Japan Image Sensors Market Expected to Reach USD 3,415.8 Million by 2033 - IMARC Group

Japan Image Sensors Market Statistics, Outlook and Regional Analysis 2025-2033

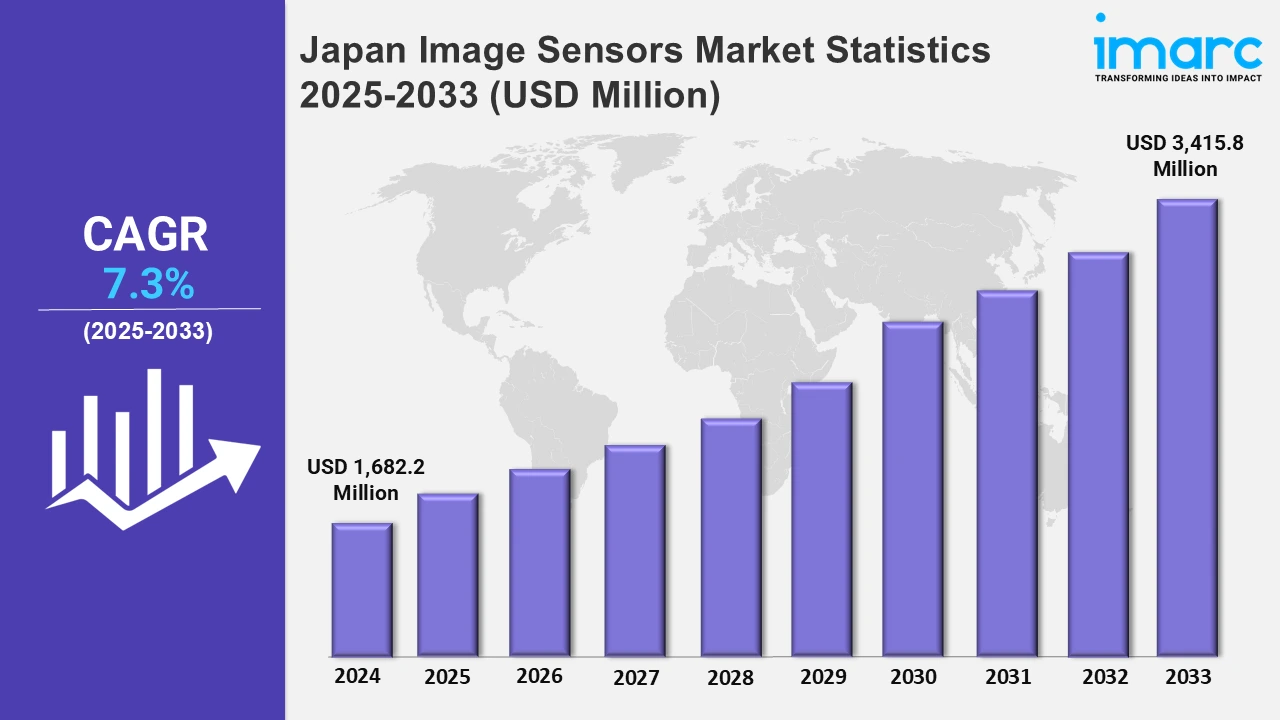

The Japan image sensors market size was valued at USD 1,682.2 Million in 2024, and it is expected to reach USD 3,415.8 Million by 2033, exhibiting a growth rate (CAGR) of 7.3% from 2025 to 2033.

To get more information on this market, Request Sample

Japan’s image sensor industry is experiencing increased investment in advanced semiconductor materials, enhancing development, production, and quality evaluation capabilities. This shift supports innovation in wafer processing, photolithography, and color filter materials, driving higher-performance imaging solutions for evolving technological applications. For instance, in September 2024, FUJIFILM Corporation invested ¥ 20 Billion to expand its semiconductor materials business in Japan. This initiative enhances the development, production, and quality evaluation of advanced materials, including those used in wafer processing, photolithography, and image sensor color filters.

Additionally, advancements in automotive imaging technology are shaping Japan’s image sensor market, enhancing ADAS, autonomous driving, and infotainment systems. Improved image processing capabilities enable better environment detection, recognition accuracy, and AR-based driver assistance, contributing to safer, smarter, and more efficient mobility solutions in the evolving automotive industry. For instance, in October 2024, Sony Semiconductor Solutions Corporation unveiled the ISX038 CMOS image sensor for automotive cameras, capable of simultaneously processing and outputting RAW and YUV images. This enhances ADAS, autonomous driving, and infotainment applications by improving environment detection, recognition, and AR-based features. Besides this, with rising investment in smart factories, automation, and security systems, Japan's industrial sector is experiencing a surge in demand for high-precision image sensors. Machine vision systems rely on high-resolution, high-speed, and infrared-capable sensors for defect detection, quality control, and robotic guidance. Similarly, surveillance cameras use AI-powered facial recognition, night vision, and motion detection to improve security monitoring. The emergence of smart cities and IoT-based security infrastructure drives up demand for high-sensitivity, wide dynamic range (WDR), and low-power sensors, establishing Japan as a major player in industrial and security imaging.

Japan Image Sensors Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The increasing R&D investments and government-backed semiconductor initiatives are driving the adoption of image sensors in Japan.

Kanto Region Image Sensors Market Trends:

Kanto, home to Tokyo, remains a hub for advanced image sensor development. The automotive, consumer electronics, and surveillance sectors drive the region's demand. Tokyo's leading tech companies, like Sony, continue innovating with CMOS sensors, offering superior performance in low-light conditions. Recent advancements include real-time image processing systems, boosting applications in autonomous vehicles, and security cameras.

Kansai/Kinki Region Image Sensors Market Trends:

The region’s diverse industrial sectors fuel Kansai’s demand for image sensors. Sensors for robots and industry automation have increased in Osaka, a major Kansai city. Production lines are increasingly using image sensors for quality control. For instance, operational efficiency is being increased by Panasonic's developments in image sensors for smart manufacturing. In this area, AI integration with image technology is also becoming more popular.

Central/Chubu Region Image Sensors Market Trends:

The Central/Chubu region, with cities like Nagoya, specializes in automotive sensors, especially in electric and autonomous vehicles. Image sensors in this region are integral to driver assistance systems (ADAS). The region’s expertise in automotive manufacturing, with giants like Toyota, is driving the adoption of high-precision image sensors for monitoring road conditions. Recently, there’s been a rise in demand for high-definition cameras and advanced driver-assistance features in smart vehicles.

Kyushu-Okinawa Region Image Sensors Market Trends:

In Kyushu-Okinawa, the image sensor market is influenced by both the consumer electronics and agriculture sectors. Fukuoka and Kagoshima are witnessing increased use of sensors in precision agriculture, where they monitor crop health. Image sensors in drones and robots are becoming common for capturing high-resolution aerial images. Kyushu's growing focus on smart agriculture solutions is advancing image sensors’ role in sustainable farming practices.

Tohoku Region Image Sensors Market Trends:

The demand for image sensors in the robotics sector is rising in Tohoku, a city renowned for its reliable electronics production. Moreover, image sensors are used by Sendai businesses for industrial automation, particularly in smart factories. Besides this, sensors are used in the Tohoku region to boost output and lower assembly line mistakes. For example, sensor-based robotic arms are increasingly used to ensure high-precision assembly in the semiconductor industry.

Chugoku Region Image Sensors Market Trends:

The Chugoku region, with Hiroshima as a key city, is focusing on image sensors for automotive applications and security systems. The demand for cameras integrated into vehicles for safety and navigation is rising. In particular, Hiroshima's involvement in vehicle manufacturing, along with advances in automated surveillance systems, has led to the increased deployment of image sensors in public security and private surveillance systems for enhanced safety.

Hokkaido Region Image Sensors Market Trends:

In Hokkaido, the image sensor market is seeing growth due to its application in environmental monitoring and tourism. Sensors are widely used in weather stations and wildlife observation systems. Hokkaido’s harsh winter conditions make low-light and high-contrast imaging crucial for research purposes. In addition, sensors for capturing scenic views are becoming popular in tourism, with resorts and tour companies adopting advanced image sensor technology for enhanced customer experiences.

Shikoku Region Image Sensors Market Trends:

Shikoku, though smaller in population, is focusing on specialized image sensor applications in medical technology and agriculture. In cities like Matsuyama, image sensors are increasingly used in medical imaging equipment, improving diagnostics and patient care. Additionally, the agricultural sector in Shikoku is adopting image sensors in systems for monitoring crop growth, pest control, and irrigation, helping local farmers improve productivity with more precise, data-driven decisions.

Top Companies Leading in the Japan Image Sensors Industry

Some of the key players are Hamamatsu Photonics K.K., Sony Semiconductor Solutions Corporation (Sony Corporation), and Toshiba Electronic Devices and Storage Corporation (Toshiba Corporation). In September 2024, Hamamatsu Photonics K.K., an image sensor pioneer based in Japan, introduced an innovative cell analysis instrument. This new system combines light-sheet optics and advanced image analysis with an intuitive interface, providing a fast and user-friendly solution for 3D cell screening assays.

Japan Image Sensors Market Segmentation Coverage

- On the basis of the technology, the market has been bifurcated into complementary metal-oxide-semiconductor (CMOS), charge-coupled device (CCD), and others. CMOS sensors, known for low power consumption, high-speed performance, and AI integration, are widely used in smartphones, automotive, and industrial applications. In contrast, CCD sensors, offering high image quality and low noise, remain relevant in scientific imaging, medical diagnostics, and aerospace applications.

- Based on the processing type, the market has been bifurcated into 2D image sensors and 3D image sensors. 2D sensors, widely used in smartphones, cameras, and medical imaging, offer high-resolution and low-power performance. Moreover, 3D sensors are essential for facial recognition. AR/VR and autonomous vehicles enable advanced object detection, which is further driving the segment’s growth.

- On the basis of the spectrum, the market has been bifurcated into visible spectrum and non-visible spectrum. Visible spectrum sensors, used in smartphones, cameras, and industrial imaging, enhance color accuracy and resolution. Moreover, non-visible spectrum sensors, including infrared and ultraviolet, support night vision, security, and scientific applications, expanding technological advancements, and propelling the segment’s growth.

- Based on the array type, the market has been bifurcated into linear image sensors and area image sensors. Linear image sensors, used in barcode scanning, document imaging, and industrial inspection, capture images line by line. Moreover, area image sensors found in cameras provide detailed full-frame captures, enhancing performance across various industries.

- On the basis of the end use industry, the market has been bifurcated into consumer electronics, healthcare, security and surveillance, automotive and transportation, aerospace and defense, and others. Consumer electronics, including smartphones and cameras, drive demand for high-resolution CMOS sensors. Moreover, healthcare relies on medical imaging sensors for diagnostics and endoscopy. Security and surveillance use infrared and low-light sensors for facial recognition and monitoring. Besides this, automotive and transportation integrate ADAS and LiDAR sensors for autonomous driving, while aerospace and defense utilize radiation-resistant and infrared sensors for satellite imaging and military applications.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,682.2 Million |

| Market Forecast in 2033 | USD 3,415.8 Million |

| Market Growth Rate 2025-2033 | 7.3% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Complementary Metal-Oxide-Semiconductor (CMOS), Charge-Coupled Device (CCD), Others |

| Processing Types Covered | 2D Image Sensors, 3D Image Sensors |

| Spectrums Covered | Visible Spectrum, Non-visible Spectrum |

| Array Types Covered | Linear Image Sensors, Area Image Sensors |

| End Use Industries Covered | Consumer Electronics, Healthcare, Security and Surveillance, Automotive and Transportation, Aerospace and Defense, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Hamamatsu Photonics K.K., Sony Semiconductor Solutions Corporation (Sony Corporation), Toshiba Electronic Devices and Storage Corporation (Toshiba Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Image Sensors Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)