Japan Biochips Market Expected to Reach USD 76.0 Billion by 2033 - IMARC Group

Japan Biochips Market Statistics, Outlook and Regional Analysis 2025-2033

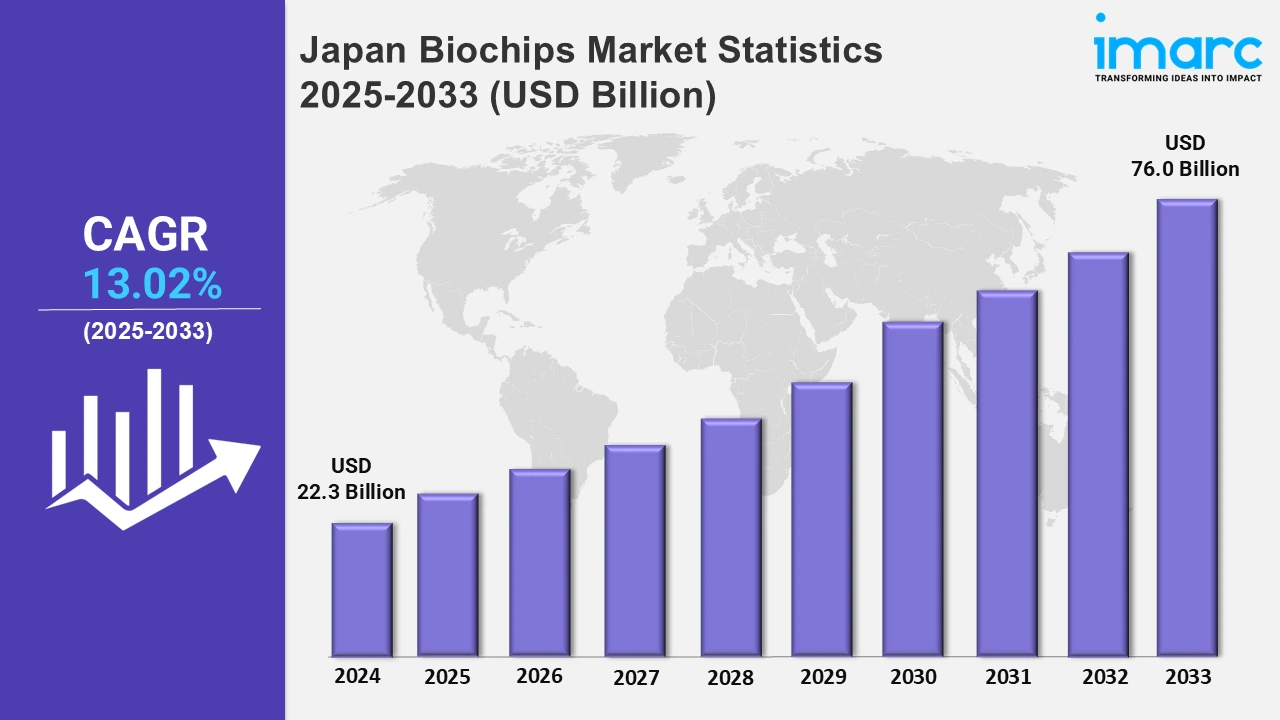

The Japan Biochips market size was valued at USD 22.3 Billion in 2024, and it is expected to reach USD 76.0 Billion by 2033, exhibiting a growth rate (CAGR) of 13.02% from 2025 to 2033.

To get more information on this market, Request Sample

The rising adoption of biochip technologies in the medical sector is bolstering the market. Factors such as the increasing demand for personalized medicine, developments in genomics, and the growing focus on cost-effective diagnostic solutions are creating lucrative opportunities for biochip development and application. Additionally, the Japanese government’s emphasis on healthcare innovation and investments in advanced research and development (R&D) are fueling the market growth. Major players in Japan are actively working towards integrating cutting-edge imaging technologies into biochips, enhancing precision and efficiency. For instance, in January 2025, Coherent Corp launched pin-hole array biochips for gene sequencing and diagnostics. These biochips incorporate imaging components like dichroic mirrors, facilitating high-throughput diagnostics while supporting advancements in personalized medicine and reducing diagnostic costs. The increasing need for miniaturized diagnostic platforms further supports the rapid technological evolution in the biochip sector. The surge in the prevalence of chronic diseases, the aging population in Japan, and the demand for point-of-care diagnostic solutions are fostering the adoption of lab-on-a-chip technologies.

Companies are focusing on designing compact and efficient biochips to meet these growing demands. For example, in March 2024, Archer Materials unveiled a miniaturized graphene field-effect transistor (gFET) biochip. This innovation is a breakthrough for lab-on-a-chip platforms, offering enhanced production capabilities and precise detection of biologically relevant targets. Such advancements are poised to strengthen Japan’s position in the biochips market. Additionally, the integration of chemiluminescent biochip technology is transforming toxicology diagnostics in Japan. The expanding applications of biochips in forensic and clinical matrices, coupled with a strong focus on improving diagnostic accuracy, are creating new growth avenues. A notable example includes the introduction of a multi-analyte immunoassay platform by Biochip Array Technology, enabling the simultaneous detection of over 600 drug metabolites. This platform is revolutionizing toxicology diagnostics by providing reliable results across various matrices, further cementing Japan’s role as a leader in biochip innovations. In conclusion, advancements in imaging, miniaturization, and multi-analyte detection, coupled with a robust R&D ecosystem, are key drivers propelling the growth of Japan’s biochips market.

Japan Biochips Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The Kanto region is dominating the market due to chronic disease prevalence, nanotechnology advancements, microchip innovations, and supportive government initiatives enhancing healthcare infrastructure.

Kanto Region Biochips Market Trends:

The Kanto region, including Tokyo, is leading in biochips market innovation due to its advanced biotechnology infrastructure. Rising investments by firms like Hitachi in nanotechnology and bioinformatics are elevating the market. For instance, Japan's National Cancer Center in Tokyo actively utilizes biochips for cancer research. A strong academic-industry collaboration is propelling personalized medicine, creating vast potential for biochip applications in diagnostics and therapy.

Kansai/Kinki Region Biochips Market Trends:

The Kansai/Kinki region, encompassing Osaka, excels in biochip manufacturing due to its pharmaceutical base. Osaka University has pioneered lab-on-chip devices for genetic studies. Companies such as Sysmex Corporation in Kobe are advancing healthcare technologies by integrating biochips into hematology analyzers. The presence of world-class research facilities supports the expansion of biochips for drug discovery and disease modeling, positioning Kansai as a biotech hub.

Central/Chubu Region Biochips Market Trends:

The Central/Chubu region, home to Nagoya, is progressing in biochip automation for agricultural biotechnology. With Toyota Industries’ diversification into biosensors, the region is enhancing crop disease detection. Research institutes in Aichi prefecture are developing biochips for monitoring soil nutrients and addressing smart agriculture needs. This innovation fosters food security while supporting biochip adoption in sustainable farming practices, making the Central/Chubu region a leader in agri-biochip advancements.

Kyushu-Okinawa Region Biochips Market Trends:

Kyushu-Okinawa emphasizes biochip applications in marine biotechnology. With Okinawa's Institute of Science and Technology (OIST) exploring DNA sequencing chips, this region is improving marine species conservation. Biochips are aiding coral reef monitoring in the Ryukyu Islands. Companies like Daiichi Seiko are integrating biochips into aquaculture solutions, enhancing the sustainable fish farming sector, a critical industry for Kyushu’s economy.

Tohoku Region Biochips Market Trends:

The Tohoku region, including Sendai, focuses on biochip applications in disaster response healthcare. Following the 2011 earthquake, universities like Tohoku University developed biochip-based portable diagnostic tools for emergency medicine. These devices enable rapid pathogen detection during crises. Regional partnerships in Iwate are advancing biochip-based immunoassays to manage outbreaks, underlining Tohoku's role in emergency-ready biotechnologies and healthcare solutions.

Chugoku Region Biochips Market Trends:

The Chugoku region, centered around Hiroshima, is leveraging biochips for radiation exposure studies. Research institutions in Hiroshima are developing biochips to monitor radiation-induced DNA damage, benefiting cancer treatment. Shimane University focuses on biochips for detecting environmental pollutants. Collaboration with local firms is driving market penetration in environmental health applications, making Chugoku a hub for biochips in eco-health technologies.

Hokkaido Region Biochips Market Trends:

The Hokkaido region is pioneering biochips for cold-climate agricultural research. With Sapporo Agricultural University studying frost-resistant crops using biochip-based genetic profiling, the region ensures food security. Companies like Hokkaido Bio-Industry Co. Ltd. are commercializing biochips for dairy quality control and optimizing livestock productivity. These innovations highlight Hokkaido’s contribution to agro-biotech advancements in cold environments, promoting regional economic growth.

Shikoku Region Biochips Market Trends:

Shikoku focuses on biochip innovations for pharmaceutical quality assurance. Tokushima-based institutes are creating microfluidic biochips for drug testing, improving efficiency in medication development. Companies like Nichia Corporation are exploring biochips for bioluminescent assays in new drug discoveries. Shikoku’s focus on niche pharmaceutical applications highlights its growing role in Japan’s biochip market, leveraging regional expertise to enhance biotech capabilities.

Top Companies Leading in the Japan Biochips Industry

The market research report provides a detailed analysis of Japan's biochip market, which thrives on R&D innovation driven by government-backed public-private partnerships. Takeda's 2024 launch of FRUZAQLA capsules underscores advances in drug discovery. Frequent product launches and academic collaborations drive growth. Japan’s leadership continues as emerging technologies meet expanding demands for diagnostics, agriculture, and beyond.

Japan Biochips Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into DNA chip, protein chip, lab-on-a-chip, and enzyme chip. These product types represent diverse biochip technologies enabling advanced biomolecular analysis, miniaturized assays, and multifunctional platforms for diagnostics, drug discovery, and personalized medicine applications.

- Based on the fabrication technique, the market is categorized into microarray and microfluidic. Microarray and microfluidic technologies in biochips facilitate high-throughput biomolecular analysis, integrating precise fluid handling and spatially organized arrays to enable miniaturized, efficient, and cost-effective diagnostic and research solutions.

- On the basis of the analysis method, the market has been divided into electrophoresis, luminescence, mass spectrometry, electrical signals, and magnetism. These analysis methods are instrumental techniques incorporated into biochip systems, advancing molecular detection, and quantification offer high precision and sensitivity in varied applications.

- Based on the application, the market is categorized into molecular analysis (hybridization, protein, immunological, biomolecules, biomarker, and others), diagnosis (gene diagnosis, oncology, inflammatory, and others), and non-biological usage. Biochips enable molecular analysis, enhance diagnostic accuracy, and expand into non-biological applications, revolutionizing fields such as environmental monitoring, food safety testing, and forensic investigations with rapid, reliable results.

- On the basis of the end user, the market has been divided into pharmaceutical and biotechnology companies, hospitals and diagnostics centers, academic and research institutes, and others. These end users extensively adopt biochips, driving innovation in diagnostics, drug development, personalized medicine, and advanced scientific research.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 22.3 Billion |

| Market Forecast in 2033 | USD 76.0 Billion |

| Market Growth Rate 2025-2033 | 13.02% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | DNA Chip, Protein Chip, Lab-On-a-Chip, Enzyme Chip |

| Fabrication Techniques Covered | Microarray, Microfluidic |

| Analysis Methods Covered | Electrophoresis, Luminescence, Mass Spectrometry, Electrical Signals, Magnetism |

| Applications Covered |

|

| End Users Covered | Pharmaceutical and Biotechnology Companies, Hospitals and Diagnostics Centers, Academic and Research Institutes, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Biochips Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)