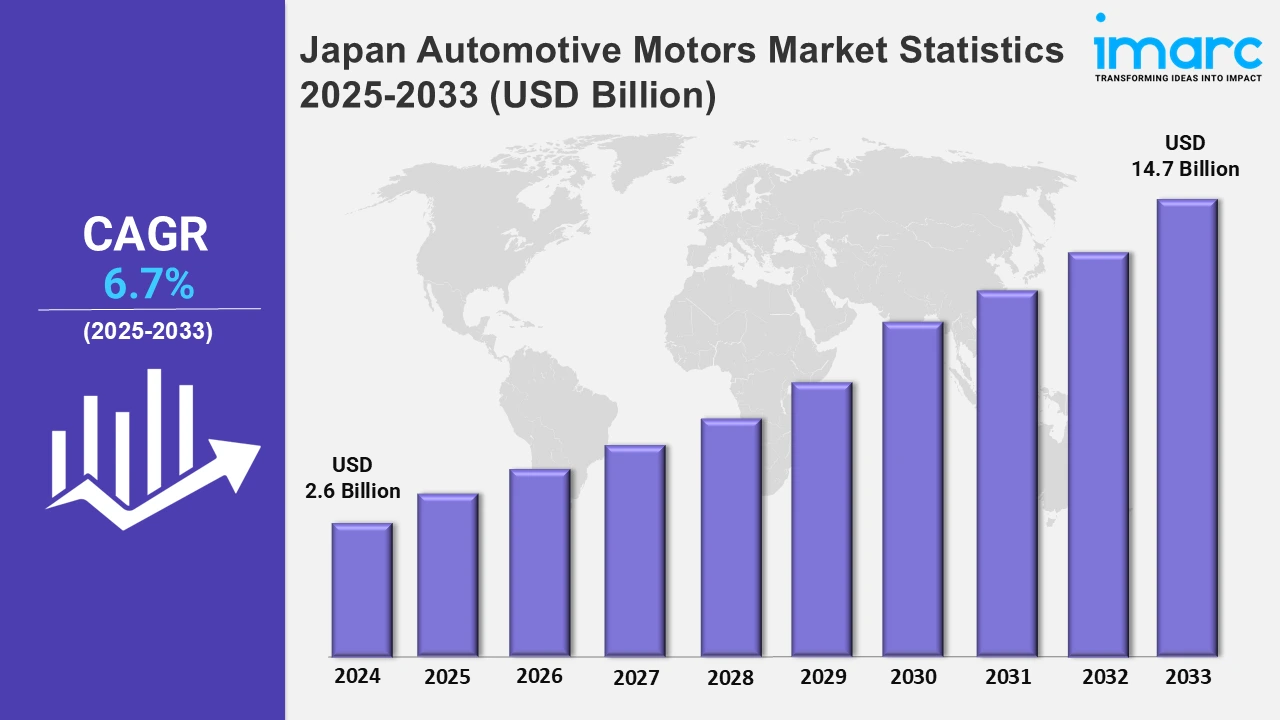

Japan Automotive Motors Market Expected to Reach USD 14.7 Billion by 2033 - IMARC Group

Japan Automotive Motors Market Statistics, Outlook, and Regional Analysis 2025-2033

The Japan automotive motors market size was valued at USD 2.6 Billion in 2024, and it is expected to reach USD 14.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.7% from 2025 to 2033

To get more information on this market, Request Sample

Sustainability initiatives and innovative advancements are factors responsible for the growth of the automotive motors industry in Japan. In addition, the growing emphasis on hybrid and electric vehicles is stimulated by government incentives and inflating preference for eco-friendly transportation options, further accelerating the market growth. Similarly, the widespread usage of compact and reasonably priced cars emphasizes the market's need for effective and reasonably priced solutions. Also, manufacturers are taking advantage of these trends to launch advanced models that are suited to Japanese consumers' tastes and demonstrate affordability and innovative technology. Reflecting this trend, Suzuki launched the India-made Fronx compact SUV in Japan in October 2024, which aligns with the requirement for vehicles that incorporate affordability with high quality, accentuating India's production capabilities in meeting international standards.

Concurrent with this, Hyundai's introduction of the compact EV in January 2025 marked a prominent milestone by becoming the most affordable electric car in Japan at ¥2.84 Million. This movement seeks to encourage sustainable transportation alternatives and hasten the adoption of automotive vehicles in Japan's price-sensitive car sector. The introduction of innovative hybrid models further supports the market's transition to sustainable vehicles. In line with these advancements, Toyota unveiled the Alphard and Vellfire plug-in hybrid electric vehicles in December 2024. These models, which are the first minivan PHEVs in Japan, have a 72 km electric-only range and meet environmental and family-oriented goals. Toyota's dedication to matching its products with Japan's carbon-neutral targets while offering customers more comfort and usefulness is demonstrated by this development. Correspondingly, fuel economy, cutting-edge safety features, and hybrid-electric technology are now leading priorities for automakers to complete changing consumer expectations and legal necessities. In addition to illustrating the market's evolution, these patterns also point to its potential as a pioneer in next-generation mobility solutions.

Japan Automotive Motors Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. These regions have implemented strict environmental rules, which are elevating the market.

Kanto Region Automotive Motors Market Trends:

The Kanto region compels developments in autonomous vehicles and hybrid technology with a focus on autonomous systems and AI integration. Reflecting this trend, Nissan's Leaf is a primary example, showcasing innovations in battery efficiency and endurable design. The region benefits from cutting-edge research hubs, including Kanagawa, which pioneers battery recycling processes. This focus on eco-friendly automotive motors supports growing exports to Europe and strengthens Kanto’s market standing.

Kansai/Kinki Region Automotive Motors Market Trends:

Kansai, including Osaka and Kyoto, excels in electrifying public transport. BYD's electric buses, adopted in Kyoto, highlight the region’s progress in reducing emissions through sustainable urban mobility. Local suppliers play a vital role in producing key EV components and exporting to China and Southeast Asia. With Osaka as a logistics hub, Kansai’s investments in battery technologies and charging infrastructure further enhance its competitive edge in the automotive motor market.

Central/Chubu Region Automotive Motors Market Trends:

In the Chubu region, Toyota’s headquarters is situated and is the backbone of Japan’s automotive motors industry, which majorly contributed to the market growth. The region focuses on hydrogen fuel cells and hybrid motors, with Toyota's Mirai leading hydrogen innovation. Advanced manufacturing facilities in Aichi ensure efficient production of eco-friendly motors for international markets, particularly Europe and North America. Chubu’s integration of robotics in production aligns with its reputation as a center of high-tech automotive manufacturing excellence.

Kyushu-Okinawa Region Automotive Motors Market Trends:

Automotive motors for cars like the Nissan Ariya are the specialty of the Kyushu region, catalyzing industry growth. Moreover, this area exports motors to Southeast Asian markets by making use of its geographic location. Also, Okinawa's foremost priority is to promote small EVs for eco-tourism. Besides this, the region's sustainability is improved by renewable energy projects, notably solar-powered enterprises in Miyazaki.

Tohoku Region Automotive Motors Market Trends:

Tohoku, comprising Miyagi and Fukushima, focuses on cold-resistant EV motors suited for icy climates. Tohoku has emerged as a hub for specialized motors made by Miyagi to serve markets in Scandinavia, where low-temperature efficiency is crucial. The region leverages renewable energy sources, which support environmental objectives. Moreover, this focus on innovation and green energy has solidified the region's position as an integral contributor to the multinational automotive supply chain.

Chugoku Region Automotive Motors Market Trends:

Chugoku region is home to Mazda's SkyActiv engine technology, which prioritizes lower emissions and fuel efficiency, thereby positively contributing to the automotive motors sector. Mazda’s production of hybrid motors for export to North America showcases the region’s engineering strengths. Hiroshima’s proximity to major ports aids in efficient distribution. Chugoku’s focus on sustainable internal combustion and hybrid systems ensures its continued relevance in both domestic and international automotive markets.

Hokkaido Region Automotive Motors Market Trends:

Hokkaido prioritizes EV motor systems designed for extreme cold, addressing challenges in sub-zero battery performance. Sapporo’s research facilities develop cold-resistant technologies exported to Northern Europe and Canada. The region also explores renewable energy integration, such as geothermal power, to support sustainable production. Hokkaido’s innovations cater to regions with harsh winters, enhancing its role in the market for climate-adapted automotive motors.

Shikoku Region Automotive Motors Market Trends:

Shikoku, known for precision engineering, excels in producing niche motor components for EVs and hybrids. Ehime’s factories supply advanced parts to leading automakers like Subaru, reinforcing its position in the supply chain. The region’s compact industry emphasizes quality and innovation, catering to rising demand in Japan and Southeast Asia. Shikoku’s focus on efficient production methods aligns with its strategy to minimize environmental impact while boosting output.

Top Companies Leading in the Japan Automotive Motors Industry

Some of the leading automotive motors market companies include Nidec Corporation, Johnson Electric Holdings Limited, Mabuchi Motor Co. Ltd., MinebeaMitsumi Inc., and Mitsuba Corporation, among many others. These firms are leading innovation in the automotive motors sector by focusing on developments in vehicle motor technology, energy-efficient systems, and partnerships with automakers to fulfill the growing demand for high-performance vehicles. Suzuki launched the India-made Fronx compact SUV in Japan in October 2024, which aligns with the requirement for vehicles.

Japan Automotive Motors Market Segmentation Coverage

- On the basis of the motor type, the market has been bifurcated into brushed DC motor, brushless DC motor, stepper motor, and traction motor. Brushed DC motors are adopted for their simple design and cost-effectiveness, primarily in basic automotive functions. In contrast, brushless DC motors provide higher efficiency and durability, suitable for advanced applications like electric vehicles and automation.

- Based on the vehicle type, the market is categorized into electric vehicle (BEV and PHEV) and non-electric vehicle (passenger, LCV, and HCV). Electric vehicles are driving motor demand due to the growing adoption and sustainability focus. Non-electric vehicles, spanning passenger cars, LCVs, and HCVs, also significantly utilize motors for essential functionalities.

- On the basis of the sales channel, the market has been divided into original equipment manufacturer (OEM) and aftermarket. Original equipment manufacturers supply motors directly to automotive production lines, ensuring seamless integration. The aftermarket provides replacement motors and upgrades, catering to diverse customer needs and extending vehicle operational lifespan.

- Based on the application, the market is categorized into safety, comfort, and performance. Motors enhance safety through features like advanced braking and stability systems, improve comfort via climate control and seat adjustments, and boost performance in drivetrains, contributing to better efficiency and vehicle reliability.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.6 Billion |

| Market Forecast in 2033 | USD 14.7 Billion |

| Market Growth Rate 2025-2033 | 6.7% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Motor Types Covered | Brushed DC Motor, Brushless DC Motor, Stepper Motor, Traction Motor |

| Vehicle Types Covered |

|

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Applications Covered | Safety, Comfort, Performance |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Nidec Corporation, Johnson Electric Holdings Limited, Mabuchi Motor Co. Ltd., MinebeaMitsumi Inc., Mitsuba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Automotive Motors Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)