Europe Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Country, 2026-2034

Europe Digital Health Market Summary:

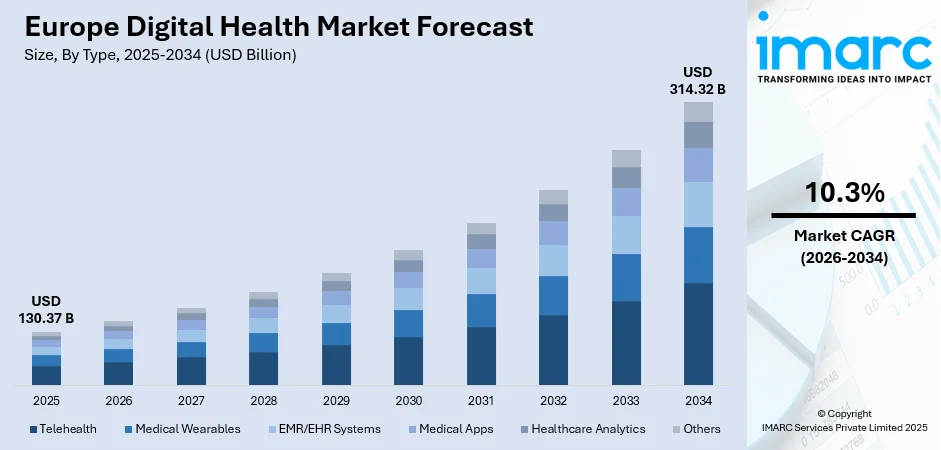

The Europe digital health market size was valued at USD 130.37 Billion in 2025 and is projected to reach USD 314.32 Billion by 2034, growing at a compound annual growth rate of 10.3% from 2026-2034.

The accelerated digital transformation of healthcare, supportive regulatory frameworks in place, and the growing demand for accessible and efficient medical services are driving the growth of the Europe digital health market. This region has been capable of offering advanced technological infrastructure and government initiatives that support eHealth development and adoption. Additionally, consumer acceptance of digital health platforms increases for health monitoring, managing, and improving health outcomes, pushing further sustained market growth across Europe.

Key Takeaways and Insights:

-

By Type: Telehealth dominates the market with a share of 28% in 2025, driven by widespread adoption of virtual consultations, remote patient monitoring capabilities, and healthcare system integration that enables convenient access to medical services across urban and rural populations.

-

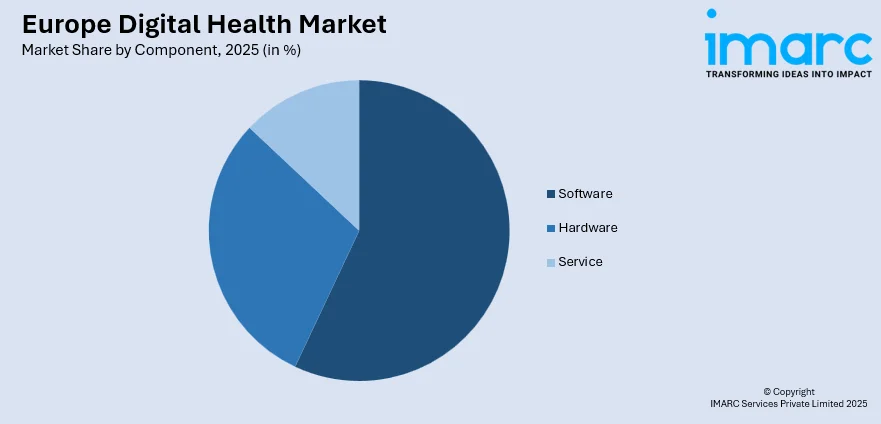

By Component: Software leads the market with a share of 57% in 2025, owing to increasing investments in cloud-based healthcare platforms, electronic health record systems, AI-powered diagnostic tools, and interoperable digital solutions that enhance clinical workflows and patient engagement.

-

By Country: United Kingdom represents the largest segment with a market share of 26% in 2025, supported by the National Health Service's digital transformation initiatives, robust investment in health technology innovation, and comprehensive government strategies promoting digital healthcare adoption.

-

Key Players: The Europe digital health market exhibits a dynamic competitive landscape, featuring established healthcare technology corporations alongside innovative startups and specialized solution providers driving continuous advancement in digital healthcare delivery.

To get more information on this market Request Sample

The Europe digital health market encompasses a broad and evolving range of technology-enabled healthcare solutions aimed at improving patient outcomes, increasing system efficiency, and modernizing traditional healthcare delivery models. Digital health includes telehealth and telemedicine platforms, mobile health applications, electronic health records, wearable and remote monitoring devices, healthcare data analytics systems, and AI-driven diagnostic and decision-support tools. The market reflects Europe’s strong commitment to healthcare innovation, with public and private stakeholders investing in digital infrastructure. In 2025, the EU published the European Health Data Space (EHDS) Regulation, aiming to enhance access, interoperability, and innovative use of electronic health data across member states. National health systems are increasingly adopting these technologies to address aging populations, workforce shortages, rising healthcare costs, and growing patient demand for accessible, data-driven, and personalized healthcare services across both urban and remote settings.

Europe Digital Health Market Trends:

Accelerating Integration of Artificial Intelligence in Healthcare

European healthcare is increasingly adopting AI across diagnostics, clinical decision support, and predictive analytics, enhancing disease detection, personalized treatment, and operational efficiency. In October 2025, the European Commission launched a €1 billion “Apply AI” strategy, funding AI‑powered screening centres to improve early disease detection. Complementing this, the EU Artificial Intelligence Act, effective 2024, sets requirements for high-risk medical AI systems, ensuring patient safety and algorithmic transparency.

Rising Adoption of Remote Patient Monitoring Solutions

Healthcare providers across Europe are expanding remote patient monitoring programs to manage chronic conditions, reduce hospital admissions, and extend care into home settings. Connected medical devices and wearable sensors enable continuous health data collection, supporting proactive intervention and personalized care management. London’s Doccla raised £35 million in 2024 to expand remote monitoring across the UK and Europe, enabling 24/7 patient tracking and reducing emergency hospital admissions. National health systems recognize remote monitoring as essential infrastructure for addressing aging population needs.

Expansion of European Health Data Space Initiatives

The European Union is advancing comprehensive health data governance frameworks to enable secure data sharing, interoperability, and cross‑border healthcare access. In November 2025, the European Health and Digital Executive Agency (HaDEA) signed new EU4Health contracts to strengthen the European Health Data Space (EHDS) and help stakeholders comply with requirements for secure and interoperable secondary use of health data. These initiatives also establish standardized electronic health record requirements, allowing citizens to access their health information across member states while supporting research and innovation.

Market Outlook 2026-2034:

The Europe digital health market is positioned for substantial growth throughout the forecast period, supported by demographic pressures, technological advancement, and evolving healthcare delivery models. Aging populations and rising chronic disease prevalence create sustained demand for digital health solutions that enable efficient care management and improve health outcomes. Regulatory support through initiatives such as the European Health Data Space and national digital health strategies accelerates technology adoption and infrastructure development. The market generated a revenue of USD 130.37 Billion in 2025 and is projected to reach a revenue of USD 314.32 Billion by 2034, growing at a compound annual growth rate of 10.3% from 2026-2034.

Europe Digital Health Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Telehealth | 28% |

| Component | Software | 57% |

| Country | United Kingdom | 26% |

Type Insights:

- Telehealth

- Medical Wearables

- EMR/EHR Systems

- Medical Apps

- Healthcare Analytics

- Others

The telehealth dominates with a market share of 28% of the total Europe digital health market in 2025.

Telehealth solutions have become foundational components of European healthcare delivery, enabling virtual consultations, remote diagnostics, and continuous patient monitoring across diverse clinical settings. The technology addresses critical healthcare access challenges, particularly in rural and underserved areas where specialist availability remains limited. The Europe telehealth market size was valued at USD 6.62 Billion in 2025 and is projected to reach USD 25.98 Billion by 2034, reflecting the rapid adoption and integration of telehealth across public and private healthcare systems. National health systems have institutionalized telehealth services within reimbursement frameworks, accelerating adoption among healthcare providers and patients.

The integration of telehealth platforms with electronic health records and clinical workflows enhances care coordination and continuity across primary, secondary, and tertiary healthcare settings. Advanced teleconsultation capabilities incorporating high-definition video, secure messaging, and integrated diagnostic tools support comprehensive virtual care delivery. Healthcare organizations leverage telehealth infrastructure to optimize resource allocation, reduce patient travel burdens, and extend specialist expertise to community-based settings.

Component Insights:

Access the comprehensive market breakdown Request Sample

- Software

- Hardware

- Service

The software leads with a share of 57% of the total Europe digital health market in 2025.

Software solutions form the technological backbone of digital health ecosystems across Europe, encompassing electronic health record platforms, clinical decision support systems, patient engagement applications, and healthcare analytics tools. Cloud-based deployment models enable scalable, accessible, and cost-effective implementation across healthcare organizations of varying sizes. According to sources, Kaiku Health raised EUR 4.4 million to expand its digital therapeutics platform across Switzerland, Germany, Italy, Sweden, and Finland, highlighting rising investment in health-focused software solutions. The growing emphasis on interoperability standards drives software development toward open architectures that facilitate seamless data exchange.

Investment in AI-powered software applications accelerates as healthcare providers seek enhanced diagnostic accuracy, workflow optimization, and personalized treatment recommendations. Platform consolidation trends emerge as healthcare organizations prioritize integrated solutions over fragmented point applications. Regulatory compliance requirements, including data protection and medical device certification, shape software development priorities and market positioning strategies.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

United Kingdom exhibits a clear dominance with a 26% share of the total Europe digital health market in 2025.

This keeps the United Kingdom at the forefront, with the comprehensive digital transformation impetus provided by the National Health Service, and supported by strong government investment in health technology infrastructure. Ambitious targets for the integration of digital healthcare are set out in the NHS Long Term Plan, driving take-up of electronic health records, virtual care platforms, and AI-enabled clinical tools throughout the health system. Venture capital investment in UK health technology start-ups remains strong, fostering ongoing innovation.

Regulatory autonomy in the post-Brexit environment offers scope for flexible approaches toward new digital health technologies while remaining aligned with international standards on safety. This concentration of world-class research institutions, technology companies, and healthcare providers within the UK develops an energetic ecosystem of innovation that draws both global investment and talent. Government strategies around preventive care, population health management, and patient empowerment accelerate digital health technology deployment.

Market Dynamics:

Growth Drivers:

Why is the Europe Digital Health Market Growing?

Aging Population and Rising Chronic Disease Burden

Europe's demographic profile, characterized by one of the world's oldest populations, creates sustained demand for digital health solutions that enable efficient chronic disease management and elderly care. As of early 2024, about one-fifth of the EU population was aged 65 or older, reflecting rising life expectancy, declining birth rates, and long-term pressures on healthcare systems. Healthcare systems face escalating pressure to deliver more care with constrained resources, driving adoption of technologies that extend clinical capacity beyond traditional settings. Remote patient monitoring, telehealth consultations, and digital therapeutics address the growing need for accessible, continuous care for populations managing multiple chronic conditions. Digital health technologies enable proactive intervention, reducing acute episodes and costly hospitalizations.

Government Support and Regulatory Advancement

European governments actively promote digital health adoption through comprehensive national strategies, substantial funding initiatives, and progressive regulatory frameworks. The European Health Data Space regulation establishes standardized requirements for electronic health records and cross-border data sharing, creating infrastructure for continental-scale digital health deployment. For instance, Germany’s DiGA framework allows certified digital health applications to be prescribed and reimbursed, embedding “apps on prescription” into statutory healthcare and driving nationwide adoption of electronic patient records. Public-private partnerships accelerate innovation while ensuring alignment with public health objectives.

Healthcare Workforce Constraints and Efficiency Imperatives

Projected healthcare workforce shortages across European countries intensify demand for digital technologies that enhance clinical productivity and extend specialist expertise. A 2025 survey of 442 healthcare executives in 13 European countries found severe staff shortages, with 90% of German hospitals affected, driving AI adoption in scheduling, remote monitoring, telemedicine, and automation. Automation of administrative tasks, AI-assisted diagnostics, and virtual care delivery models enable healthcare professionals to focus on complex clinical activities requiring human judgment. Digital health platforms support task redistribution across care teams, empowering nurses, pharmacists, and allied health professionals with decision support tools. Healthcare organizations recognize digital transformation as essential for maintaining service quality amid demographic and workforce challenges.

Market Restraints:

What Challenges the Europe Digital Health Market is Facing?

Data Privacy, Concerns, and Security

Tough data protection laws in GDPR, coupled with imminent regulations for AI, make it more complex for digital healthcare service providers. With this, healthcare organizations face the challenge of promoting innovation while upholding sound cybersecurity practices. Patient data can still be considered invaluable since digital platforms grow, despite the prevalence of breaches and misuse.

Interoperability and Integration Challenges

The problem of outdated IT infrastructure in the area of medical care makes it difficult to ensure seamless data exchange. To ensure interoperability of IT systems in this area, it is necessary to make a major investment in the modernization of IT infrastructure. The issue of change management should be taken into account in this area.

Digital Literacy and Access Inequalities

Differences in digital literacy and unequal access to technology can worsen existing health disparities. Older adults, low-income populations, and rural residents often struggle to adopt digital health solutions, limiting their participation in technology-enabled care. These barriers reduce access to timely services, hinder health management, and risk widening gaps in health outcomes across vulnerable population groups.

Competitive Landscape:

The Europe digital health market has an evolving competitive environment that includes large technology companies from across the world, well-established medical equipment companies, new technology startups, and niche healthcare IT companies. Leaders in the market use their holistic product offerings and significant research and development capabilities to stay ahead in the game. Acquisitions as a strategy will enable companies to immediately leverage new capabilities and expand their market share, and technology companies as well as healthcare organizations will combine efforts to accelerate the development of digital health solutions. Cloud infrastructure companies are emerging as new competitors in the digital health market, offering scalable infrastructure and advanced healthcare services.

Recent Developments:

-

In June 2025, Hims & Hers announced its European expansion by acquiring digital health platform ZAVA, accelerating its entry into the UK, Germany, France, and Ireland. The acquisition will expand Hims & Hers’ personalized digital care services across dermatology, mental health, weight loss, and more.

Europe Digital Health Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Telehealth, Medical Wearables, EMR/EHR Systems, Medical Apps, Healthcare Analytics, Others |

| Components Covered | Software, Hardware, Service |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe digital health market size was valued at USD 130.37 Billion in 2025.

The Europe digital health market is expected to grow at a compound annual growth rate of 10.3% from 2026-2034 to reach USD 314.32 Billion by 2034.

Telehealth dominated with a 28% market share, driven by widespread adoption of virtual consultations, integration with healthcare systems, and growing demand for accessible remote healthcare services across urban and rural populations.

Key factors driving the Europe digital health market include aging population demographics, rising chronic disease prevalence, government digital health initiatives, healthcare workforce constraints, and increasing adoption of AI-powered healthcare solutions.

Major challenges include data privacy and security concerns under stringent regulatory requirements, interoperability challenges with legacy healthcare IT systems, digital literacy disparities across population segments, and complex reimbursement frameworks for digital health services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)