GCC Buildings Construction Market Size, Share, Trends and Forecast by Type, Construction Type, End User, and Country, 2026-2034

GCC Buildings Construction Market Summary:

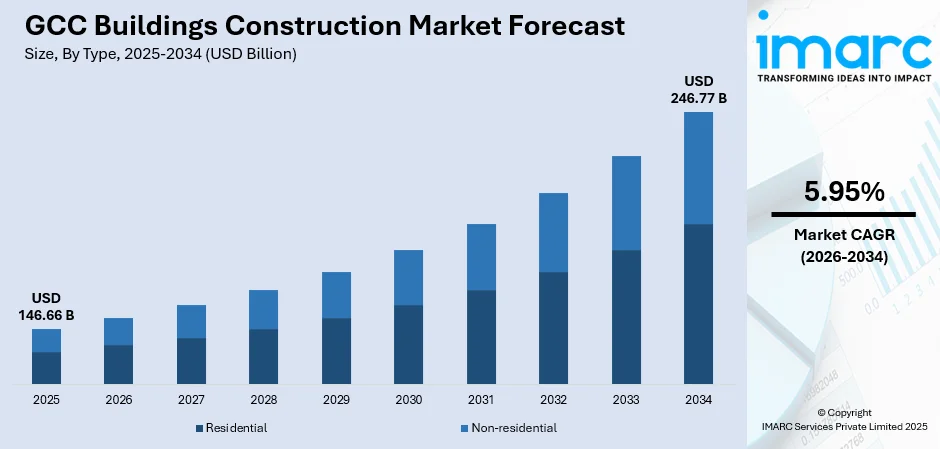

The GCC buildings construction market size was valued at USD 146.66 Billion in 2025 and is projected to reach USD 246.77 Billion by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

The GCC buildings construction market is experiencing substantial expansion driven by ambitious government-led development initiatives and rapid urbanization across member nations. Strategic economic diversification programs are accelerating infrastructure investments, while rising population growth fuels residential and commercial construction demand. The adoption of sustainable building practices and smart construction technologies continues to reshape the regional construction landscape, positioning the GCC as a global construction hub.

Key Takeaways and Insights:

- By Type: Residential dominates the market with a share of 68% in 2025, driven by substantial population growth, government housing initiatives, and increasing expatriate workforce accommodation requirements across GCC nations.

- By Construction Type: New construction leads the market with a share of 79% in 2025, reflecting the region's focus on developing new urban centers, mega-projects, and infrastructure expansion under national vision programs.

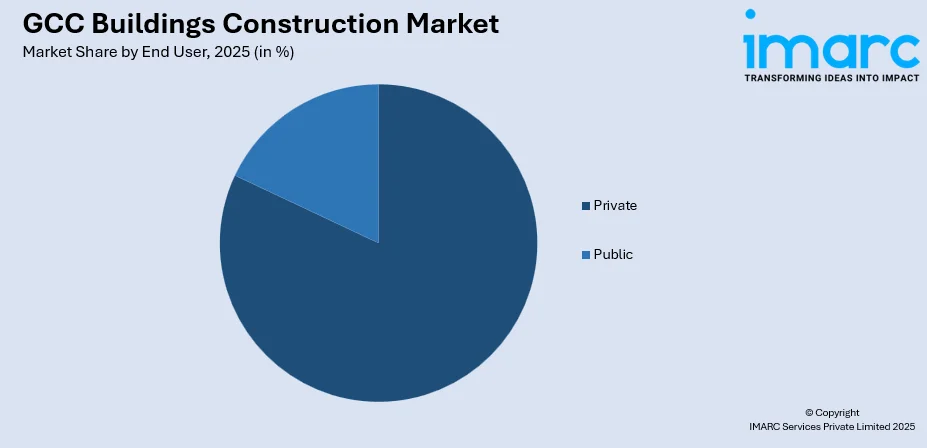

- By End User: Private represents the largest segment with a market share of 82% in 2025, owing to increasing private investments in real estate development, hospitality projects, and commercial complexes across the region.

- By Country: Saudi Arabia dominates with 46% market share in 2025, propelled by Vision 2030 initiatives, NEOM development, and extensive entertainment and tourism infrastructure projects.

- Key Players: The GCC buildings construction market exhibits a moderately fragmented competitive structure, characterized by the presence of established regional contractors, international construction conglomerates, and specialized local builders competing across residential, commercial, and infrastructure segments.

To get more information on this market Request Sample

The GCC buildings construction market is undergoing transformational growth as regional governments pursue ambitious economic diversification strategies and urban development programs. Nations across the Gulf are investing heavily in creating world-class infrastructure, smart cities, and sustainable communities to reduce hydrocarbon dependency and attract global investment. Saudi Arabia's giga-projects, including NEOM and The Red Sea Project, exemplify the scale of construction activity reshaping the regional landscape. The UAE continues expanding its tourism and commercial infrastructure, while Qatar leverages post-World Cup momentum for continued development. Building Information Modeling adoption and prefabricated construction methods are gaining traction, enhancing project efficiency and reducing construction timelines. Green building certifications and energy-efficient design standards are increasingly mandated, reflecting the region's commitment to sustainable development.

GCC Buildings Construction Market Trends:

Rising Adoption of Sustainable and Green Building Practices

GCC nations are increasingly prioritizing environmentally conscious construction methodologies as part of broader sustainability agendas. Government mandates requiring LEED and Estidama certifications for new developments are driving the adoption of energy-efficient materials, solar integration, and water conservation systems. Dubai's Al Maktoum International Airport expansion incorporates extensive sustainable design elements, demonstrating the region's commitment to green construction standards and carbon footprint reduction initiatives. For instance, in September 2025, UAE-based company DesertBoard, specializing in sustainable construction materials, introduced Palm Strand Board (PSB), a new building product created from regenerated date palm biomass. Highlighting the untapped potential of agricultural palm waste in the Middle East, DesertBoard emphasized that PSB addresses the growing demand for eco-friendly, locally produced construction materials, providing a sustainable solution for the regional building sector.

Integration of Smart Building Technologies and Digital Construction

The construction sector is witnessing accelerated integration of Internet of Things sensors, artificial intelligence, and automation technologies across building projects. Smart building management systems enabling real-time monitoring of energy consumption, security, and maintenance requirements are becoming standard specifications. Saudi Arabia's NEOM development showcases this trend, incorporating advanced robotics and automated construction techniques to create fully connected, technology-driven urban environments. For instance, in December 2025, the Siemon Company, a worldwide leader in designing and producing high-performance connectivity solutions for data centers and smart buildings, announced the introduction of Smart Building Complete, an integrated connectivity and cabling system designed to support and link the essential technologies driving today’s modern workplaces.

Expansion of Mixed-Use and Integrated Community Developments

Urban planning approaches are shifting toward comprehensive mixed-use developments combining residential, commercial, retail, and entertainment facilities within integrated communities. These master-planned projects address the growing demand for convenient, walkable neighborhoods offering diverse amenities. The UAE's Masdar City expansion exemplifies this approach, creating self-contained sustainable communities designed to enhance the quality of life while reducing transportation dependencies. For instance, in October 2025, Marjan, the leading developer of freehold properties in Ras Al Khaimah, unveiled its latest mixed-use coastal destination, Marjan Beach. The project is expected to draw billions in investments spanning lifestyle, real estate, and hospitality sectors, while supporting the objectives of RAK Vision 2030. Positioned as a transformative driver for Ras Al Khaimah’s growth as a sustainable investment hub and premier tourism gateway, Marjan Beach aims to set new standards for waterfront living across the GCC region.

Market Outlook 2026-2034:

The GCC buildings construction market outlook remains strongly positive, supported by continued government investment in transformative infrastructure projects and private sector expansion. Economic diversification programs across Saudi Arabia, the UAE, and Qatar will sustain robust construction activity, while increasing foreign direct investment accelerates development timelines. Growing tourism sectors and expanding entertainment industries create sustained demand for hospitality and leisure facilities. Saudi Arabia's Entertainment City project near Riyadh illustrates the magnitude of upcoming construction opportunities. The market generated a revenue of USD 146.66 Billion in 2025 and is projected to reach a revenue of USD 246.77 Billion by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

GCC Buildings Construction Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Residential |

68% |

|

Construction Type |

New Construction |

79% |

|

End User |

Private |

82% |

|

Country |

Saudi Arabia |

46% |

Type Insights:

- Residential

- Non-residential

The residential dominates with a market share of 68% of the total GCC buildings construction market in 2025.

The residential construction segment commands the leading position in the GCC buildings construction market, driven by rapidly expanding populations and substantial government housing programs. Saudi Arabia's Sakani initiative and the UAE's affordable housing projects exemplify large-scale residential development efforts addressing growing accommodation demands. Rising expatriate populations supporting economic growth further accelerate residential construction activity across metropolitan centers.

Luxury residential developments targeting high-net-worth individuals and premium apartment complexes serving urban professionals contribute significantly to market expansion. Waterfront residential communities in Qatar and branded residences in Dubai attract international buyers seeking lifestyle properties. Government policies enabling foreign property ownership and long-term residency visas stimulate investment in residential real estate across the region. Recent large-scale property launches are anticipated to increase housing availability in Dubai, following the emirate’s recording of 194,200 real estate transactions valued at Dh611.1 billion (US$166.51 billion) between January 1 and November 26, 2025, according to Dubai Land Department data.

Construction Type Insights:

- New Construction

- Renovation

The new construction leads with a share of 79% of the total GCC buildings construction market in 2025.

New construction dominates the GCC buildings construction landscape, reflecting the region's emphasis on developing entirely new urban areas, entertainment destinations, and commercial districts. Mega-projects, including Saudi Arabia's NEOM, Qatar's Lusail City, and the UAE's various freehold development zones drive substantial new construction volumes. Government-backed infrastructure expansion programs supporting economic diversification create continuous demand for greenfield developments.

The preference for modern, purpose-built facilities incorporating contemporary design standards and advanced building technologies further supports new construction dominance. Industrial zones, logistics parks, and transportation infrastructure projects require entirely new facilities designed to accommodate emerging requirements. Kuwait's Silk City project demonstrates the scale of new construction initiatives transforming GCC urban landscapes. For instance, in September 2025, UAE President His Highness Sheikh Mohamed bin Zayed Al Nahyan attended the unveiling of agreements to develop 13 new residential communities across Abu Dhabi. The projects are set to deliver over 40,000 homes and residential plots for Emirati citizens, with a combined investment of AED106 billion.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Public

Private exhibits a clear dominance with an 82% share of the total GCC buildings construction market in 2025.

The private sector leads the GCC buildings construction market due to substantial investment capacity and active participation in residential, commercial, and mixed-use developments. Developers respond quickly to market demand for high-quality housing, office spaces, and retail complexes, enabling faster project initiation and completion compared to public sector initiatives. Their financial resources, coupled with access to international design and construction expertise, allow the creation of premium and innovative properties that cater to evolving consumer lifestyles and business requirements across the region.

Private companies dominate the GCC construction landscape because they can adapt rapidly to market trends and client preferences, unlike public sector projects often bound by bureaucratic procedures. They leverage partnerships, joint ventures, and modern construction technologies to deliver projects efficiently, optimizing costs and timelines. Their focus on profitability and competitiveness encourages innovative designs, high-quality finishes, and integrated amenities, ensuring buildings meet both investor expectations and end-user needs, thereby sustaining private sector leadership in the GCC construction market.

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Saudi Arabia dominates with a 46% share of the total GCC buildings construction market in 2025.

Saudi Arabia’s buildings construction market is driven by the government’s strategic initiatives under Vision 2030, aimed at reducing hydrocarbon dependence and diversifying the economy. Investments in residential, commercial, tourism, and industrial projects create substantial construction demand. Large-scale urban developments, mixed-use districts, and infrastructure upgrades enhance livability and business competitiveness. Public-private partnerships, regulatory reforms, and funding incentives further accelerate construction activities, ensuring steady project pipelines and creating opportunities for local and international developers across the Kingdom.

Rapid population growth, urban migration, and a young demographic profile fuel construction demand in Saudi Arabia. Rising household formation, homeownership initiatives, and increasing lifestyle expectations drive residential, commercial, and mixed-use developments. Expanding urban centers require high-rise buildings, mass transit systems, utilities, and public facilities to sustain growing populations. Government policies promoting affordable housing, urban planning, and integrated communities stimulate construction across income segments while supporting economic growth and the creation of modern, vibrant cityscapes.

Market Dynamics:

Growth Drivers:

Why is the GCC Buildings Construction Market Growing?

Government-Led Economic Diversification and Infrastructure Investment Programs

GCC governments are implementing ambitious economic diversification strategies aimed at reducing hydrocarbon dependency through substantial infrastructure investments. Saudi Arabia's Vision 2030, UAE's Centennial 2071, and Qatar National Vision 2030 allocate significant capital toward transformative construction projects, creating new economic opportunities. For instance, in December 2024, H. H. Sheikh Mohammed bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, launched the UAE Centennial Plan 2071, a five-decade strategy from 2021 outlining long-term government priorities to enhance the nation’s global standing. The plan focuses on preparing future generations with the skills and knowledge to navigate rapid changes, aiming to make the UAE the world’s leading country by 2071. The focus of these national programs is on the development of tourism infrastructure, entertainment facilities, industrial zones and residential communities that facilitate population growth. The government expenditure on transport infrastructure, such as airports, railways, and ports, attracts wide-ranging construction demands. Increased dedication of the public sector in funding mega-projects also guarantees continued demand in construction over the time horizon of forecasting, which gives the contractors an impression of long-term project pipelines, thus allowing them to plan the capacity strategically.

Rapid Urbanization and Population Growth Driving Housing Demand

The GCC region is witnessing a booming population growth based on natural growth and immigration as a contributor to the economy. Large populations of young people need substantial residential facilities, educational institutions, and medical facilities. Urban migration patterns concentrating populations in major metropolitan centers create intensive construction demand in cities including Riyadh, Dubai, Doha, and Abu Dhabi. Government housing programs addressing accommodation requirements for citizens and initiatives supporting expatriate workforce housing needs generate sustained residential construction activity. The expanding middle class across GCC nations drives demand for quality housing, modern amenities, and community facilities. Rising household formation rates among young populations accelerate residential unit requirements throughout urban areas.

Expanding Tourism and Hospitality Sectors

Tourism development represents a central pillar of GCC economic diversification strategies, generating substantial commercial construction demand. Saudi Arabia's opening to international tourism and development of entertainment destinations creates requirements for hotels, resorts, and leisure facilities. The UAE continues expanding its hospitality infrastructure supporting Dubai's position as a global tourism hub, while Qatar builds upon World Cup investments to establish regional tourism prominence. The UAE hospitality market size was valued at USD 25.17 Billion in 2025 and is projected to reach USD 38.95 Billion by 2034, growing at a compound annual growth rate of 4.97% from 2026-2034. Cultural tourism initiatives including museum developments, heritage site enhancements, and entertainment complexes require specialized construction expertise. The anticipated growth in visitor numbers drives hotel development, retail expansion, and supporting infrastructure projects. Religious tourism to Saudi Arabia's holy sites sustains accommodation and transportation infrastructure requirements supporting millions of annual pilgrims.

Market Restraints:

What Challenges is the GCC Buildings Construction Market Facing?

Skilled Labor Shortages and Workforce Development Challenges

The GCC construction industry faces persistent challenges in securing adequate skilled labor to support expanding project portfolios. Nationalization policies limiting expatriate workforce participation create transition pressures, while training programs require time to develop domestic construction expertise. Competition among projects for experienced contractors, engineers, and specialized tradespeople drives labor cost inflation, affecting project economics.

Construction Material Cost Volatility and Supply Chain Disruptions

The construction sector remains vulnerable to fluctuations in building material prices and global supply chain uncertainties. Dependence on imported materials including steel, cement, and specialized building products, exposes projects to commodity price volatility. Shipping disruptions and logistics constraints periodically impact material availability, creating project delays and budget pressures for contractors and developers.

Regulatory Complexity and Project Approval Processes

Operating across GCC countries poses challenges for construction firms due to differing regulatory frameworks. Variations in building permits, environmental approvals, and compliance standards complicate project execution, while complex government procurement procedures and lengthy approval timelines can delay project starts. These regulatory hurdles impact contractor cash flow, scheduling, and investment planning, requiring firms to navigate each jurisdiction carefully to ensure timely and efficient project delivery.

Competitive Landscape:

The GCC buildings construction market exhibits a moderately fragmented competitive structure characterized by the presence of large regional contractors, international construction groups, and specialized local builders. Market participants compete across diverse project types including residential developments, commercial complexes, hospitality facilities, and infrastructure projects. Competitive differentiation occurs through technical capabilities, project execution track records, safety performance, and financial capacity to undertake large-scale developments. Strategic partnerships between international contractors and local entities facilitate market access and combine global expertise with regional knowledge. Joint ventures for mega-projects allow risk sharing and resource pooling among major contractors. Increasing focus on sustainable construction and digital capabilities creates competitive advantages for firms investing in green building technologies and construction digitalization.

Recent Developments:

- In December 2025, the Saudi Green Building Forum (SGBF) reported increasing regional adoption of its SAAF green building system, with 312 projects registered across 22 Arab countries. Collectively, these projects cover over 785,000 square meters of constructed space, highlighting the expansion of the Saudi-developed framework beyond the Kingdom.

- In July 2025, Qatar inaugurated the world’s largest 3D-printed construction project, establishing a new standard in sustainable infrastructure and educational innovation. Led by UCC Holding in partnership with the Public Works Authority (Ashghal), the initiative comprises 14 public schools, including two expansive 3D-printed buildings, each covering 20,000 square meters. With a combined 40,000 square meters, these structures are 40 times larger than any previously completed 3D-printed building, marking a milestone in large-scale additive construction.

GCC Buildings Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Residential, Non-residential |

| Construction Types Covered | New Construction, Renovation |

| End Users Covered | Private, Public |

| Countries Covered | Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The GCC construction market size was valued at USD 154.35 Billion in 2025.

The market is expected to grow at a compound annual growth rate of 4.70% from 2026-2034 to reach USD 233.44 Billion by 2034.

Residential construction dominated the market with a share of 38.18% in 2025, driven by population growth, government housing initiatives, and urban expansion programs creating sustained demand for diverse housing typologies across income segments and demographic groups throughout the region.

Key factors driving the GCC construction market include national economic diversification programs requiring massive infrastructure investments, rapid population growth necessitating residential and public facility construction, urbanization acceleration demanding modern city infrastructure, government megaproject implementations, and strategic positioning as regional hubs for tourism, logistics, and manufacturing sectors.

Major challenges include labor supply constraints affecting workforce availability, specialized skill gaps limiting advanced project capabilities, supply chain disruptions creating material sourcing difficulties, construction cost volatility impacting project budgets, regulatory complexity requiring continuous compliance adaptation, permitting delays extending project timelines, and climate conditions affecting construction scheduling and worker productivity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)