Japan Automotive Sensors Market Expected to Reach USD 2.9 Billion by 2033 - IMARC Group

Japan Automotive Sensors Market Statistics, Outlook and Regional Analysis 2025-2033

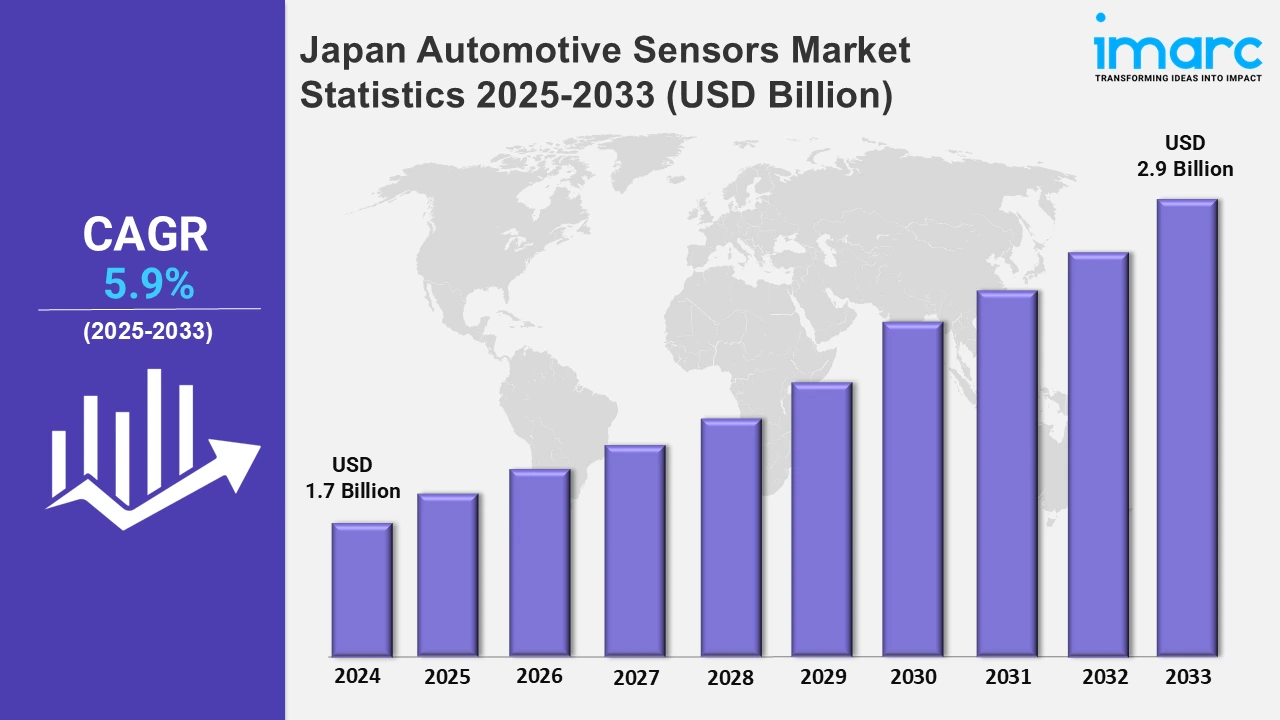

The Japan automotive sensors market size was valued at USD 1.7 Billion in 2024, and it is expected to reach USD 2.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.9% from 2025 to 2033.

To get more information on this market, Request Sample

The growing emphasis on strict safety regulations and the rising usage of autonomous driving technology are augmenting the automotive sensors market in Japan. At the same time, the government's efforts to support electric vehicles and driverless cars further fuel the expansion of the market. Moreover, the demand for precise sensing technologies and the incorporation of sensors into ADAS platforms are contributing to the market growth in this country. Aligned with these trends, Sony Semiconductor Solutions introduced the ISX038 CMOS image sensor in October 2024, which can output RAW and YUV images simultaneously. Also, the architecture of automobile camera systems is created more easily by this breakthrough, which is essential for ADAS and autonomous driving features. The sensor is a significant advancement for the Japanese automobile industry as it reduces the space, cost, and power needs of these systems.

Correspondingly, Nuvoton Technology Corporation launched a 3D Time-of-Flight (TOF) sensor in July 2024, which is capable of precise object recognition and distance measurement in difficult circumstances. Its significance in improving the security and effectiveness of autonomous motorcars is accentuated by its real-time imaging capabilities and adherence to ASIL B safety regulations. Furthermore, these advancements indicate how advanced sensors are increasingly used in Japan's automobile sector to meet strict safety and performance requirements. Besides this, the necessity for high-performance and reasonably priced components and the trend toward vehicle electrification are inflating the automotive industry in Japan. Sensors that maximize battery performance, keep an eye on environmental conditions, and ensure occupant safety are becoming necessary as EV adoption picks up speed. For example, Murata Manufacturing released the SCH1633-D01 6DoF MEMS sensor in November 2024, specially designed for ADAS, autonomous driving, and vehicle stability control. This further solidifies Japan's position as a pioneer in invention and safety standards by completing the increasing demand for precise and affordable sensing solutions in the country's automotive industry with features including high integration, compliance, and robust performance.

Japan Automotive Sensors Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The emerging demand for eco-friendly automobiles with sensors for fuel efficiency is bolstering the market.

Kanto Region Automotive Sensors Market Trends:

In the automotive sensors industry, the demand for autonomous driving technologies is advancing in the Kanto region. Adaptive cruise control and LiDAR sensors are given priority in urban centers due to the high volume of traffic. Yokohama is also focused on improving sensor-driven safety features for electric vehicles. At the same time, Kanto's focus on smart mobility is demonstrated by Nissan's PrPILOT Assist, which uses advanced sensors to enable lane-centering and traffic-jam management.

Kansai/Kinki Region Automotive Sensors Market Trends:

The Kansai region places a strong emphasis on creating eco-friendly sensors for electric and hybrid cars. The area's R&D centers focus on reducing carbon emissions by enhancing battery management sensors for energy optimization. Panasonic, headquartered in Osaka, has pioneered thermal sensors for EV battery safety, ensuring precise heat regulation. These innovations align with regional efforts to lead green automotive technologies and meet stringent emissions regulations.

Central/Chubu Region Automotive Sensors Market Trends:

As Japan's manufacturing hub, home to Toyota’s headquarters in Aichi, the Chubu region drives innovations in engine management and emission sensors. With a strong industrial base, the area emphasizes sensors that improve fuel efficiency and reduce environmental impact. Toyota’s hybrid vehicles, such as the Prius, integrate advanced sensors for combustion monitoring. These developments highlight Chubu's leadership in sustainable automotive sensor technology catering to international standards.

Kyushu-Okinawa Region Automotive Sensors Market Trends:

Kyushu and Okinawa, including Fukuoka, are expanding the use of IoT-enabled sensors in connected and autonomous vehicles. The region focuses on smart city integration, where sensors enhance interaction between vehicles and infrastructure. Mazda, with production facilities in Kyushu, leverages communication sensors to optimize the flow of traffic, decrease congestion, and enhance safety. These advancements align with the region's vision of interconnected transportation systems for future mobility.

Tohoku Region Automotive Sensors Market Trends:

The Tohoku region, including Sendai, focuses on cold-climate sensor technologies suited to harsh winter conditions. Sensors that ensure vehicle function in cold weather, including advanced traction control and stability systems, have experienced a heightened demand. Subaru's Tohoku research and development center develops all-wheel-drive systems with unique sensors to improve dependability and safety on ice roads. Furthermore, these developments manage the region's particular weather-related issues.

Chugoku Region Automotive Sensors Market Trends:

The Chugoku region showcases developments in pedestrian detection sensors and crash avoidance. Mazda is a major player in the development of sensors for active safety systems that use radar and cameras. In addition, Mazda's i-Activsense suite improves obstacle recognition and braking reaction in congested cities by combining these technologies. This reflects Chugoku’s commitment to reducing traffic accidents through innovative sensor-driven solutions.

Hokkaido Region Automotive Sensors Market Trends:

Hokkaido’s automotive sensor market focuses on applications for autonomous agriculture and heavy-duty vehicles. The region's snowy terrain and vast farmland create demand for sensors that enhance efficiency and safety in off-road conditions. Radar and GPS sensors are pivotal in ensuring precision and durability. For instance, tractors in Hokkaido employ obstacle detection systems, enabling reliable operations in challenging environments and supporting the region's agricultural economy.

Shikoku Region Automotive Sensors Market Trends:

Shikoku, known for its rural landscapes, emphasizes sensors for small electric vehicles and last-mile logistics. Tokushima leads regional efforts in lightweight and energy-efficient sensor technologies, particularly for compact EVs used in local transportation networks. Pressure sensors designed to optimize EV tire performance are increasingly popular, enhancing safety and efficiency. This focus on niche applications positions Shikoku as a significant contributor to specialized automotive sensor innovations.

Top Companies Leading in the Japan Automotive Sensors Industry

The report offers a detailed analysis of the competitive landscape in Japan's automotive sensors market. At the same time, it delivers complete profiles of leading businesses operating in the sector. Nuvoton Technology Corporation launched a 3D Time-of-Flight (TOF) sensor in July 2024, which is capable of precise object recognition and distance measurement in difficult circumstances. Sony Semiconductor Solutions introduced the ISX038 CMOS image sensor in October 2024, which can output RAW and YUV images simultaneously.

Japan Automotive Sensors Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into level/position sensors, temperature sensors, pressure sensors, speed sensors, gas sensors, magnetic sensors, and others. Measures specific parameters like position, temperature, or pressure enable precision in automotive systems, industrial operations, and consumer applications. They are tailored to specific functional requirements across diverse sectors and environments.

- Based on the vehicle type, the market is categorized into passenger cars and commercial vehicles. Sensor technology addresses passenger or commercial vehicle needs with efficiency and performance optimization for diverse automotive categories, thereby enhancing user experience and ensuring safety and regulatory compliance.

- On the basis of the application, the market has been divided into powertrain, chassis, vehicle body electronics, safety and security, telematics, and others. These systems contribute to operational efficiency and enhanced functionality by integrating advanced sensors within specific automotive or industrial applications to meet precise requirements.

- Based on the sales channel, the market is categorized into original equipment manufacturer (OEM) and aftermarket. These channel offers tailored solutions through original manufacturing or aftermarket channels, ensuring seamless integration, replacement, and upgrades for diverse industries while maintaining performance standards and meeting evolving technological demands effectively.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Market Growth Rate 2025-2033 | 5.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Level/Position Sensors, Temperature Sensors, Pressure Sensors, Speed Sensors, Gas Sensors, Magnetic Sensors, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Applications Covered | Powertrain, Chassis, Vehicle Body Electronics, Safety and Security, Telematics, Others |

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Automotive Sensors Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)