Japan Electric Two-Wheeler Batteries Market Size, Share, Trends and Forecast by Battery Type, Vehicle Type, and Region, 2026-2034

Japan Electric Two-Wheeler Batteries Market Overview:

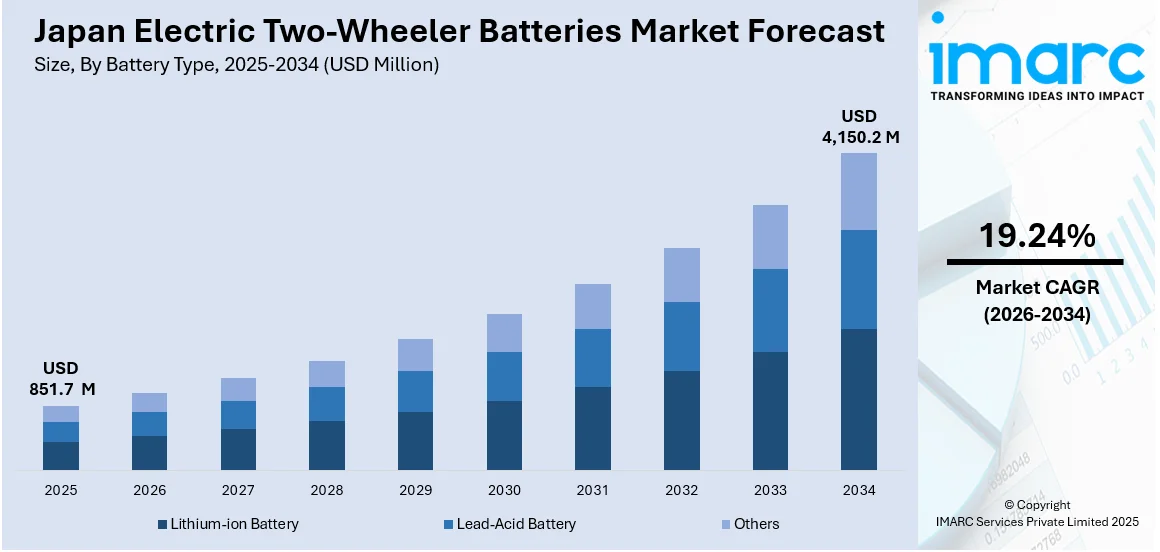

The Japan electric two-wheeler batteries market size reached USD 851.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,150.2 Million by 2034, exhibiting a growth rate (CAGR) of 19.24% during 2026-2034. The market is driven by rising urban environmental concerns, government incentives for clean mobility, growing demand for energy-efficient transport, and technological advancements in battery systems. These factors collectively contribute to the increasing Japan electric two-wheeler batteries market share across both consumer and commercial segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 851.7 Million |

| Market Forecast in 2034 | USD 4,150.2 Million |

| Market Growth Rate 2026-2034 | 19.24% |

Japan Electric Two-Wheeler Batteries Market Trends:

Technological Innovations in Battery Chemistry

Advancements in battery technology are central to the evolution of the Japan electric two-wheeler batteries market. Manufacturers are focusing on enhancing energy density, safety, and overall performance through innovations in battery chemistry. Lithium-ion batteries remain prevalent due to their high energy storage capacity and longevity. Additionally, research into solid-state batteries promises even greater energy density and improved safety features, potentially revolutionizing the market. These technological strides are crucial for improving the efficiency and reliability of two-wheeler batteries, making them more appealing to consumers and manufacturers alike. As battery technology continues to advance, the Japan electric two-wheeler batteries market growth is expected to accelerate, offering more efficient and sustainable transportation options. For instance, in January 2025, Yadea launched a groundbreaking electric two-wheeler powered by sodium-ion battery technology, marking a significant shift in the electric mobility sector. The sodium batteries offer improved safety, environmental sustainability, and cost efficiency compared to lithium batteries. With high energy density, fast charging, and long lifespan, Yadea’s sodium-powered electric vehicle aims to revolutionize the market, especially in colder regions, while supporting the global green mobility trend.

To get more information on this market Request Sample

Expansion of Battery-Swapping Infrastructure

The development of battery-swapping infrastructure is gaining momentum in Japan, addressing concerns related to charging times and battery lifespan. Companies like Honda and Yamaha are leading initiatives to establish standardized swappable battery systems, facilitating quick and convenient exchanges for users. This approach mitigates the need for prolonged charging periods, enhancing the practicality of electric two-wheelers for daily use. Collaborations among manufacturers and energy providers are further accelerating the deployment of battery-swapping stations across urban areas. As the infrastructure expands, the adoption of electric two-wheelers is expected to increase, contributing to the overall growth of the Japan electric two-wheeler batteries market. For instance, as per September 2024 industry reports, Gachaco, a battery swap alliance formed by Honda, Yamaha, Kawasaki, Suzuki, and ENEOS, aims to accelerate Japan's electric motorcycle market. Honda and Yamaha's collaboration on battery sharing technology allows them to jointly produce batteries for electric motorcycles. This cooperation supports Japan's electrification.

Government Incentives and Regulatory Support

Government policies play a pivotal role in shaping the Japan electric two-wheeler batteries market. The Japanese government has introduced various incentives, including tax reductions and subsidies, to encourage the adoption of electric vehicles and the development of supporting infrastructure. These measures not only reduce the financial burden on consumers but also stimulate investment in EV technologies and infrastructure. Moreover, stringent emissions regulations are compelling manufacturers to innovate and produce cleaner, more efficient vehicles. Such regulatory frameworks are instrumental in accelerating the transition towards sustainable transportation solutions, thereby fostering the growth of the Japan electric two-wheeler batteries market. For instance, in September 2024, Japan approved ¥347.9 billion ($2.4 billion) to fund 12 electric vehicle (EV) battery projects, aiming to boost domestic production capacity to 150 GWh per year by 2030. Key projects include partnerships with Panasonic, Subaru, Nissan, and Toyota for lithium-ion and LFP battery production. The initiative is part of Japan's broader Green Transformation policy to enhance EV affordability and reduce foreign dependency on battery supplies.

Japan Electric Two-Wheeler Batteries Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecast at the country/regional level for 2026-2034. Our report has categorized the market based on battery type and vehicle type.

Battery Type Insights:

- Lithium-ion Battery

- Lead-Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion battery, lead-acid battery, and others.

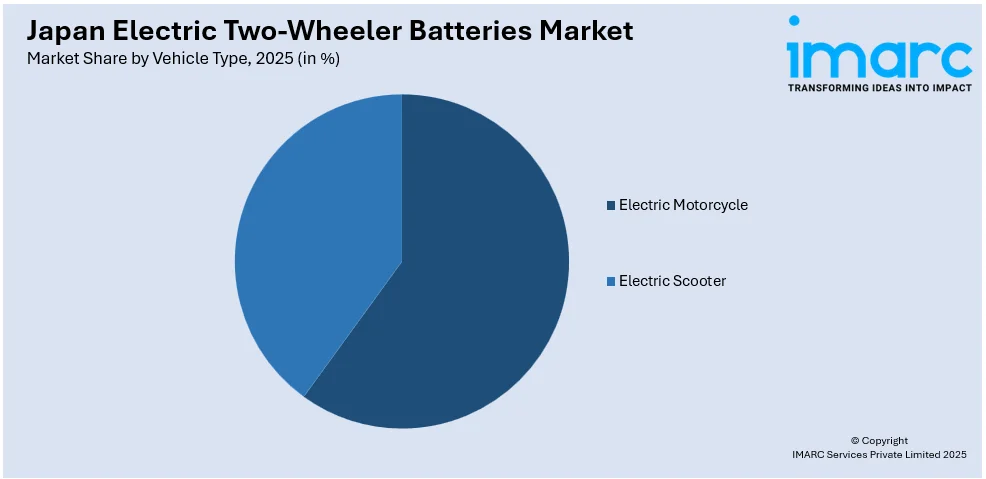

Vehicle Type Insights:

Access the comprehensive market breakdown Request Sample

- Electric Motorcycle

- Electric Scooter

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes electric motorcycle and electric scooter.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Electric Two-Wheeler Batteries Market News:

- In December 2024, BYD partnered with e-bike manufacturer TAILG to enhance the electric two-wheeler market. The collaboration focuses on developing high-performance electric bikes, combining BYD's battery technology with TAILG's e-bike expertise. This partnership aims to expand BYD's presence in the global e-mobility sector, offering sustainable transportation solutions.

- In November 2024, Honda unveiled a demonstration production line for all-solid-state batteries in Sakura City, Tochigi Prefecture, Japan. This line, which begins production in January 2025, aims to establish mass production processes for next-generation batteries with high energy density and durability. Honda’s goal is to apply these batteries to various mobility products, including cars, motorcycles, and aircraft, by the second half of the 2020s.

Japan Electric Two-Wheeler Batteries Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion, Lead-Acid Battery, others |

| Vehicle Types Covered | Electric Motorcycle, Electric Scooter |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan electric two-wheeler batteries market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan electric two-wheeler batteries market on the basis of battery type?

- What is the breakup of the Japan electric two-wheeler batteries market on the basis of vehicle type?

- What is the breakup of the Japan electric two-wheeler batteries market on the basis of region?

- What are the various stages in the value chain of the Japan electric two-wheeler batteries market?

- What are the key driving factors and challenges in the Japan electric two-wheeler batteries?

- What is the structure of the Japan electric two-wheeler batteries market and who are the key players?

- What is the degree of competition in the Japan electric two-wheeler batteries market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan electric two-wheeler batteries market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan electric two-wheeler batteries market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan electric two-wheeler batteries industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)