Brazil Bariatric Surgery Market Size, Share, Trends and Forecast by Device, and Region, 2026-2034

Brazil Bariatric Surgery Market Summary:

The Brazil bariatric surgery market size was valued at USD 47.09 Million in 2025 and is projected to reach USD 58.66 Million by 2034, growing at a compound annual growth rate of 2.47% from 2026-2034.

The Brazil bariatric surgery market encompasses medical procedures and devices designed to facilitate weight loss through digestive system modifications. The market includes assisting devices such as suturing devices, closure devices, stapling devices, and trocars, alongside implantable devices including gastric bands, electrical stimulation devices, and gastric balloons. Brazil has emerged as a significant hub for bariatric procedures in Latin America, driven by sophisticated surgical expertise, improving healthcare infrastructure, and growing recognition of surgical interventions as effective solutions for morbid obesity and associated metabolic disorders.

Key Takeaways and Insights:

- By Device: Assisting devices dominated the market with 63% revenue share in 2025, driven by the widespread adoption of laparoscopic surgical techniques requiring specialized suturing, closure, and stapling equipment for minimally invasive procedures that ensure safe surgical execution and optimal patient outcomes.

- Key Players: The Brazil bariatric surgery market demonstrates moderate competition, characterized by both global and regional manufacturers across various product segments. Competition is driven by continuous innovation in medical devices, the advancement of surgical techniques, and investment in research and development to enhance treatment efficacy, safety, and patient outcomes within the bariatric care landscape.

The Brazil bariatric surgery market is witnessing significant growth, fueled by the rising prevalence of obesity across the population. Improvements in healthcare infrastructure, especially in major urban centers, have increased access to advanced surgical procedures, enabling more patients to benefit from effective interventions. The adoption of minimally invasive techniques has further enhanced patient outcomes by reducing recovery times, minimizing complications, and improving overall safety. Expanding private health insurance coverage for bariatric procedures has broadened accessibility, allowing a larger segment of the population to undergo surgery beyond the limitations of public healthcare. Additionally, Brazil’s growing reputation as a medical tourism hub has attracted international patients seeking high-quality, cost-efficient bariatric treatments. The Brazil medical tourism market size reached USD 3.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 16.3 Billion by 2034, exhibiting a growth rate (CAGR) of 17.96% during 2026-2034. Accredited medical facilities and highly skilled surgical teams with expertise in weight management have reinforced the country’s position as a preferred destination for both domestic and international bariatric procedures, supporting sustained market growth.

Brazil Bariatric Surgery Market Trends:

Adoption of Minimally Invasive Surgical Techniques

The Brazil bariatric surgery market is witnessing accelerated adoption of minimally invasive procedures, including laparoscopic and robotic-assisted surgeries. The Brazil minimally invasive surgery devices market size was valued at USD 1,240.10 Million in 2025 and is projected to reach USD 2,474.83 Million by 2034, growing at a compound annual growth rate of 7.98% from 2026-2034.

These advanced techniques offer significant advantages including reduced surgical trauma, smaller incisions, decreased post-operative pain, and faster patient recovery. Brazilian healthcare facilities are increasingly investing in sophisticated surgical equipment, with leading hospitals integrating robotic systems that provide enhanced precision and control during complex bariatric procedures, improving overall surgical outcomes and patient satisfaction.

Integration of Multidisciplinary Care Approaches

Bariatric surgery providers in Brazil are increasingly adopting comprehensive multidisciplinary care models that go beyond the surgical procedure itself. These approaches involve coordinated efforts among surgeons, endocrinologists, dietitians, and psychologists to address the physical, nutritional, and psychological aspects of obesity management. Postoperative programs offering tailored dietary guidance and ongoing psychological support have become essential components of patient care, helping to enhance long-term outcomes, improve adherence to lifestyle changes, and reduce the likelihood of weight regain, ultimately contributing to higher overall treatment success and patient satisfaction.

Expansion of Medical Tourism Infrastructure

Brazil is strengthening its reputation as a leading destination for bariatric medical tourism, drawing patients from North America, Europe, and other Latin American countries. The country combines cost-effective treatment options with internationally accredited healthcare facilities and highly skilled surgical teams. Expanding support services, including specialized accommodations, multilingual staff, and personalized concierge programs, further enhance the patient experience. These factors collectively make Brazil an attractive choice for international patients, boosting demand for bariatric procedures and contributing to sustained growth in the medical tourism and surgical care market.

Market Outlook 2026-2034:

The Brazil bariatric surgery market demonstrates favorable growth prospects, underpinned by the persistent obesity epidemic and increasing recognition of surgical interventions as effective long-term weight management solutions. Government initiatives aimed at combating obesity, coupled with expanding health insurance coverage for bariatric procedures, are creating conducive conditions for market expansion. The ongoing development of surgical techniques and device innovations continues to enhance procedure safety and efficacy, while the strengthening medical tourism sector attracts international patients seeking quality care at competitive prices. The market generated a revenue of USD 47.09 Million in 2025 and is projected to reach a revenue of USD 58.66 Million by 2034, growing at a compound annual growth rate of 2.47% from 2026-2034.

Brazil Bariatric Surgery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Device |

Assisting Devices |

63% |

Device Insights:

To get Detaile segment analysis of this market, Request Sample

- Assisting Devices

- Suturing Device

- Closure Device

- Stapling Device

- Trocars

- Others

- Implantable Devices

- Gastric Bands

- Electrical Stimulation Devices

- Gastric Balloons

- Gastric Emptying

- Others

Assisting devices dominates with a market share of 63% of the total Brazil bariatric surgery market in 2025.

Assisting devices have established market leadership due to their essential role in modern bariatric surgical procedures. These devices, encompassing suturing, closure, stapling equipment, and trocars, form the technological backbone of minimally invasive weight loss surgeries. The segment's dominance reflects the widespread adoption of laparoscopic techniques across Brazilian healthcare facilities, where these instruments ensure precise tissue manipulation, secure wound closure, and optimal surgical outcomes during procedures such as sleeve gastrectomy and Roux-en-Y gastric bypass.

The closure devices sub-segment demonstrates particularly strong growth momentum, driven by increasing bariatric surgery volumes and the critical requirement for safe port site sealing following laparoscopic procedures. These devices efficiently close small incisions while minimizing complications such as infections and hernias. Healthcare campaigns and expanded surgical access have contributed to rising procedure volumes, directly stimulating demand for high-quality closure devices. As hospitals continue integrating bariatric surgery programs, the requirement for reliable assisting devices remains fundamental to achieving successful surgical outcomes.

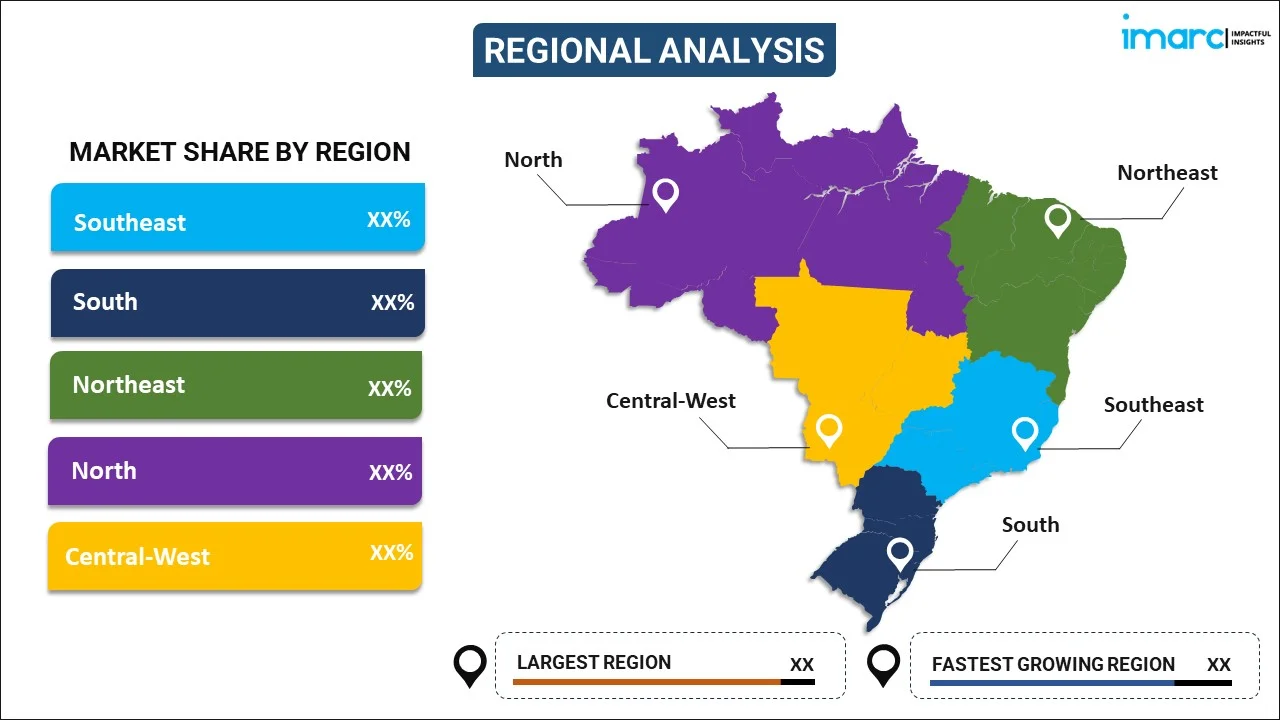

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region drives bariatric surgery market growth due to its advanced healthcare infrastructure, high concentration of specialized hospitals, and skilled medical professionals. Rising obesity prevalence, coupled with greater awareness of weight management interventions, fuels demand. The presence of private health insurance coverage and urban population density facilitates access to surgical procedures, while the region’s reputation for medical innovation and adoption of minimally invasive techniques further supports market expansion.

Market growth in the South is supported by well-established healthcare facilities and strong regional focus on preventive and surgical obesity management. Urban centers with higher healthcare accessibility, combined with increasing awareness of bariatric solutions, drive patient adoption. Private healthcare penetration and insurance coverage enhance affordability, while emphasis on advanced surgical techniques and multidisciplinary care models strengthens treatment outcomes, sustaining market development across the region.

The Northeast bariatric surgery market is growing due to rising obesity rates and improving healthcare infrastructure in key cities. Expanding access to specialized hospitals and surgical centers, along with increased patient awareness of bariatric solutions, is boosting adoption. Affordable private healthcare options and regional initiatives promoting minimally invasive procedures enhance accessibility and treatment outcomes, encouraging more patients to seek surgical interventions for long-term weight management.

The North is experiencing growth due to slow changes in healthcare accessibility and increased awareness of the health risks of obesity. The increased availability of specialty bariatric services has been caused by the expansion of urbanization and the development of infrastructure. The increased access to treatment is being enhanced using minimally invasive surgical procedures, together with the increasing role of private healthcare coverage. All these add positively to patient confidence and help in expanding the market in this new region.

The growth in the market of the Central-West region is driven by the growing obesity rates and the growing need for weight management products. The access to bariatric surgery among patients is facilitated by the development of specialized surgical centers and better healthcare infrastructure. There is an increase in the availability and outcomes of treatment due to the adoption of multidisciplinary care methods, private insurance coverage, and population increase in cities, which is leading to a gradual growth in bariatric surgery in the region.

Market Dynamics:

Growth Drivers:

Why is the Brazil Bariatric Surgery Market Growing?

Rising Prevalence of Obesity and Associated Comorbidities

The escalating obesity epidemic in Brazil represents the primary growth catalyst for the bariatric surgery market. Obesity prevalence has increased substantially over recent decades, with projections indicating that nearly half of Brazilian adults could be living with obesity within the coming years. Research presented at the International Congress on Obesity (ICO 2024) in São Paulo indicates that, if current trends continue, nearly half of adult Brazilians will be living with obesity by 2044. A further 27% of adults are projected to be overweight, indicating that in the next twenty years, nearly three-quarters of Brazil’s adult population may experience issues related to obesity or excess weight, up from the current 56%. This alarming trend is accompanied by a rising incidence of obesity-related comorbidities including type 2 diabetes, cardiovascular disease, hypertension, and sleep apnea, which significantly impact population health and impose substantial economic burdens on the healthcare system. Bariatric surgery has emerged as an effective intervention for addressing severe obesity and its associated metabolic disorders, demonstrating proven efficacy in achieving sustained weight loss and improving or resolving comorbid conditions. The recognition of surgical intervention as a comprehensive treatment approach, rather than merely a weight loss solution, continues to drive patient demand and physician referrals for bariatric procedures.

Advancements in Surgical Techniques and Technology

Significant technological advancements in bariatric surgical techniques have transformed the treatment landscape, making procedures safer, more accessible, and more effective. The widespread adoption of minimally invasive approaches, including laparoscopic and robotic-assisted surgeries, has substantially reduced surgical risks, shortened hospital stays, and accelerated patient recovery. These innovations have expanded the pool of eligible candidates for bariatric intervention and improved overall patient acceptance of surgical weight loss options. Brazilian healthcare facilities continue investing in advanced surgical equipment, including robotic systems that provide enhanced precision and control during complex procedures. The introduction of single-incision laparoscopic surgery and improved device designs for enhanced accuracy further contribute to market expansion by improving surgical outcomes and reducing post-operative complications.

Expanding Healthcare Infrastructure and Insurance Coverage

The continuous development and modernization of Brazil's healthcare infrastructure have significantly enhanced access to bariatric surgery services across the country. Brazil represents the largest healthcare market in Latin America, allocating 9.7% of its GDP, around US$135 billion, to healthcare. Of the country’s 7,309 hospitals, 63% are private. As of 2024, Brazil has over 500,000 hospital beds, nearly 576,000 physicians, 402,000 dentists, 668 health insurance providers, and more than 93,000 drugstores, reflecting a broad and diverse healthcare infrastructure that supports both public and private medical services. In Brazil, the large urban areas have been subject to major investments in specialized bariatric surgical facilities, with regional hospitals also providing bariatric programs to deal with the local obesity problems. The increased coverage of private health insurance and favorable government policies has enhanced accessibility to weight loss surgeries. Even though laparoscopic bariatric surgery is available in the public healthcare system, the lack of capacity compels the demand to shift to the private providers.

Market Restraints:

What Challenges the Brazil Bariatric Surgery Market is Facing?

High Treatment Costs and Limited Accessibility

Despite improvements in healthcare coverage, the substantial cost of bariatric surgery remains a significant barrier for many potential patients. The overall expense encompasses pre-operative evaluations, surgical procedures, specialized equipment, and comprehensive post-operative care, creating financial challenges for individuals without adequate insurance coverage. Hospital reimbursements from public healthcare systems often fall below actual procedural costs, creating economic pressures that limit service availability and capacity expansion.

Uneven Geographic Distribution of Surgical Services

Access to bariatric procedures varies significantly across Brazilian regions, with surgical services concentrated primarily in major urban centers. Limited availability of authorized facilities, particularly in rural and underserved areas, creates substantial barriers for patients seeking surgical intervention. The shortage of qualified bariatric surgeons in certain regions further constrains service capacity and extends waiting periods for patients dependent on public healthcare systems.

Post-Operative Complications and Long-Term Management Requirements

Potential post-surgical complications including nutritional deficiencies, infections, and weight regain present ongoing management challenges that may deter prospective patients. The requirement for lifelong dietary modifications, nutritional supplementation, and regular medical monitoring represents a significant commitment that some patients find difficult to maintain. Inadequate post-operative care and follow-up support can compromise long-term treatment effectiveness and patient outcomes.

Competitive Landscape:

The Brazil bariatric surgery market exhibits a moderately consolidated competitive structure, characterized by the presence of major multinational medical device corporations alongside smaller specialized manufacturers. Leading players maintain significant market positions through continuous investment in research and development, product innovation, and strategic partnerships with healthcare providers. Competition is driven by the need for less invasive devices, improved patient outcomes, and cost-effectiveness, leading to continuous development in areas such as minimally invasive surgical instruments, advanced imaging techniques, and improved implant materials. Major players focus on São Paulo and Rio de Janeiro markets due to higher population density and concentration of specialized hospitals. The competitive landscape is further shaped by regulatory requirements from ANVISA, which influence market access, product approvals, and pricing strategies. Companies are increasingly emphasizing post-sale support, surgical training programs, and clinical collaboration to strengthen their market positions and differentiate their offerings.

Recent Developments:

- September 2024, EziSurg Medical officially launched its powered endoscopic staplers, easyEndo™ E-lite, in Brazil, marking a major step in the company’s expansion across South America. Following successful registration with ANVISA, the distributor has transitioned to EziSurg’s brand after nearly a year of preparation, bringing advanced stapling technology to the Brazilian surgical market and supporting enhanced efficiency and precision in minimally invasive procedures.

- June 2025, The Jean Bitar Hospital (HJB) in Belém opened the “I Northern Congress on Bariatric and Metabolic Surgery”, organized by the Brazilian Society of Bariatric and Metabolic Surgery alongside the Amazonas, Pará, and Rondônia chapters. The event brought together specialists across surgery, endocrinology, hepatology, nutrition, and psychology, providing a platform for healthcare professionals to share expertise and enhance clinical and surgical practices in bariatric and metabolic care.

Brazil Bariatric Surgery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil bariatric surgery market size was valued at USD 47.09 Million in 2025.

The Brazil bariatric surgery market is expected to grow at a compound annual growth rate of 2.47% from 2026-2034 to reach USD 58.66 Million by 2034.

Assisting devices dominated the market with 63% revenue share in 2025, driven by their essential role in minimally invasive laparoscopic procedures including suturing, closure, and stapling operations that are fundamental to modern bariatric surgery techniques.

Key factors driving the Brazil bariatric surgery market include the rising prevalence of obesity and associated metabolic disorders, advancements in minimally invasive surgical techniques, expanding healthcare infrastructure, increasing private health insurance coverage for bariatric procedures, and Brazil's emergence as a prominent medical tourism destination.

Major challenges include high treatment costs limiting accessibility for uninsured patients, uneven geographic distribution of surgical services with concentration in urban centers, post-operative complication risks requiring comprehensive long-term management, shortage of qualified bariatric surgeons in certain regions, and the need for sustained patient commitment to lifestyle modifications following surgery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)