Australia Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2026-2034

Australia Real Estate Market Summary:

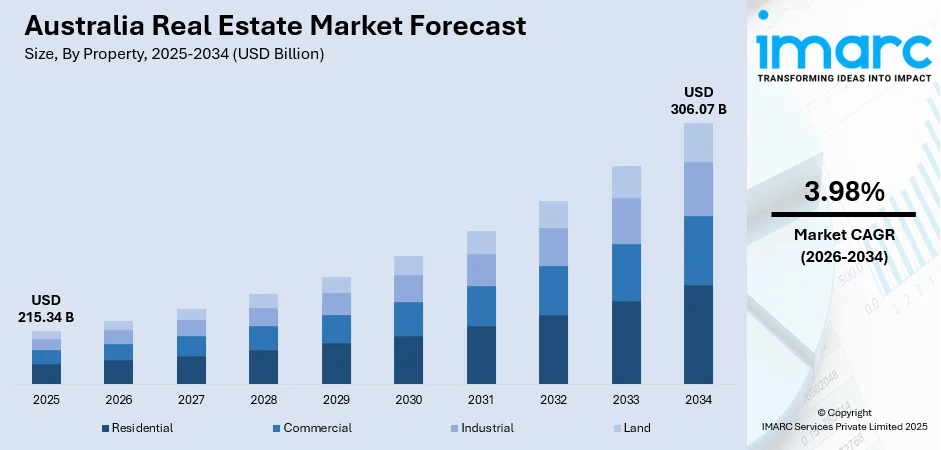

The Australia real estate market size was valued at USD 215.34 Billion in 2025 and is projected to reach USD 306.07 Billion by 2034, growing at a compound annual growth rate of 3.98% from 2026-2034.

The market is driven by strong population growth, rising urbanization, and sustained demand for housing across metropolitan and regional areas. Government incentives supporting first-home buyers and favorable lending conditions continue to stimulate property transactions. Infrastructure development and foreign investment further enhance market activity, while evolving lifestyle preferences drive demand for diverse property types, contributing significantly to Australia real estate market share.

Key Takeaways and Insights:

- By Property: Residential dominates the market with a share of 58.1% in 2025, driven by persistent housing demand from population growth, urbanization trends, and government incentives supporting homeownership aspirations.

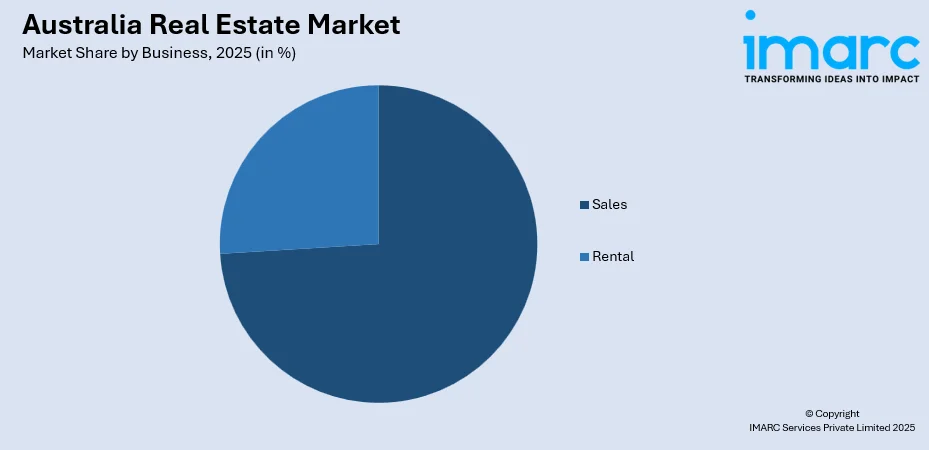

- By Business: Sales leads the market with a share of 74.08% in 2025, owing to strong investor appetite for property ownership, favorable capital appreciation trends, and cultural preferences prioritizing ownership.

- By Mode: Offline represents the largest segment with a market share of 69.07% in 2025, driven by consumer preference for in-person property inspections, face-to-face negotiations, and trust in traditional agent relationships.

- By Region: Australia Capital Territory & New South Wales leads the market with a share of 31% in 2025, driven by economic concentration in Sydney and Canberra, population density, and robust infrastructure development.

- Key Players: The Australia real estate market exhibits a moderately fragmented structure, with established national agencies competing alongside regional specialists and boutique firms across residential, commercial, and industrial property segments, leveraging localized expertise and service differentiation.

To get more information on this market Request Sample

The Australia real estate market continues to experience robust growth propelled by fundamental economic drivers and demographic shifts reshaping property demand across the nation. Sustained population expansion through natural increase and immigration creates persistent housing requirements, particularly in major metropolitan centers along the eastern seaboard. According to sources, in October 2025, the Australian Government expanded the First Home Guarantee scheme, increasing property price limits and removing caps on places, enabling more first-time buyers with 5% deposits to enter the market. Moreover, government policies supporting homeownership through stamp duty concessions and first-home buyer grants stimulate market activity across price segments. Infrastructure investments in transportation networks and urban amenities enhance property values in developing suburbs and regional centers. Foreign investment attraction programs bring international capital into premium residential and commercial assets.

Australia Real Estate Market Trends:

Australia Real Estate Market Trends

Australian buyers increasingly prioritize environmentally sustainable properties featuring energy-efficient designs and renewable energy systems. In March 2025, the Australian and NSW governments launched a $25 Million Solar for Apartment Residents program co‑funding rooftop solar installations on multi‑unit dwellings, broadening access to renewable technology and lowering energy costs for residents. Green building certifications and sustainable construction materials significantly influence purchasing decisions across residential and commercial segments. Developers respond by incorporating solar installations, rainwater harvesting systems, and passive design principles into new constructions. Government incentives supporting green building initiatives accelerate this trend, while rising energy costs make environmentally conscious properties financially attractive to buyers seeking long-term operational savings.

Growth of Build-to-Rent Developments

The Australia real estate market witness’s significant expansion in purpose-built rental developments designed specifically for long-term tenants. This institutional rental model offers professionally managed accommodations with enhanced amenities unavailable in traditional rental properties. In December 2025, Marubeni Corporation joined Australian real estate firm AsheMorgan and partners to launch the District Living Build‑to‑Rent project in Melbourne’s Docklands, underscoring major developer commitment to long‑term rental housing. Furthermore, developers create communities featuring shared facilities including fitness centers, co-working spaces, and communal entertainment areas. The build-to-rent sector attracts institutional investors seeking stable rental income streams while addressing housing affordability concerns and providing renters with tenure security.

Regional Market Expansion and Decentralization

Australian property markets beyond major metropolitan centers experience unprecedented growth as buyers seek affordable alternatives with lifestyle benefits. Regional cities and coastal communities attract residents prioritizing space, natural amenities, and improved work-life balance enabled by remote working flexibility. According to sources, the South Australian Government’s Office for Regional Housing listed the first homes under its Regional Key Worker Housing Scheme in Port Augusta, offering government‑backed leasebacks to attract essential workers and support regional living. Furthermore, infrastructure improvements connecting regional areas to metropolitan centers enhance accessibility and economic opportunities. State governments actively promote regional relocation through incentive programs, spreading property investment opportunities across previously overlooked markets.

Market Outlook 2026-2034:

The Australia real estate market revenue is projected to demonstrate sustained expansion throughout the forecast period, supported by fundamental demand drivers including population growth and urbanization trends. Continued infrastructure investments and economic diversification across states will unlock new development opportunities in emerging corridors. The residential segment will maintain dominance while commercial and industrial properties benefit from evolving business requirements. Regional markets are expected to capture increasing revenue shares as decentralization continues, with overall market performance reflecting balanced growth across property types and geographic regions. The market generated a revenue of USD 215.34 Billion in 2025 and is projected to reach a revenue of USD 306.07 Billion by 2034, growing at a compound annual growth rate of 3.98% from 2026-2034.

Australia Real Estate Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Property |

Residential |

58.1% |

|

Business |

Sales |

74.08% |

|

Mode |

Offline |

69.07% |

|

Region |

Australia Capital Territory & New South Wales |

31% |

Property Insights:

- Residential

- Commercial

- Industrial

- Land

Residential dominates with a market share of 58.1% of the total Australia real estate market in 2025.

The residential commands the leading position within the Australia real estate market, reflecting fundamental housing requirements driven by population dynamics and cultural preferences for homeownership. Sustained immigration programs and natural population growth create continuous demand for housing across metropolitan and regional areas. As per sources, in 2025, Landmark Group advanced two major residential projects in Sydney under streamlined State Significant Development (SSD) planning rules, accelerating delivery of high‑quality homes and affordable housing targets for essential workers. Moreover, diverse dwelling types ranging from detached houses to apartments accommodate varying household compositions and budget considerations.

Investment property ownership remains culturally significant as a wealth-building strategy, with residential assets offering rental income potential alongside capital appreciation prospects. Urban densification programs drive apartment development in established suburbs while new housing estates expand metropolitan boundaries to accommodate growing populations. Lifestyle preferences increasingly influence residential choices, with buyers seeking properties accommodating remote work arrangements and enhanced living spaces. Strong demand from both owner-occupiers and investors ensures residential properties maintain market dominance throughout the forecast period.

Business Insights:

Access the comprehensive market breakdown Request Sample

- Sales

- Rental

Sales leads with a share of 74.08% of the total Australia real estate market in 2025.

The sales dominate business activity within the Australia real estate market, underpinned by strong cultural affinity toward property ownership as a cornerstone of financial security. Australian households traditionally prioritize property acquisition as their primary wealth accumulation strategy, driving sustained transaction volumes across price categories. According to sources, in 2025, The Agency Group Australia (ASX: AU1) achieved over $1 Billion in residential property sales for November, marking the company’s strongest monthly sales in its history and highlighting the momentum of national transactions. Moreover, favorable lending conditions and competitive mortgage products facilitate ownership transitions.

Investment motivations significantly contribute to sales activity, with property investors acquiring residential and commercial assets for portfolio diversification and passive income generation. Capital appreciation expectations in growing markets attract both domestic and international buyers seeking asset growth opportunities. Government superannuation regulations permitting property investments through self-managed funds channel additional capital into sales transactions. Inheritance patterns often result in property liquidations maintaining transaction volumes, while downsizing trends among older Australians create ongoing market turnover supporting sustained sales activity.

Mode Insights:

- Online

- Offline

Offline exhibits a clear dominance with a 69.07% share of the total Australia real estate market in 2025.

The offline maintains market leadership within Australia real estate transactions, reflecting consumer preferences for traditional agency relationships and physical property engagement throughout purchasing processes. High-value real estate transactions benefit from personalized service, expert local knowledge, and negotiation support that physical agents provide effectively. As per sources, in 2025, The Agency Group Australia was recognised as Western Australia’s leading real estate office at the REIWA Awards, affirming strong agent performance and client trust in face‑to‑face service delivery. Furthermore, face-to-face interactions establish trust essential for significant financial commitments involving property purchases.

Offline remains critical to buyer confidence, enabling thorough assessment of construction quality, neighbourhood characteristics, and spatial configurations beyond digital representations. Auction processes, particularly prevalent in major metropolitan markets, require physical attendance and create competitive bidding environments driving sale prices. Established agency networks with local market expertise offer sellers comprehensive marketing strategies combining physical presence with digital visibility. Open home inspections and private viewings facilitate emotional connections between buyers and properties, influencing purchasing decisions in ways virtual alternatives cannot match.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales dominates with a market share of 31% of the total Australia real estate market in 2025.

Australia Capital Territory & New South Wales collectively represent the largest regional market, anchored by Sydney's position as the nation's premier property market and economic hub. The region's substantial population concentration creates enormous housing demand across all price categories, while Canberra's role as the national capital ensures stable government-related property requirements consistently. World-class infrastructure, educational institutions, and employment opportunities attract domestic and international residents seeking premium living standards. Economic diversity across financial services, technology, and professional sectors supports sustained property demand.

Diverse property offerings spanning harbor-side luxury residences to suburban family homes accommodate varying buyer preferences and financial capacities effectively. Strong international investor interest in Sydney properties maintains premium valuations while regional New South Wales areas experience growth from metropolitan overflow and lifestyle migration patterns. Infrastructure investments including transportation upgrades and urban renewal projects continuously enhance property values and development opportunities throughout this economically significant region. Emerging growth corridors benefit from government planning initiatives directing population expansion toward strategically identified development areas.

Market Dynamics:

Growth Drivers:

Why is the Australia Real Estate Market Growing?

Strong Population Growth and Immigration Influx

Australia's sustained population expansion through strategic immigration programs and natural increase creates fundamental demand underpinning real estate market growth. Government policies actively attract skilled migrants and international students who require housing upon arrival and often transition to permanent residency with property ownership aspirations. According to reports, the Australian Government confirmed the 2025–26 permanent migration cap at 185,000 places and introduced a new Talent & Innovation visa to attract high‑skilled migrants in priority sectors, reinforcing long‑term residency and housing demand. Furthermore, this population pipeline ensures continuous market demand regardless of economic cycles, particularly in major metropolitan areas serving as immigrant gateways.

Government Incentive Programs and Policy Support

Comprehensive government interventions across federal and state levels actively stimulate real estate market activity through targeted incentive mechanisms. First-home buyer programs reduce entry barriers through stamp duty concessions, grants, and guarantee schemes enabling purchases with smaller deposits. Negative gearing and capital gains tax provisions maintain investor appetite for property acquisition, ensuring ongoing demand beyond owner-occupier markets. As per sources, in 2025, the New South Wales Government’s landmark Planning System Reforms Bill 2025 was introduced, modernising nearly 50-year-old planning laws to cut red tape and speed approvals, bolstering housing supply expansion. Moreover, state governments compete to attract residents and businesses through development incentives and infrastructure commitments enhancing property values.

Infrastructure Development and Urban Connectivity

Major infrastructure investments in transportation networks, utilities, and community facilities directly enhance property values and unlock development opportunities across Australian markets. New rail lines, motorway extensions, and public transport improvements increase accessibility to previously underserved areas, triggering residential development and price appreciation along infrastructure corridors. According to reports, the Albanese Government’s 2025–26 Budget committed $17.1 Billion to new and existing road and rail infrastructure projects nationwide, including $7.2 Billion for safety and capacity upgrades on the Bruce Highway and $2.3 Billion for major Western Sydney transport improvements. Furthermore, airport expansions and port upgrades support commercial and industrial property demand in logistics-focused locations.

Market Restraints:

What Challenges the Australia Real Estate Market is Facing?

Housing Affordability Challenges and Price Pressures

Escalating property prices relative to household incomes create significant market accessibility barriers, particularly for first-home buyers in major metropolitan areas. Affordability constraints force potential buyers to delay purchases, reduce aspirations, or relocate to more affordable regions, limiting transaction volumes in premium markets. Deposit requirements represent substantial hurdles for younger households without family support.

Regulatory Uncertainty and Policy Changes

Evolving government policies regarding taxation, foreign investment restrictions, and lending regulations create uncertainty affecting market sentiment and investment decisions. Potential changes to negative gearing, capital gains tax treatment, or investor lending criteria could significantly impact property demand and valuations. State-based land tax reforms and planning policy modifications introduce compliance complexities for developers.

Interest Rate Sensitivity and Lending Conditions

The property market performance demonstrates significant correlation with monetary policy settings and lending institution credit availability. Interest rate fluctuations directly impact borrower serviceability and purchasing capacity, with increases potentially constraining transaction volumes and price growth. Prudential regulations governing lending standards, including debt-to-income ratios and loan-to-value restrictions, limit credit accessibility effectively.

Competitive Landscape:

The Australia real estate market operates within a competitive framework characterized by diverse participant categories serving distinct market segments and geographic territories. National agency networks leverage brand recognition and comprehensive service offerings to capture market share across major metropolitan centers and regional markets. Independent agencies emphasize localized expertise, personalized service approaches, and community relationships to differentiate from larger competitors. Digital platforms increasingly challenge traditional agency models by offering alternative transaction pathways and reduced commission structures. Market participants compete across service quality dimensions, marketing capabilities, technology adoption, and fee structures to attract property listings and buyer clients in an environment where reputation and track record significantly influence consumer decisions.

Recent Developments:

- In November 2025, Fingerprint Property, led by Ben De Luca, launched its first residential project, Plaza Place, in Carseldine. The $65 Million development offers 70 two-bedroom apartments with sustainable design features, forming part of the broader $250 Million Carseldine Village project supported by Deluca Corporation.

Australia Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia real estate market size was valued at USD 215.3 Billion in 2025.

The Australia real estate market is expected to grow at a compound annual growth rate of 3.98% from 2026-2034 to reach USD 306.1 Billion by 2034.

Residential held the largest market share, driven by sustained housing demand from population growth, immigration programs, and cultural preferences favoring homeownership as a primary wealth-building strategy, supported by government incentives encouraging first-home buyer market participation.

Key factors driving the Australia real estate market include sustained population growth through immigration, government incentive programs supporting homeownership, infrastructure development enhancing property values, and strong investor demand for property assets.

Major challenges include housing affordability constraints limiting buyer accessibility, regulatory uncertainty regarding taxation and investment policies, interest rate sensitivity impacting borrower serviceability, supply constraints in high-demand areas, and increasing competition from alternative investment assets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)