Global CBRN Defense Market Expected to Reach USD 33.1 Billion by 2033- IMARC Group

Global CBRN Defense Market Statistics, Outlook, and Regional Analysis 2025-2033

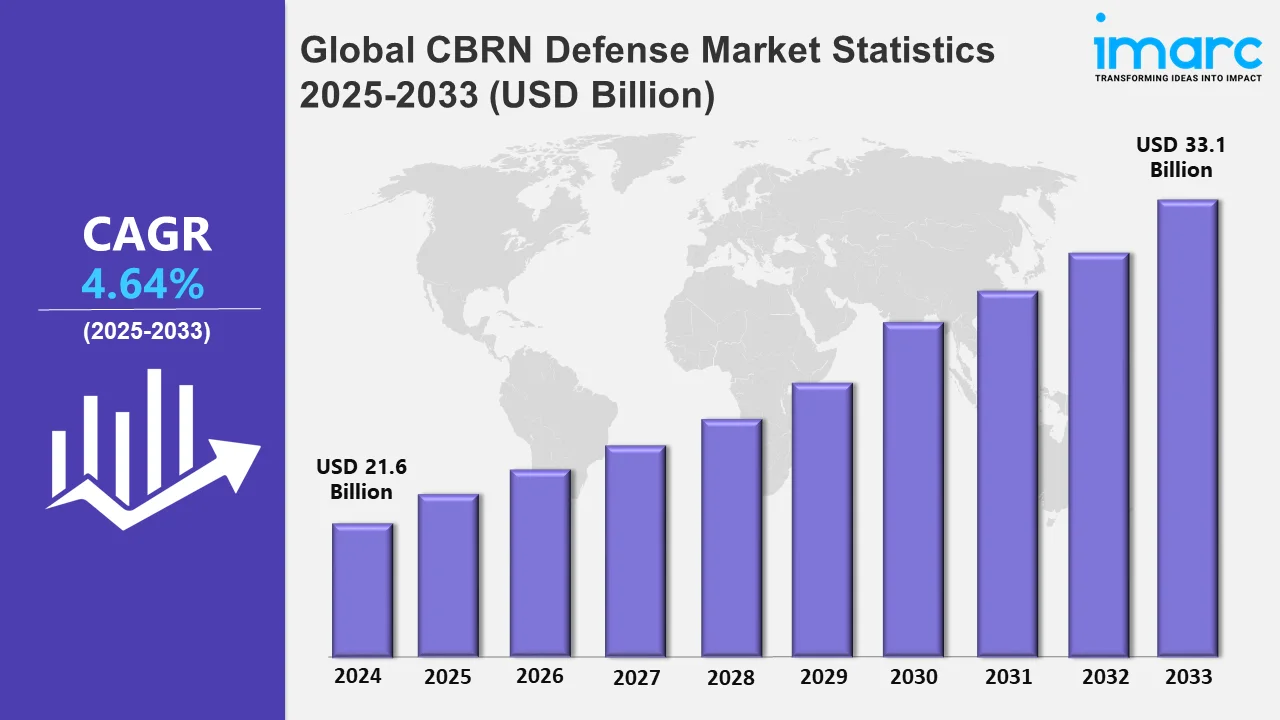

The global CBRN defense market size was valued at USD 21.6 Billion in 2024 and it is expected to reach USD 33.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.64% from 2025 to 2033.

To get more information on this market, Request Sample

The CBRN (Chemical, Biological, Radiological, and Nuclear) defense market is driven by escalating geopolitical tensions and rising threats from terrorism necessitating robust defense mechanisms against CBRN threats. To address these challenges industry players are launching innovative solutions to enhance detection and response capabilities. For instance, in September 2024, Smiths Detection and Riskaware launched UrbanAware an advanced platform that enhances CBRN hazard intelligence in real time. This solution integrates data collection and analysis enabling faster response for first responders and military planners during incidents, particularly in urban environments. Governments worldwide are heavily investing in advanced protective equipment, detection systems, and decontamination technologies to safeguard civilians and military personnel. The proliferation of dual-use technologies has raised concerns over the misuse of chemical and biological agents prompting the development of stringent regulatory frameworks and innovative countermeasures.

The market is witnessing increased adoption of AI and IoT-based technologies for real-time threat detection and situational awareness. For instance, in November 2024, Buckley Space Force Base showcased CHAPPIE, a pioneering chemical, biological, radiological, and nuclear quadrupedal unmanned ground vehicle. U.S. Air Force Master highlights its advanced remote sensing capabilities. Funded by a $1.24 million AFWERX grant, CHAPPIE aims to enhance CBRN defense and foster innovation within the Air and Space Forces. Portable detection systems and wearable protective gear are gaining traction due to their efficiency and convenience. Countries are emphasizing collaboration with private players to develop advanced solutions fostering innovation in materials and system designs. The integration of autonomous systems such as drones for surveillance and decontamination is another emerging trend.

Global CBRN Defense Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to substantial government investments, advanced technologies, and robust defense infrastructure.

North America CBRN Defense Market Trends:

Key trends in the North America CBRN defense market include the adoption of advanced technologies such as AI and IoT for real-time threat detection and response. Investment in portable detection systems and wearable protective gear is improving operational efficiency. The collaboration between government agencies and private players is fostering innovation in decontamination and hazard mitigation solutions. For instance, in September 2024, the Joint Project Manager for CBRN Sensors announced the successful early fielding of the Common Analytical Laboratory System Field Confirmatory Analytical Capability Set to USAF units. The system enhances the detection of chemical and biological threats with 43 chemical and 45 biological detectors delivered, improving the warfighters' operational readiness. This has resulted in the evolution of platforms such as UrbanAware to optimize CBRN hazard intelligence and respond rapidly and effectively in case of any incidents.

Asia-Pacific CBRN Defense Market Trends:

Rising geopolitical tensions and regional security challenges in the Asia Pacific region are forcing investments in defense modernization. India, China, and South Korea are putting more emphasis on developing advanced detection, protection, and decontamination technologies. The governments also focus on the development of a robust emergency response framework and the conduct of joint military exercises to build preparedness against CBRN threats. Integration of AI-based detection systems with portable monitoring devices is underway. Public-private partnerships are facilitating innovation and accelerating the introduction of advanced defense capabilities.

Europe CBRN Defense Market Trends:

Increased cross-border security and geopolitical tensions fuel investments in Europe CBRN defense market. Governments are mainly focusing on the modernization of detection as well as decontamination technology with increased incorporation of AI in threat assessment processes. EU initiatives further aim at the standardization of defense mechanisms which contributes to interoperability. Training programs for first responders and military personnel are becoming more relevant with the integration of wearable protective equipment in order to better address emerging CBRN threats.

Latin America CBRN Defense Market Trends:

The Latin America CBRN defense market is observing increased investments in modernizing defense infrastructure amid the rising concerns of chemical and biological threats. The governments in the region are shifting their focus to enhancing disaster preparedness and response mechanisms, particularly in densely populated urban areas. The partnerships with global defense technology providers are enhancing access to the most advanced detection and decontamination systems. Increased participation in international training programs and alliances is driving the adoption of interoperable solutions tailored to regional security needs.

Middle East and Africa CBRN Defense Market Trends:

Key trends in the MEA CBRN defense market include an increase in defense spending by countries fueled by regional security concerns and geopolitical instability. Countries are investing in better CBRN defense capabilities with the latest detection systems, protective gear, and decontamination technologies. Governments are increasingly partnering with the private sector to come up with innovative solutions. Rapid growth in the awareness of biological threats specifically for the healthcare and military sectors is fueling demand for integrated CBRN defense systems across MEA.

Top Companies Leading in the CBRN Defense Industry

Some of the leading CBRN defense market companies include Argon Electronics (UK) Ltd, Avon Protection, Battelle Memorial Institute, Bruker Corporation, HDT Global, Karcher Futuretech GmbH, QinetiQ, Rheinmetall AG, Saab AB, Smiths Detection Group Ltd, Teledyne FLIR LLC, Thales Group, among many others. In May 2024, Argon Electronics was chosen as the provider of CBRN simulation training equipment for the Austrian Armed Forces. The new equipment which includes simulators for radiological and contamination training will improve the operational effectiveness of both military and civilian responders. This will allow for safe and efficient training in realistic scenarios.

Global CBRN Defense Market Segmentation Coverage

- On the basis of the threat type, the market has been categorized into chemical, biological, radiological, and nuclear, wherein chemical represents the leading segment. The chemical segment leads the CBRN defense market due to the persistent threat of chemical warfare agents and industrial accidents. Governments and defense organizations prioritize chemical defense solutions investing in advanced detection systems, protective equipment, and response protocols to counteract chemical attacks. The growing concern over chemical terrorism further bolsters this segment's dominance making it a key focus area for CBRN defense advancements.

- Based on the equipment, the market is classified into protective wearables, respiratory systems, detection and monitoring systems, decontamination systems, simulators, and others, amongst which protective wearables segment dominates the market. Protective wearables dominate the CBRN defense market as they provide essential personal protection against chemical, biological, radiological, and nuclear threats. These wearables including hazmat suits, gloves, and boots are crucial for ensuring the safety of military personnel and first responders during CBRN incidents. Their widespread use in hazardous environments drives their market leadership with continuous advancements improving their functionality and comfort.

- On the basis of the end use, the market has been divided into military, civil and law enforcement, and others. Among these, military accounts for the majority of the market share. The military segment holds the largest share of the CBRN defense market due to the critical need for defense against CBRN threats in combat and strategic operations. Military forces worldwide prioritize CBRN defense to safeguard personnel and assets from chemical, biological, radiological, and nuclear threats.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 21.6 Billion |

| Market Forecast in 2033 | USD 33.1 Billion |

| Market Growth Rate 2025-2033 | 4.64% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Threat Types Covered | Chemical, Biological, Radiological, Nuclear |

| Equipments Covered | Protective Wearables, Respiratory Systems, Detection and Monitoring Systems, Decontamination Systems, Simulators, Others |

| End Uses Covered | Military, Civil and Law Enforcement, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Argon Electronics (UK) Ltd, Avon Protection, Battelle Memorial Institute, Bruker Corporation, HDT Global, Karcher Futuretech GmbH, QinetiQ, Rheinmetall AG, Saab AB, Smiths Detection Group Ltd, Teledyne FLIR LLC, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)