Japan Ethnic Foods Market Expected to Reach USD 6.4 Billion by 2033 - IMARC Group

Japan Ethnic Foods Market Statistics, Outlook and Regional Analysis 2025-2033

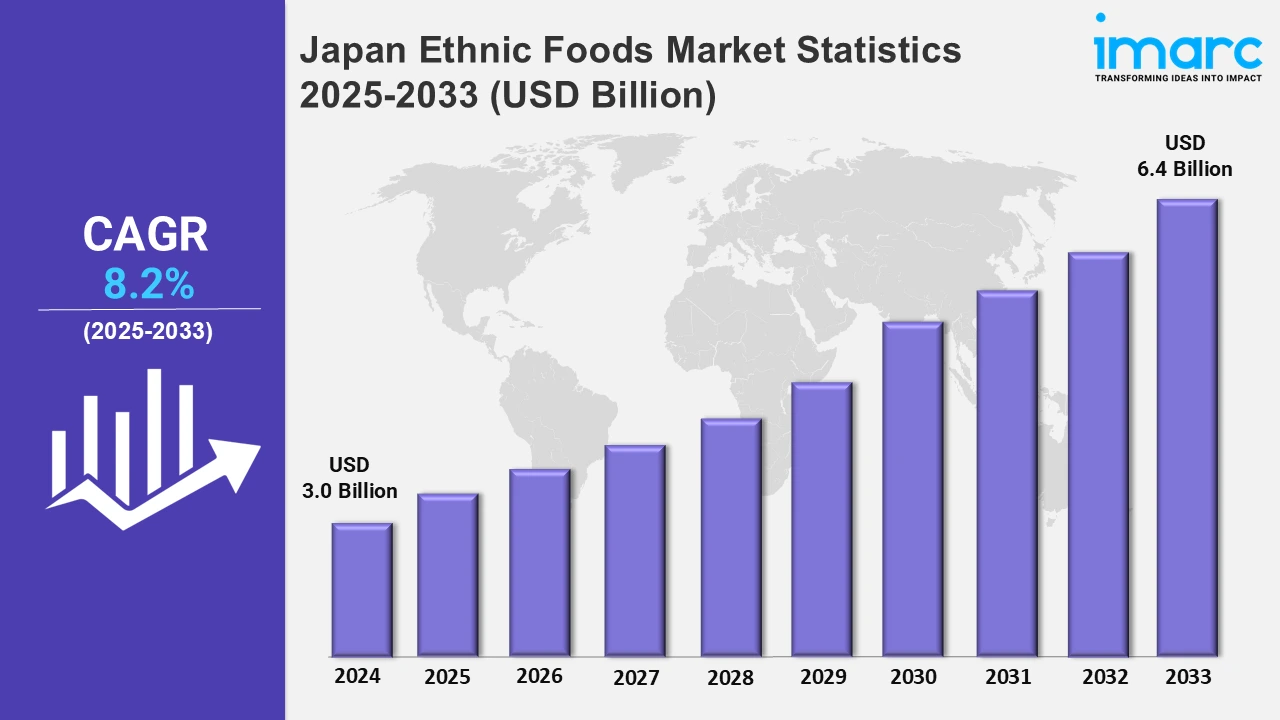

The Japan ethnic foods market size was valued at USD 3.0 Billion in 2024, and it is expected to reach USD 6.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.2% from 2025 to 2033.

To get more information on this market, Request Sample

The expanding popularity of Japanese ethnic foods and the increasing focus on sustainability are the factors fostering growth in the market. As consumers become more health-conscious and seek authentic culinary experiences, traditional cuisine is gaining traction for its unique taste and cultural significance. Rising disposable incomes and urbanization are further fueling the demand for premium ethnic food products, with dishes like osechi ryori and snacks like takoyaki capturing attention. Moreover, innovative strategies by Japanese retailers to modernize traditional offerings, such as introducing AI-curated osechi, are attracting younger audiences and revitalizing interest in traditional dishes, helping to counteract declining demand for classic New Year cuisine. In September 2024, retailers in the country introduced AI-curated osechi, blending traditional dishes with innovative elements like karaage garnished with gold powder. This approach appeals to younger consumers who value both novelty and cultural preservation.

Concurrently, in May 2024, Osechi Ryori, Japan's traditional New Year cuisine, gained recognition for its symbolic dishes such as Kuromame, representing health, and Kobu Maki, symbolizing happiness. These dishes showcase Japan's cultural richness and highlight the growing appeal of its ethnic food traditions. Also, these developments are reinforcing the position of Japanese ethnic foods as a blend of cultural pride and culinary innovation by merging tradition with modern tastes and preserving cultural authenticity. Another important factor is the increasing emphasis on sustainability within the food industry. Japanese ethnic foods often feature ingredients derived from sustainable practices, aligning with environmental goals and consumer demand for eco-friendly products. As highlighted in an article published by The Japan News in November 2024, land-based seaweed cultivation is gaining traction, with the cultivation of Sujiaonori using the Kochi method as a prime example. This method preserves the traditional Aonori culture, essential for iconic ethnic dishes like okonomiyaki and takoyaki, while supporting decarbonization and sustainability. Such developments demonstrate the country’s dedication to blending tradition with innovation to address contemporary challenges, thereby ensuring the continued relevance and growth of its ethnic food market.

Japan Ethnic Foods Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Demographic changes, health awareness, government initiatives, food technology progress, and food tourism growth are major factors fueling Japan's market expansion.

Kanto Region Ethnic Foods Market Trends:

The Kanto region shows increasing demand for halal-certified products due to its diverse population and tourism. Ethnic restaurants, such as Pakistani curry houses in Kawasaki, are thriving. Also, in October 2024, the Great Big Rice Festival in Ibaraki highlighted Kanto’s rice culture with mochi pounding, Koshihikari rice promotions, and local cuisine, fostering an appreciation for ethnic foods and regional agriculture through interactive experiences. Furthermore, convenience stores are introducing bento boxes tailored to Filipino and Vietnamese preferences, reflecting the growing expatriate communities.

Kinki Region Ethnic Foods Market Trends:

In Japan's Kinki region, the demand for international cuisine has grown significantly, which is positively impacting the market. Local supermarkets, such as AEON, offer diverse options, including barbeque kits, catering to both residents and visitors. In addition, fusion dishes incorporating unique flavors into traditional recipes, like variations of yakiniku, highlight how culinary trends are influencing preferences in the area. Besides, this trend showcases the evolving tastes and expanding diversity in the region's food culture.

Central/Chubu Region Ethnic Foods Market Trends:

The Chubu region, known for Nagoya, reflects a rising interest in Southeast Asian cuisine. Thai green curry pastes and Vietnamese pho kits are becoming mainstream in local grocery stores. Companies like Kaldi Coffee Farm are expanding their ethnic product ranges here. As per the article published by EAT LIVE FOODIE in August 2024, Chubu's ethnic cuisine, featuring Hida beef, Nagoya's miso katsu, and Shizuoka green tea, showcases its culinary richness, aligning with the region's increasing demand for diverse flavors, including Brazilian staples like pao de queijo in Aichi Prefecture.

Kyushu-Okinawa Region Ethnic Foods Market Trends:

In Kyushu-Okinawa, ethnic food trends focus on incorporating local ingredients like goya (bitter melon) and mozuku (seaweed) into dishes inspired by foreign cuisines. Moreover, restaurants in Okinawa creatively adapt traditional dishes like soki soba with modern and ethnic-inspired flavors. Also, Fukuoka sees rising popularity in ethnic street foods fused with local specialties. These trends reflect the region’s culinary diversity, with strong influences from Okinawan traditional diets.

Tohoku Region Ethnic Foods Market Trends:

The Tohoku region blends ethnic food influences with local products like sansai and rice. Morioka’s wanko soba has inspired ethnic adaptations, incorporating spicy broths and international sauces. Local festivals increasingly feature such fusion dishes, reflecting the growing interest in flavors. Besides this, restaurants in Miyagi Prefecture are experimenting with incorporating miso-based broths in ethnic-style curries, appealing to both traditional and modern tastes.

Chugoku Region Ethnic Foods Market Trends:

In Chugoku, ethnic foods are reinterpreted with the region’s fresh seafood and mountain vegetables. Hiroshima’s okonomiyaki-inspired ethnic creations, such as those with unique spice blends, are gaining traction. Specialty products from Okayama, like kibi dango, are also finding their way into ethnic-inspired desserts. Moreover, fusion dishes showcasing Chugoku’s local specialties help create a distinctive take on ethnic food trends in Japan.

Hokkaido Region Ethnic Foods Market Trends:

Hokkaido’s ethnic food trends focus on using its dairy and agricultural abundance. Ethnic-style soups and stews featuring potatoes, butter, and corn are increasingly popular in the region. Local restaurants innovate with fusion dishes like dairy-rich curry soups, blending Hokkaido and ethnic culinary techniques. Prefectures like Sapporo lead in promoting these trends during food festivals, drawing attention to the region’s rich ingredients.

Shikoku Region Ethnic Foods Market Trends:

Shikoku highlights its iconic udon noodles by fusing them with ethnic flavors. Prefectures like Kagawa experiment with adding unique spices and broths, creating dishes like ethnic-inspired curry udon. Tokushima incorporates local produce like sudachi (citrus) in ethnic noodle salads, offering fresh, region-specific flavors. Shikoku’s focus on premium noodles and local ingredients drives innovation in Japan’s ethnic food market.

Top Companies Leading in the Japan Ethnic Foods Industry

The report offers a detailed analysis of Japan's ethnic foods industry, highlighting competitive factors like market structure, key player positioning, and strategies. According to a June 2024 Statista report, ethnic restaurants in Japan featuring Western and Southeast Asian cuisines generated approximately ¥ 1.54 trillion in revenue in 2023, underscoring their critical role in the dining sector. The analysis includes company evaluation quadrants and profiles of major players, showcasing their strategies and contributions to this thriving market.

Japan Ethnic Foods Market Segmentation Coverage

- On the basis of the cuisine type, the market has been bifurcated into American, Chinese, Japanese, Mexican, Italian, and others. These cuisine types showcase unique ingredients and preparation techniques rooted in cultural heritage. Also, it provides traditional flavors, thereby offering an array of dishes that cater to diverse palates and culinary preferences.

- Based on the food type, the market is categorized into vegetarian and non-vegetarian. Ethnic foods incorporate vegetarian dishes, such as Japanese tofu-based meals or Indian lentil curries, alongside non-vegetarian options, including Mexican carnitas or Italian seafood. This diversity reflects cultural traditions and dietary practices within various regional cuisines.

- On the basis of the distribution channel, the market has been divided into food services and retail stores. Food services and retail stores enhance accessibility to ethnic cuisines by offering ready-to-eat meals, spices, and specialty ingredients. They enable consumers to explore authentic flavors while supporting the preservation and spread of culinary traditions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Market Growth Rate 2025-2033 | 8.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Cuisine Types Covered | American, Chinese, Japanese, Mexican, Italian, Others |

| Food Types Covered | Vegetarian, Non-Vegetarian |

| Distribution Channels Covered | Food Services, Retail Stores |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ethnic Foods Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)