Global Class D Audio Amplifier Market Expected to Reach USD 6.8 Billion by 2033 - IMARC Group

Global Class D Audio Amplifier Market Statistics, Outlook and Regional Analysis 2025-2033

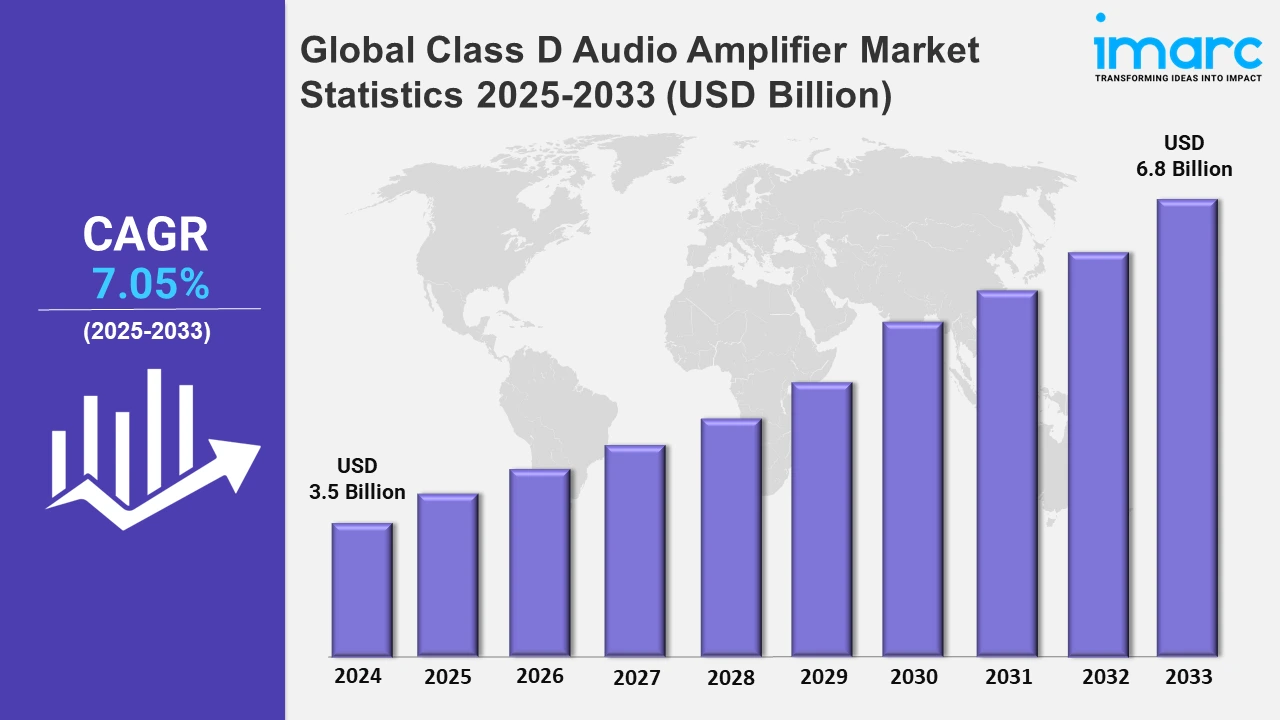

The global class D audio amplifier market size was valued at USD 3.5 Billion in 2024, and it is expected to reach USD 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.05% from 2025 to 2033.

To get more information on this market, Request Sample

Ongoing improvements in digital signal processing technology are enhancing sound quality and energy efficiency in the market for class D audio amplifiers. The increasing use of IoT devices is greatly expanding the need for audio solutions that are integrated. According to IoT Analytics, there was a 20% annual growth in global cellular IoT connections, reaching 3.9 Billion in mid-2024, which is a 181% increase over five years. In late 2024, the number of connections exceeded 4 Billion, making up 22% of the estimated 18.8 Billion worldwide IoT connections. Class D amplifiers, popular for being small and effective, are commonly used in IoT applications. Furthermore, the market growth is being further accelerated by the shift to 5G connectivity and smart electronics. Manufacturers are concentrating on creating high-speed, high-capacity amplifiers designed for gaming and virtual reality uses, guaranteeing a continued growth in the market.

The growing focus on sustainability and energy efficiency is also a key driver for the market. On November 7, 2024, Musway unveiled its new eco-friendly car audio packaging innovations, emphasizing sustainability in materials and design. The company has transitioned to using biodegradable and recycled materials, reducing the size and weight of packaging to minimize waste and transportation emissions. This initiative reflects Musway's commitment to corporate environmental responsibility, setting a new industry standard for sustainable practices in the overall automotive audio market. Apart from this, governments and industries across the globe are requiring eco-friendly practices, speeding up the use of energy-efficient amplifiers in automotive and consumer electronics industries. Moreover, the quick incorporation of high-tech diagnostic and monitoring systems increases the dependability of class D amplifiers, making them well-suited for important uses, such as automotive infotainment and professional audio systems. Due to the rapid expansion of online shopping, the worldwide availability of these cutting-edge amplifiers is increasing, fueling their acceptance and broadening the market's opportunities.

Global Class D Audio Amplifier Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of growing consumer electronics demand, rapid urbanization, increasing disposable incomes, and expanding automotive and entertainment industries.

Asia-Pacific Class D Audio Amplifier Market Trends:

Asia Pacific leads the class D audio amplifier market due to rapid growth in consumer electronics and automotive industries. Currently, 54% of the region’s 2.3 Billion population resides in urban areas. The United Nations projects this figure will rise to 3.5 Billion by 2050, increasing urbanization by 20%. Rising disposable incomes and urbanization drive demand for high-quality audio devices. Key players in the region leverage technological advancements to address diverse applications, such as portable speakers and home theaters, solidifying Asia Pacific’s dominance in the market. This combination of demographic growth and technological innovation positions the region as a leader in global audio amplifier development.

North America Class D Audio Amplifier Market Trends:

The class D audio amplifier market in North America is witnessing steady growth driven by the rising adoption of smart home entertainment systems and advanced audio solutions. Increased investments in consumer electronics innovation and a strong demand for premium audio devices further propel the market. Additionally, the automotive sector's focus on enhanced in-car audio experiences contributes to market expansion in this region.

Europe Class D Audio Amplifier Market Trends:

In Europe, the class D audio amplifier market is growing as consumers increasingly seek energy-efficient and compact audio solutions. The rise of smart devices and streaming services is bolstering demand for advanced audio equipment. Additionally, the region's focus on sustainability aligns with the benefits of Class D amplifiers, such as lower power consumption, further supporting market adoption.

Latin America Class D Audio Amplifier Market Trends:

Latin America’s class D audio amplifier market is expanding due to the growing popularity of home entertainment systems and portable audio devices. Rising consumer spending on electronics and increasing connectivity through streaming platforms are key drivers. The region's burgeoning automotive sector is also contributing to the growing integration of advanced audio systems in vehicles.

Middle East and Africa Class D Audio Amplifier Market Trends:

The Middle East and Africa market for class D audio amplifiers is changing as consumer interest in premium audio devices grows. Expanding smart home technologies and increased demand for portable sound systems are fueling growth in the market. The region's developing automotive market is also supporting adoption, as manufacturers integrate energy-efficient audio solutions into vehicles.

Top Companies Leading in the Class D Audio Amplifier Industry

Some of the leading class D audio amplifier market companies include Analog Devices Inc., Infineon Technologies AG, NXP Semiconductors, ON Semiconductor, Qualcomm Technologies Inc., Renesas Electronics Corporation, ROHM Co. Ltd., Silicon Laboratories, STMicroelectronics, Texas Instruments Incorporated, and Toshiba Corporation, among many others. On September 23, 2024, STMicroelectronics introduced HFA80A automotive-grade class D audio amplifier that combines high efficiency, compact size, and cost-effectiveness, delivering up to 4x 49W into 2Ω speakers with low THD (0.015%). It features optimized load diagnostics, noise cancellation, flat frequency response up to 40kHz (extendable to 80kHz), and advanced protection mechanisms. Designed for automotive applications, it ensures electromagnetic compatibility without extra filtering. Priced from USD 4.80 (1000 units), it comes in a compact 7mm x 7mm LQFP48L package.

Global Class D Audio Amplifier Market Segmentation Coverage

- On the basis of amplifier type, the market has been categorized into mono-channel, 2-channel, 4-channel, 6-channel, and others, wherein mono-channel represents the leading segment. Their popularity is due to their widespread use in compact audio devices, portable speakers, and single-channel applications where size and efficiency are critical. Their simpler design and cost-effectiveness render them ideal for manufacturers targeting budget-friendly consumer segments. Additionally, mono-channel amplifiers are highly favored in automotive audio systems for delivering precise sound control and efficient power distribution.

- Based on device, the market is classified into television sets, home audio systems, desktop and laptops, automotive infotainment systems, and others, amongst which home audio systems dominates the market driven by increasing consumer demand for high-quality sound in home entertainment setups. The growing popularity of smart speakers, soundbars, and home theater systems contributes significantly to this segment. Rising disposable incomes and advancements in wireless connectivity, such as Bluetooth and Wi-Fi integration, further support the adoption of class D amplifiers in modern home audio systems.

- On the basis of end use, the market has been divided into automotive, consumer electronics, and others, wherein consumer electronics represented the largest segment. This is propelled by the rapid adoption of smartphones, tablets, and wearable devices with integrated audio functionalities. The demand for portable and energy-efficient audio solutions is propelling manufacturers to incorporate class D amplifiers into a wide range of devices. Their high efficiency, compact size, and ability to deliver superior audio performance render them indispensable in the consumer electronics industry.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Market Growth Rate 2025-2033 | 7.05% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Amplifier Types Covered | Mono-Channel, 2-Channel, 4-Channel, 6-Channel, Others |

| Devices Covered | Television Sets, Home Audio Systems, Desktop and Laptops, Automotive Infotainment Systems, Others |

| End Uses Covered | Automotive, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., Infineon Technologies AG, NXP Semiconductors, ON Semiconductor, Qualcomm Technologies Inc., Renesas Electronics Corporation, ROHM Co. Ltd., Silicon Laboratories, STMicroelectronics, Texas Instruments Incorporated, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)