China Shrimp Market Size, Share, Trends and Forecast by Environment, Domestic Production and Imports, Species, Product Categories, and Distribution Channel, 2025-2033

China Shrimp Market Size and Share:

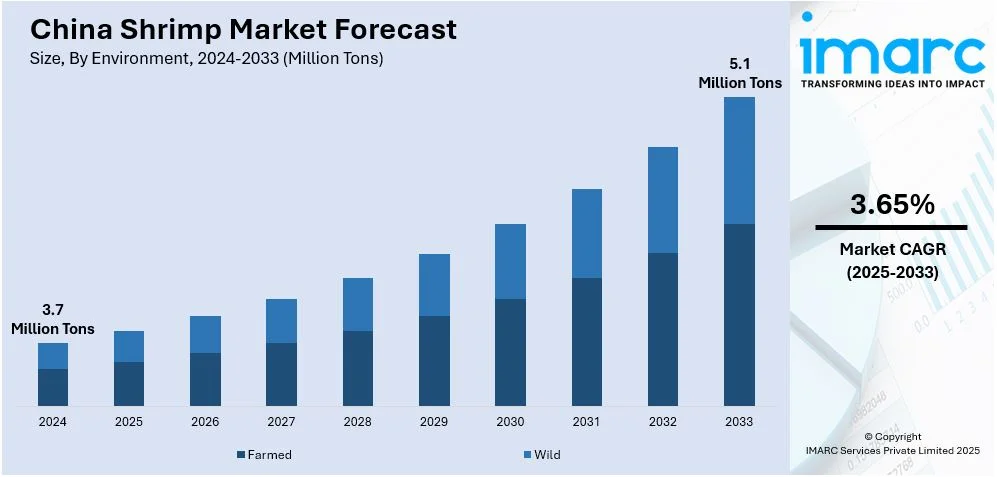

The China shrimp market size was valued at 3.7 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 5.1 Million Tons by 2033, exhibiting a CAGR of 3.65% from 2025-2033. The higher seafood consumption, rising disposable incomes, increased aquaculture output, government backing for sustainable fisheries, and a surge in demand for value-added shrimp items are factors driving the China shrimp market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

3.7 Million Tons |

|

Market Forecast in 2033

|

5.1 Million Tons |

| Market Growth Rate (2025-2033) | 3.65% |

The China shrimp market has been registering significant growth in recent times, with the forces playing at both the consumption and production ends. Rising consumer disposable incomes and shifting eating habits have resulted in an increased level of seafood consumption in general, and shrimp are highly preferred due to their nutritional benefits and general use in Chinese cuisine. Urbanization has also been a factor as more consumers in cities demand high-quality and conveniently processed shrimp products, including frozen and ready-to-cook options. As per Reuters, urbanization rate of the nation is projected to reach 70% in the coming 5 years. Furthermore, improvements in aquaculture technology and government support for sustainable shrimp farming have boosted domestic shrimp production, thereby lessening dependence on imports and market price stabilization.

Shrimp expansion through e-commerce and cold chain logistics is an added benefit as it distributes across China in such a manner that consumers may enjoy the accessibility from both the urban and the rural areas. Market dynamics will be influenced through export opportunities whereby the Chinese shrimp producers seek more penetration into other markets, mostly Asian and North America. In addition, growing health awareness among consumers has led to a preference for high-protein, low-fat seafood such as shrimp, which has further increased demand.

China Shrimp Market Trends:

Rising disposable incomes and changing dietary preferences

Increased disposable incomes, along with swift economic growth in China, have enabled consumers to spend more on a variety of nutritious food choices, like seafood. Shrimp, known for its high protein levels, low fat, and adaptability in both classic and contemporary Chinese dishes, has gained significant popularity. The urbanizing middle-class consumer seeks high-quality, fresh, and conveniently processed shrimp products. This worldwide food trend also boosts the demand for high-quality imported shrimp types. For instance, wild-caught and organic options have become more popular over the years. The swiftly expanding foodservice industry in China, which includes restaurants, hotels, and street vendors, increases demand even more, as shrimp is a key ingredient in popular hotpot, dim sum, and various stir-fried meals. The rise of fast-food and casual dining establishments offering shrimp dishes is further creating a positive China shrimp market outlook.

Advancements in aquaculture and government support

China is one of the top producers of farmed shrimp, and improvements in aquaculture technology have improved shrimp farming efficiency and sustainability in the industry. There have been policies undertaken by the government to fund and support local shrimp farming activities with the hope of leaning away from importation. Better breeding techniques, measures to control disease, and a sustainable feed formulation improved shrimp yield, and helped stabilize an appropriate supply into domestic and export markets. This aside, environmental pressures have also enforced strict regulations regarding the farming practices of shrimp and are promoting ecologically friendly systems for aquaculture, like biofloc technology and RAS. Development of disease-resistant strains of shrimp by government-aided research programs has helped to reduce infections from white spot syndrome and losses from the diseases.

Expansion of e-commerce and cold chain logistics

According to China shrimp market forecast, e-commerce has transformed the mode of shrimp sale in China as it is available to consumers anywhere in the country. According to industry reports, more than 60% of the region’s population prefer online shopping. Online grocery platforms like JD Fresh, Tmall Fresh, and Pinduoduo have increased seafood sales, giving consumers the chance to buy fresh and frozen shrimps. Home delivery can be made upon order. More people consume shrimps mainly because of its convenience in consumption, especially the urban population whose lifestyle is full of busy working schedules. Improvement in cold chain logistics has also ensured efficient distribution of shrimp, and this has led to freshness and quality from farm to table. Investment in refrigerated storage, transport, and last-mile delivery has reduced the incidence of spoilage and reached the remotest of areas with high-quality shrimp.

China Shrimp Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China shrimp market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on environment, domestic production and imports, species, product categories and distribution channel.

Analysis by Environment:

- Farmed

- Wild

Controlled farming of shrimps is now the largest segment in the China shrimp market in terms of environment because it appears to have governmental support and high yields. Farmed shrimp can supply steadily in large volumes, eliminating concerns about seasonal fluctuations and overfishing associated with wild caught shrimps. Improvements in breeding, disease control, and sustainable feeds have increased productivity and made farmed shrimp cheaper for fish producers and consumers alike. Another area of improvement in shrimp farming is efficiency due to the investment China has made in modern aquaculture infrastructure, including biofloc systems and recirculating aquaculture. Demand for consistent quality and traceable seafood products continues to push farmed shrimp into dominance in the market.

Analysis by Domestic Production and Imports:

- Domestic Production

- Imports

The largest percentage in China is domestic production based on the available aquaculture infrastructure in China, government promotions of local shrimp farming, and cost advantages versus imports. Domestic production has enhanced in China. China is actually one of the world's most significant shrimp producing countries. More advanced breeding, disease management technology, and eco-friendly farming enhanced output. Reducing dependence and reliance on importing seafood has therefore strengthened domestic policy. Additionally, lower transportation costs, improved cold chain logistics, and strong demand for locally farmed shrimp in foodservice and retail sectors contribute to its dominance over imports, making it the preferred choice for both businesses and consumers.

Analysis by Species:

- Penaeus Vannamei

- Penaeus Monodon

- Macrobrachium Rosenbergii

- Others

Penaeus vannamei dominates the market due to available aquaculture infrastructure in China, government promotions of local shrimp farming, and cost advantages versus imports. Domestic production has enhanced in China. China is actually one of the world's most significant shrimp producing countries. More advanced breeding, disease management technology, and eco-friendly farming enhanced output. Reducing dependence and reliance on importing seafood has therefore strengthened domestic policy. Additionally, lower transportation costs, improved cold chain logistics, and strong demand for locally farmed shrimp in foodservice and retail sectors contribute to its dominance over imports, making it the preferred choice for both businesses and consumers.

Analysis by Product Categories:

- Peeled

- Shell-on

- Cooked

- Breaded

- Others

Peeled shrimp captures the biggest share in the market segment under product categories because it is convenient and versatile. It takes up less time for preparation, making it a favorite for consumers who want to have ready-to-cook products. Increasing demand for easier meal solutions, particularly for urban groupings, has made peeled shrimp a more preferred commodity among busy households and foodservice groups. Moreover, peeled shrimp is perfect for many cooking purposes, such as stir-fries and sushi, soups, and salads, which increases its market share. It is also easy to handle and store.

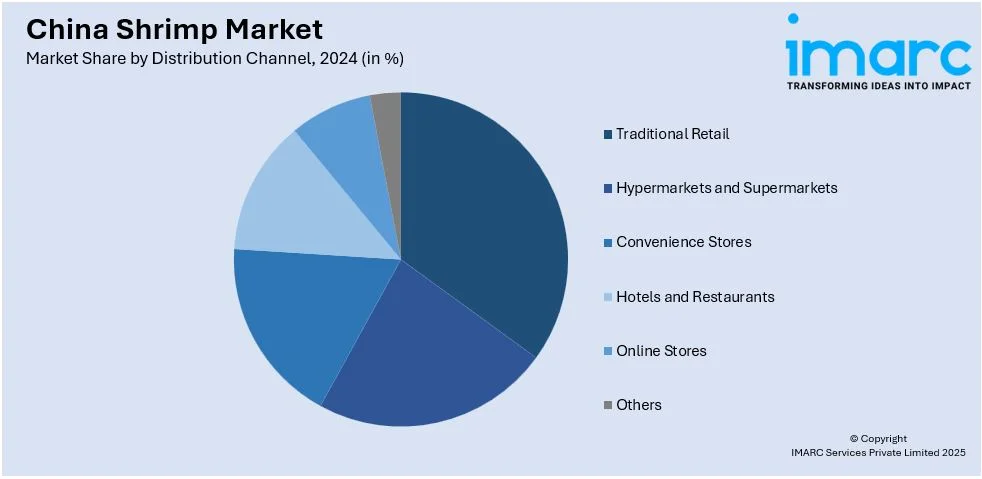

Analysis by Distribution Channel:

- Traditional Retail

- Hypermarkets and Supermarkets

- Convenience Stores

- Hotels and Restaurants

- Online Stores

- Others

Traditional channel holds the biggest share of the shrimp market since local wet markets, small retailers, and neighborhood grocery stores abound in every part of China. Consumers like these channels for convenience: to buy fresh shrimp in smaller quantities and at cheaper prices, more to the taste of budget-conscious buyers and people who prefer buying in person. Moreover, conventional retailers have well-established customer loyalty and trust in rural areas, where online shopping and modern supermarkets are not widespread. This vast accessibility and developed infrastructure continue to lead the market, even with the increasing role of modern retail and e-commerce channels.

Competitive Landscape:

The key drivers for the China shrimp market are increasing disposable incomes and changing dietary preferences. With an expanding middle class in China, consumers are increasingly likely to buy seafood, particularly shrimp, as it is a healthy food, rich in protein, and used in many different dishes. Increased consumption of healthy foods and inclusion in modern as well as traditional preparations have pushed the shrimp demand. Besides, new breeding technologies, better control of disease conditions, and integrated and sustainable aquaculture systems also contribute to shrimp farming, leading to stable availability of this food commodity within the country. The government has also supported the industry through policies that promote sustainable farming and research into disease-resistant shrimp strains, which have further fueled the growth of the market.

Latest News and Developments:

- September 2024: In accordance with the free trade agreement's (FTA) early harvest arrangement, which went into effect on September 1, the first shipment of Honduran whiteleg shrimp officially entered the Chinese market on Sunday under a zero-tariff arrangement, signaling deeper economic and trade ties between China and the Latin American nation.

- June 11, 2024: A Chinese seafood processing facility in Shandong province, Shandong Meijia Group Co., Ltd. (also called Rizhao Meijia Group), was added to the Entity List kept up to date under the Uyghur Forced Labor Prevention Act (UFLPA) by the Forced Labor Enforcement Task Force (FLETF). The federal government will assume that any seafood exported by any Shandong Meijia Group company was produced using forced labor, and as a result, it will not be allowed to enter the United States.

- 13 October 2024: Honduran whiteleg shrimp entered the Chinese market under a zero-tariff arrangement, marking closer economic ties between the two countries. The early harvest arrangement of the China-Honduras Free Trade Agreement took effect on September 1, 2024, facilitating this trade milestone.

- 13 February 2023: Guangdong Haid is investing €1.1 billion in a shrimp farming project in China that will produce 200,000 Metric Tons annually. The company holds a 20% share of the Chinese aquaculture feed market and will supply feed for the new shrimp project. Guangdong Haid has been expanding in fish and shrimp breeding for two decades and partnered with Louis Dreyfus in 2019 to build a feed mill in Tianjin.

- June 23, 2023: As part of the 16th World Chinese Entrepreneurs Convention (WCEC), which will take place in Bangkok from June 24–26, 2023, Thai Union Group PCL will take part in a program for Chinese entrepreneurs. Thai Union will host Chinese businesses at its shrimp plant in Samut Sakhon as part of the initiative. A product tasting exercise and a manufacturing line tour showcasing the production technology will be part of the visit.

China Shrimp Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Farmed, Wild |

| Domestic Production and Imports Covered | Domestic Production, Imports |

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, Others |

| Product Categories Covered | Peeled, Shell-on, Cooked, Breaded, Others |

| Distribution Channels Covered | Traditional Retail, Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Stores, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China shrimp market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China shrimp market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China shrimp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China shrimp market in the region was valued at 3.7 Million Tons in 2024.

The China shrimp market is driven by increasing consumer demand for protein-rich foods, advancements in aquaculture technology, and a growing export market for both fresh and frozen shrimp products.

The China shrimp market is projected to exhibit a CAGR of 3.65% during 2025-2033, reaching a value of 5.1 Million Tons by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)