Brazil Data Center Market Report by Data Center Size (Large, Massive, Medium, Mega, Small), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Absorption (Non-Utilized, Utilized), and Region 2026-2034

Brazil Data Center Market:

The Brazil data center market reached USD 4.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.0 Billion by 2034, exhibiting a growth rate (CAGR) of 9.50% during 2026-2034. This growth is driven by rising hyperscale investments from global cloud providers such as Google, AWS, and Microsoft, which are expanding their infrastructure to support increasing digital demand. Additionally, the widespread adoption of IoT, supported by Brazil’s 187.9 million internet users, is significantly boosting data generation and processing needs. These trends, along with ongoing developments in the telecommunications sector and supportive government initiatives, are catalyzing the country’s data center market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.0 Billion |

|

Market Forecast in 2034

|

USD 9.0 Billion |

| Market Growth Rate 2026-2034 | 9.50% |

Brazil Data Center Market Analysis:

- Major Market Drivers: The growing shift towards digitalization for data processing and storage is stimulating the market across the country.

- Key Market Trends: The regulatory authorities recognize the importance of digital infrastructure for economic development, with numerous initiatives introduced to support the growth of the IT sector, including data center construction.

- Competitive Landscape: Some of the major market companies across the country include Ascenty Data Centers e Telecomunicações S.A., EdgeUno Inc., Equinix Inc., HostDime Global Corp., Lumen Technologies Inc., ODATA Colocation (Aligned Data Centers), Quântico Data Center, and Scala Data Centers, among many others.

- Geographical Trends: The expanding financial sector is fueling the market in the Southeast region. Moreover, the increasing number of 4G and 5G networks is also augmenting the overall market in the South. Besides this, the elevating requirement for managing energy grids is bolstering the market in the Northeast. Additionally, the widespread adoption of cloud services is further catalyzing the market in the North.

- Challenges and Opportunities: The limited infrastructure in remote areas is hindering the market. However, enhancing connectivity is expected to bolster the market in the coming years.

Brazil Data Center Market Trends:

Growth of Hyperscale Data Centers

Brazil's data center market is seeing rapid expansion with the rise of hyperscale data centers. These facilities, which are designed to support massive amounts of data and compute power, are in high demand due to the growth of cloud services, big data, and IoT. The country's strategic location in Latin America makes it an attractive destination for global cloud providers. Companies are investing heavily in scalable infrastructure to meet the increasing needs of businesses that rely on large-scale data processing. This shift toward hyperscale facilities reflects broader global trends and signals that Brazil will play an important role in regional data storage and processing capabilities.

Demand for Cloud Computing

Cloud computing demand in Brazil has surged, driven by businesses looking for scalable, cost-efficient solutions. With more organizations embracing digital transformation, the need for reliable cloud services has escalated. Public and hybrid cloud adoption has increased across sectors like finance, healthcare, and retail, seeking flexibility and enhanced security. Data centers have expanded to meet this growing demand, offering robust infrastructure and advanced services to ensure seamless cloud experiences. Additionally, Brazil's government policies supporting digitalization and cloud infrastructure are accelerating the market's growth, making the country a key player in Latin America's cloud computing revolution.

Emphasis on Edge Computing

As Brazil embraces digitalization, edge computing is gaining significant attention. The demand for low-latency services, such as autonomous vehicles, industrial automation, and real-time data processing, is pushing businesses to adopt edge computing. This technology places data storage and processing closer to the source, reducing delays and enhancing performance. Brazil's vast geographical spread creates an opportunity for edge data centers in remote locations, ensuring faster and more reliable connections. As businesses look to improve operational efficiency and customer experiences, the shift toward edge computing is becoming a key focus for both local and international data center providers in Brazil.

Infrastructure Modernization

Brazil’s data center market is undergoing rapid infrastructure modernization, driven by the demand for high-speed connectivity, low-latency services, and secure storage solutions. Major cloud service providers, including Google, AWS, and Microsoft, are investing heavily in hyperscale facilities and new data centers in Brazil. These investments are not only boosting capacity but also introducing advanced technologies such as modular data centers, liquid cooling, and edge computing. Urban hubs like São Paulo and Rio de Janeiro are emerging as digital infrastructure hotspots. This modernization is enabling hybrid IT environments, where enterprises are increasingly integrating on-premise systems with cloud-based platforms to improve scalability, agility, and disaster recovery. These advancements reflect the broader data center market trends shaping a resilient digital ecosystem across the country

Big Data, IoT, and AI

The explosive growth of Big Data, IoT, and artificial intelligence is significantly driving Brazil’s data center industry report outlook. With over 186.9 million internet users, Brazil is witnessing a surge in connected devices, real-time analytics, and automation across industries such as manufacturing, healthcare, and agriculture. These technologies require robust computational power, vast storage, and real-time data processing—making modern data centers essential. AI and machine learning workloads further demand GPU-based infrastructure, prompting operators to upgrade facilities. Additionally, IoT proliferation is fueling edge deployments to ensure low-latency services. Together, these digital transformations are accelerating data center market growth and pushing enterprises to adopt scalable, intelligent infrastructure capable of supporting next-generation applications and services.

Government Support

Government support is a major catalyst for the market data center landscape in Brazil. The Brazilian government has introduced several initiatives to promote digital infrastructure, such as "Brasil Conectado", aimed at expanding broadband access nationwide. The Fund for the Universalisation of Telecommunications Services (FUST) also prioritizes data center expansion as a strategic goal. Additionally, the government is incentivizing sustainable and energy-efficient (green) facilities through tax benefits and streamlined permitting. These initiatives are attracting both domestic and foreign investment. Supportive policies on data sovereignty and digital transformation are further creating a favorable regulatory environment for hyperscale and enterprise operators, as outlined in the latest Brazil Data Center Report, helping accelerate national digital infrastructure growth.

Brazil Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for the period 2026-2034. Our report has categorized the market based on data center size, tier type, and absorption.

Breakup by Data Center Size:

To get more information of this market, Request Sample

- Large

- Massive

- Medium

- Mega

- Small

The report has provided a detailed breakup and analysis of the market based on data center size. This includes large, massive, medium, mega, and small.

Small and medium-sized data centers are usually adopted by government entities and local businesses, providing localized services with lower energy consumption and limited infrastructure. Large data centers support multinational companies, offering more redundancy and capacity. Mega data centers focus on hyperscale operations, thereby meeting the needs of Brazil’s expanding cloud and internet-based services sector. These larger facilities are augmenting the country’s role as a regional data hub. This is positively influencing the Brazil data center market outlook.

Breakup by Tier Type:

- Tier 1 and 2

- Tier 3

- Tier 4

The report has provided a detailed breakup and analysis of the market based on tier type. This includes tier 1 and 2, tier 3, and tier 4.

Tier 1 and Tier 2 data centers are usually used for less critical applications. They are cost-effective but less resilient to power or network outages. However, tier 3 data centers are suitable for businesses that require continuous operations with minimal downtime. These facilities are favored by enterprises and service providers for their balance of cost and reliability. Tier 4 data centers provide the highest level of fault tolerance, redundancy, uptime, etc. This is elevating the Brazil data center market demand.

Breakup by Absorption:

- Non-Utilized

- Utilized

The report has provided a detailed breakup and analysis of the market based on absorption. This includes non-utilized and utilized.

As the demand for cloud computing, digital services, and internet connectivity surges, particularly in major urban centers like Rio de Janeiro and São Paulo, the segment is experiencing significant growth. Moreover, factors, such as technological adoption rates, economic fluctuations, and regional infrastructure development all influence absorption levels. Overall, monitoring utilized versus non-utilized capacity is essential for stakeholders to plan for sustainable growth in Brazil's data center market share.

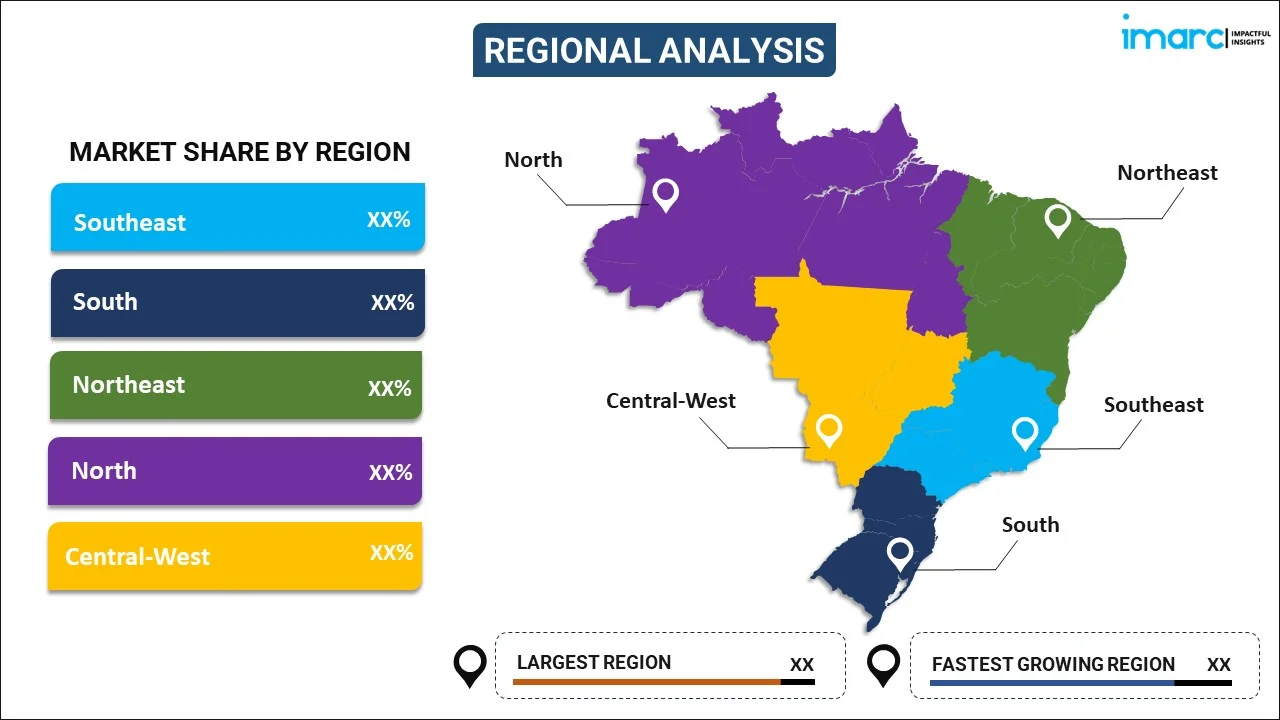

Breakup by Region:

- Southeast

- South

- Northeast

- North

- Central-West

The Brazil data center market research report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

The Southeast is the country's leading data center hub on account of the strong connectivity, infrastructure, and demand from the financial and technology sectors. The South, with cities like Porto Alegre, is also supported by industrial and commercial sectors that require enhanced digital services. In the Northeast, the market is emerging, fueled by public and private investments. The North and Central-West regions still need to be developed in terms of data center infrastructure. Still, recent efforts to introduce cloud services and edge computing facilities are opening up new possibilities.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive market price analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

Some of the key players include:

- Ascenty Data Centers e Telecomunicações S.A.

- EdgeUno Inc.

- Equinix Inc.

- HostDime Global Corp.

- Lumen Technologies Inc.

- ODATA Colocation (Aligned Data Centers)

- Quântico Data Center

- Scala Data Center

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Brazil Data Center Market Recent Developments:

- April 2025: Nova Complex, a Singaporean infrastructure developer, announced plans to invest $ 3 billion in Brazil to build an integrated renewable energy and intelligent computing data center complex. Using a "tri-site deployment" model, the project will combine 1 GW of renewable energy (solar, wind, hydro) with 800 IT MW of data centers, supporting Brazil’s digital economy. The centers will feature advanced cooling, high-density servers, and smart energy management.

- March 2025: Odata, a leading data center provider, announced the launch of a new data center in São Paulo, Brazil. This expansion aims to meet the growing demand for digital infrastructure in Latin America, offering advanced technology, high energy efficiency, and robust security. The facility will support hyperscale, cloud, and enterprise customers, reinforcing Odata’s commitment to sustainability and innovation. This new center strengthens Odata’s presence in the region, enhancing connectivity and supporting the digital transformation of businesses in Brazil.

- January 2025: WEG and Elea Data Centers formed a strategic partnership to advance high-performance, AI-focused infrastructure in Brazil. WEG will supply transformers for Elea’s 50 MW São Paulo site, part of a US$ 300 million investment in sustainable data centers. These transformers, made in Brazil, ensure reliable, efficient power for AI operations while supporting the local industry.

Brazil Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Data Center Sizes Covered | Large, Massive, Medium, Mega, Small |

| Tier Types Covered | Tier 1 and 2, Tier 3, Tier 4 |

| Absorptions Covered | Non-Utilized, Utilized |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Ascenty Data Centers e Telecomunicações S.A., EdgeUno Inc., Equinix Inc., HostDime Global Corp., Lumen Technologies Inc., ODATA Colocation (Aligned Data Centers), Quântico Data Center, Scala Data Centers, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil data center market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil data center market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil data center industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Brazil data center market size reached USD 4.0 Billion in 2025.

The data center market in Brazil is expected to reach USD 9.0 Billion by 2034, exhibiting a CAGR of 9.50% during 2026-2034.

Market growth is driven by hyperscale investments from global cloud providers (e.g., Google, AWS, Microsoft), the widespread adoption of IoT and AI technologies, rising demand for edge and colocation services, digital transformation across industries, and supportive government initiatives promoting green infrastructure and broadband expansion.

Based on the data center size, the market has been segmented into large, massive, medium, mega, and small data centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)