Global Acoustic Camera Market Expected to Reach USD 534.54 Million by 2033 - IMARC Group

Global Acoustic Camera Market Statistics, Outlook and Regional Analysis 2025-2033

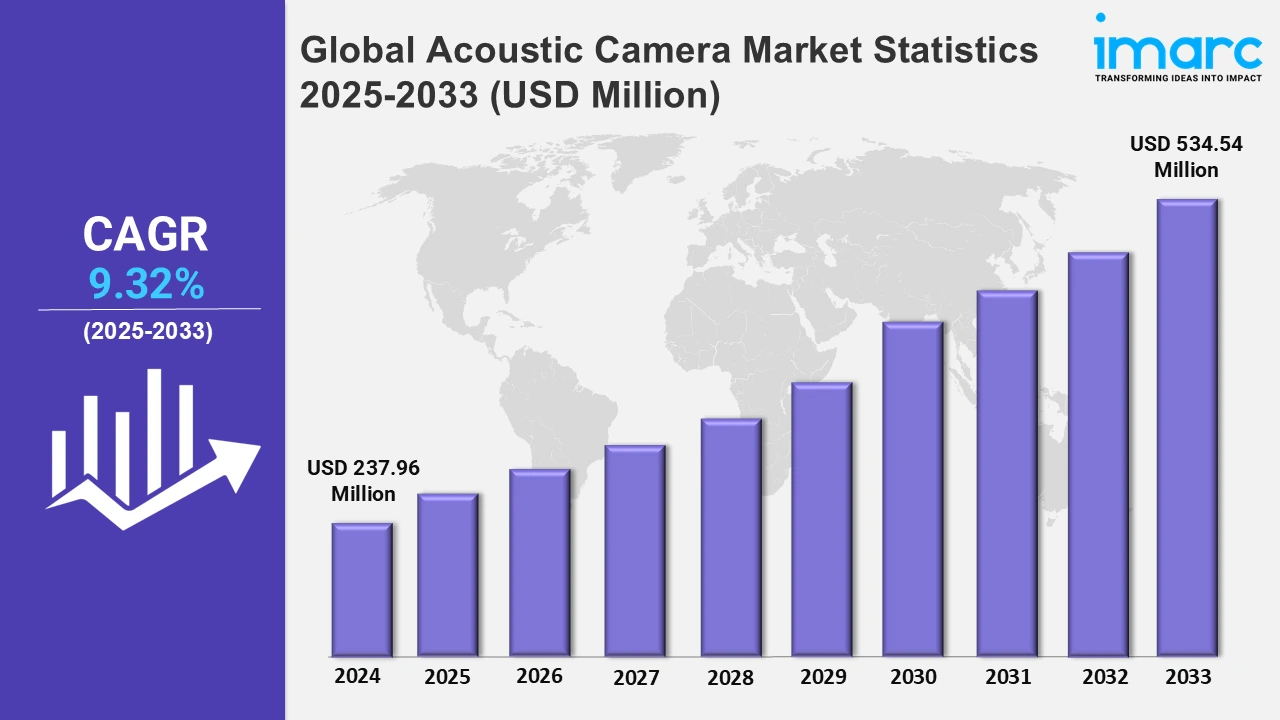

The global acoustic camera market size was valued at USD 237.96 Million in 2024, and it is expected to reach USD 534.54 Million by 2033, exhibiting a growth rate (CAGR) of 9.32% from 2025 to 2033.

To get more information on this market, Request Sample

The acoustic camera market is growing as different industries realize the potential that comes with sound visualization to improve operational efficiency and safety. Emerging trends shaping the acoustic camera market include the advancement of technology, the ever-increasing concern about the environment, and the growing adoption of noise monitoring solutions. Companies have focused on improving their resolution and accuracy for acoustic imaging systems so that noise sources are detected better and along with a detailed visual representation of sound. Additionally, some improved applications of acoustic cameras come with integrated AI and machine-learning algorithms, which automate analysis and reporting. Noise pollution awareness has also become one of the noteworthy trends affecting demand for noise monitoring solutions across urban planning, construction, and transportation because of their well-known effects on human health and the environment. Several industries are adopting acoustic cameras, to align with regulatory mandates due to the stringent limits on noise emission, mainly in automotive and industrial applications. The market is also shifting toward portable and handheld acoustic cameras that are more flexible and convenient during field diagnostics use.

The acoustic camera market is primarily driven by the increasing need for noise control and regulatory compliance across various industries. According to the European Environment Agency, about 95 million people are exposed to hazardous levels of road traffic noise, while almost 20% of the urban population is exposed to levels which considered harmful to health. Companies are using acoustic cameras for precise identification of noise sources as they require to comply with stricter limitations on noise emissions imposed by governments and regulatory bodies. The automotive industry is currently embracing this technology to improve design and reduce cabin noise for a better customer feel. Similarly, in manufacturing and industry segments, these cameras have become an essential preventive maintenance tool, helping to give early warning signals of impending problems such as mechanical failures which can, in turn, produce intolerable noise. Besides, increasing awareness about product quality and efficiency of operations are also driving consumers to purchase sophisticated solutions for acoustic measurements that reduce costly repairs caused by negligence and along with the risk of death in work-related accidents. The proactive approach that acoustic cameras can add to noise management is extremely sustainable in terms of continuity for minimization of disturbances in urban and industrial areas. Technology developments, like AI integrated with real-time analysis of acoustic events, are adding to the functionality of acoustic cameras, thus granting businesses fast and accurate access to in-house operations.

Global Acoustic Camera Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization, strict noise regulations, growing manufacturing sectors, and increasing demand for noise control and quality assurance across various industries.

Asia-Pacific Acoustic Camera Market Trends:

The Asia Pacific acoustic camera market is driven by the increasing focus on noise, vibration, and harshness (NVH) reduction in automotive, aerospace, and industrial applications. Manufacturers in these sectors are using acoustic cameras to improve product quality, optimize designs, and comply with stringent environmental regulations on noise emissions. The rise of smart manufacturing and Industry 4.0 has also led to higher adoption of acoustic camera technology, as it allows real-time monitoring and diagnostic capabilities, contributing to enhanced operational efficiency. Another significant driver is urbanization, with growing concerns about noise pollution in cities. According to industry reports, urbanization is a vital driver of economic growth in Southeast Asia, with 80% of GDP stemming from its cities. This calls for various urban developments which in turn necessitate the demand of acoustic cameras. These cameras are also increasingly used in environmental monitoring to identify and mitigate noise pollution from construction, transportation, and industrial activities. Technological advancements, such as the integration of artificial intelligence for data analysis and improved sensor capabilities, are making acoustic cameras accessible and affordable, further accelerating market growth in the region.

North America Acoustic Camera Market Trends:

The North American acoustic camera market is growing due to increasing demand for noise, vibration, and harshness (NVH) control in industries like automotive, aerospace, and manufacturing. Stricter regulations on noise in cities such as Los Angeles and New York are driving the adoption of acoustic cameras for noise monitoring using in conjunction with other environmental monitoring tools. AI and machine learning integrations are new technological advancements that improve accuracy and efficiency in camera use. The movement toward smart manufacturing and predictive maintenance in some sectors such as energy and construction also result in real-time noise monitoring. The continuing focus of North America on sustainability and regulatory compliance adds to the increasing growth of the market in the region.

Europe Acoustic Camera Market Trends:

The acoustic camera market in Europe is steadily growing due to technological advancements and regulatory pressure. Stricter noise pollution regulations in countries like Germany, France, and the United Kingdom are largely responsible for drivers in pivotal industries like automotive, manufacturing, and construction. Acoustic cameras assist companies in defining their noise pollution sources and improving their effectiveness in controlling them, thus meeting these requirements. The automotive industry is a significant adopter of acoustic camera technology, as they use these cameras in testing for noise, vibration, and harshness (NVH) levels in vehicles. Besides, increased environmental awareness and sustainability initiatives across Europe are leading to more industry-wide noise monitoring system adoption. Technological advancements such as the incorporation of AI and machine learning are improving the accuracy and functionality of these acoustic cameras, thus making them usable for a broad spectrum of applications-from urban planning to industrial monitoring.

Latin America Acoustic Camera Market Trends:

Major factors such as growing urbanization, rapid industrialization, and conscious environmental considerations have become significant drivers in the evolution of the Latin American acoustic camera market. Noise has become an important concern as cities develop and major urban centers like Sao Paulo and Mexico City become affected. Noise monitoring has thus become an essential demand. The automotive industry, which is booming in countries like Mexico and Brazil, is utilizing acoustic cameras for improving vehicle NVH performance due to demand from consumers. Industries that include energy and manufacturing are also considering these technologies for machinery diagnostics and predictive maintenance. Increasing regulatory pressures, technological advances such as AI-based data analysis, and real-time monitoring capabilities are adding fueling the market for acoustic cameras. The future of this market will remain robust as countries in Latin America focus on sustainability, noise reduction, and compliance in industrial and urban societies.

Middle East and Africa Acoustic Camera Market Trends:

The Middle East and Africa (MEA) acoustic camera market is growing, driven by increasing industrialization, urbanization, and a heightened focus on environmental sustainability. Countries like Saudi Arabia, the UAE, and South Africa are adopting acoustic camera technology across sectors such as construction, oil and gas, automotive, and manufacturing. In particular, the oil and gas sector use acoustic cameras for machinery diagnostics, vibration analysis, and predictive maintenance. Stricter noise regulations in urban areas are also fueling demand for noise source detection solutions. Technological advancements, including AI integration, are enhancing the capabilities of acoustic cameras, making them more accessible and effective. As MEA continues to focus on sustainable development, urban planning, and regulatory compliance, the demand for acoustic cameras for noise monitoring and mitigation is expected to rise, especially in rapidly growing metropolitan areas and industrial zones.

Top Companies Leading in the Acoustic Camera Industry

Some of the leading acoustic camera market companies include Brüel & Kjær (Spectris Plc), CAE Software & Systems GmbH, gfai tech GmbH, Microflown Technologies, Norsonic AS, Polytec GmbH, Siemens AG, Signal Interface Group, SINUS Messtechnik GmbH, SM Instruments and Sorama among many others.

- In June 2024, SINUS Messtechnik GmBH launched its new ACAM200 specially designed for mobile applications. This, in spite of the camera's compact size, allows sound source localization in the frequency range of 200 Hz to 24 kHz.

Global Acoustic Camera Market Segmentation Coverage

- On the basis of the array type, the market has been categorized into 2D and 3D, wherein 3D represents the leading segment. 3D array acoustic cameras use a configuration of multiple microphones arranged in a three-dimensional grid to capture sound information. This spatial arrangement enables precise localization of sound sources within a defined volume, offering an enhanced ability to visualize acoustic events in three dimensions. Unlike traditional microphones or 2D arrays, these systems create detailed, real-time sound maps that provide spatial and directional information. They are commonly used in applications such as industrial monitoring, medical diagnostics, and environmental studies, where understanding positions and movements of the sound sources is crucial. By processing sound data, 3D acoustic cameras can generate accurate, dynamic acoustic visualizations.

- Based on the measurement type, the market is classified into far field and near field, amongst which near field dominates the market. Near-field measurement in acoustic cameras refers to capturing sound data from sources located close to the sensor array, typically within a few meters. This method focuses on detecting high-resolution sound information from nearby sources, where sound pressure levels are higher, and acoustic waves are more direct. Near-field measurements provide detailed insights into the precise location, shape, and intensity of sound sources in a localized area. This type of measurement is particularly useful for applications like machinery diagnostics, noise reduction in industrial settings, and identifying vibrations or sound anomalies in products. It offers high accuracy in visualizing and localizing sound sources in proximity.

- On the basis of the application, the market has been divided into noise source detection, leak detection, and others. Among these, noise source detection accounts for the majority of the market share. Noise source detection is a key application of acoustic cameras, enabling the identification and localization of unwanted sound sources in various environments. By utilizing an array of microphones or sensors, acoustic cameras capture sound data and create visual representations, allowing operators to pinpoint the exact origin of noise. This technology is widely used in industries such as automotive, aerospace, and manufacturing to detect sources of noise pollution or mechanical malfunction. It helps improve product design, reduce noise emissions, and enhance acoustic comfort in environments like offices or residential areas. Acoustic cameras provide accurate, real-time noise mapping, ensuring effective noise control and mitigation strategies.

- Based on the end use, the market is segregated into aerospace and defense, infrastructure, energy and power, automotive, and others. Among these, automotive represents the leading segment. In the automotive industry, acoustic cameras are used to identify and analyze noise sources, improving vehicle design and performance. These cameras allow engineers to visually detect sound emissions from components such as engines, exhaust systems, tires, and interiors. By mapping noise levels, they can pinpoint areas contributing to undesirable sounds, such as vibrations or mechanical malfunctions. This leads to better noise, vibration, and harshness (NVH) management, enhancing the overall driving experience. Acoustic cameras also aid in developing quieter vehicles, meeting regulatory noise standards, and optimizing parts for durability and efficiency. The technology ensures higher quality, comfort, and noise control in modern vehicles.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 237.96 Million |

| Market Forecast in 2033 | USD 534.54 Million |

| Market Growth Rate 2025-2033 | 9.32% |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Array Types Covered | 2D, 3D |

| Measurement Types Covered | Far Field, Near Field |

| Applications Covered | Noise Source Detection, Leak Detection, and Others |

| End Uses Covered | Aerospace and Defense, Infrastructure, Energy and Power, Automotive, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brüel & Kjær (Spectris Plc), CAE Software & Systems GmbH, gfai tech GmbH, Microflown Technologies, Norsonic AS, Polytec GmbH, Siemens AG, Signal Interface Group, SINUS Messtechnik GmbH, SM Instruments, Sorama, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)