Latin America Pharmaceutical Excipients Market Size, Share, Trends and Forecast by Product Type, Functionality, Dosage Form, End-User, and Country, 2026-2034

Latin America Pharmaceutical Excipients Market Summary:

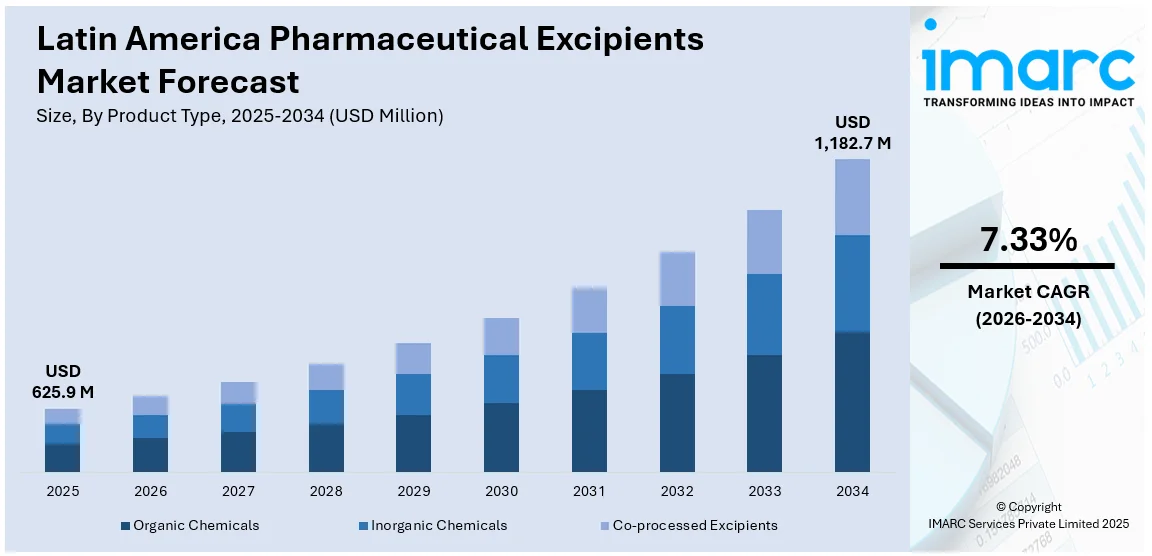

The Latin America pharmaceutical excipients market size was valued at USD 625.9 Million in 2025 and is projected to reach USD 1,182.7 Million by 2034, growing at a compound annual growth rate of 7.33% from 2026-2034.

The Latin America pharmaceutical excipients market is driven by the rapid growth of the regional pharmaceutical sector, increasing generic drug production following patent expirations, and enhanced healthcare accessibility across the region. Government initiatives to strengthen domestic pharmaceutical manufacturing capabilities, rising investments in production facilities, and the growing demand for cost-effective healthcare solutions are accelerating the market development. The convergence of regulatory modernization, expanding chronic disease treatment requirements, and technological advancements in drug formulation is creating substantial opportunities for excipient manufacturers.

Key Takeaways and Insights:

- By Product Type: Organic chemicals dominate the market with a share of 40% in 2025, driven by their superior compatibility with active pharmaceutical ingredients, favorable chemical properties, and extensive use in oral solid dosage formulations across the region.

- By Functionality: Fillers and diluents lead the market with a share of 21% in 2025, owing to their essential role in solid dosage form manufacturing, cost-effectiveness in bulk production, and critical function in ensuring proper tablet compression and capsule filling processes.

- By Dosage Form: Oral formulations represent the largest segment with a market share of 55% in 2025, supported by patient preference for non-invasive drug administration, lower manufacturing costs compared to injectable formulations, and widespread use in chronic disease management.

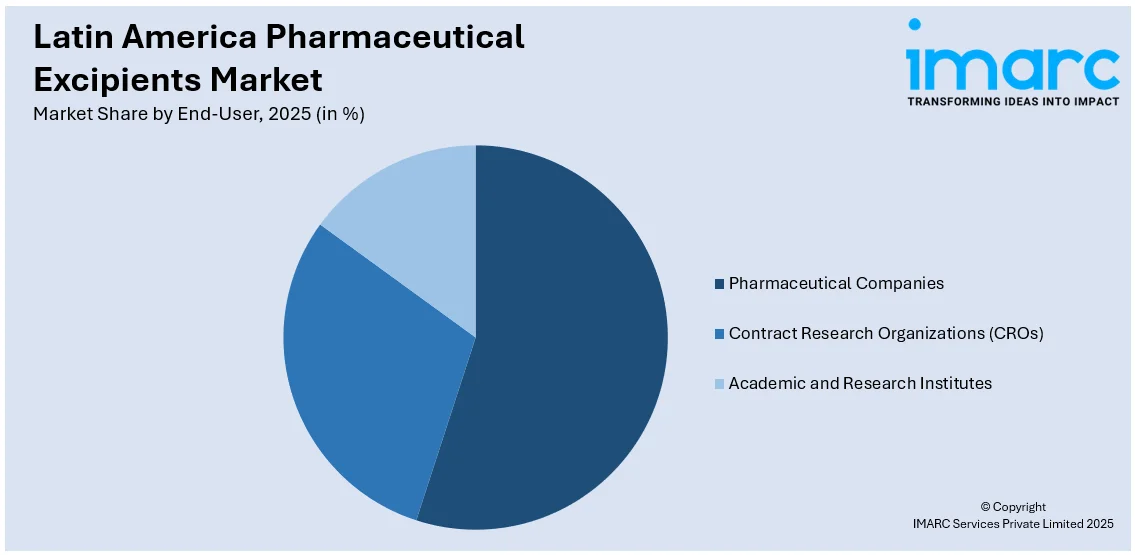

- By End-User: Pharmaceutical companies dominate the market with a share of 60% in 2025, reflecting their primary role as consumers of excipients for large-scale drug manufacturing, generic drug production, and formulation development activities.

- Key Players: The Latin America pharmaceutical excipients market exhibits moderate competitive intensity, characterized by the presence of multinational specialty chemical corporations competing alongside regional distributors through product innovation, strategic acquisitions, and expanded formulation expertise.

To get more information on this market Request Sample

The Latin American pharmaceutical excipients market is experiencing growth, driven by the rising healthcare demands, increasing chronic disease prevalence, and evolving regulatory frameworks. The region's expanding middle class and improved access to healthcare are catalyzing the demand for both branded and generic medications, which in turn increases the need for high-quality excipients that ensure the stability, bioavailability, and effectiveness of these drugs. The growing focus on personalized medicine and the development of specialized formulations for pediatric, geriatric, and chronic disease management further contributed to the market demand. According to the International Diabetes Federation, Brazil’s adult population reached 155,426,300 in 2024, with diabetes prevalence estimated at 10.6%. Additionally, the shift towards e-commerce and online pharmaceutical sales is leading to an increased focus on packaging and product integrity, creating further demand for excipients that maintain stability during transportation and storage. As the pharmaceutical industry in Latin America continues to grow, the need for excipients that meet global regulatory standards while optimizing drug formulations becomes more pronounced.

Latin America Pharmaceutical Excipients Market Trends:

Increased Focus on Pediatric and Geriatric Drug Formulations

As the Latin American population ages and awareness about children's healthcare grows, there is a rise in the focus on pediatric and geriatric drug formulations. These specialized formulations require excipients that can address unique needs, such as improved taste masking for pediatric drugs or enhanced stability for geriatric medications. Additionally, the aging population’s need for chronic disease management further fuels the demand for drugs tailored to elderly patients, which rely on excipients for controlled release and optimal bioavailability. According to IBGE population projections, Brazil’s average population age was 35.5 years in 2023 and is expected to rise to 48.4 years by 2070, highlighting a steadily growing geriatric cohort. The increased demand for age-appropriate drug formulations across these demographic segments supports the growth of the excipients market in Latin America.

Growing Prevalence of Chronic Diseases

The rising occurrence of chronic diseases, such as diabetes, cardiovascular conditions, and cancer, among the masses in Latin America is a crucial factor bolstering the growth of the market. This prevalence is supported by the data provided by the International Diabetes Federation, which stated that Mexico’s adult population (20-79 years) with diabetes reached 13.6 million in 2024. Chronic diseases often require long-term treatment regimens that rely on stable, effective pharmaceutical formulations. Excipients are essential in improving the stability, shelf-life, and efficacy of these medications, particularly for patients on prolonged therapy. As the demand for chronic disease management medications increases, pharmaceutical companies require excipients that meet the specific needs of these formulations.

Rising E-commerce and Online Pharmaceutical Sales

With the increasing prevalence of online sales for medicines and health products, there is a greater emphasis on product consistency, packaging, and shelf-life. Excipients play a crucial role in maintaining the stability and integrity of pharmaceutical products during storage and transportation, especially as online sales networks expand. For example, Argentina’s e-commerce sector accounted for an estimated USD 26.7 Billion in transaction volume in 2023, with projections to continue growing at a 17 percent CAGR through 2027, according to the PCMI E-commerce Data Library. This rapid expansion of e-commerce platforms for pharmaceutical and wellness products drives the growing demand for excipients that preserve product quality in diverse environmental conditions across the region.

Market Outlook 2026-2034:

The Latin America pharmaceutical excipients market demonstrates notable growth potential throughout the forecast period, supported by expanding pharmaceutical manufacturing capabilities and sustained investments in regional healthcare infrastructure. Rising demand for generic medicines, improved drug formulation requirements, and increased production of specialty pharmaceuticals are contributing to market growth across key countries. The growing focus on quality standards and regulatory compliance is also encouraging the adoption of advanced excipient solutions. The market generated a revenue of USD 625.9 Million in 2025 and is projected to reach a revenue of USD 1,182.7 Million by 2034, growing at a compound annual growth rate of 7.33% from 2026-2034.

Latin America Pharmaceutical Excipients Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Organic Chemicals |

40% |

|

Functionality |

Fillers and Diluents |

21% |

|

Dosage Form |

Oral Formulations |

55% |

|

End-User |

Pharmaceutical Companies |

60% |

Product Type Insights:

- Organic Chemicals

- Carbohydrates

- Petrochemicals

- Proteins

- Others

- Inorganic Chemicals

- Calcium Phosphate

- Calcium Carbonate

- Silicon Dioxide

- Others

- Co-processed Excipients

Organic chemicals dominate with a market share of 40% of the total Latin America pharmaceutical excipients market in 2025.

Organic chemicals hold the biggest market share due to their wide functional range in drug formulation. These excipients are used as binders, fillers, stabilizers, and preservatives across tablets, capsules, and liquid medicines. Their compatibility with active pharmaceutical ingredients and ability to improve bioavailability makes them essential for both generic and branded drug production. With rising pharmaceutical manufacturing in countries like Brazil and Mexico, demand for organic chemical excipients continues to grow steadily.

Another reason organic chemicals lead the market is their cost-effectiveness and strong supply availability from regional and international producers. Many organic excipients, such as cellulose derivatives, sugars, and polymers, are well-established in formulation processes and meet regulatory requirements across Latin America. Their adaptability supports the growing production of complex dosage forms, including controlled-release drugs. As the region expands healthcare access and local drug output, organic excipients remain the preferred choice for manufacturers.

Functionality Insights:

- Binders

- Fillers and Diluents

- Disintegrants

- Coating Agents

- Flavoring and Sweetening Agents

- Lubricants and Glidants

- Preservatives

- Solvents and Co-solvents

- Colorants

- Others

Fillers and diluents lead with a market share of 21% of the total Latin America pharmaceutical excipients market in 2025.

Fillers and diluents represent the largest segment owing to their essential role in tablet and capsule manufacturing. These excipients add bulk to formulations, ensuring accurate dosing and improving product consistency, especially when active ingredients are present in small quantities. With strong demand for solid oral dosage forms across Brazil, Argentina, and Colombia, manufacturers rely heavily on fillers like lactose, microcrystalline cellulose, and starch. Their widespread use supports large-scale production of affordable generic medicines.

Another factor driving the dominance of fillers and diluents is their cost efficiency and ease of formulation across various therapeutic segments. They enhance compressibility, flow properties, and overall stability during processing and storage. As pharmaceutical companies in Latin America expand production capacity, particularly for chronic disease treatments, the need for reliable excipients that ensure uniform drug delivery increases. Fillers and diluents are also compatible with a wide range of active ingredients, making them a preferred choice for both standard and complex drug formulations.

Dosage Form Insights:

- Oral Formulations

- Parenteral Formulations

- Topical Formulations

- Others

Oral formulations exhibit a clear dominance with a 55% share of the total Latin America pharmaceutical excipients market in 2025.

Oral formulations dominate the market attributed to the high consumption of tablets, capsules, and syrups across the region. Oral drugs are widely preferred because they are easy to administer, cost-effective, and suitable for mass treatment of common conditions like diabetes, hypertension, and infections. Countries such as Brazil and Mexico have strong generic drug manufacturing bases focused largely on oral solid dosage forms. This drives the demand for excipients used in oral drug production.

Another reason oral formulations lead the market is the established infrastructure for producing and distributing oral medicines across Latin America. Tablets and capsules offer better stability, longer shelf life, and easier storage compared to injectable or topical forms. Excipients, such as binders, fillers, disintegrants, and coatings are extensively required in oral manufacturing processes. As healthcare access improves and pharmaceutical output increases, especially for chronic therapies, oral dosage forms remain the most practical and widely adopted option in the market.

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutes

Pharmaceutical companies dominate with a market share of 60% of the total Latin America pharmaceutical excipients market in 2025.

Pharmaceutical companies lead the market because of the region’s expanding drug manufacturing activity. These companies require large volumes of excipients for producing tablets, capsules, injectables, and other dosage forms. With rising demand for generic medicines and increased local production in countries like Brazil, Mexico, and Argentina, pharmaceutical manufacturers remain the primary consumers. Excipients are essential for ensuring drug stability, effectiveness, and patient-friendly delivery, making them a constant input in large-scale pharmaceutical operations.

Another factor supporting the dominance of pharmaceutical companies is their focus on regulatory compliance and formulation innovation. Drug makers invest in high-quality excipients to meet safety standards and improve product performance, especially for chronic disease treatments and specialty drugs. As Latin America strengthens its healthcare systems, pharmaceutical firms continue expanding capacity and outsourcing excipient supply through global and regional producers. Their consistent demand across multiple therapeutic categories ensures that pharmaceutical companies remain the leading end user segment in the market.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil is a crucial segment in the market due to its large pharmaceutical manufacturing base and strong demand for generic medicines. The growing healthcare access, government support for local production, and increasing chronic disease prevalence drive excipient consumption across oral and injectable formulations.

Mexico holds a significant share in the market, supported by its expanding drug production and exports to North America. Rising demand for affordable medicines and the presence of major pharmaceutical firms boost the use of fillers, binders, and stabilizers.

Argentina’s market growth is driven by domestic pharmaceutical production and increasing focus on high-quality formulations. Demand for excipients remains strong in solid oral dosage forms, supported by rising healthcare needs and generic drug manufacturing.

Colombia is emerging as a vital segment in the market owing to improving pharmaceutical infrastructure and expanding healthcare coverage. Increased demand for chronic disease treatments and steady growth in local drug production support excipient usage across formulations.

Chile’s pharmaceutical excipients demand is supported by rising imports of medicines and a developing local manufacturing sector. The market benefits from increased healthcare spending and the growing consumption of oral dosage drugs requiring functional excipients.

Peru shows steady growth in excipients demand because of expanding pharmaceutical distribution networks and increasing access to essential medicines. The growing reliance on generic drugs and regional manufacturing expansion contribute to rising excipient consumption.

Others Latin American countries contribute through gradual growth in pharmaceutical production and medicine consumption. Improving healthcare infrastructure and rising demand for affordable drugs continue to support excipient market expansion across smaller regional markets.

Market Dynamics:

Growth Drivers:

Why is the Latin America Pharmaceutical Excipients Market Growing?

Rising Demand for Generic Drugs

As healthcare costs continue to rise, more patients in Latin America are turning to affordable treatment options, driving the popularity of generic drugs. Excipients play an essential role in ensuring the stability, bioavailability, and controlled release of these drugs. The shift towards generic drug consumption is particularly pronounced in emerging Latin American economies, creating an ongoing demand for excipients that meet regulatory requirements while optimizing drug formulations. For instance, the Latin American generic drug market reached USD 37.2 Billion in 2024, according to the IMARC Group. This growth underscores the steady market demand for excipients as the pharmaceutical sector expands to accommodate the increasing reliance on generic alternatives.

Growing Middle-Class Population and Increased Healthcare Access

The rise of the middle-class population and the expansion of healthcare access in Latin America are significantly supporting the pharmaceutical excipients market growth. As income levels rise and more people gain access to healthcare services, the demand for both branded and generic pharmaceutical products increase. For instance, according to the Brazilian Institute of Geography and Statistics (IBGE), in 2025, the per capita household income for Brazil in 2024 was BRL 2,069, ranging from BRL 1,077 in Maranhão to BRL 3,444 in the Federal District. This income growth is driving greater user demand for affordable medications. Pharmaceutical companies are increasingly relying on excipients that improve the performance and affordability of these medications, thus driving the need for high-quality excipients to meet the expanding healthcare needs of the population across the region.

Favorable Government Policies for Local Pharmaceutical Manufacturing

Many countries in Latin America are introducing various policies to support and stimulate domestic drug production, including offering tax incentives, grants, and subsidies to pharmaceutical companies. These measures aim to reduce dependency on imported drugs, enhance local production capabilities, and lower healthcare costs. As a result, both local and foreign pharmaceutical manufacturers are establishing or expanding their production facilities within the region. With the rise in local drug manufacturing, there is an increase in the demand for excipients that comply with stringent regulatory standards. This, in turn, supports the market growth for excipients, as manufacturers require high-quality ingredients to meet both regional and international quality requirements.

Market Restraints:

What Challenges the Latin America Pharmaceutical Excipients Market is Facing?

Complex Regulatory Requirements and Approval Delays

The Latin America pharmaceutical excipients market faces challenges from complex and sometimes lengthy regulatory approval processes that can delay market entry for new products. Regulatory agencies maintain stringent quality requirements for excipients used in drug manufacturing, requiring extensive documentation and testing that extends approval timelines and increases compliance costs for manufacturers seeking regional market access.

Supply Chain Dependencies and Import Reliance

Limited local production of active pharmaceutical ingredients and specialty excipients creates supply chain vulnerabilities that can affect pharmaceutical manufacturing continuity. Latin American markets continue to rely significantly on imported excipients, exposing manufacturers to currency fluctuations, logistics disruptions, and potential supply shortages that can impact production scheduling and cost structures.

Price Sensitivity in Developing Market Segments

Cost constraints in lower-income market segments significantly limit the adoption of premium excipients and advanced drug delivery technologies. Pharmaceutical manufacturers catering to price-sensitive individuals must carefully balance formulation performance with affordability. This often reduces the willingness to invest in specialty excipients, even when they provide better stability, bioavailability, or enhanced therapeutic outcomes. As a result, demand for high-value excipient solutions may remain restricted in such markets.

Competitive Landscape:

The Latin America pharmaceutical excipients market exhibits moderate competitive intensity characterized by the presence of multinational specialty chemical corporations alongside regional distributors competing across product categories and geographic markets. Market dynamics reflect strategic positioning through product innovation, acquisition activities, and expanded formulation expertise. Companies are focusing on diversifying product portfolios, improving technical support capabilities, and establishing local partnerships to strengthen market presence. The competitive landscape is increasingly shaped by sustainability initiatives, regulatory compliance capabilities, and the ability to provide comprehensive solutions that address evolving user requirements in drug formulation and delivery across the region.

Recent Developments:

- October 2025: Roquette opened its Pharmaceutical Innovation Center in São Paulo, Brazil, to advance drug delivery solutions using key pharmaceutical excipients like Avicel® microcrystalline cellulose and METHOCEL™ hydroxypropyl methylcellulose. The state-of-the-art center aimed to accelerate product development and foster collaboration with clients.

Latin America Pharmaceutical Excipients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Functionalities Covered | Binders, Fillers and Diluents, Disintegrants, Coating Agents, Flavoring and Sweetening Agents, Lubricants and Glidants, Preservatives, Solvents and Co-solvents, Colorants, Others |

| Dosage Forms Covered | Oral Formulations, Parenteral Formulations, Topical Formulations, Others |

| End-Users Covered | Pharmaceutical Companies, Contract Research Organizations (CROs), Academic and Research Institutes |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America pharmaceutical excipients market size was valued at USD 625.9 Million in 2025.

The Latin America pharmaceutical excipients market is expected to grow at a compound annual growth rate of 7.33% from 2026-2034 to reach USD 1,182.7 Million by 2034.

Organic chemicals held the largest revenue share of 40% in 2025, driven by their superior compatibility with active pharmaceutical ingredients, favorable chemical properties for drug formulation, and extensive use in oral solid dosage forms.

Key factors driving the Latin America pharmaceutical excipients market include the aging population and increased awareness about children’s healthcare. As Brazil's average age rises from 35.5 years in 2023 to 48.4 years by 2070, demand for specialized excipients for pediatric and geriatric formulations grows.

Major challenges include complex regulatory requirements and approval delays, supply chain dependencies on imported materials, price sensitivity in developing market segments, currency fluctuations affecting import costs, and limited local production of specialty excipients.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)