Brazil Computed Tomography Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Brazil Computed Tomography Market Summary:

The Brazil computed tomography market size was valued at USD 248.74 Million in 2025 and is projected to reach USD 351.12 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034.

The Brazil computed tomography market is growing at a steady pace due to the rising prevalence of chronic diseases, advancements in medical facilities, and the growing demand for sophisticated diagnostic offerings. Technical developments such as artificial intelligence integration into computed tomography systems, as well as the adoption of low-dose scanning procedures, are improving the diagnostic performance of these systems while improving the safety of patients undergoing these procedures.

Key Takeaways and Insights:

- By Type: High slice CT scanners dominate the market with a share of 38% in 2025, driven by superior diagnostic capabilities, enhanced image resolution, faster scanning speeds, and growing adoption for complex cardiovascular, oncological, and neurological imaging applications requiring detailed visualization.

- By Application: Oncology leads the market with a share of 32% in 2025, owing to the rising cancer incidence across Brazil, increasing demand for early tumor detection, staging assessments, treatment planning, and post-treatment monitoring driving CT utilization in cancer care pathways.

- By End User: Hospitals represent the largest segment with a market share of 60% in 2025, attributable to comprehensive imaging infrastructure, high patient volumes, emergency diagnostic requirements, multi-specialty service offerings, and substantial capital investment capabilities for advanced CT equipment.

- Key Players: The Brazil computed tomography market features a competitive landscape dominated by global medical imaging technology leaders. Market participants are focusing on technological innovation, service network expansion, and strategic partnerships with healthcare providers to strengthen market positioning and address evolving diagnostic imaging requirements across Brazil's healthcare sector.

The Brazil computed tomography market is experiencing progressive expansion driven by fundamental healthcare transformation and technological advancement. The escalating burden of chronic diseases including cancer, cardiovascular conditions, and neurological disorders is generating sustained demand for sophisticated diagnostic imaging capabilities. In March 2025, the Brazilian Health Regulatory Agency (ANVISA) granted full regulatory approval for Telix Pharmaceuticals’ Illuccix® prostate cancer imaging agent, the first PSMA‑PET diagnostic product authorized in Brazil, strengthening the country’s precision imaging landscape. Government healthcare investment programs are supporting infrastructure modernization and equipment upgrades across public healthcare facilities. The integration of artificial intelligence technologies is enhancing diagnostic accuracy, workflow efficiency, and image interpretation capabilities. Regulatory streamlining through ANVISA's mutual recognition agreements with international regulatory bodies is facilitating faster market access for advanced CT technologies.

Brazil Computed Tomography Market Trends:

Integration of Artificial Intelligence in CT Imaging Workflows

The Brazil computed tomography market is witnessing significant adoption of artificial intelligence technologies that are transforming diagnostic imaging workflows and clinical decision-making processes. AI-powered solutions are being integrated across the imaging chain from patient positioning and protocol selection through image reconstruction and interpretation assistance. In November 2025, Bracco Imaging and Subtle Medical received ANVISA clearance in Brazil for their jointly developed AI diagnostic software, expanding access to advanced AI-powered imaging solutions in one of Latin America’s key healthcare markets. These technologies enable automated detection of abnormalities, quantitative analysis of anatomical structures, and prioritization of critical findings for radiologist review.

Adoption of Low-Dose Imaging Protocols and Patient Safety Enhancement

Brazilian healthcare providers are increasingly implementing ultra-low-dose imaging protocols and iterative reconstruction techniques to minimize patient radiation exposure while maintaining diagnostic image quality. A prospective multi-site study in Brazil established diagnostic reference levels (DRLs) and achievable doses (AD) for adult CT examinations, highlighting coordinated efforts across healthcare facilities to benchmark and optimize radiation doses as part of national dose management strategies, which represents an important step toward reducing exposure in routine clinical practice. This trend reflects growing emphasis on patient safety and regulatory attention toward radiation dose optimization in diagnostic imaging. Advanced CT systems incorporate dose modulation technologies that automatically adjust radiation output based on patient anatomy and clinical requirements.

Expansion of Mobile and Portable CT Imaging Solutions

The Brazil computed tomography market is experiencing growing demand for mobile and portable CT imaging systems that address healthcare access disparities across geographically dispersed regions. For example, mobile low-dose CT units have been successfully used in public health programs in Brazil, including a community lung cancer screening initiative that deployed mobile CT vans to underserved areas to improve early detection and preventive care. These solutions enable diagnostic imaging services to reach remote and underserved communities lacking fixed imaging facilities and support bedside scanning for critically ill patients requiring intensive care monitoring.

Market Outlook 2026-2034:

The Brazil computed tomography market is positioned for continued expansion over the forecast period, underpinned by favorable healthcare investment trends, technological advancement, and evolving diagnostic requirements. Public healthcare funding increases are supporting equipment procurement and facility modernization initiatives that drive CT system installations across government healthcare networks. Private sector healthcare expansion through hospital networks and diagnostic center chains creates additional market growth opportunities. Regulatory streamlining through ANVISA's recognition of international device approvals is accelerating market access for next-generation CT technologies. The market generated a revenue of USD 248.74 Million in 2025 and is projected to reach a revenue of USD 351.12 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034.

Brazil Computed Tomography Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

High Slice |

38% |

| Application | Oncology |

32% |

|

End User |

Hospitals |

60% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Low Slice

- Medium Slice

- High Slice

The high slice dominates with a market share of 38% of the total Brazil computed tomography market in 2025.

High slice CT scanners maintain commanding market leadership in Brazil due to their superior diagnostic capabilities and clinical versatility across diverse medical applications. These advanced systems deliver enhanced image resolution, faster scan times, and improved anatomical visualization essential for complex diagnostic procedures in cardiovascular, oncological, and neurological imaging. High slice configurations enable sub-second cardiac imaging and sub-millimeter isotropic resolution that support sophisticated clinical workflows requiring detailed three-dimensional reconstructions.

The segment benefits from growing demand among major hospitals and specialized diagnostic centers seeking premium imaging capabilities for complex case management. High slice systems support advanced applications including coronary CT angiography, perfusion imaging, and whole-body oncological staging that require superior temporal and spatial resolution. Healthcare facilities are prioritizing high slice installations to attract referrals for specialized diagnostic services and maintain competitive positioning in the advanced imaging services market.

Application Insights:

- Oncology

- Neurology

- Cardiovascular

- Musculoskeletal

- Others

The oncology leads with a share of 32% of the total Brazil computed tomography market in 2025.

Oncology applications dominate the Brazil computed tomography market driven by the substantial and growing cancer burden across the country's population. In 2025, Brazil’s Ministry of Health announced a SUS Super Center for Cancer Diagnosis to reduce turnaround times and strengthen early detection using integrated pathology and imaging workflows. CT imaging serves as a fundamental diagnostic modality throughout the cancer care continuum from initial detection and staging through treatment planning, response assessment, and surveillance monitoring. The technology enables precise tumor localization, size measurement, and characterization essential for clinical decision-making in oncological care pathways.

The segment benefits from national cancer screening programs and growing emphasis on early detection initiatives that drive CT utilization volumes. Breast, prostate, colorectal, and lung cancers represent prevalent malignancies generating substantial imaging demand. Oncology centers are deploying advanced CT capabilities including dual-energy imaging and perfusion analysis for enhanced tumor characterization. The integration of CT imaging with radiation therapy planning systems further reinforces the modality's central role in comprehensive cancer care delivery.

End User Insights:

- Hospitals

- Diagnostic Centers

- Others

The hospitals dominate with a market share of 60% of the total Brazil computed tomography market in 2025.

Hospitals command the largest share of the Brazil computed tomography market owing to their comprehensive diagnostic imaging infrastructure, substantial patient volumes, and diverse clinical service requirements. The Brazil hospital equipment market reached USD 951.32 million in 2024 and is projected to reach USD 2,665.78 million by 2033, reflecting strong investment in hospital infrastructure and diagnostic capabilities that directly supports CT adoption and upgrades. Hospital-based CT services support emergency diagnostics, inpatient care, surgical planning, and multi-specialty outpatient consultations requiring immediate imaging access. The concentration of specialist physicians and technical expertise enables hospitals to maximize CT utilization across broad clinical applications.

The segment benefits from capital investment capabilities enabling acquisition of advanced CT systems with premium imaging features. Public hospitals receive equipment through government healthcare investment programs while private hospital networks pursue technology upgrades to maintain competitive service offerings. Hospital CT installations typically achieve high utilization rates driven by emergency department volumes, inpatient requirements, and specialist referral networks. The integration of CT services within comprehensive hospital diagnostic pathways supports efficient patient management workflows.

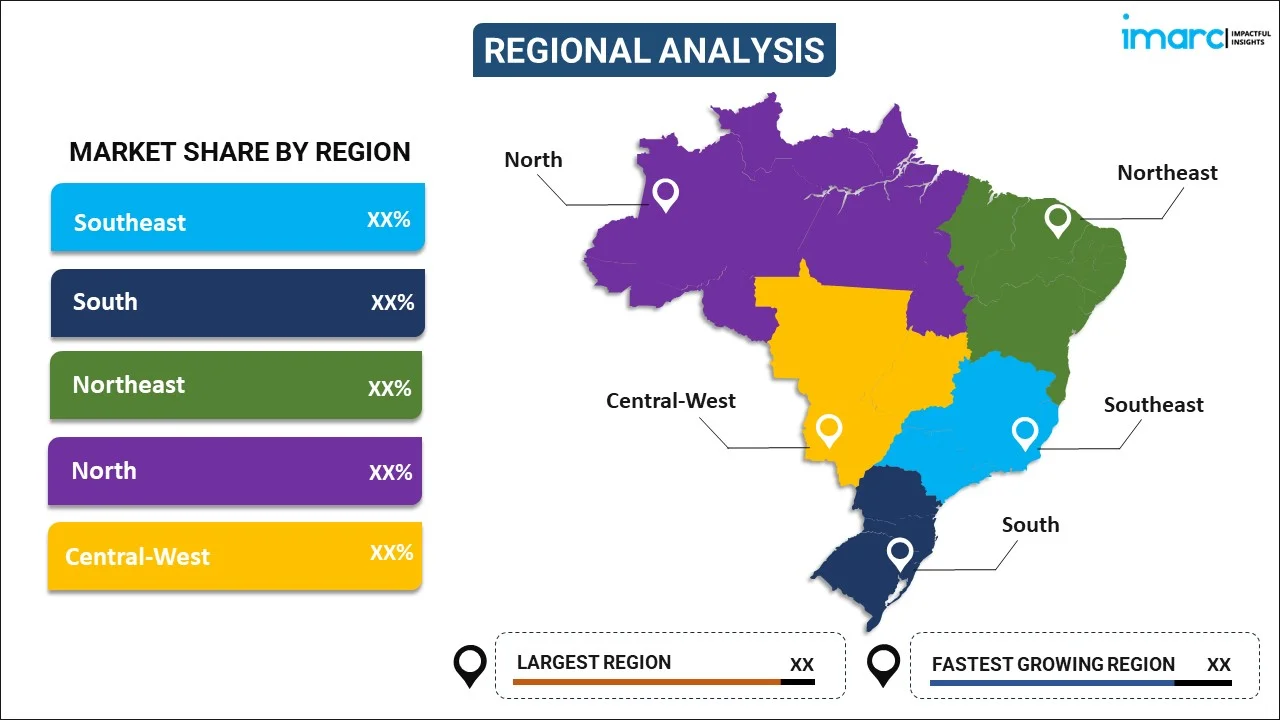

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region dominates the Brazil computed tomography market, supported by advanced healthcare infrastructure, concentration of premier medical institutions, and substantial population density. São Paulo and Rio de Janeiro serve as major healthcare hubs with extensive hospital networks and specialized diagnostic imaging centers. The region benefits from strong private healthcare sector development, medical tourism inflows, and significant healthcare investment driving CT equipment adoption.

The South region represents a significant market for computed tomography services, characterized by well-developed healthcare infrastructure and favorable socioeconomic indicators supporting healthcare consumption. States including Paraná, Santa Catarina, and Rio Grande do Sul maintain quality hospital networks and diagnostic service providers. The region demonstrates strong health insurance penetration rates and healthcare expenditure levels driving demand for advanced diagnostic imaging capabilities.

The Northeast region presents growing opportunities for computed tomography market expansion as healthcare infrastructure development accelerates across major population centers. Government healthcare investment programs are supporting equipment procurement and facility modernization initiatives. Urban centers including Salvador, Recife, and Fortaleza are experiencing healthcare sector growth through public and private investments that expand diagnostic imaging access for regional populations.

The North region faces unique healthcare access challenges due to geographic dispersion and limited infrastructure that create opportunities for mobile and portable CT solutions. Healthcare development programs are targeting diagnostic service expansion to address underserved populations across Amazonas and Pará states. Telemedicine initiatives integrating remote image interpretation are supporting CT service delivery in areas lacking specialist radiologist availability on-site.

The Central-West region demonstrates steady computed tomography market growth driven by healthcare infrastructure expansion in Brasília, Goiânia, and other major urban centers. The federal capital attracts healthcare investment supporting advanced diagnostic service development. Agribusiness prosperity in the region contributes to private healthcare consumption and demand for quality diagnostic imaging services among the regional population base.

Market Dynamics:

Growth Drivers:

Why is the Brazil Computed Tomography Market Growing?

Rising Prevalence of Chronic Diseases and Aging Population

The escalating burden of chronic diseases including cancer, cardiovascular conditions, and neurological disorders is driving sustained demand for computed tomography diagnostic services across Brazil. In 2025, Brazil’s Ministry of Health allocated R$561 million to women’s health and oncology research, supporting early diagnosis and cancer treatment and indirectly driving demand for advanced CT imaging nationwide. The country's demographic transition toward an aging population is intensifying healthcare utilization as advanced age correlates with higher disease prevalence and diagnostic imaging requirements. Cancer incidence continues to rise with breast, prostate, colorectal, and lung malignancies generating substantial CT imaging demand for detection, staging, and monitoring.

Government Healthcare Investment and Infrastructure Modernization

Substantial government healthcare investment is driving CT equipment procurement and healthcare infrastructure modernization across Brazil's public healthcare system. In 2025, Ebserh completed a R$100 million modernization program, installing 23 new CT scanners across federal university hospitals in Brazil to enhance diagnostic capacity and care quality for SUS patients. Federal and state healthcare budgets have increased significantly, enabling replacement of outdated imaging equipment and expansion of diagnostic service capacity. Public-private partnerships are facilitating advanced technology deployment in government healthcare facilities. Healthcare infrastructure development programs are prioritizing diagnostic imaging capabilities at regional and district hospital levels to improve healthcare access equity..

Technological Advancement and AI Integration

Continuous technological advancement in CT imaging systems is driving equipment upgrade cycles and expanding clinical applications in Brazil. In July 2025, Body Vision Medical’s LungVision® AI-driven imaging system received ANVISA approval in Brazil to enhance early and accurate lung cancer diagnosis, advancing access to AI-powered imaging innovations nationwide. Next-generation scanners incorporating artificial intelligence, spectral imaging, and photon-counting detector technologies are creating compelling replacement rationales for existing installations. AI integration enables enhanced diagnostic accuracy, workflow optimization, and dose reduction that deliver tangible clinical and operational benefits. Regulatory streamlining through ANVISA's recognition of international device approvals is accelerating market access for innovative CT technologies.

Market Restraints:

What Challenges the Brazil Computed Tomography Market is Facing?

High Equipment and Operational Costs

The substantial capital investment required for CT equipment acquisition presents significant barriers for healthcare facilities, particularly smaller clinics and resource-constrained public institutions. Advanced CT systems command premium pricing that exceeds budget allocations for many potential buyers. Import dependence exposes purchasers to currency exchange volatility that affects equipment affordability. Ongoing operational costs including maintenance, service contracts, and consumables add to total ownership expenses. These financial constraints limit market penetration particularly among secondary and tertiary healthcare facilities outside major metropolitan areas.

Radiologist Shortage and Workforce Constraints

The shortage of qualified radiologists and imaging technicians constrains CT service capacity and equipment utilization across Brazil. Workforce distribution skews toward major metropolitan centers, creating service delivery challenges in regional and rural healthcare settings. Training capacity limitations affect the pipeline of new imaging professionals entering the field. Workforce constraints affect both image acquisition quality and interpretation throughput. Telemedicine solutions for remote image interpretation are partially addressing geographic workforce gaps but cannot fully substitute for on-site expertise.

Geographic Healthcare Access Disparities

Significant disparities in healthcare access between metropolitan areas and remote regions limit CT service availability for substantial population segments. Infrastructure limitations including unreliable electricity and inadequate facilities constrain equipment deployment in underserved areas. Geographic distances create patient travel burdens that reduce imaging utilization despite clinical need. The concentration of CT installations in major urban centers perpetuates access inequities. Mobile imaging solutions offer partial mitigation but face operational challenges in remote geographic settings.

Competitive Landscape:

The Brazil computed tomography market exhibits a consolidated competitive structure dominated by global medical imaging technology leaders with established market presence. Major multinational corporations maintain comprehensive product portfolios spanning entry-level through premium CT systems and support these with service networks and financing solutions. Competition centers on technology differentiation, clinical application support, service reliability, and total cost of ownership optimization. Market participants are pursuing strategies including AI capability integration, workflow software enhancement, and dose reduction technologies to differentiate product offerings. Local distribution partnerships and service infrastructure investments are critical competitive factors given Brazil's geographic scale. Emerging opportunities in mobile imaging and telemedicine-integrated solutions are attracting new market entrants targeting underserved segments.

Recent Developments:

- In April 2025, Royal Philips launched its AI-enabled CT 5300 computed tomography system in Brazil at Jornada Paulista de Radiologia (JPR) 2025 in São Paulo. The new scanner integrates artificial intelligence to enhance image quality, reduce radiation dose, and accelerate clinical workflows, marking a significant upgrade for Brazil’s diagnostic imaging market.

Brazil Computed Tomography Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Low Slice, Medium Slice, High Slice |

| Applications Covered | Oncology, Neurology, Cardiovascular, Musculoskeletal, Others |

| End Users Covered | Hospitals, Diagnostic Centers, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil computed tomography market size was valued at USD 248.74 Million in 2025.

The Brazil computed tomography market is expected to grow at a compound annual growth rate of 3.90% from 2026-2034 to reach USD 351.12 Million by 2034.

The high slice segment dominated the market with a 38% share, driven by superior diagnostic capabilities, enhanced image resolution, faster scanning speeds, and growing adoption for complex cardiovascular, oncological, and neurological imaging applications.

Key factors driving the Brazil computed tomography market include rising prevalence of chronic diseases, aging population demographics, government healthcare investment and infrastructure modernization, technological advancement including AI integration, expanding health insurance penetration, and regulatory streamlining through ANVISA mutual recognition agreements.

Major challenges include high equipment and operational costs, radiologist and technician workforce shortages, geographic healthcare access disparities between metropolitan and remote regions, currency exchange volatility affecting import costs, and infrastructure limitations in underserved areas constraining equipment deployment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)