Indonesia Mortgage Loan Brokers Market Size, Share, Trends and Forecast by Type of Mortgage Loan, Mortgage Loan Terms, Interest Rate, Provider, and Region, 2026-2034

Market Overview:

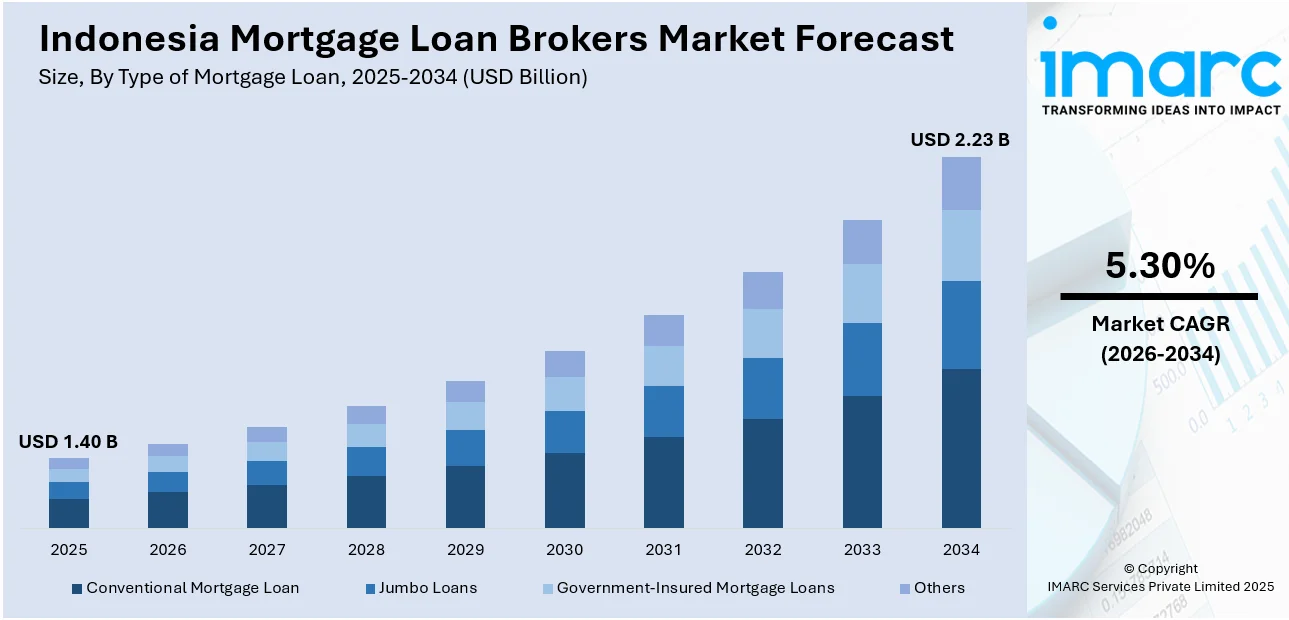

Indonesia mortgage loan brokers market size reached USD 1.40 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.23 Billion by 2034, exhibiting a growth rate (CAGR) of 5.30% during 2026-2034. Robust economic growth, availability of low-interest rates, rapid digitalization and the increasing availability of online services, diversified loan products and flexible repayments, and rising government support for affordable housing initiatives are bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.40 Billion |

| Market Forecast in 2034 | USD 2.23 Billion |

| Market Growth Rate (2026-2034) | 5.30% |

Mortgage and loan brokers are intermediaries who play a pivotal role in the financial industry, facilitating the borrowing process for individuals and businesses. They act as intermediaries between borrowers and lenders, connecting those seeking funds with suitable lending institutions. Their primary objective is to streamline the loan application and approval process, making it more accessible and efficient for borrowers. Mortgage and loan brokers operate by first assessing the financial needs and creditworthiness of their clients. They then leverage their extensive network of lending partners, including banks, credit unions, and private lenders, to identify the most suitable loan options. Brokers provide valuable guidance to clients regarding the various types of loans available, such as mortgages, personal loans, business loans, or car loans, based on individual circumstances. The advantages of utilizing the services of mortgage and loan brokers are manifold, such as brokers offer convenience by saving borrowers time and effort in researching and contacting multiple lenders. They negotiate on behalf of their clients to secure competitive interest rates and favorable terms. Moreover, they often have access to a wider range of loan products than individual borrowers, increasing the chances of finding a loan that aligns with specific needs. Additionally, they can assist clients with imperfect credit histories in finding lenders who may be more lenient in their lending criteria.

To get more information on this market Request Sample

Indonesia Mortgage Loan Brokers Market Trends:

The Indonesia mortgage loan brokers market is influenced by several key drivers, such as the country's robust economic growth and expanding middle class, which have facilitated the demand for housing, thereby consequently driving the demand for mortgage and loan brokerage services. Moreover, the government's favorable policies and incentives for the real estate sector are fueling the market growth. This is further supported by the fact that Indonesia's mortgage interest rates remain relatively low, making homeownership more accessible. This is further supported by the fact that brokers often provide tailored solutions and access to a wide range of lenders, saving time and effort for borrowers. Furthermore, the digitalization of financial services has significantly streamlined the mortgage application process, making it more convenient for consumers, further contributing to the market growth. Additionally, the stability of the banking sector and prudent lending practices, government efforts to promote affordable housing initiatives, and the diversification of loan products and flexible repayment options are providing a positive environment for the market growth across the country.

Indonesia Mortgage Loan Brokers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type of mortgage loan, mortgage loan terms, interest rate, and provider.

Type of Mortgage Loan Insights:

- Conventional Mortgage Loan

- Jumbo Loans

- Government-Insured Mortgage Loans

- Others

The report has provided a detailed breakup and analysis of the market based on the type of mortgage loan. This includes conventional mortgage loan, jumbo loans, government-insured mortgage loans, and others.

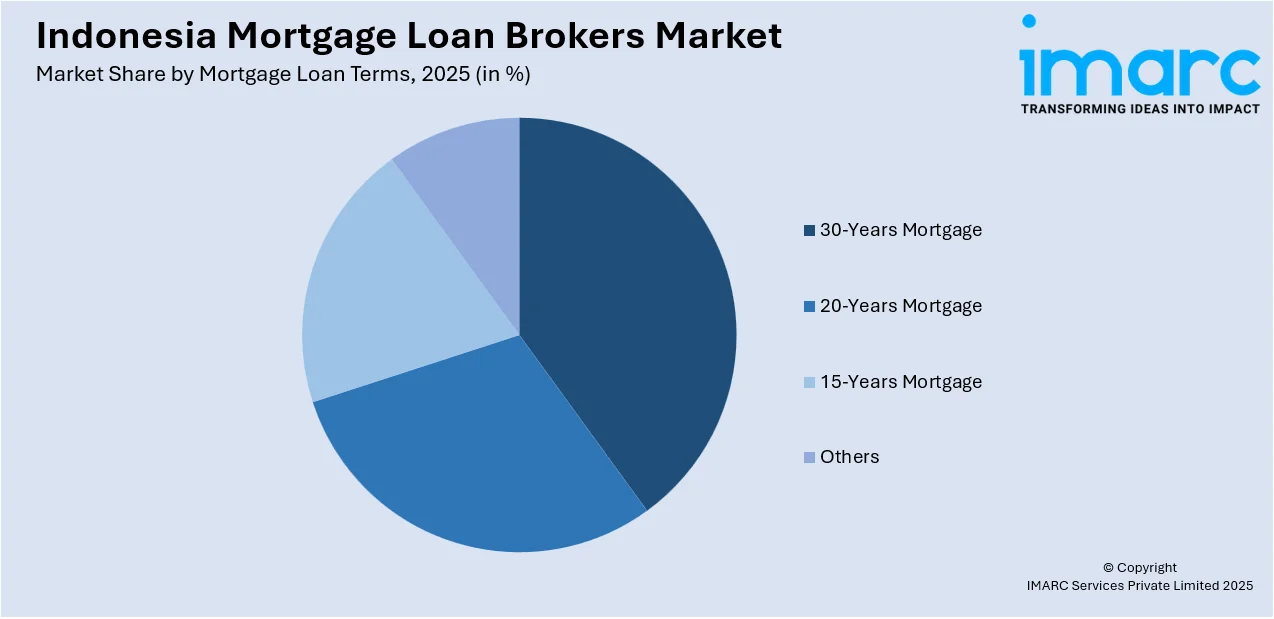

Mortgage Loan Terms Insights:

Access the comprehensive market breakdown Request Sample

- 30-Years Mortgage

- 20-Years Mortgage

- 15-Years Mortgage

- Others

A detailed breakup and analysis of the market based on the mortgage loan terms have also been provided in the report. This includes 30- years mortgage, 20-year mortgage, 15-year mortgage, and others.

Interest Rate Insights:

- Fixed-Rate

- Adjustable-Rate

The report has provided a detailed breakup and analysis of the market based on the interest rate. This includes fixed-rate and adjustable-rate.

Provider Insights:

- Primary Mortgage Lender

- Secondary Mortgage Lender

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes primary mortgage lenders and secondary mortgage lender.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Mortgage Loan Brokers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Type of Mortgage Loans Covered | Conventional Mortgage Loan, Jumbo Loans, Government-Insured Mortgage Loans, Others |

| Mortgage Loan Terms Covered | 30-Years Mortgage, 20-Years Mortgage, 15-Years Mortgage, Others |

| Interest Rates Covered | Fixed-Rate, Adjustable-Rate |

| Providers Covered | Primary Mortgage Lender, Secondary Mortgage Lender |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia mortgage loan brokers market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Indonesia mortgage loan brokers market?

- What is the breakup of the Indonesia mortgage loan brokers market on the basis of type of mortgage loan?

- What is the breakup of the Indonesia mortgage loan brokers market on the basis of mortgage loan terms?

- What is the breakup of the Indonesia mortgage loan brokers market on the basis of interest rate?

- What is the breakup of the Indonesia mortgage loan brokers market on the basis of provider?

- What are the various stages in the value chain of the Indonesia mortgage loan brokers market?

- What are the key driving factors and challenges in the Indonesia mortgage loan brokers?

- What is the structure of the Indonesia mortgage loan brokers market and who are the key players?

- What is the degree of competition in the Indonesia mortgage loan brokers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia mortgage loan brokers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia mortgage loan brokers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia mortgage loan brokers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)