand Market Report by End-Use (Glass Industry, Foundry, Hydraulic Fracturing, Filtration, Abrasives, and Others), and Region 2026-2034

Silica Sand Market Size:

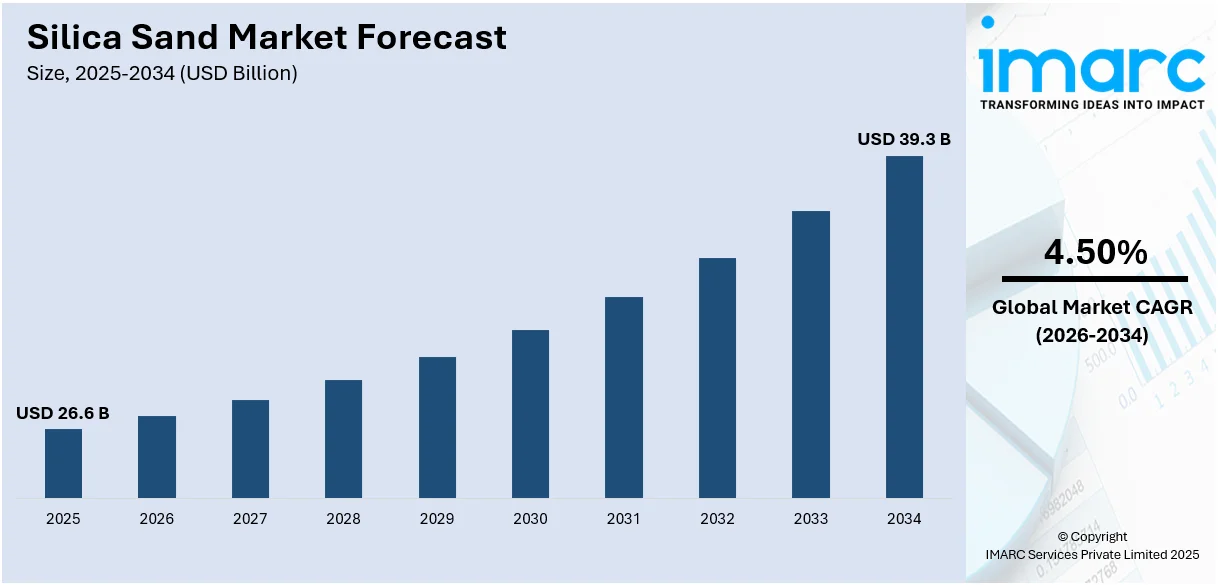

The global silica sand market size reached USD 26.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 39.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.50% during 2026-2034. The global market is primarily driven by the increasing demand from the construction and glass manufacturing industries, continual advancements in hydraulic fracturing technology in oil and gas extraction and rapid changes in environmental and regulatory landscapes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 26.6 Billion |

|

Market Forecast in 2034

|

USD 39.3 Billion |

| Market Growth Rate (2026-2034) | 4.50% |

Silica Sand Market Analysis:

- Market Growth and Size: The global market is experiencing robust growth, with escalating demand from various sectors. With its growing application in diverse industries, the silica sand market is reaching billions of dollars.

- Major Market Drivers: The increasing application of silica sand from various sectors, including glass manufacturing, construction, and oil and gas extraction, is primarily driving the growth of the global silica sand market. Moreover, the elevating levels of urbanization across several emerging economies are also contributing to the market growth.

- Technological Advancements: Ongoing technological innovations in mining and processing silica sand are improving efficiency and product quality. The industry is also utilizing environmentally sustainable practices, including reducing water usage and implementing land reclamation projects.

- Industry Applications: Silica sand is crucial in various industries, including glass manufacturing, foundries, hydraulic fracturing, water filtration, and abrasives. Its diverse employment across these sectors is bolstering its need in the market.

- Key Market Trends: The rising preference for high-purity sand, especially for specialized glass manufacturing, is one of the key trends in the market. The market is also witnessing an emerging trend towards sustainability in mining practices in response to regulatory pressures.

- Geographical Trends: China dominates the market on account of its massive construction and manufacturing industries, while on the other hand, the United States sees significant demand from the hydraulic fracturing industry. Countries, including Italy and Germany, contribute to the market with their advanced glass manufacturing sectors.

- Competitive Landscape: The market is characterized by the presence of several key players, including Badger Mining Corporation, Cairo minerals, Cape Flattery Silica Mines Pty., Ltd (Mitsubishi Corporation), Covia Holdings LLC, Euroquarz GmbH, Holcim AG, JFE Mineral & Alloy Company, Ltd., Quarzwerke GmbH, Sibelco, Sil Industrial Minerals, Source Energy Services, Tochu Corporation, U.S. Silica, etc., focusing on expanding production capacities, engaging in mergers and acquisitions, and investing in R&D.

- Challenges and Opportunities: Implementation of stringent environmental regulations poses challenges, requiring companies to inculcate sustainable practices. However, this also offers opportunities for innovation in environmentally friendly mining and processing techniques. The consistent demand across various industries offers significant growth potential for the market.

To get more information on this market Request Sample

Silica Sand Market Trends:

Increasing demand in the construction industry

The escalating utilization of silica sand in the expanding construction industry, primarily for the production of glass, concrete, and mortar, is significantly driving the market growth. The global rise in infrastructure and construction projects, fueled by elevating levels of urbanization and industrialization, especially in emerging economies, is also contributing to the market growth. For instance, according to the National Bureau of Statistics, China's construction sector is the largest industry in the world. As per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is projected to maintain a 6% share of the country's GDP going into 2025. The country's demographics are expected to favor housing and commercial construction activities. Moreover, the growing population in the country has triggered public and private sector investments in affordable residential colonies. Additionally, the government authorities of China have taken the initiative to gift 40 critical cities with 6.5 million government-subsidized rental homes that are supposed to accommodate around 13 million people. Moreover, the shift towards sustainable and energy-efficient buildings is increasing the use of sand in architectural glass and other construction applications. This growing demand in the construction sector is expected to continue, further propelling the growth of the market.

Advancements in hydraulic fracturing technology

The rising adoption of hydraulic fracturing (fracking) technology in the oil and gas industry is significantly augmenting the growth of the market. Silica sand is a key proppant used in hydraulic fracturing to keep fractures open and facilitate the extraction of oil and natural gas. According to the International Energy Agency, global oil consumption is expected to reach 104.1 million barrels per day by 2026. This would be a 4.4 mb/d increase over current levels. Furthermore, the International Energy Agency stated that global oil demand increased by 1.9 mb/d in 2023 to a record 101.7 mb/d. As the global energy sector continues to invest in and adopt hydraulic fracturing technology, the demand for high-quality sand variants is expected to rise. Moreover, the total production of crude oil and liquid fuels in North America in 2022 was 27.81 million barrels per day, while in 2021 was 26.44 million barrels per day. According to the U.S. Energy Information Administration (EIA), crude oil production in the United States reached 12,462 thousand barrels in January 2023, compared to 12,115 thousand barrels annually in December 2022. The United States is emerging as one of the leading countries globally in the exploration of unconventional crude oil reserves. Thus, due to the abovementioned points, the oil and gas industry is likely to dominate the market, which, in turn, is expected to enhance the demand for silica sand during the forecast period.

Technological Innovations in Filtration Systems

Natural resources, including silica sand, are one of the best approaches for treating dye-polluted wastewater. Natural resource-based silica is gaining interest from researchers because of its low cost, eco-friendliness, bioactivity, and availability. According to the United Nations (UN) World Water Development Report of 2018, an estimated six billion people all over the world will endure acute water resource depletion by 2050. As a result, a new green reactive adsorbent (calcium ferric oxide silica sand (CFO-SS)) made from wastepaper sludge ash and ferric ions was synthesized and shown to effectively remove tetracycline antibiotics (TC) from contaminated water. Such advancements have the potential to significantly impact the silica sand industry.

Environmental and regulatory factors

Environmental and regulatory policies are significantly impacting the market. Implementation of stricter regulations regarding sand mining and processing, aimed at reducing environmental impact and ensuring worker safety, can influence production costs and supply. For instance, the implementation of federal regulations states that mining companies are required to obtain permits from the federal government under the Clean Water Act and Clean Air Act to ensure that their operations do not harm the environment. Additionally, the US state governments have also imposed regulations to manage silica sand mining, such as requiring companies to reclaim mined land or to conduct environmental impact assessments. On the other hand, policies encouraging the use of environmentally friendly materials in construction and manufacturing can substantially augment the demand for the sand. The industry's response to these regulatory challenges, including commitment to investment in sustainable mining techniques and adherence to environmental standards, plays a vital role in shaping the silica sand market outlook.

Silica Sand Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, and country levels for 2026-2034. Our report has categorized the market based on end-use.

Breakup by End-Use:

Access the comprehensive market breakdown Request Sample

- Glass Industry

- Foundry

- Hydraulic Fracturing

- Filtration

- Abrasives

- Others

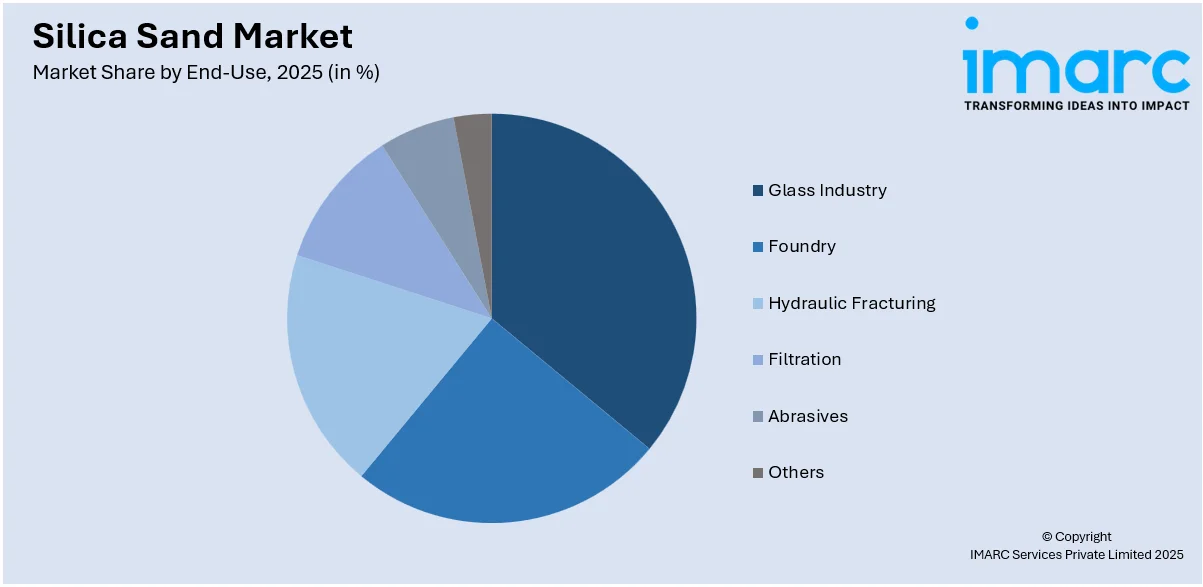

Glass industry accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes glass industry, foundry, hydraulic fracturing, filtration, abrasives, and others. According to the report, the glass industry represented the largest segment.

As the largest segment in the sand market, the glass industry heavily relies on high-quality sand for manufacturing a wide range of glass products, including flat glass, container glass, and specialty glass. Silica sand is an inevitable part of the glass manufacturing industry and accounts for more than 50% of the raw materials used. The clarity, strength, and chemical purity of the sand make it ideal for glass production, which demands exacting standards. Moreover, the use of specialty glass in the reputable electronics sector in developed countries is expected to aid further the growth of the glass manufacturing industry, which, in turn, will increase the demand for silica sand across the globe. The growth in the glass industry is propelled by the increasing use of glass in the construction, automotive, and consumer electronics sectors, particularly for energy-efficient buildings and lightweight vehicles. This segment's expansion is a key driver of the overall market.

Breakup by Region:

- China

- United States

- Italy

- Turkey

- Germany

- Australia

- Others

China leads the market, accounting for the largest silica sand market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, the United States, Italy, Turkey, Germany, Australia, and others. According to the report, China accounted for the largest silica sand market share.

As the largest regional segment in the sand market, China's dominance is driven by thriving construction, manufacturing, and automotive sectors, which extensively utilize silica sand for glass production and concrete manufacturing. Furthermore, various players in the glass production market are contemplating sourcing silica sand from Asian countries, notably China, to produce diverse, high-quality glass products. This is due to the availability of sand with a silicon dioxide content exceeding 99% in the Asia-Pacific region. For instance, VRX Silica Ltd. is focused on developing silica sand projects in Western Australia, targeting the export market to Asia, primarily China, and exploring opportunities for glass manufacturing locally. Besides this, China’s rapidly expanding infrastructure, coupled with a flourishing automotive industry and a significant push towards renewable energy projects, heavily relies on the sand. China's large-scale industrial activities, supported by government policies promoting urbanization and industrialization, make it a pivotal player in the global market.

Leading Key Players in the Silica Sand Industry:

Key players in the market are focusing on expanding their production capacities, improving mining and processing efficiencies, and investing in research and development to enhance the quality of their products. They are also actively engaging in strategic partnerships, mergers, and acquisitions to strengthen their market position and expand their global footprint. These companies are increasingly adopting environmentally sustainable practices, such as reducing water usage in processing and implementing reclamation projects, to comply with stringent environmental regulations. Additionally, they are leveraging advanced technologies for better resource management and to meet the diverse requirements of various industries, including glass manufacturing, foundry, and hydraulic fracturing.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Badger Mining Corporation

- Cairo minerals

- Cape Flattery Silica Mines Pty., Ltd (Mitsubishi Corporation)

- Covia Holdings LLC

- Euroquarz GmbH

- Holcim AG

- JFE Mineral & Alloy Company, Ltd.

- Quarzwerke GmbH

- Sibelco

- Sil Industrial Minerals

- Source Energy Services

- Tochu Corporation

- U.S. Silica

Latest News:

- February 2024: Manitoba has greenlighted a silica sand mining project in Hollow Water First Nation that is expected to generate $200 million per year in provincial taxes and nearly 300 jobs, most of them in Selkirk.

- August 2023: Chongqing Changjiang River Moulding Material Group Co., Ltd. (CCRMM) has transformed waste sand, previously discarded, into usable "new sand" after multiple processes. The new sand shows reduced scorch, less gas generation, and a diminished expansion coefficient, thereby cutting foundry production costs.

Silica Sand Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Uses Covered | Glass Industry, Foundry, Hydraulic Fracturing, Filtration, Abrasives, Others |

| Countries Covered | China, United States, Italy, Turkey, Germany, Australia, Others |

| Companies Covered | Badger Mining Corporation, Cairo minerals, Cape Flattery Silica Mines Pty., Ltd (Mitsubishi Corporation), Covia Holdings LLC, Euroquarz GmbH, Holcim AG, JFE Mineral & Alloy Company, Ltd., Quarzwerke GmbH, Sibelco, Sil Industrial Minerals, Source Energy Services, Tochu Corporation, U.S. Silica, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the silica sand market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global silica sand market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the silica sand industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Silica sand is used in a diverse range of industries, including glass manufacturing, construction, foundry, chemicals, water filtration, and sports among others.

According to the IMARC Group, the global market of silica sand accounted for a market value of USD 26.6 Billion in the year 2025. The increasing utilization of fiberglass across the automotive and construction sectors is primarily driving the demand for silica sand on a global level. Moreover, the escalating requirement for silica sand owing to the growing production of unconventional natural gas, as it is extracted using the hydraulic fracturing process wherein silica sand is used as a proppant, is also propelling the silica and sand market growth.

We expect the global silica sand market to exhibit a CAGR of 4.50% during 2026-2034.

The growing focus of the key players on the adoption of low-grade silica sand in lightweight glazing glass, solar control glazing for building glass, and nanotechnology in flat glass, will continue to bolster the global silica sand market in the coming years. Moreover, the elevating use of silica sand in the manufacturing of various construction materials, which include paints and coatings, ceramics, stained glass, etc., is also expected to propel the silica and sand market growth.

In the year 2025, the United States was the top exporter of silica sand. It was followed by Australia, Belgium, and Germany.

The expanding application of silica sand in paving roads, glass making, foundries and coal burning boilers, oil and water filtration, industrial casting, sandblasting, etc., is currently catalyzing the global silica sand market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end-use industries for silica sand.

On a regional level, the market has been classified into China, United States, Italy, Germany, Turkey, Australia, and others, where China currently dominates the global market.

Some of the major players in the global silica sand market include Badger Mining Corporation, Cairo minerals, Cape Flattery Silica Mines Pty., Ltd (Mitsubishi Corporation), Covia Holdings LLC, Euroquarz GmbH, Holcim AG, JFE Mineral & Alloy Company, Ltd., Quarzwerke GmbH, Sibelco, Sil Industrial Minerals, Source Energy Services, Tochu Corporation, U.S. Silica, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)