Brazil Waste-to-Energy Market Size, Share, Trends and Forecast by Technology and Region, 2026-2034

Brazil Waste-to-Energy Market Summary:

The Brazil waste-to-energy market size was valued at USD 1,044.38 Million in 2025 and is projected to reach USD 1,473.51 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034.

Brazil’s waste-to-energy (WtE) sector is witnessing strong growth, fueled by rising municipal solid waste generation, shrinking landfill capacity, and the need for sustainable disposal solutions. Rapid urbanization and the country’s focus on lowering greenhouse gas emissions are driving interest in alternative energy recovery methods. Government policies, including the National Solid Waste Policy, PLANARES targets, and the Fuel of the Future law, are encouraging private investment and biomethane adoption. Abundant organic waste from agriculture, sanitation, and municipalities further supports WtE as a key element of Brazil’s circular economy and energy transition strategies.

Key Takeaways and Insights:

- By Technology: Physical dominates the market with a share of 48% in 2025, driven by the mature state of thermal incineration technologies, proven operational efficiency in waste volume reduction, and growing adoption of advanced combustion systems that integrate energy recovery with emission control capabilities.

- By Region: Southeast leads the market with a share of 32% in 2025, supported by higher waste generation volumes in São Paulo and Rio de Janeiro metropolitan areas, superior waste management infrastructure, and concentration of industrial activities requiring sustainable energy solutions.

- Key Players: The Brazil waste-to-energy market exhibits a moderately concentrated competitive structure, with domestic waste management corporations competing alongside multinational environmental services providers. Market participants are focused on expanding biogas production capacity, developing integrated waste treatment facilities, and securing municipal concession contracts to establish long-term operational footholds across key metropolitan regions.

Brazil's waste-to-energy sector is positioned at a critical inflection point, transitioning from reliance on traditional landfill disposal toward advanced energy recovery technologies. The market encompasses thermal treatment processes including incineration and gasification, as well as biochemical pathways such as anaerobic digestion and landfill gas capture. Municipal solid waste serves as the primary feedstock, with Brazil generating approximately 81 million tons annually, of which only a fraction currently undergoes energy recovery. The Amazonas Waste Treatment and Processing Center (CTTR), opened in 2024 in Manaus, exemplifies the emerging trend toward integrated biomethane production facilities that combine waste treatment with renewable gas generation. This facility, scheduled for full operations in 2028, represents Amazonas state's first biomethane plant and demonstrates the sector's potential for addressing both waste management and energy security challenges simultaneously.

Brazil Waste-to-Energy Market Trends:

Accelerating Biomethane Infrastructure Development

Brazil is witnessing the rapid expansion of biomethane production facilities as the country leverages its abundant organic waste resources for renewable gas generation. The biogas sector has expanded substantially over the past decade, experiencing rapid growth in facility numbers and production capacity, reflecting increasing adoption and investment in renewable energy solutions. The Brazil biogas market size was valued at USD 1.16 Billion in 2025 and is projected to reach USD 1.70 Billion by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034. The Fuel of the Future law, introduced in late 2024, requires producers and importers to incorporate a minimum share of biomethane into natural gas supplies, ensuring a baseline demand for renewable gas. In response, several companies are advancing biomethane projects across Brazil, developing facilities that utilize feedstocks such as sugarcane bagasse to generate sustainable energy and support the country’s transition toward cleaner fuel alternatives.

Integration of WtE with Circular Economy Models

Market participants are increasingly adopting integrated waste management approaches that combine material recovery with energy generation. This trend reflects the recognition that waste-to-energy complements rather than competes with recycling activities, enabling communities to maximize resource value while minimizing landfill dependence. The National Solid Waste Information System now recognizes energy recovery as a legitimate form of environmentally appropriate final disposal within the waste hierarchy. ABREN estimates that Brazil's 28 metropolitan regions with populations exceeding one million could collectively generate 18.9 terawatt-hours annually through WtE, representing approximately three percent of national electricity demand.

Rising Investment in Advanced Thermal Treatment Technologies

Advanced incineration technologies featuring ultra-high temperature furnaces and sophisticated emission control systems are gaining traction as municipalities seek efficient solutions for managing high volumes of non-recyclable waste. Modern moving grate incineration systems can reduce waste volumes by up to ninety percent while generating stable baseload electricity. The URE Barueri project, under construction in São Paulo state with 20 MW capacity, will process 300,000 tons of solid waste annually, serving as Latin America's first commercial-scale mass burn WtE facility and demonstrating the viability of thermal treatment in Brazilian market conditions.

Market Outlook 2026-2034:

The Brazil waste-to-energy market outlook remains positive as the country pursues ambitious targets for sustainable waste management and clean energy generation. The National Solid Waste Plan updated in 2024 established targets for 994 MW of WtE capacity, 252 MW from landfill gas, and 69 MW from anaerobic digestion by 2040. Brazilian companies managing municipal solid waste are expected to invest approximately R$8.5 billion over the next five years in new biomethane production facilities, according to ABREMA. The market generated a revenue of USD 1,044.38 Million in 2025 and is projected to reach a revenue of USD 1,473.51 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034.

Brazil Waste-to-Energy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

Physical |

48% |

|

Region |

Southeast |

32% |

Technology Insights:

To get detailed segment analysis of this market, Request Sample

- Physical

- Bio-Chemical

- Others

Physical dominates with a market share of 48% of the total Brazil waste-to-energy market in 2025.

The physical segment, encompassing thermal treatment technologies such as incineration, gasification, and pyrolysis, dominates Brazil’s waste-to-energy (WtE) market due to its proven efficiency in managing municipal solid waste. These technologies can significantly reduce waste volume, modern incineration facilities can decrease waste mass by up to ninety percent, while processing mixed and non-recyclable streams that are otherwise difficult to manage. Their ability to generate energy from diverse feedstocks, including municipal, industrial, and agricultural waste, positions thermal treatment as a reliable and scalable solution for Brazil’s urban waste challenges.

In addition, thermal treatment technologies benefit from established operational track records in developed markets, providing confidence in performance, safety, and energy recovery potential. The segment also aligns with Brazil’s environmental and energy policies, offering solutions that reduce landfill dependency and support renewable energy generation. Industrial applications, such as co-processing in cement production, further expand their utilization, allowing waste-to-energy integration across multiple sectors. Combined, these factors make physical technologies the leading choice for WtE investments and infrastructure development in Brazil.

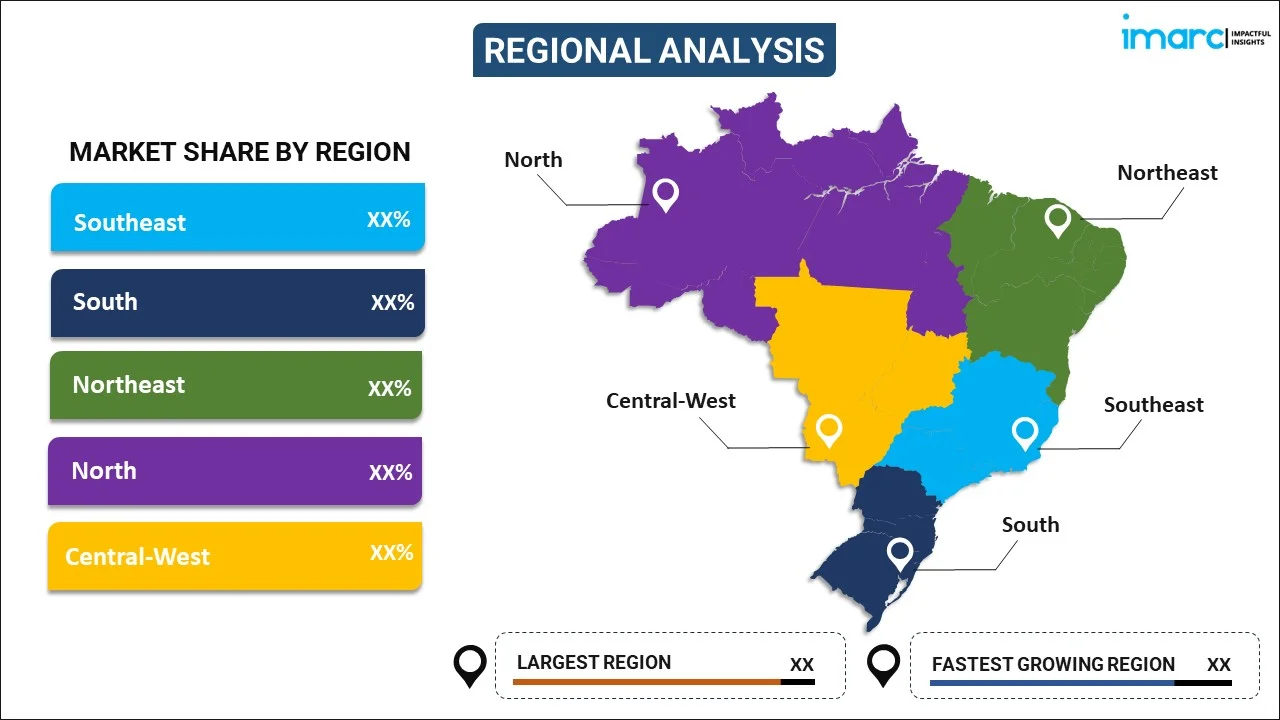

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast leads with a share of 32% of the total Brazil waste-to-energy market in 2025.

The Southeast region's dominance reflects its concentration of Brazil's largest metropolitan areas, highest population density, and most developed waste management infrastructure. São Paulo and Rio de Janeiro states generate most national municipal solid waste volumes, creating substantial feedstock availability for energy recovery operations. The region achieves proper waste disposal rates exceeding sixty-nine percent in sanitary landfills, significantly higher than national averages and demonstrating the infrastructure foundation necessary for advanced WtE development.

The Southeast region leads Brazil’s waste-to-energy development due to its advanced waste management infrastructure and strong industrial base. Superior landfill management practices in the region create favorable conditions for transitioning toward energy recovery from municipal and industrial waste streams. Additionally, local industries are driving demand for sustainable energy solutions, seeking to reduce carbon emissions and align operations with environmental, social, and governance objectives. These factors collectively make the Southeast a strategic hub for the expansion and adoption of waste-to-energy technologies.

Market Dynamics:

Growth Drivers:

Why is the Brazil Waste-to-Energy Market Growing?

Escalating Municipal Solid Waste Generation and Landfill Capacity Constraints

Brazil’s rapidly expanding urban population and increasing consumption are driving unprecedented volumes of municipal solid waste, creating an urgent need for sustainable disposal solutions. Limited landfill capacity in major metropolitan areas is heightening pressure on waste management systems, prompting authorities to explore long-term alternatives. Waste-to-energy technologies offer a viable solution by processing large volumes of organic and non-recyclable waste while generating renewable electricity. This approach supports environmental sustainability, reduces reliance on landfills, and contributes to the country’s broader energy diversification and climate objectives. For instance, in 2024, Brazil produced 81.6 million tonnes of municipal solid waste (MSW), reflecting a slight increase from the previous year. Of this total, 76.4 million tonnes, or nearly 94 percent, were collected, while around 41.4 million tonnes, representing approximately 60 percent, were properly managed through sanitary landfills.

Supportive Government Policies and Regulatory Framework Development

Comprehensive policy frameworks are fostering the development of waste-to-energy in Brazil, recognizing energy recovery as an environmentally sound method of disposal. Regulations set clear targets for capacity expansion and promote integration of renewable energy into the broader energy mix. Incentives and supportive financing mechanisms encourage investment in infrastructure for biomass and other waste-derived energy sources. Together, these regulatory measures create a stable and enabling environment, ensuring that waste-to-energy technologies can expand sustainably while contributing to resource efficiency, emissions reduction, and long-term energy security.

National Energy Diversification and Climate Commitments

Brazil's traditional dependence on hydropower generation, which accounts for approximately sixty percent of national electricity production, creates vulnerability to drought cycles and climate variability. Recent water crises have demonstrated the need for energy matrix diversification beyond variable renewable sources. Waste-to-energy provides dispatchable baseload generation capacity that can operate continuously regardless of weather conditions, contributing to grid stability and energy security. The country's climate commitments under the Paris Agreement further support WtE adoption, as these facilities divert organic waste from landfills where decomposition generates methane emissions while producing renewable electricity that displaces fossil fuel generation.

Market Restraints:

What Challenges the Brazil Waste-to-Energy Market is Facing?

High Capital Investment Requirements and Financing Barriers

Waste-to-energy facilities require substantial upfront capital investments for construction, equipment procurement, and emission control systems. Project financing remains challenging due to perceived technology risks, lengthy permitting timelines, and uncertainty regarding long-term waste supply agreements. Municipal budget constraints limit public sector contributions to public-private partnerships, while commercial lending terms may not align with extended project payback periods.

Competition from Low-Cost Landfill Disposal Alternatives

In Brazil, traditional landfill disposal often remains more economical than waste-to-energy solutions due to lower operational costs and widespread use of open dumps in underserved areas. High investment and energy recovery expenses make WtE facilities less financially competitive, while competition from cheaper energy sources further limits viability. These factors continue to pose challenges for the broader adoption of energy-from-waste technologies.

Social Opposition and Informal Waste Sector Concerns

Large-scale WtE incineration projects face opposition from waste picker communities who depend on informal collection and recycling activities for livelihood. Environmental groups raise concerns regarding air emissions and ash disposal requirements. Public perception linking incineration with pollution and health impacts creates permitting challenges despite modern emission control technologies meeting stringent environmental standards.

Competitive Landscape:

The Brazil waste-to-energy market is moderately concentrated competitive with both local waste management companies and foreign environmental services companies involved. Municipal concession contracts, landfill operations, and development of biogas facilities have given major players in the market a footing. The local knowledge and existing contacts with the municipal authorities are used by domestic players, whereas the international firms deliver technical skills and the ability to fund the project. The strategic focus areas will be to increase the biomethane production capacity, to create an integrated waste treatment facility that will combine sorting, recycling, as well as energy recovery, and to make long-term agreements with the suppliers of waste. It is an energy market that is experiencing growing attention on the part of market players in the energy industry, such as oil majors, which are diversifying into the renewable gas production industry as a wider energy transition trend.

Recent Developments:

- June 2025: FGV Energia and Petrobras collaborated to convert fishing waste from Brazil’s Amazon Legal region into renewable energy and value-added products. The project, in collaboration with UFAM and the Senai Institute of Innovation in Biomass, is an 18-month research, development, and innovation program that was inaugurated on World Environment Day at Petrobras’ headquarters in Rio de Janeiro.

- August 2024: Clean Energy Technologies expanded waste heat to power operations in Brazil through a partnership with Green Energy Ventures, demonstrating continued international investment interest in the country's waste-to-energy sector.

Brazil Waste-to-Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Physical, Bio-Chemical, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil waste-to-energy market size was valued at USD 1,044.38 Million in 2025.

The Brazil waste-to-energy market is expected to grow at a compound annual growth rate of 3.90% from 2026-2034 to reach USD 1,473.51 Million by 2034.

Physical dominated the market with a 48% share in 2025, driven by mature thermal treatment technologies including incineration and gasification that offer proven waste volume reduction and energy generation capabilities suitable for high-density urban environments.

Key factors driving the Brazil waste-to-energy market include escalating municipal solid waste generation volumes approaching 100 million tons annually, imminent landfill capacity exhaustion in major metropolitan areas, supportive government policies including the Fuel of the Future law mandating biomethane blending, and national energy diversification priorities seeking alternatives to hydropower dependence.

Major challenges include high capital investment requirements for facility construction, competition from low-cost landfill disposal averaging R$140 per ton, financing barriers due to perceived technology risks, social opposition from informal waste picker communities, and limited integration of WtE projects into regulated energy auctions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)