Brazil Sports Drinks Market Size, Share, Trends and Forecast by Packaging, Distribution Channel, and Region, 2026-2034

Brazil Sports Drinks Market Summary:

The Brazil sports drinks market size was valued at USD 625.89 Million in 2025 and is projected to reach USD 815.87 Million by 2034, growing at a compound annual growth rate of 2.99% from 2026-2034.

Market growth is largely supported by Brazil’s expanding fitness culture, rising health awareness, and a growing preference for functional hydration beverages among diverse age groups. Increased participation in gyms, amateur sports, and outdoor activities is widening the consumer base. In addition, sports event sponsorships, influencer-led promotions, and broader retail penetration across supermarkets, convenience stores, and online channels are reshaping competition and unlocking meaningful opportunities for manufacturers, distributors, and brand owners across the value chain.

Key Takeaways and Insights:

- By Packaging: PET bottles dominate the market with a share of 69% in 2025, driven by their lightweight durability, cost-effectiveness in manufacturing, superior product visibility on retail shelves, and widespread consumer preference for convenient grab-and-go hydration solutions.

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 50% in 2025. This dominance is because of extensive product assortment, competitive pricing strategies, one-stop shopping convenience, and strategic shelf placement within dedicated sports nutrition sections.

- Key Players: The Brazil sports drinks market exhibits moderate competitive intensity, with multinational beverage corporations competing alongside regional manufacturers across price segments and distribution channels. Competition centers on brand visibility, flavor innovation, formulation choices, and retail reach, while marketing partnerships with sports events and athletes play a key role in influencing consumer preference.

The Brazil sports drinks market is driven by the rising health awareness and greater participation in physical activity, which are driving the need for functional hydration solutions among both active and semi active consumers. Shifting preferences away from traditional carbonated soft drinks toward purpose driven beverages further support category expansion. Product innovation, flavor variety, and premium formulations are attracting broader consumer segments and encouraging repeat purchases. The growth in gyms, fitness studios, and outdoor exercise spaces is embedding fitness into daily routines, increasing regular consumption. For instance, in 2024, Ganas Gym Equipment partnered with local entrepreneur Maelson to open a 750-sqm Planet Fitness gym in Rio de Janeiro, highlighting sustained growth in structured exercise environments. Besides this, expanding e commerce and modern retail penetration are improving accessibility and national reach, while marketing investments and brand visibility are strengthening category awareness and long-term consumption habits across urban and suburban markets.

Brazil Sports Drinks Market Trends:

Expansion of Fitness Facilities and Informal Exercise Spaces

The expansion of organized fitness infrastructure across Brazil is catalyzing the demand for functional hydration beverages. Greater availability of gyms, studios, and outdoor exercise spaces encourages regular participation in physical activity, increasing the need for hydration before, during, and after workouts. This trend is reinforced by long term investment in fitness facilities, as exemplified in 2025, when Gold’s Gym announced its entry into Brazil through a master franchise agreement to open 60 gyms over the next decade. As fitness becomes embedded in daily routines, sports drinks transition from occasional use to habitual purchases, supporting repeat consumption and steady market growth across urban and suburban areas.

Rise of E-Commerce and Digital Retail Access

The rapid expansion of e-commerce in Brazil is strengthening distribution reach and consumption frequency for sports drinks. Online platforms improve product visibility, enable broader brand comparison, and support direct to consumer purchasing, particularly among younger and urban consumers. Digital retail also facilitates subscription models, bulk purchases, and targeted promotions that encourage repeat buying. This structural shift is reflected in market scale, as Brazil’s e-commerce sector was projected to generate USD 36.3 billion in revenue in 2025, with an estimated 94 million Brazilians making online purchases, up 3 million from 2024, according to Associação Brasileira de Comércio Eletrônico (ABCOMM). The growing online penetration lowers access barriers, supports national reach, and accelerates sports drink market growth.

Product Innovation

Product diversification and flavor innovation strengthen the market growth, as consumers increasingly seek differentiated taste profiles, varied sweetness levels, and targeted functional benefits. Expanded portfolios encourage experimentation and repeat purchasing while reducing category fatigue across hydration, energy, and recovery use cases. This innovation led approach also supports premium positioning and higher value perception. Reflecting this trend, in 2024, Prime Drinks, the hydration brand founded by KSI and Logan Paul, entered the Brazilian market with an electrolyte based, low calorie, vegan, and gluten free offering featuring bold tropical flavors aimed at active consumers. By aligning formulations with local preferences, brands strengthen loyalty, expand shelf presence, and support consistent market growth nationwide.

Market Outlook 2026-2034:

The Brazil sports drinks market shows steady growth potential across the forecast period, driven by the expansion of fitness awareness, rising participation in recreational sports, and changing hydration habits among urban consumers. Increasing interest in functional beverages that support endurance, recovery, and electrolyte balance is broadening consumption beyond professional athletes. The market generated a revenue of USD 625.89 Million in 2025 and is projected to reach a revenue of USD 815.87 Million by 2034, growing at a compound annual growth rate of 2.99% from 2026-2034. Product innovation, wider retail availability, and targeted marketing toward active lifestyles continue to support demand.

Brazil Sports Drinks Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Packaging |

PET Bottles |

69% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

50% |

Packaging Insights:

To get detailed segment analysis of this market, Request Sample

- PET Bottles

- Cans

PET bottles dominate with a market share of 69% of the total Brazil sports drinks market in 2025.

PET bottles represent the largest segment due to their cost efficiency, durability, and suitability for mass distribution. The material supports lightweight handling, efficient storage, and reduced transportation costs, which are critical for high-volume beverage categories. PET packaging also offers design flexibility, enabling varied sizes and ergonomic formats that align with consumer usage patterns. Their compatibility with carbonation control and sealing requirements ensures product integrity. These functional advantages support widespread adoption, reinforcing PET bottles as the preferred packaging format within the sports drinks segment.

Another factor driving dominance is the strong alignment of PET bottles with established manufacturing and filling infrastructure. Production processes are optimized for PET, allowing high-speed bottling and consistent quality control. The material supports clear labeling and branding visibility, enhancing shelf presence. Recyclability initiatives and material recovery systems further strengthen acceptance within regulatory and operational frameworks. Standardization across supply chains simplifies procurement and scaling. These combined operational and logistical benefits sustain the leading position of PET bottles in Brazil’s sports drinks packaging market over long-term commercial cycles.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail Channel

- Others

Supermarkets and hypermarkets lead with a market share of 50% of the total Brazil sports drinks market in 2025.

Supermarkets and hypermarkets hold the biggest market share, driven by their extensive retail networks and strong product visibility, which is underpinned by the sector's immense size, with the Brazilian Supermarket Association (ABRAS) reporting supermarket sales at USD 197 billion in 2024 across 424,120 stores serving 30 million consumers daily. These outlets offer wide shelf space that supports assortment depth and brand comparison, encouraging higher purchase volumes. High customer footfall and routine shopping behavior ensure consistent demand generation. In addition, centralized procurement and efficient inventory management enable reliable product availability. Pricing competitiveness, promotional capacity, and established supplier relationships further strengthen their position.

This dominance is further reinforced by operational efficiency and scale advantages inherent to supermarkets and hypermarkets. Their logistics systems support bulk handling, rapid replenishment, and broad geographic coverage. Integration of private labels and branded products enhances category presence and consumer choice. Data-driven merchandising and standardized placement improve sales performance and turnover rates. Strong compliance with food and beverage regulations ensures trust and continuity in distribution. These structural strengths enable supermarkets and hypermarkets to maintain leadership as the primary distribution channel for sports drinks across Brazil’s organized retail environment.

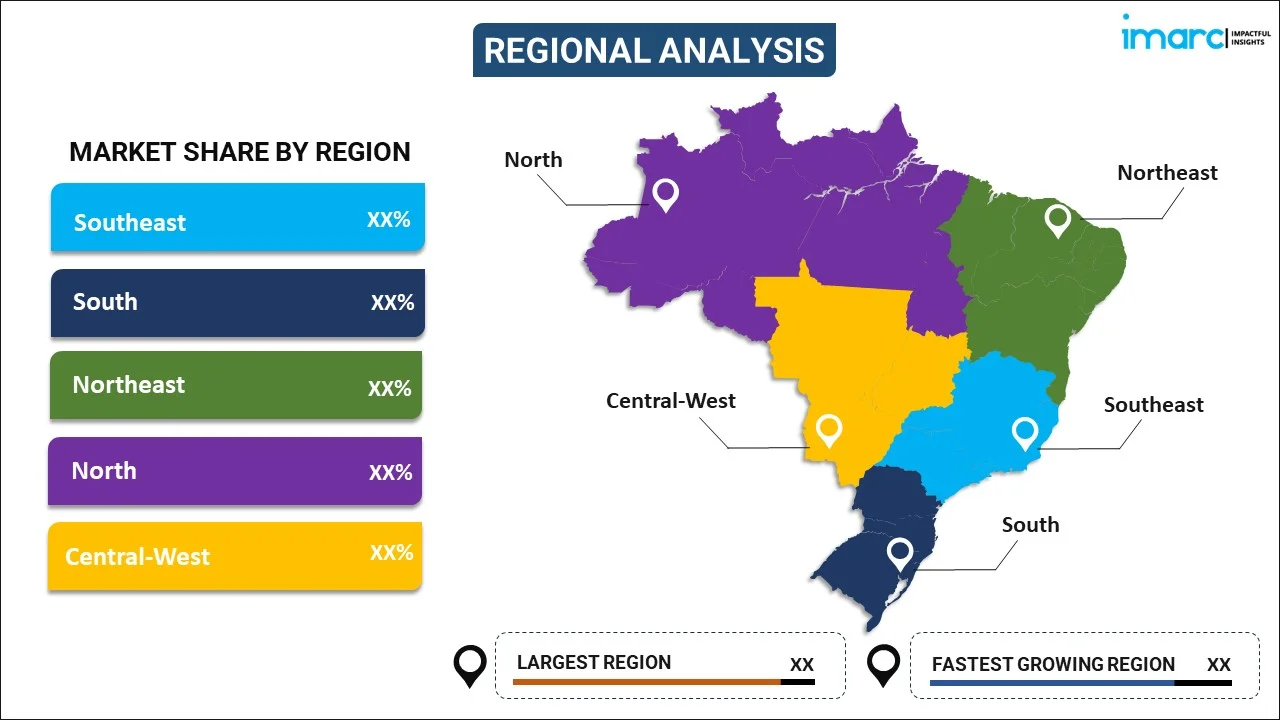

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- South

- Northeast

- North

- Central-West

Southeast drives the Brazil sports drinks market through high retail penetration, strong distribution networks, and elevated consumer awareness. Concentrated urban populations, efficient logistics, and consistent product availability support higher sales volumes and sustained market strength within this region.

South contributes positively to the market due to organized retail infrastructure and steady consumer demand. Strong supply chain efficiency, effective merchandising, and reliable cold storage capabilities enhance product reach and support stable market performance.

Northeast shows positive momentum supported by expanding retail access and improving distribution coverage. The growing market penetration, rising availability across sales channels, and increasing focus on beverage category expansion contribute to the market growth.

North benefits from ongoing improvements in distribution infrastructure and increasing market access. Expansion of retail networks and better logistics connectivity support gradual growth and wider availability of sports drinks across the region.

Central-West region demonstrates positive market conditions driven by improving retail penetration and structured distribution systems. Regional logistics development, rising availability of modern retail formats, and consistent supply support stable participation in the sports drinks market.

Market Dynamics:

Growth Drivers:

Why is the Brazil Sports Drinks Market Growing?

Rising Health Awareness and Active Lifestyles

The growing health awareness and active lifestyles are driving the demand for functional hydration products across Brazil. Consumers are placing greater emphasis on physical wellbeing, stamina, and recovery, driving interest in beverages positioned around performance support. Sports participation, fitness routines, and recreational exercise are becoming more routine across age groups. In 2024, the Health & Fitness Association (HFA), in partnership with ABC Fitness, released the Latin America Fitness Consumer Survey covering major metro areas across six countries, including Brazil. The survey found that 61% of consumers exercise multiple times per week, with gyms and fitness facilities serving as the primary workout location for most active individuals. Sports drinks benefit from perceptions of electrolyte replenishment and energy support during physical activity.

Growing Disposable Incomes and Premium Beverage Demand

Income growth and a rising middle class are strengthening purchasing power for value added beverages in Brazil. According to the Brazilian Institute of Geography and Statistics (IBGE), in 2025, the per capita household income for Brazil in 2024 was BRL 2,069, ranging from BRL 1,077 in Maranhão to BRL 3,444 in the Federal District. Consumers with higher discretionary income are more willing to pay for functional benefits. Sports drinks benefit from this shift as they are positioned above basic refreshments. Premium packaging and specialized formulations align with aspirational consumption patterns. Greater affordability supports higher consumption frequency and brand switching.

Brand Investment and Promotional Activity

Strong visibility across sports related and fitness-oriented platforms continues to reinforce associations between sports drinks, performance, and effective hydration. Consistent brand messaging builds familiarity and trust, encouraging repeat purchasing and strengthening consumer loyalty over time. Established brand equity supports price stability and reduces sensitivity to competitive pricing pressures, enabling sports drinks to compete effectively against substitute beverages. Rising marketing expenditure improves category recognition, increases trial among new users, and sustains engagement among existing consumers. Coordinated promotional strategies, including partnerships, in store activation, and targeted consumer outreach, enhance shelf impact and recall. These sustained brand building efforts support volume growth while reinforcing long term market positioning across diverse demographics and income segments nationwide.

Market Restraints:

What Challenges is the Brazil Sports Drinks Market Facing?

Price Sensitivity and Affordability Constraints

Economic volatility and high price sensitivity among Brazilian consumers create obstacles to market expansion, especially within lower-income segments. In these groups, sports drinks compete directly with cheaper hydration options like water, traditional juices, and homemade beverages. Premium positioning and higher price points restrict wider adoption, as cost-conscious consumers prioritize affordability over functional benefits when making everyday beverage choices.

Competition from Substitute Products and Natural Alternatives

Sports drinks face intensifying competition from substitutes such as coconut water, enhanced waters, and traditional fruit juices that many consumers perceive as more natural and healthier options. The growing preference for clean-label beverages, free from artificial colors, flavors, and sweeteners, is reshaping buying behavior. This shift challenges conventional sports drink formulations and pressures brands to reformulate, reposition, or innovate to retain relevance and market share.

Health Concerns Regarding Sugar Content and Artificial Additives

Rising consumer awareness around sugar intake and the use of artificial ingredients has intensified scrutiny of traditional sports drink formulations. Health-conscious consumers are increasingly questioning the need for carbohydrate-heavy beverages during low-intensity or everyday activities. This shift in perception is narrowing consumption occasions beyond vigorous exercise, encouraging demand for cleaner labels, reduced sugar content, and alternative functional hydration options.

Competitive Landscape:

The Brazil sports drinks market exhibits moderate competitive intensity characterized by the presence of multinational beverage corporations alongside regional manufacturers competing across price segments and distribution channels. Market dynamics reflect strategic positioning, ranging from premium, innovation-driven offerings emphasizing advanced hydration science to value-oriented products targeting cost-conscious consumers. The competitive landscape is increasingly shaped by sustainability initiatives, e-commerce capabilities, product innovation in low-sugar and functional formulations, and marketing effectiveness in connecting brands with Brazil's passionate sports culture and the growing fitness community.

Recent Developments:

- June 2025: Neymar Jr. participated in the launch of his new beverage brand, “Pley by Ney,” developed in partnership with Brazilian company Tial and Fun Brands. The product targeted the active lifestyle drinks segment, focusing on hydration and nutrient replenishment for health-conscious consumers. The launch introduced three fruit-based flavors with coconut water, aligning the brand with Neymar’s lifestyle and Brazilian taste preferences.

- July 2024: NotCo launched Not Shake Protein, a new line of zero-sugar, plant-based protein drinks aimed at the sports nutrition market. The beverages delivered 16g of protein per serving, added vitamins, and no lactose or gluten, with a focus on lighter, less-sweet flavor profiles. Initially introduced in Brazil, the launch reflected NotCo’s expansion into athlete-focused nutrition and functional beverage categories.

Brazil Sports Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packagings Covered | PET Bottles, Cans |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail Channel, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 9-11 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil sports drinks market size was valued at USD 625.89 Million in 2025.

The Brazil sports drinks market is expected to grow at a compound annual growth rate of 2.99% from 2026-2034 to reach USD 815.87 Million by 2034.

PET bottles dominate the Brazil sports drinks market with a share of 69% in 2025, driven by lightweight durability, cost-effectiveness, superior product visibility, and widespread consumer preference for convenient portable hydration.

Key factors driving the Brazil sports drinks market include the rising participation in organized fitness activities, increasing availability of gyms and exercise spaces, and higher consumer focus on functional hydration. Long term investments in fitness infrastructure, such as Gold’s Gym’s 2025 announcement to open 60 gyms in Brazil over the next decade, are reinforcing regular workout habits and supporting sustained demand for sports drinks across urban and suburban markets.

Major challenges include price sensitivity limiting penetration among cost-conscious individuals, competition from natural alternatives like coconut water, health concerns regarding sugar content in traditional formulations, and economic volatility affecting discretionary spending patterns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)