Saudi Arabia Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034

Saudi Arabia Digital Health Market Summary:

The Saudi Arabia digital health market size was valued at USD 5.01 Billion in 2025 and is projected to reach USD 15.32 Billion by 2034, growing at a compound annual growth rate of 13.23% from 2026-2034.

The Saudi Arabia digital health market is experiencing transformative growth driven by the government's comprehensive Vision 2030 healthcare modernization agenda and substantial investments in digital infrastructure. The Kingdom's commitment to telemedicine expansion, artificial intelligence (AI) integration, and mobile health applications is reshaping healthcare delivery across both urban centers and remote regions. Rising chronic disease prevalence, particularly diabetes and cardiovascular conditions, is catalyzing the demand for remote monitoring and virtual care solutions. A young, digitally native population combined with advanced telecommunications infrastructure is further accelerating the adoption of innovative healthcare technologies. Strategic public-private partnerships (PPP) and regulatory reforms are creating a dynamic ecosystem that positions Saudi Arabia as a regional leader in healthcare digitalization.

Key Takeaways and Insights:

- By Type: Telehealth dominates the market with a share of 32% in 2025, driven by the widespread adoption of virtual consultation platforms, government-backed telemedicine initiatives, and the expansion of Seha Virtual Hospital infrastructure connecting healthcare facilities across the Kingdom.

- By Component: Software leads the market with a share of 55% in 2025, reflected by increasing adoption of AI-powered diagnostic tools, mobile health applications, electronic health record (EHR) platforms, and cloud-based healthcare management solutions across public and private healthcare systems.

- By Region: Northern and Central Region represents the largest segment with a market share of 34% in 2025, benefiting from concentrated government healthcare policies in Riyadh, advanced digital infrastructure, and the presence of flagship institutions implementing cutting-edge digital health solutions.

- Key Players: The Saudi Arabia digital health market exhibits moderate competitive intensity, with global technology corporations and regional healthcare providers competing across telehealth, software, and healthcare analytics segments while expanding digital capabilities.

The Saudi Arabia digital health market is undergoing rapid transformation as public policy, private capital, and technology innovation converge to modernize healthcare delivery. Strong government backing, high digital adoption, and demand for scalable care models are accelerating deployment of telehealth, analytics, and AI-enabled platforms across the health system. Venture funding and structured innovation programs are strengthening the startup ecosystem and accelerating commercialization of new solutions. In 2025, Sanabil Investments and Redesign Health partnered to launch the Sanabil Venture Studio, targeting the creation of at least 20 new healthcare companies in Saudi Arabia by combining venture-building expertise with local market insight. This initiative supported Vision 2030 by encouraging entrepreneurship, building skilled employment, and advancing patient-centered digital solutions. The growing collaboration between investors, providers, and technology firms is positioning Saudi Arabia as a regional and emerging global hub for digital health innovation and long-term healthcare system modernization.

Saudi Arabia Digital Health Market Trends:

Government Digital Health Strategy and Vision 2030 Alignment

Saudi Arabia’s digital health market is experiencing significant growth, driven by government-led transformation programs aligned with Vision 2030. National health authorities are prioritizing digital platforms to enhance care delivery, streamline data integration, and improve patient access. Investments in EHRs, telemedicine, and health information exchanges are accelerating system-wide adoption. In 2025, Persivia launched the National Health Intelligence (NHI) Initiative, harnessing AI and data analytics to support smarter, evidence-based healthcare decisions. This initiative, aligned with Vision 2030, promoted real-time insights, improved outcomes, and sustainable, data-driven care, encouraging innovation, localization, and workforce development across Saudi Arabia's healthcare system.

Growing Adoption of AI

The rising adoption of AI is influencing the digital health market in Saudi Arabia by strengthening clinical accuracy and operational efficiency. AI-powered tools are revolutionizing diagnostics, radiology interpretation, pathology analysis, and clinical decision-making. Hospitals are increasingly adopting AI algorithms to enhance diagnostic accuracy, reduce turnaround times, and prioritize critical cases. In 2025, RapidAI partnered with Saudi Arabia’s Health Holdings Company (HHC) to introduce Deep Clinical AI to 20 hospital clusters, improving diagnostics and workflow across multiple specialties. This collaboration aligned with Vision 2030, advancing healthcare innovation, digital transformation, and patient-centered care, while enabling clinicians to make faster, more informed decisions with real-time, data-driven insights.

Expansion of Telemedicine and Virtual Care Models

The rise of telemedicine and virtual care models is transforming healthcare delivery in Saudi Arabia by addressing access gaps in remote areas and reducing the travel burden for patients. Hospitals are integrating teleconsultation services into outpatient workflows for follow-ups and routine care. In 2025, Aster DM Healthcare launched its myAster digital health platform, offering telehealth, pharmacy delivery, appointment management, and health tracking services. The platform integrated AI and generative AI-powered Arabic voice responses via Google Cloud, providing personalized, culturally relevant healthcare guidance. Such models reduce costs and improve care continuity. Telemedicine adoption also supports emergency response and specialist access.

How Vision 2030 is Transforming the Saudi Arabia Digital Health Market:

Vision 2030 is transforming the Saudi Arabia digital health market by prioritizing technology-driven healthcare delivery, efficiency, and accessibility. National initiatives support telemedicine, electronic health records, and data integration across public and private healthcare systems. Investment in digital infrastructure, health information platforms, and regulatory frameworks is enabling wider adoption of remote consultations and AI-supported diagnostics. Emphasis on preventive care and patient-centric services aligns with digital monitoring and virtual health solutions. In addition, PPP and local innovation are accelerating platform development, improving care coordination, and expanding access to healthcare services, positioning digital health as a central component of the Kingdom’s long-term healthcare modernization strategy.

Market Outlook 2026-2034:

The Saudi Arabia digital health market demonstrates robust growth potential throughout the forecast period, driven by sustained government investment, healthcare modernization, and increasing adoption of technology-enabled care models. Expansion of telemedicine, EHRs, and remote monitoring solutions is improving access and efficiency across public and private healthcare systems. Rising demand for preventive care, data-driven diagnostics, and patient-centric services further supports the market growth. Regulatory support and growing public–private collaboration are further accelerating the adoption. The market generated a revenue of USD 5.01 Billion in 2025 and is projected to reach a revenue of USD 15.32 Billion by 2034, growing at a compound annual growth rate of 13.23%. from 2026-2034.

Saudi Arabia Digital Health Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Telehealth |

32% |

|

Component |

Software |

55% |

|

Region |

Northern and Central Region |

34% |

Type Insights:

To get more information on this market, Request Sample

- Telehealth

- Medical Wearables

- EMR/EHR Systems

- Medical Apps

- Healthcare Analytics

- Others

Telehealth dominates with a market share of 32% of the total Saudi Arabia digital health market in 2025.

Telehealth holds the biggest market share due to its ability to improve healthcare access across urban and remote regions. Virtual consultations reduce travel requirements, waiting times, and facility burden, making healthcare services more accessible and efficient for patients and providers.

This dominance is further supported by strong government backing, regulatory clarity, and increasing acceptance from both patients and healthcare professionals. Integration with public healthcare systems and expanding insurance coverage enhances telehealth adoption. In 2025, Doctorna launched its CRM and telehealth services, aligning with Vision 2030. The platform used AI-powered tools and smart features to streamline operations, improve patient care, and comply with local regulations, further driving telehealth’s role in chronic disease management and preventive care.

Component Insights:

- Software

- Hardware

- Services

Software leads with a market share of 55% of the total Saudi Arabia digital health market in 2025.

Software represents the largest segment owing to its central role in enabling telemedicine, EHRs, data analytics, and remote patient monitoring. Healthcare providers increasingly rely on software platforms to manage patient information, coordinate care, and support clinical decision-making across digital healthcare ecosystems. In 2024, Saudi Arabia’s Minister of Health launched a licensing initiative for medical software at the Global Health Exhibition, enabling digital health technologies to facilitate diagnosis and treatment, streamlining healthcare without the need for physical infrastructure.

This dominance is reinforced by national investments in health information technology (IT) infrastructure and interoperability standards. Demand for secure, scalable, and compliant digital solutions continues to rise as hospitals and clinics modernize operations. Software platforms also support integration of AI and analytics, further strengthening their importance within the market.

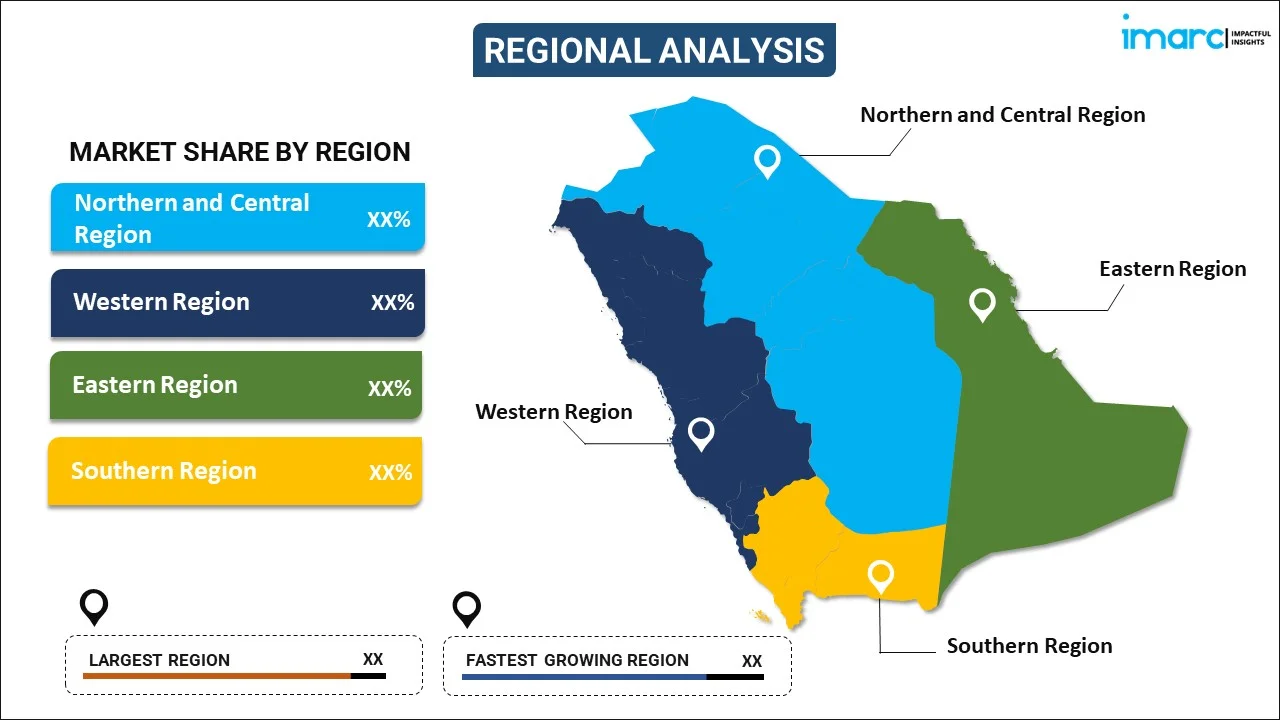

Regional Insights:

To get more information on this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibit a clear dominance with a 34% share of the total Saudi Arabia digital health market in 2025.

Northern and Central Region accounts for the majority of the market share, driven by concentration of major hospitals, government healthcare institutions, and technology infrastructure. These regions serve as primary hubs for healthcare innovation, pilot programs, and early adoption of digital health solutions.

This dominance is further supported by higher population density, stronger internet connectivity, and greater availability of skilled healthcare professionals. Presence of leading public and private healthcare providers accelerates deployment of telehealth and health IT platforms, reinforcing the Northern and Central regions’ leading role in digital health adoption. For instance, in 2025, Saudi Arabia launched an AI-powered health coach in its national Sehaty app, developed with Lean Business Services and Google Cloud. The AI provided personalized, real-time health guidance through voice, video, and text, supporting preventive, patient-centered care. This initiative advanced Vision 2030, integrating AI into healthcare while ensuring data privacy and secure local governance.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Digital Health Market Growing?

Focus on Data Analytics and Population Health Management

Healthcare providers and public authorities in Saudi Arabia are increasingly relying on data analytics to enhance clinical and operational decision making. Digital health platforms enable large-scale collection of clinical, genomic, and population-level data to support disease surveillance, resource planning, and targeted interventions. In 2025, global health company M42 launched M42 Saudi Arabia, expanding AI, genomics, and population health services based on a long-standing collaboration with the Ministry of Health. Predictive analytics help identify high-risk patients and optimize care pathways, improving outcomes and cost control while driving adoption of interoperable, analytics-enabled digital health systems nationwide.

Integration of Digital Health with Preventive Care Models

Preventive healthcare initiatives are catalyzing the demand for digital health platforms across Saudi Arabia, as authorities prioritize early detection, screening, and lifestyle management to control long-term healthcare costs. Digital tools support population-level screening, appointment reminders, and health education while enabling continuous engagement through mobile applications and connected devices. In line with this trend, in 2024, Bayer expanded its partnership with Huma to launch the Aspirin Heart Health Risk Assessment tool in Saudi Arabia, supporting the Kingdom’s Vision 2030 healthcare goals. This digital tool assessed cardiovascular disease risk without invasive tests, aiming to reduce heart disease burdens in the region. The initiative aligned with national strategies to prioritize preventive care and early detection of cardiovascular issues.

Expansion of Nationwide Virtual Care Infrastructure

The Saudi Arabia digital health market is being driven by large-scale investment in nationwide virtual care infrastructure that expands access, efficiency, and clinical reach. Advanced virtual hospitals enable remote consultations, specialist access, and integrated care delivery across regions. This momentum is demonstrated by the 2024 launch of the Seha Virtual Hospital, now the world’s largest virtual hospital, connecting 224 hospitals and serving hundreds of thousands of patients. Integration with platforms, such as Sehhaty and Wasfaty, supports virtual appointments and prescription management. Leveraging AI and augmented reality (AR), such initiatives strengthen proactive, technology-driven healthcare delivery, accelerating digital health adoption across the Kingdom.

Market Restraints:

What Challenges the Saudi Arabia Digital Health Market is Facing?

Limited Digital Literacy Among Older Populations and Rural Communities

A digital literacy gap remains evident among older populations and rural communities, limiting broad adoption of digital health technologies. Individuals unfamiliar with smartphones, applications, or internet-based services encounter challenges using telehealth platforms and remote monitoring tools. This gap can reduce effective participation in virtual consultations, delay diagnosis, and restrict access to modern healthcare delivery models.

Data Privacy and Cybersecurity Concerns

Healthcare systems continue to face heightened exposure to cybersecurity threats, raising serious concerns regarding patient data privacy and system reliability. The Kingdom has reported notable cyber incidents affecting healthcare infrastructure, highlighting sector vulnerability. Addressing these risks requires sustained investment in encryption technologies, intrusion detection systems, continuous monitoring, and AI–enabled cybersecurity solutions.

Infrastructure Gaps in Remote and Underserved Regions

Urban centers benefit from advanced digital infrastructure and broad healthcare access, while several rural and remote regions continue to face connectivity limitations and fewer specialized medical facilities. These geographic gaps restrict consistent deployment of digital health services. Addressing infrastructure shortfalls and improving network coverage remain essential to ensure equitable healthcare access for populations across the Kingdom.

Competitive Landscape:

The Saudi Arabia digital health market exhibits a fragmented and increasingly competitive landscape characterized by the presence of global technology corporations, regional healthcare providers, and emerging healthtech startups. Market participants are focusing on diversifying their digital health offerings, enhancing platform interoperability, and forming strategic partnerships to expand market presence. Competition is intensifying as companies invest in AI capabilities, cloud-based solutions, and localized Arabic-language platforms tailored to regional healthcare needs. Ongoing government initiatives under Vision 2030 and the digital health strategies are encouraging new market entrants and public-private collaborations, further diversifying the competitive environment and driving innovation across telemedicine, software, and healthcare analytics segments.

Recent Developments:

- November 2025: Siemens Healthineers and the Saudi Ministry of Health launched the “SHIFT Innovation Center” in Riyadh to foster collaboration among hospitals, universities, startups, and government bodies. The center focused on innovation infrastructure, AI-driven healthtech solutions, and capacity-building programs to improve patient outcomes and operational efficiency. Aligned with Saudi Vision 2030, it aimed to accelerate healthcare transformation through technology, strategic partnerships, and scalable regional solutions.

- November 2025: Saudi Arabia launched the world’s first digital diabetes command center to monitor patients’ vital signs in real time. The initiative, unveiled by Health Minister Fahad AlJalajel at the Global Health Exhibition in Riyadh, aimed to enhance preventive, patient-centered care and reduce complications. It marked a major step in the Kingdom’s digital healthcare transformation and commitment to innovation.

Saudi Arabia Digital Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Telehealth, Medical Wearables, EMR/EHR Systems, Medical Apps, Healthcare Analytics, Others |

| Components Covered | Software, Hardware, Service |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia digital health market size was valued at USD 5.01 Billion in 2025.

The Saudi Arabia digital health market is expected to grow at a compound annual growth rate of 13.23% from 2026-2034 to reach USD 15.32 Billion by 2034.

Telehealth holds the largest market share of 32% in 2025, driven by the expansion of virtual hospital infrastructure, government-backed telemedicine initiatives, and increasing demand for remote consultations and chronic disease management.

Key factors driving the Saudi Arabia digital health market include government led transformation aligned with Vision 2030, with national authorities prioritizing digital platforms to enhance efficiency, integration, and patient access. In 2025, Persivia launched the National Health Intelligence (NHI) Initiative, using AI and data analytics to enhance evidence-based decision-making and improve healthcare outcomes.

Major challenges include limited digital literacy among older populations and rural communities, data privacy and cybersecurity concerns requiring substantial investment in protection measures, and infrastructure gaps restricting access to digital health services in certain remote regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)