CAT Cable Cost Structure: Materials, Production & Performance Economics

_11zon.webp)

What is CAT Cable?

CAT (Category) cables are twisted-pair Ethernet cables utilized for copper-based wired network communications, varying from CAT5e to CAT8 standards.

Key Applications Across Industries:

The cables carry data through copper conductors, but with different speeds (up to 40 Gbps for CAT8) and bandwidths, supporting networks such as LANs, data centers, and smart buildings. The most common variants are unshielded (UTP) for standard use and shielded (STP/FTP) for high-interference networks. The demand for stable, high-speed connectivity within enterprises, industrial IoT, and residential networks drives the market. As PoE and 5G backhaul join the fray, CAT cables continue to be essential with fiber optic competition, with cost-effective, plug-and-play solutions available for short-range data transmission.

What the Expert Says: Market Overview & Growth Drivers

The India CAT cables market reached USD 112.0 Million in 2024. According to IMARC Group, the market is projected to reach USD 308.7 Million by 2033, at a projected CAGR of 11.8% during 2025-2033. Digital transformation powers the CAT cable market as enterprises move to CAT6A/CAT7 for high-bandwidth applications (e.g., cloud computing, 4K video). 5G deployment requires strong wired backhaul infrastructure, and smart city initiatives and industrial automation depend on CAT cables for PoE-based devices (e.g., cameras, sensors).

Data center upgrades prefer CAT6A+ for 10G/40G networks, and the work-from-home culture increases residential installation demand. Cost benefits over fiber optics (up to 50% cheaper for short-distance applications) and commoditization via standardized RJ-45 drive adoption in SMEs and legacy infrastructure. Asia-Pacific emerging markets (India's Digital India Mission, for example) and Latin America invest in structured cabling to penetrate broadband. Advances in technology such as shielded designs (crosstalk reduction) and LSZH (Low Smoke Zero Halogen) jackets (fire protection) cater to niche demands. That said, raw material price fluctuations (copper) and fiber optic competition in long-distance applications are challenges.

Case Study on Cost Model of CAT Cable Manufacturing Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a large-scale CAT cable manufacturing plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed CAT cable manufacturing plant in Tamil Nadu, India. This plant is designed to produce 100 km of CAT cable per day.

Manufacturing Process: Fabrication of CAT cables starts with the drawing of high-purity copper or aluminum rods through dies for accurate conductor diameters followed by annealing for increased flexibility and conductivity. Preheating sets the conductors up for insulation, where plastic-like PVC or HDPE is extruded over every wire to protect the signal from interference. Sophisticated tandem extrusion can apply insulation and initial jacketing at the same time for convenience. Insulated cables are then twisted into pairs in precisely calculated rates to reduce crosstalk, a key process for signal integrity in Ethernet standards (CAT5e to CAT8). Shielded versions (STP/FTP) have aluminum foil or braided metal layers added to prevent electromagnetic interference. The constructed core is sheathed with robust outer jackets (PVC/LSZH) to provide mechanical and environmental protection, with flame-retardant compounds reserved for safety-critical installs. Along the production line, automated equipment performs concurrent quality assurance, testing electrical parameters (impedance, attenuation), dimensions, and tensile strength. Final cables are wound onto RFID-monitored reels with samples going through strict certification (e.g., TIA/EIA-568) prior to shipping. New factories deploy Industry 4.0 technologies such as AI-based defect detection and automated packaging by robots to guarantee consistency for applications from data centers to PoE-powered IoT networks. The process strikes the balance between accuracy (i.e., ±0.01mm conductor tolerance) and scalability to achieve worldwide demand for high-speed structured cabling.

_11zon.webp)

Mass Balance and Raw Material Required: The primary raw materials used in the CAT cable manufacturing plant include CCA (Copper Clad Aluminium), insulation PE, outer PVC, copper wire, aluminium mesh, aluminum foil and cross.

For a plant producing 1 km of CAT 5E cable, 0.005 tons of CCA (Copper Clad Aluminium), 0.004 tons of insulation PE, 0.013 tons of outer PVC, and 0.021 tons of copper wire is required.

Additionally, a plant producing 1 km of CAT 6 cable requires 0.005 ton of CCA (Copper Clad Aluminium), 0.004 tons of insulation PE, 0.016 tons of outer PVC, and 0.026 tons of copper wire.

For a plant producing 1 km of CAT 6A cable, 0.006 tons of CCA (Copper Clad Aluminium), 0.004 tons of insulation PE, 0.016 tons of outer PVC, and 0.027 tons of copper wire is required.

_11zon.webp)

Moreover, for a plant producing 1 km of CAT 7 cable, 0.003 tons of CCA (Copper Clad Aluminium), 0.002 tons of insulation PE, 0.010 tons of outer PVC, 0.016 tons of copper wire, 0.002 tons of aluminium mesh, and 0.002 tons of aluminium foil is required.

Furthermore, for a plant producing 1 km of CAT 8 cable, 0.005 tons of CCA (Copper Clad Aluminium), 0.003 tons of insulation PE, 0.017 tons of outer PVC, 0.030 tons of copper wire, 0.002 tons of aluminium mesh, 0.001 tons of aluminium foil, and 0.002 tons of cross is required.

_11zon.webp)

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

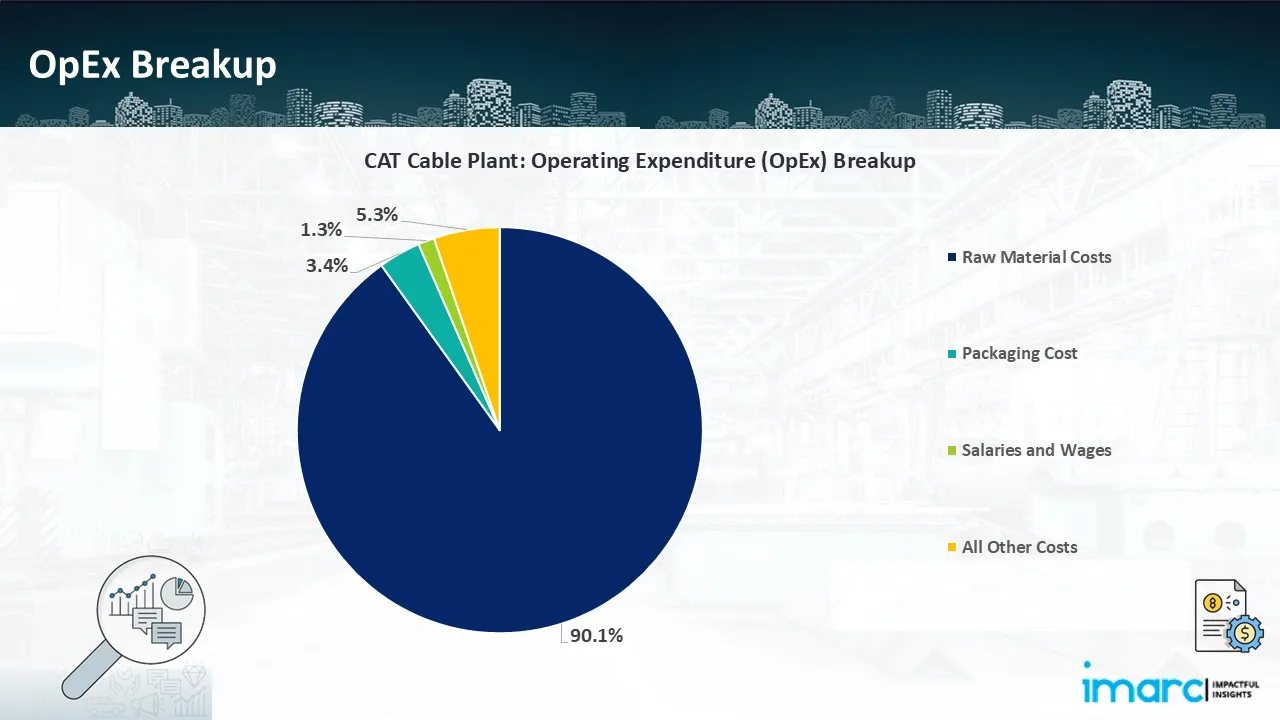

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

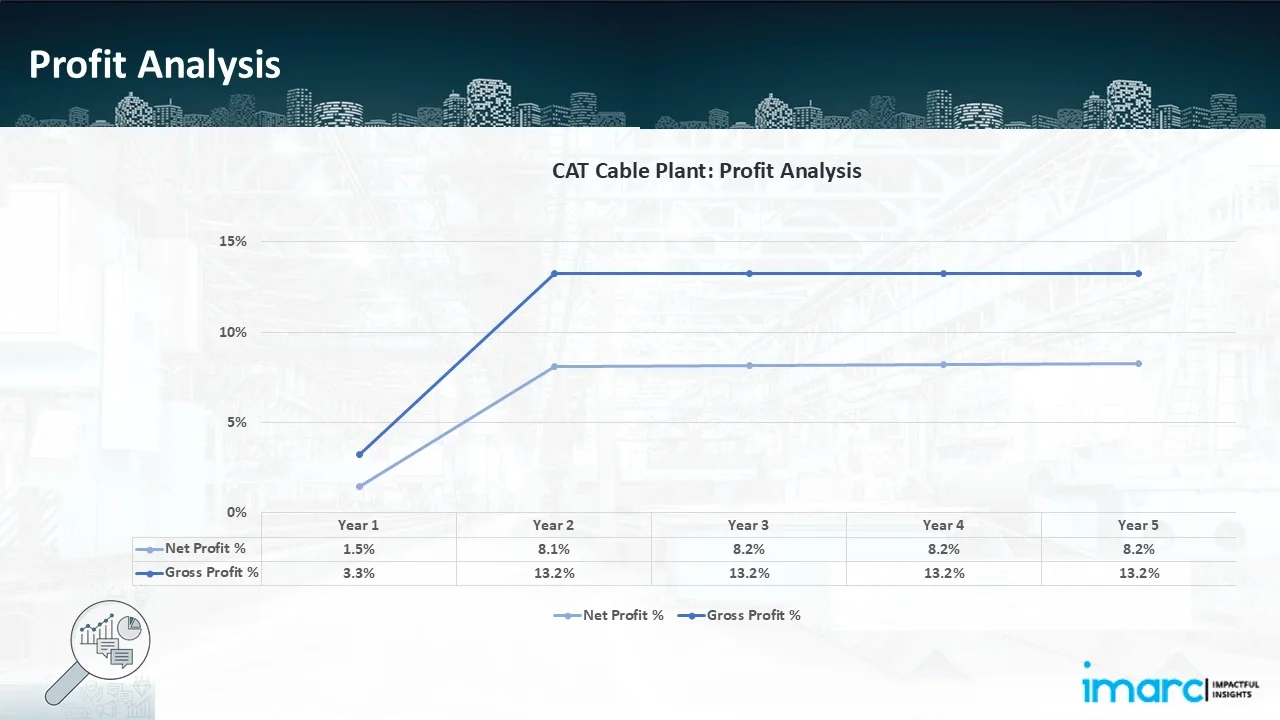

- Profitability Analysis Year on Year Basis: The proposed CAT cable plant, with a capacity of 100 km of CAT cable per day, achieved an impressive revenue of US$ 14.0 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins improve from 3.3% to 13.2% by year 5, and net profit rises from 1.5% to 8.2%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the CAT cable manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of producing 100 km of CAT cable per day, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

- In June 2025, compact RJ45 keystone modules for Cat 6 and Cat 6A applications have been released by Panduit. These modules provide the connectivity required for the ever-increasing demands of building wiring and are readily installed into conventional keystone jacks from a range of switch manufacturers. The performance of the network depends on how well the jack and cable are connected.

- In May 2025, global supplier of comprehensive connectivity solutions Belden Inc. has announced the release of its 10GXM13 Category 6A Cable. This 0.230" (5.84 mm) cable expands on Belden's dominance in the smart infrastructure market and establishes new benchmarks for Category 6A cables with small diameters.

Why Choose IMARC?

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104