Global Dental Bonding Agent Market Expected to Reach USD 34.0 Billion by 2033 - IMARC Group

Global Dental Bonding Agent Market Statistics, Outlook and Regional Analysis 2025-2033

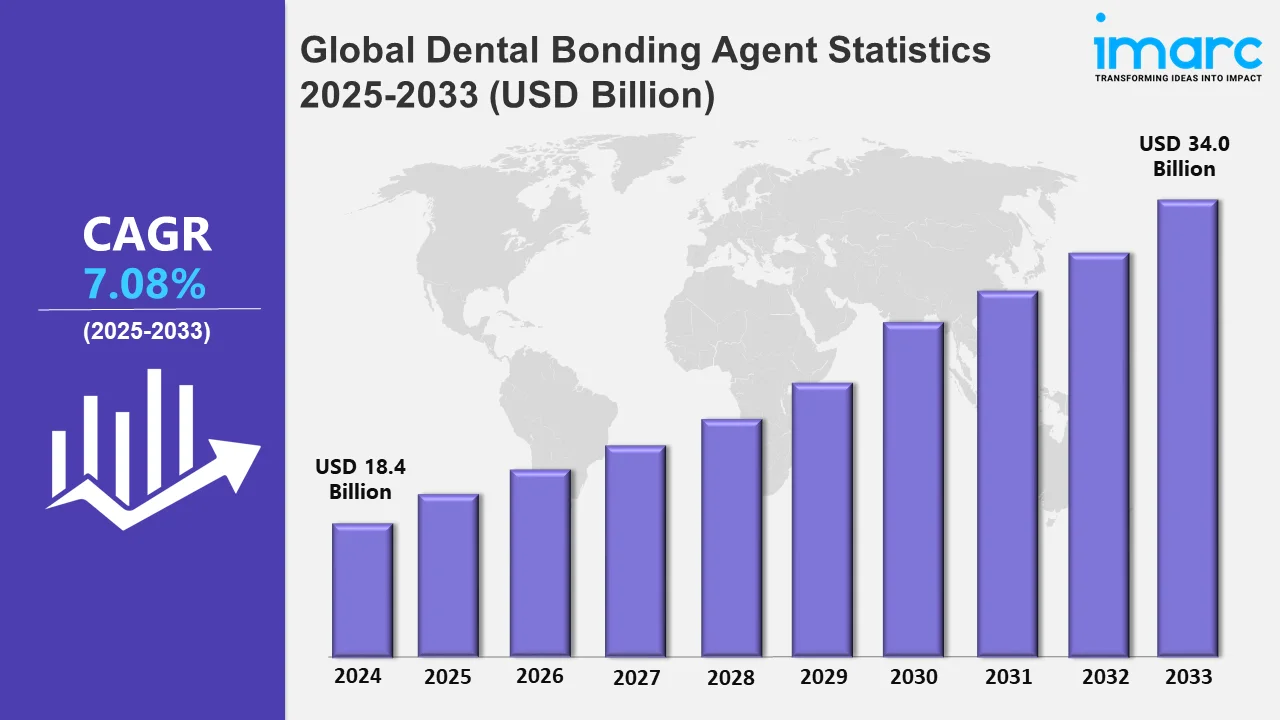

The global dental bonding agent market size was valued at USD 18.4 Billion in 2024, and it is expected to reach USD 34.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.08% from 2025 to 2033.

To get more information on this market, Request Sample

The global dental bonding agent market is experiencing notable growth, driven by advancements in restorative dentistry and a rising focus on aesthetic dental treatments. Increasing demand for cosmetic procedures, such as veneers and composite restorations, is fueling the adoption of high-performance bonding agents that ensure durable adhesion and natural appearances. Additionally, the growing prevalence of dental conditions, including cavities and enamel erosion, underscores the need for effective dental materials. For instance, as per industry reports, around 3.9 billion people globally are living with untreated cavities. Furthermore, innovations in bonding agent formulations, such as universal adhesives with simplified application processes, are reshaping clinical workflows and boosting market penetration. The integration of nanotechnology to enhance bond strength and durability further strengthens the appeal of modern dental bonding agents.

Market trends also highlight the expanding role of digital dentistry, which is driving the adoption of advanced bonding systems compatible with CAD/CAM technologies. The shift towards minimally invasive procedures aligns with the increasing preference for adhesive-based treatments that preserve natural tooth structure. In addition, the increasing number of elderly individuals, especially in advanced economies, is driving a rise in dental appointments and restorative treatments, boosting the need for adhesive materials. For instance, according to the World Health Organization (WHO), Europe's population aged 60 and above is anticipated to reach 247 million by 2030 and exceed 300 million by 2050. In addition, major countries in emerging regions are witnessing rapid growth due to improving dental healthcare infrastructure and increased awareness of oral hygiene. Combined with ongoing product development and regulatory approvals, these factors create a favorable outlook for the global dental bonding agent market.

Global Dental Bonding Agent Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to advanced dental care infrastructure, high awareness, and technological adoption.

North America Dental Bonding Agent Market Trends:

North America leads the global dental bonding agent market due to its advanced healthcare infrastructure, high dental care awareness, and increasing demand for cosmetic dentistry. The region benefits from a significant number of skilled dental professionals and the widespread adoption of advanced dental technologies. In addition, a growing elderly population, coupled with a high prevalence of dental conditions such as cavities and periodontal diseases, drives the demand for restorative treatments. For instance, as per industry reports, the population of Americans aged 65 and above is expected to grow from 58 million in 2022 to 82 million by 2050, reflecting a 47% rise. Moreover, strong support for research and innovation in dental materials, along with robust reimbursement policies, further strengthens North America's position as the leading regional market.

Asia-Pacific Dental Bonding Agent Market Trends:

Asia Pacific is one of the major regions in growth potential within the global dental bonding agent market, primarily because of the magnifying awareness regarding oral health, notable emergence of dental tourism, and proliferating healthcare infrastructure. Nations such as China and India are experiencing substantial requirement, fostered by rapid innovations in dental treatment methods and elevating disposable incomes.

Europe Dental Bonding Agent Market Trends:

Europe represents a significant share in the dental bonding agent market, mainly impacted by magnified incidents of dental disorders and an increasing aging population. Robust utilization of cutting-edge dental technologies and the establishment of leading healthcare systems in countries such as the UK, Germany, and France, further boost the market growth significantly.

Latin America Dental Bonding Agent Market Trends:

Latin America is exhibiting a stable expansion in the dental bonding agent market, typically attributed to the heavy investments in healthcare infrastructure and accelerating awareness associated with oral hygiene. Countries such as Mexico and Brazil are critical contributors to regional market growth, heavily profiting from a magnifying middle class and government ventures incentivizing oral healthcare solutions.

Middle East and Africa Dental Bonding Agent Market Trends:

The MEA region portrays gradual expansion in the dental bonding agent market, mainly propelled by enhancing healthcare access and increasing dental awareness. The market demand is specifically elevating in the Gulf countries because of the rising emphasis on aesthetic dentistry among privileged populations and bolstering investments in leading-edge dental clinics.

Top Companies Leading in the Dental Bonding Agent Industry

Some of the leading dental bonding agent market companies include 3M Company, BISCO Inc., Danaher Corporation, Dentsply Sirona, DMG America LLC, GC America Inc. (GC Corporation), SHOFU Inc., VOCO GmbH, among many others. In November 2024, Solventum, a spin-off of 3M Company, launched its new 3M Clarity Precision Grip Attachments for aligner treatment in orthodontic segment. These attachments are particularly designed to cater to the prevalent difficulties related to aligner treatment, like staining-resistance, durability, and accurate shaping.

Global Dental Bonding Agent Market Segmentation Coverage

- On the basis of the type, the market has been categorized into self-etch and total-etch, wherein self-etch represent the leading segment. This is attributed to their simplified application process and reduced risk of post-operative sensitivity. In addition, these agents eliminate the need for separate etching, making them highly efficient and time-saving for dental procedures, particularly in restorative dentistry and composite resin bonding.

- Based on the end user, the market is classified into hospitals, dental clinics, ambulatory surgical centers, and others, amongst which dental clinics dominates the market. This leading segment is driven by their widespread availability and high patient preference for specialized care. Clinics frequently adopt advanced bonding agents to improve procedural outcomes and enhance patient satisfaction. Furthermore, their robust focus on efficient, high-quality restorative treatments significantly contributes to their market leadership.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 18.4 Billion |

| Market Forecast in 2033 | USD 34.0 Billion |

| Market Growth Rate 2025-2033 | 7.08% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Self-Etch, Total-Etch |

| End Users Covered | Hospitals, Dental Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, BISCO Inc., Danaher Corporation, Dentsply Sirona, DMG America LLC, GC America Inc. (GC Corporation), SHOFU Inc., VOCO GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)