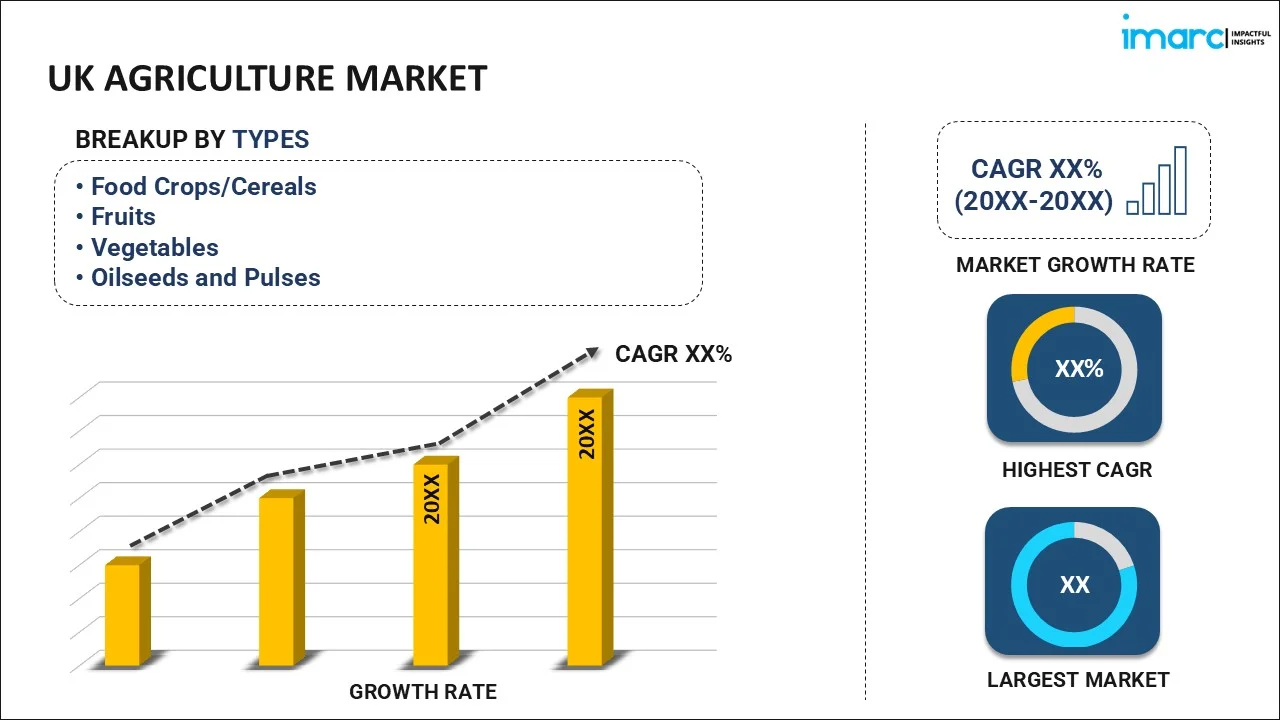

UK Agriculture Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034

UK Agriculture Market Summary:

The UK agriculture market size was valued at USD 48.39 Billion in 2025 and is projected to reach USD 71.46 Billion by 2034, growing at a compound annual growth rate of 4.43% from 2026-2034.

The market is driven by the implementation of supportive government policies promoting sustainable farming practices, increasing consumer demand for organic and locally sourced agricultural products, and widespread adoption of advanced agricultural technologies including precision farming and automation. The sector is further bolstered by favorable trade agreements and growing investments in agri-tech innovations. These factors collectively contribute to strengthening the UK agriculture market share.

Key Takeaways and Insights:

-

By Type: Food crops/cereals dominate the market with a share of 36% in 2025, owing to arable farming in eastern and southern England, flat terrain, strong demand, processing infrastructure, and fertile high-yield soils.

-

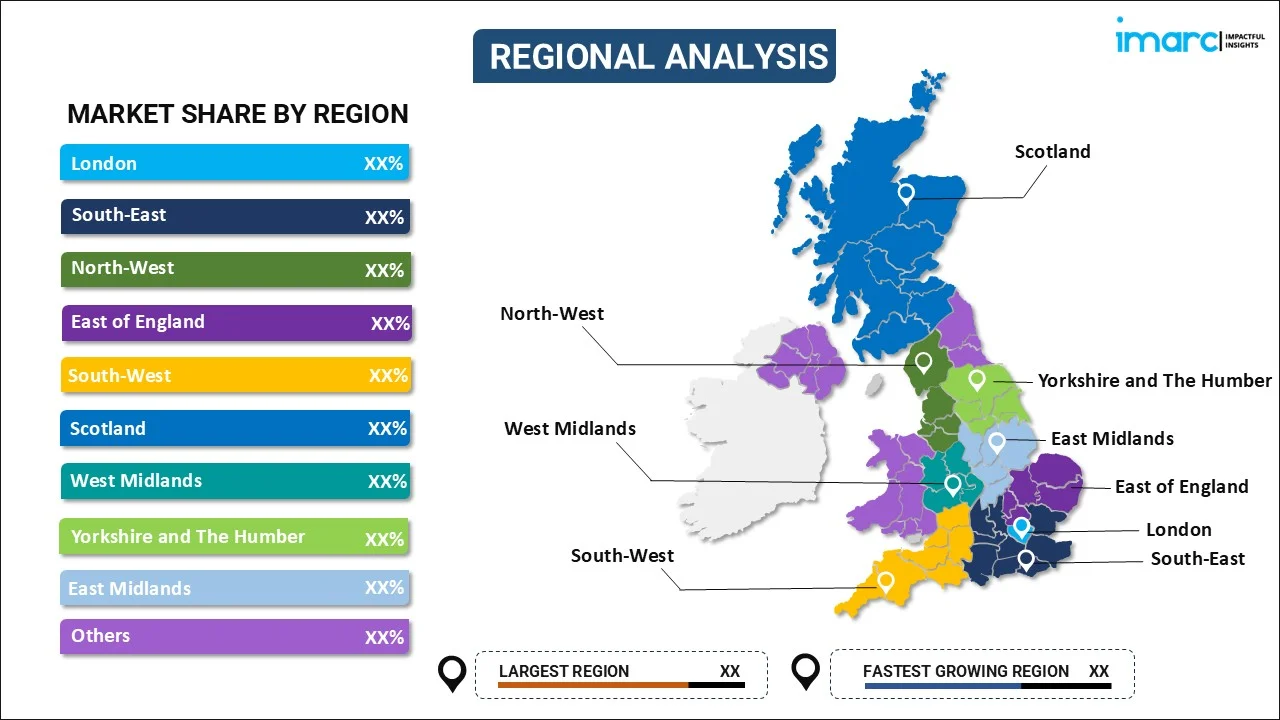

By Region: South East leads the market with a share of 15% in 2025, driven by proximity to London markets, advanced agricultural infrastructure, favorable climate, strong supply chains, and widespread adoption of modern farming technologies.

-

Key Players: The UK agriculture market exhibits a moderately fragmented competitive landscape, with a diverse mix of large-scale commercial farming operations, family-owned agricultural enterprises, cooperative farming networks, and emerging agri-tech ventures competing across various segments and regional markets.

The UK agriculture market is experiencing significant transformation driven by multiple converging factors. Government initiatives, particularly the Environmental Land Management scheme, are incentivizing sustainable farming practices while supporting domestic food production capabilities. According to sources, in August 2025, DEFRA announced the 2026 Sustainable Farming Incentives, offering higher payments for cover cropping, agroforestry, soil health, and habitat creation, aiming to reward environmentally friendly farming practices. Further, consumer preferences are shifting decisively toward organic, locally sourced, and ethically produced agricultural products, creating new market opportunities for farmers who adopt sustainable practices. Technological advancement is revolutionizing traditional farming methods through precision agriculture, drone technology, and artificial intelligence-powered monitoring systems that optimize resource utilization and enhance productivity. Additionally, the focus on food security following global supply chain disruptions has intensified efforts to strengthen domestic production capabilities and reduce import dependency. These dynamics are collectively reshaping the agricultural landscape and driving sustained market expansion.

UK Agriculture Market Trends:

Adoption of Precision Agriculture and Smart Farming Technologies

The UK agriculture market is witnessing accelerated adoption of precision farming technologies that leverage satellite imagery, IoT sensors, and artificial intelligence (AI) to optimize crop management practices. Farmers are increasingly deploying autonomous tractors, drone-based monitoring systems, and data analytics platforms to make informed decisions regarding planting, irrigation, and harvesting operations. These technologies enable real-time monitoring of soil health, crop growth patterns, and environmental conditions, thereby reducing waste and maximizing yields. According to reports, in December 2025, DEFRA’s £2.3 Million ADOPT Fund supported 30 farm tech trials, testing loweremission machinery, digital tools, and peat-free compost to boost productivity, sustainability, and real-world precision farming adoption.

Rise of Regenerative and Sustainable Farming Practices

Regenerative agriculture is rapidly transitioning from a niche practice to mainstream expectation across the UK farming sector. Farmers are increasingly adopting carbon farming techniques, cover cropping, reduced tillage methods, and integrated pest management systems to restore soil health and enhance biodiversity. In October 2025, Waitrose committed £1 Million to support 2,000 UK farmers in adopting regenerative practices, restoring soil health, protecting biodiversity, and building climate resilience. Further, this trend is driven by both regulatory requirements and growing consumer demand for sustainably produced food products. Agricultural enterprises are implementing comprehensive sustainability programs that focus on carbon sequestration, water conservation, and ecosystem protection.

Focus on Local Sourcing and Supply Chain Resilience

The UK agriculture market is experiencing a pronounced shift towards the local sourcing and development of resilient regional supply networks. Farmers and food producers are building shorter supply chains that connect directly with consumers and local retailers, reducing dependency on international imports and improving food security. As per sources, the UK government stated that monitoring public sector food sourcing could direct up to £2.5 Billion annually to British farmers by sourcing half of public food procurement domestically. Moreover, community-supported agriculture programs and farm-to-table initiatives are gaining significant traction as consumers prioritize transparency regarding food origins and production methods. This trend is strengthening relationships between producers and consumers while supporting rural economic development.

Market Outlook 2026-2034:

The UK agriculture market is positioned for sustained revenue growth throughout the forecast period, supported by continued government investment in sustainable farming initiatives and rising consumer demand for domestically produced organic products. Market revenue expansion will be driven by technological innovations that enhance farm productivity, diversification into high-value crop segments, and development of value-added agricultural products. The sector is expected to attract significant investment in agri-tech solutions and renewable energy integration, further strengthening market fundamentals. The market generated a revenue of USD 48.39 Billion in 2025 and is projected to reach a revenue of USD 71.46 Billion by 2034, growing at a compound annual growth rate of 4.43% from 2026-2034.

UK Agriculture Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Food Crops/Cereals |

36% |

|

Region |

South East |

15% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Food Crops/Cereals

- Fruits

- Vegetables

- Oilseeds and Pulses

Food crops/cereals dominate with a market share of 36% of the total UK agriculture market in 2025.

The food crops and cereals command the largest share of the UK agriculture market, driven by extensive arable farming operations concentrated in the eastern and southern regions of England. Wheat remains the predominant crop with substantial production volumes supporting both domestic consumption and export markets. The segment benefits from established processing infrastructure, mechanized farming practices, and favorable climatic conditions that enable high-yield cultivation. As per sources, Frontier Agriculture reported that UK wheat yields averaged 7.6 t/ha, with trials of high-yield, disease-resistant varieties enhancing crop resilience and supporting sustainable cereal production. Moreover, strong demand from food processing industries, brewing and distilling sectors, and livestock feed markets sustains consistent production levels throughout the year.

Barley and oats cultivation contributes significantly to food crops and cereals performance, with dedicated acreage supporting diverse end-use applications across the food and beverage industries. The segment is characterized by high levels of mechanization, advanced seed technologies, and precision agriculture adoption that optimize production efficiency. Government support through agricultural subsidies and environmental stewardship programs provides financial stability for cereal farmers while encouraging sustainable cultivation practices. Ongoing investment in crop research and development continues to enhance yield potential and disease resistance across primary cereal varieties.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

South East dominates with a market share of 15% of the total UK agriculture market in 2025.

South East continues to remain the market leader in the agricultural sector in the UK due to its proximity to London. The region offers conducive environments for farming various agricultural products such as grains, fruits, vegetables, and garden products. The region experiences favorable climatic conditions that promote the growing of various crop types throughout the year. The region benefits from the presence of well-developed transport networks that ensure the easy distribution of farm products to the processing plants or the distribution centers.

The farming businesses operating in the region reflect a high degree of technological advancement and investment in the latest farming technology. The region attracts substantial investment in agri-tech to enable the development of new farming technologies and sustainable agriculture projects. Strong institutional pillars by way of research institutions and agricultural colleges ensure that the farming community stays abreast of the latest knowledge and best practices. The factors of proximity to markets, infrastructure, and technology adoption make this region the key driver of UK agriculture market performance.

Market Dynamics:

Growth Drivers:

Why is the UK Agriculture Market Growing?

Implementation of Supportive Government Policies and Environmental Schemes

The UK government has implemented comprehensive policy frameworks that actively support agricultural sector growth and sustainability. The Environmental Land Management scheme represents a transformative approach that rewards farmers for environmental stewardship while maintaining productive food systems. Subsidies and grant programs provide financial assistance for equipment upgrades, technology adoption, and infrastructure improvements that enhance farm competitiveness. As per sources, in July 2025, Defra confirmed a £2.7 Billion annual commitment to sustainable farming and nature recovery over three years, with Environmental Land Management funding reaching £2 Billion by 2029. Moreover, trade agreements negotiated following Brexit are opening new export markets for British agricultural products while protecting domestic producers from unfair competition. Regulatory frameworks promote sustainable practices including organic certification, animal welfare standards, and environmental protection measures that strengthen consumer confidence in UK agricultural products.

Rising Consumer Demand for Organic and Locally Sourced Products

Consumer preferences are increasingly favoring organic, sustainably produced, and locally sourced agricultural products, creating substantial growth opportunities for UK farmers. Health consciousness among consumers is driving demand for food products free from synthetic chemicals, pesticides, and artificial additives. Environmental awareness is influencing purchasing decisions as consumers seek products with lower carbon footprints and sustainable production credentials. The preference for locally sourced produce reflects desires for fresher products, support for domestic farming communities, and transparency regarding food origins and production methods.

Technological Innovation and Precision Agriculture Adoption

Technological advancement is fundamentally transforming UK agricultural operations and driving significant productivity improvements across the sector. Precision agriculture technologies enable farmers to optimize resource utilization through targeted application of fertilizers, pesticides, and water based on real-time field data. Satellite imagery, drone monitoring, and IoT sensor networks provide comprehensive visibility into crop health, soil conditions, and environmental factors affecting production. Automation technologies including autonomous tractors, robotic harvesting systems, and smart irrigation reduce labor requirements while improving operational efficiency. As per sources, in April 2025, the UK government announced over £45 Million in grants supporting robotics, smart irrigation, and precision-bred crops to boost food production, farm profits, and sustainability. Further, data analytics and AI platforms enable predictive decision-making that minimizes waste and maximizes yields.

Market Restraints:

What Challenges the UK Agriculture Market is Facing?

Persistent Labor Shortages and Workforce Challenges

The UK agricultural sector faces significant workforce constraints that impact production capabilities and operational efficiency. Changes to immigration policies have reduced availability of seasonal workers traditionally employed for harvesting and processing activities. The aging domestic farming workforce presents succession planning challenges as younger generations show limited interest in agricultural careers.

Climate Variability and Extreme Weather Events

Changing climate patterns and increasing frequency of extreme weather events present substantial challenges to UK agricultural production. Unpredictable rainfall patterns disrupt planting schedules and affect crop development during critical growth phases. Extended periods of drought stress water resources and reduce yields for crops dependent on consistent moisture availability. Flooding damages crops, degrades soil quality, and destroys agricultural infrastructure in vulnerable low-lying regions.

Rising Input Costs and Economic Pressures

Agricultural producers face sustained pressure from escalating input costs that compress profit margins and threaten farm viability. Energy prices affect operational costs for machinery, irrigation systems, and controlled environment agriculture facilities. Fertilizer and agrochemical costs have increased significantly, impacting production economics particularly for intensive farming operations. Equipment acquisition and maintenance expenses strain capital resources especially for smaller farm enterprises.

Competitive Landscape:

The UK agriculture market exhibits a moderately fragmented competitive structure characterized by diverse participants operating across multiple scales and specializations. Large-scale commercial farming enterprises leverage economies of scale and technological sophistication to achieve efficient production across substantial landholdings. Family-owned agricultural operations maintain significant market presence through specialized production, premium product positioning, and direct-to-consumer sales channels. Cooperative farming networks enable smaller producers to access shared resources, collective bargaining power, and coordinated market access. Emerging agri-tech ventures are introducing innovative solutions that disrupt traditional farming practices and create new competitive dynamics.

Recent Developments:

-

In April 2024, Innovate UK launched the UK Agri-Tech Centre, merging Agri-EPI, CHAP, and CIEL to drive innovation, support startups, and scale agri-tech solutions. The centre provides strategic leadership, world-class facilities, and interdisciplinary expertise, accelerating technology adoption across the UK’s agricultural sector to enhance productivity, sustainability, and long-term food security.

-

In February 2024, Unilever launched its first UK regenerative agriculture project, partnering with British farmers growing mustard seeds and mint for Colman’s products. The four-year initiative trials low-carbon fertilisers, cover crops, digital irrigation, and soil-health monitoring to boost sustainability, resilience, and long-term supply security.

UK Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food Crops/Cereals, Fruits, Vegetables, Oilseeds and Pulses |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK agriculture market size was valued at USD 48.39 Billion in 2025.

The UK agriculture market is expected to grow at a compound annual growth rate of 4.43% from 2026-2034 to reach USD 71.46 Billion by 2034.

Food crops/cereals held the largest UK agriculture market share, supported by extensive arable farming, flat fertile lands, strong domestic demand for wheat and barley, and well-established processing and distribution infrastructure.

Key factors driving the UK agriculture market include supportive government policies and environmental schemes, rising consumer demand for organic and locally sourced products, technological innovation and precision agriculture adoption, and focus on food security and supply chain resilience.

Major challenges include persistent labor shortages due to immigration policy changes, climate variability and extreme weather events affecting crop yields, rising input costs for energy and fertilizers, land availability constraints, and regulatory compliance requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)