Europe Electric Vehicles Market Size, Share, Trends and Forecast by Component, Charging Type, Propulsion Type, Vehicle Type, and Country, 2026-2034

Europe Electric Vehicles Market Summary:

The Europe electric vehicles market size was valued at USD 301.14 Billion in 2025 and is projected to reach USD 1,200.41 Billion by 2034, growing at a compound annual growth rate of 16.6% from 2026-2034.

The market is driven by stringent emission regulations mandated by the European Union, growing environmental consciousness among consumers, and substantial government incentives promoting sustainable mobility. Expanding charging infrastructure across metropolitan and interurban corridors, alongside continuous advancements in battery technology, is accelerating consumer adoption. Additionally, corporate sustainability initiatives and fleet electrification programs are contributing to market expansion, positioning Europe as a leading region in the electric vehicles market.

Key Takeaways and Insights:

-

By Component: Battery cells and packs dominates the market with a share of 72% in 2025, driven by the critical role of advanced lithium-ion and solid-state battery technologies in determining vehicle range, performance, and overall efficiency.

-

By Charging Type: Slow charging leads the market with a share of 54% in 2025, owing to the widespread availability of home charging solutions, lower installation costs, and compatibility with overnight charging preferences among residential consumers.

-

By Propulsion Type: Battery electric vehicle (BEV) represents the largest segment with a market share of 64% in 2025, driven by zero-emission capabilities, declining battery costs, extensive model availability, and strong policy support favoring fully electric mobility solutions.

-

By Vehicle Type: Passenger vehicles dominate the market with a share of 78% in 2025, owing to increasing consumer preference for sustainable personal transportation, diverse electric model offerings, and accessible financing options.

-

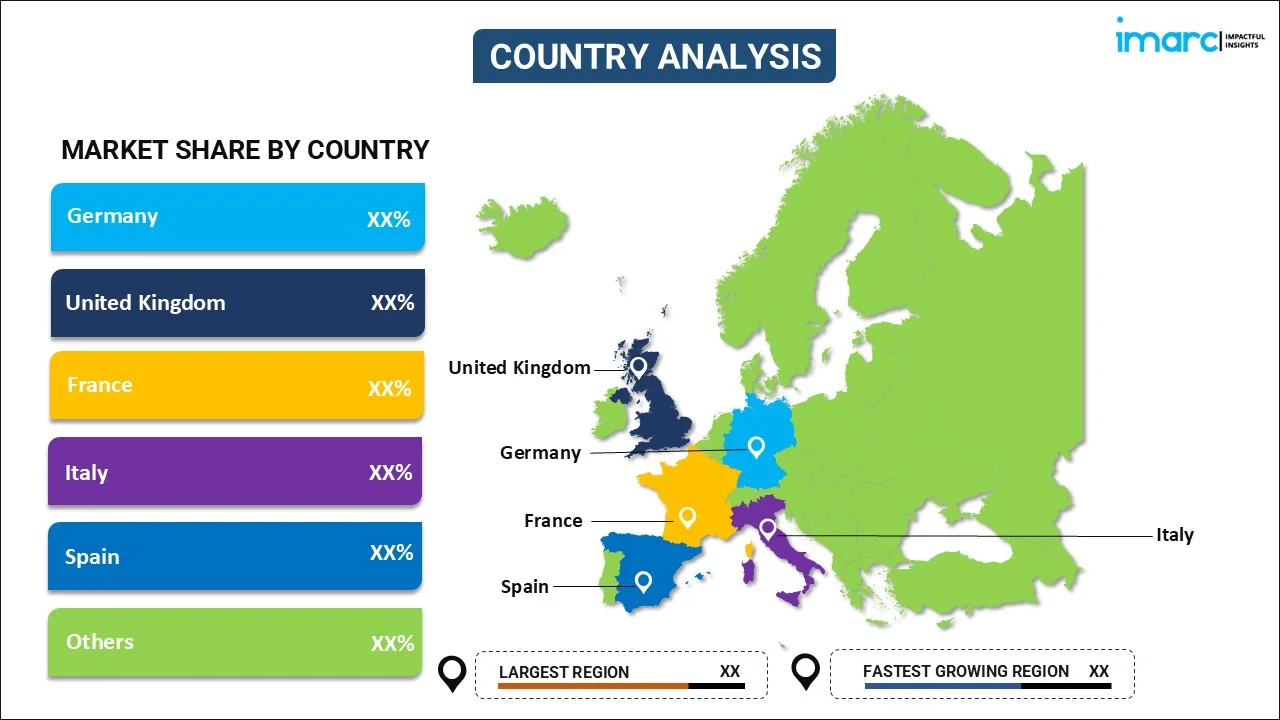

By Country: Germany leads the market with a share of 25% in 2025, driven by its robust automotive manufacturing heritage, comprehensive incentive programs, extensive charging infrastructure network, and strong consumer demand for premium electric vehicles (EVs).

-

Key Players: The Europe electric vehicles market exhibits a highly competitive landscape characterized by established automotive manufacturers and emerging players. Market participants are focusing on technological innovation, expanding product portfolios, and strategic collaborations to strengthen their market positioning across diverse vehicle segments. Some of the key players operating in the market include Audi AG, Bayerische Motoren Werke AG, Groupe Renault, Hyundai Motor Company, Kia Corporation, Mercedes-Benz, Tesla Inc., Toyota Motor Corporation, Volvo Car AB, and Volkswagen AG.

The Europe electric vehicles market is experiencing transformative growth, propelled by comprehensive regulatory frameworks aimed at achieving carbon neutrality. The European Union's commitment to reducing greenhouse gas emissions and phasing out internal combustion engines is fundamentally reshaping the automotive landscape. Consumer awareness regarding environmental sustainability continues to rise, driving preference shifts toward zero-emission transportation alternatives. Government incentives, including purchase subsidies, tax exemptions, and preferential parking benefits, are substantially reducing the total cost of ownership. Technological advancements in battery efficiency and energy density are addressing historical concerns regarding vehicle range. The expansion of public and private charging networks is enhancing convenience and accessibility for electric vehicle (EV) owners. As per sources, in September 2025, Volkswagen subsidiary Elli launched a bidirectional charging pilot at IAA Mobility 2025, allowing EV batteries to power homes and integrate with solar systems, potentially reducing household charging costs by up to 75 percent. Moreover, corporate fleet electrification initiatives are contributing significantly to market demand. This convergence of regulatory, economic, technological, and social factors is establishing Europe as a global leader in sustainable mobility.

Europe Electric Vehicles Market Trends:

Accelerated Deployment of Ultra-Fast Charging Networks

The European EV ecosystem is witnessing rapid expansion of ultra-fast charging infrastructure across major transportation corridors and urban centers. In June 2025, Eleport and Supernova Group launched nearly 200 ultrafast EV chargers across 30 locations in Croatia and Slovenia, enhancing high-speed charging accessibility in urban and transit areas. Furthermore, governments and private operators are collaborating to establish comprehensive charging networks that significantly reduce charging times, addressing consumer concerns about convenience and range anxiety. Strategic placement of high-power charging stations along highways, in commercial districts, and at destination locations is transforming the charging experience. Smart charging technologies incorporating dynamic pricing and grid balancing capabilities are being integrated to optimize energy distribution and enhance network efficiency across the continent.

Integration of Advanced Battery Technologies

Battery technology innovation is driving fundamental improvements in EV performance, range, and affordability across Europe. Research and development efforts are focused on next-generation cell chemistries, including solid-state batteries that promise enhanced energy density, faster charging capabilities, and improved safety profiles. Manufacturers are establishing local battery production facilities to reduce supply chain dependencies and enhance manufacturing flexibility. Circular economy initiatives encompassing battery recycling and second-life applications are gaining momentum, addressing sustainability concerns while creating new revenue streams throughout the battery lifecycle. As per sources, in September 2025, CEN published EN 18061:2025, establishing Europe’s first standard for safe repair, reuse, and second-life applications of EV batteries, advancing circular economy practices.

Expansion of Affordable Electric Vehicle Segments

The European market is experiencing a strategic shift toward more accessible EV offerings as manufacturers introduce competitively priced models targeting mass-market consumers. In September 2025, Volkswagen Group unveiled its “Electric Urban Car Family” of affordable EVs in Europe with starting prices around €25,000, aimed at expanding massmarket electric mobility beyond premium segments. This democratization of electric mobility is expanding beyond premium segments to include compact cars, hatchbacks, and entry-level crossovers that appeal to cost-conscious buyers. Simplified manufacturing processes and economies of scale in battery production are enabling price reductions without compromising quality or performance. Leasing and subscription models are emerging as popular alternatives to traditional ownership, further lowering barriers to EV adoption among diverse consumer demographics.

Market Outlook 2026-2034:

The Europe electric vehicles market revenue is poised for substantial expansion throughout the forecast period, driven by escalating regulatory stringency and consumer adoption acceleration. Market revenue growth will be underpinned by continued government incentive programs, expanding charging infrastructure investments, and declining battery costs. The transition from internal combustion engines to electric powertrains will intensify as emission standards tighten progressively. Technological innovations in autonomous driving features and connectivity solutions will enhance vehicle value propositions. The market generated a revenue of USD 301.14 Billion in 2025 and is projected to reach a revenue of USD 1,200.41 Billion by 2034, growing at a compound annual growth rate of 16.6% from 2026-2034.

Europe Electric Vehicles Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Battery Cells and Packs |

72% |

|

Charging Type |

Slow Charging |

54% |

|

Propulsion Type |

Battery Electric Vehicle (BEV) |

64% |

|

Vehicle Type |

Passenger Vehicles |

78% |

|

Country |

Germany |

25% |

Component Insights:

To get more information on this market, Request Sample

- Battery Cells and Packs

- On-Board Charger

- Fuel Stack

Battery cells and packs dominates with a market share of 72% of the total Europe electric vehicles market in 2025.

The battery cells and packs command the largest component revenue share in the Europe electric vehicles market, reflecting the fundamental importance of energy storage systems in modern vehicle design and architecture. This dominance stems from the critical role batteries play in determining vehicle capabilities including driving range, acceleration performance, and overall operational efficiency. Continuous investments in research and development are yielding significant improvements in energy density and thermal management systems.

European manufacturers and governments are prioritizing domestic battery production capacity to reduce reliance on external suppliers and strengthen supply chain resilience across the entire region. The establishment of gigafactories across multiple countries demonstrates the strategic significance of battery manufacturing for the regional automotive industry. As per sources, in November 2025, CATL and Stellantis broke ground on a €4.1 Billion carbon-neutral LFP battery gigafactory in Zaragoza, Spain, strengthening Europe’s domestic EV battery supply chain. Moreover, collaborations between automakers, technology companies, and academic institutions are accelerating innovation in cell chemistry, pack design, and advanced manufacturing processes.

Charging Type Insights:

- Slow Charging

- Fast Charging

Slow charging leads with a share of 54% of the total Europe electric vehicles market in 2025.

Slow charging maintains market leadership, reflecting prevalent consumer charging behaviour centred on residential and workplace charging solutions across the European region. Home charging installations offer a significant convenience and notable cost advantages which enable vehicle owners to replenish their batteries overnight during off-peak electricity rate periods. According to sources, in June 2025, Ireland launched its first home-charging EV pilot, enabling homeowners to share private chargers with neighbours, enhancing residential charging accessibility and off-peak EV adoption. Moreover, workplace charging programs are expanding rapidly as employers increasingly recognize the substantial value of supporting employee sustainability preferences and demonstrating corporate environmental responsibility.

The slow charging is especially appealing to first time EV adopters switching from conventional cars due to its accessibility and the cost-effectiveness. Enhanced by smart charging features that allow demand response and grid integration, these chargers offer added value to users and utilities alike. Additionally, government incentives promoting residential charger installations are driving faster deployment, supporting widespread adoption across urban, suburban, and semi-urban areas throughout Europe, strengthening the overall EV ecosystem.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Battery electric vehicle (BEV) exhibits a clear dominance with a 64% share of the total Europe electric vehicles market in 2025.

Battery electric vehicle (BEV) represents the dominant propulsion technology in the European market, reflecting strong consumer and regulatory preferences for zero-emission mobility solutions across the region. According to reports, Germany registered 45,535 new BEVs, a 53.5% increase from April 2024, with BEVs capturing 18.8% of new car registrations, highlighting strong adoption of battery electric vehicles. Further, the complete elimination of tailpipe emissions aligns directly with European Union environmental objectives and urban air quality improvement initiatives. Expanding model availability across all vehicle segments provides consumers with increasingly diverse options meeting varying preferences, budgets, and specific lifestyle requirements.

Declining battery costs and rising energy density are successfully alleviating past concerns about vehicle range and purchase affordability for consumers. The superior performance of electric powertrains, with instant torque and smooth acceleration, particularly attracts driving enthusiasts seeking a more engaging experience. Coupled with simplified maintenance needs and significantly lower operating expenses compared to internal combustion vehicles, these factors collectively enhance the economic appeal and overall value proposition of owning a BEV.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Others

Passenger vehicles lead with a market share of 78% of the total Europe electric vehicles market in 2025.

Passenger vehicles lead the Europe electric vehicles market, driven by robust consumer demand for sustainable personal transportation across all demographics. Automakers have expanded their electric passenger vehicle offerings, providing a wide range from compact city cars to premium sedans and versatile crossovers. This broad portfolio allows consumers of different age groups, lifestyles, and income levels to choose electric mobility solutions that suit their specific needs, promoting widespread adoption and supporting the region’s transition toward greener transportation.

Government incentives specifically targeting passenger vehicle purchases have significantly accelerated adoption rates among private consumers throughout Europe. As per sources, Spain extended its MOVES III programme, providing up to €7,000 euros as grants for new passenger EVs and up to 70% support for private home charging installations. Further, the development of shared mobility services utilizing electric passenger vehicles is creating additional demand while introducing electric mobility experiences to broader populations. Technological features including advanced driver assistance systems and connected vehicle capabilities are substantially enhancing the attractiveness of electric passenger vehicles to technology-oriented and environmentally conscious consumers.

Country Insights:

To get detailed regional analysis of this market, Request Sample

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany dominates with a market share of 25% of the total Europe electric vehicles market in 2025.

Germany remains the leading in Europe electric vehicle market, capitalizing on its established automotive manufacturing expertise and robust policy support. The government demonstrates commitment to sustainable transport through significant investments in charging infrastructure and attractive consumer incentives. Both premium and volume manufacturers headquartered in Germany are innovating and expanding EV offerings across all segments. These initiatives collectively strengthen the country’s position as a central hub for electric mobility and technological advancement in Europe’s automotive sector.

Integrating EV production within existing automotive ecosystems preserves employment while enabling a smooth industrial transition. Strong consumer purchasing power, coupled with increasing environmental consciousness, drives healthy demand across all price points. Strategic investments in battery cell manufacturing and supply chain components further solidify Germany’s role as a comprehensive electric mobility hub. This integrated approach ensures technological leadership, market resilience, and long-term growth in the country’s EV sector, supporting Europe’s broader transition toward sustainable transportation.

Market Dynamics:

Growth Drivers:

Why is the Europe Electric Vehicles Market Growing?

Stringent Emission Regulations and Carbon Neutrality Commitments

The European Union has established comprehensive regulatory frameworks mandating progressive reductions in vehicle emissions, creating structural demand for EVs. According to reports, the European Commission presented the Automotive Package to support clean mobility, introducing stricter CO₂ standards, corporate vehicle targets, and €1.8 Billion for EU battery production. Furthermore, fleet-wide emission standards require manufacturers to achieve significant reductions in average carbon dioxide emissions, with targets becoming increasingly stringent through the forecast period. Non-compliance penalties incentivize automakers to accelerate EV development and market introduction. National governments are implementing complementary policies including internal combustion engine phase-out timelines and urban access restrictions for conventional vehicles. These coordinated regulatory measures are fundamentally transforming the automotive industry landscape and consumer purchasing decisions across Europe.

Comprehensive Government Incentive Programs and Policy Support

Governments across Europe are implementing diverse incentive mechanisms to accelerate EV adoption among consumers and businesses. Purchase subsidies and tax exemptions significantly reduce the initial cost differential between electric and conventional vehicles, improving affordability for prospective buyers. Company car taxation advantages encourage fleet operators and employees to select electric alternatives. Preferential treatment including reduced parking fees, toll exemptions, and access to bus lanes provides ongoing benefits to EV owners. Installation subsidies for residential and commercial charging equipment lower barriers to ownership. These multilayered support programs demonstrate sustained governmental commitment to facilitating the mobility transition.

Expanding Charging Infrastructure and Technological Advancements

The systematic expansion of public charging infrastructure is addressing consumer concerns regarding charging accessibility and convenience throughout Europe. As per sources, in June 2025, EasyGo and Ireland’s Department of Transport launched the Shared Charging Initiative, enabling homeowners to share private EV chargers, enhancing residential charging access and supporting broader electric vehicle adoption nationwide. Moreover, strategic deployment of charging stations along highway corridors, in urban centers, and at commercial destinations creates comprehensive networks supporting long-distance travel and daily usage. Technological improvements in charging speed and reliability enhance the overall ownership experience. Smart charging solutions incorporating renewable energy integration and demand management capabilities optimize system efficiency. Private investments complement public funding in building charging networks, while interoperability standards ensure seamless access across different operator networks and national boundaries.

Market Restraints:

What Challenges the Europe Electric Vehicles Market is Facing?

High Initial Purchase Costs and Price Sensitivity

EVs continue to command the premium pricing compared to equivalent conventional alternatives which presents adoption barriers for price sensitive consumers. Battery costs constitute a substantial portion of vehicle pricing, maintaining the cost differential despite ongoing reductions. Limited availability of affordable models in entry-level segments restricts market accessibility for budget-conscious buyers.

Charging Infrastructure Gaps in Rural and Remote Regions

Despite substantial investments, charging infrastructure deployment remains concentrated in metropolitan areas and major transportation corridors. Rural communities and less densely populated regions experience limited access to public charging facilities, creating practical barriers for residents considering EVs. Infrastructure development in peripheral areas faces economic challenges due to lower utilization rates.

Battery Supply Chain Dependencies and Raw Material Constraints

The concentration of battery component manufacturing and raw material processing outside Europe creates supply chain vulnerabilities affecting EV production. Dependence on imported materials including lithium, cobalt, and rare earth elements exposes manufacturers to geopolitical risks and price volatility. Establishing domestic production capacity requires substantial investments and extended development timelines.

Competitive Landscape:

The Europe electric vehicles market features a dynamic competitive environment where established automotive manufacturers compete alongside technology-driven newcomers. Traditional automakers are leveraging their manufacturing expertise, distribution networks, and brand recognition while accelerating electrification strategies across their product portfolios. Strategic partnerships between automotive manufacturers, technology companies, and battery suppliers are shaping competitive positioning. Research and development investments focus on advancing battery technology, autonomous driving capabilities, and connected vehicle features. Market participants are differentiating through design innovation, performance characteristics, and comprehensive ownership experiences including charging solutions and digital services.

Some of the key players include:

- Audi AG

- Bayerische Motoren Werke AG

- Groupe Renault

- Hyundai Motor Company

- Kia Corporation

- Mercedes-Benz

- Tesla Inc.

- Toyota Motor Corporation

- Volvo Car AB

- Volkswagen AG

Recent Developments:

-

In December 2025, Ford and Renault announced a strategic collaboration to develop two new Ford-branded electric vehicles for Europe, based on Renault’s Ampere platform. Produced at Renault’s ElectriCity plant in northern France, the EVs will feature Ford’s design language and driving dynamics, with the first model anticipated to launch in early 2028.

Europe Electric Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Battery Cell and Packs, On-Board Charger, Fuel-Stack |

| Charging Types Covered | Slow Charging, Fast Charging |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Audi AG, Bayerische Motoren Werke AG, Groupe Renault, Hyundai Motor Company, Kia Corporation, Mercedes-Benz, Tesla Inc., Toyota Motor Corporation, Volvo Car AB, Volkswagen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe electric vehicles market size was valued at USD 301.14 Billion in 2025.

The Europe electric vehicles market is expected to grow at a compound annual growth rate of 16.6% from 2026-2034 to reach USD 1,200.41 Billion by 2034.

Battery cells and packs held the largest market share, driven by their critical role in determining vehicle range, performance efficiency, and the growing emphasis on domestic battery manufacturing capacity across the region.

Key factors driving the Europe electric vehicles market include stringent emission regulations, comprehensive government incentive programs, expanding charging infrastructure, declining battery costs, growing environmental awareness, and technological advancements in vehicle performance.

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, inconsistent government incentives, long battery replacement times, supply chain constraints, and low consumer awareness about electric mobility benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)