Japan Mobility as a Service Market Expected to Reach USD 9,581 Million by 2033 - IMARC Group

Japan Mobility as a Service Market Statistics, Outlook, and Regional Analysis 2025-2033

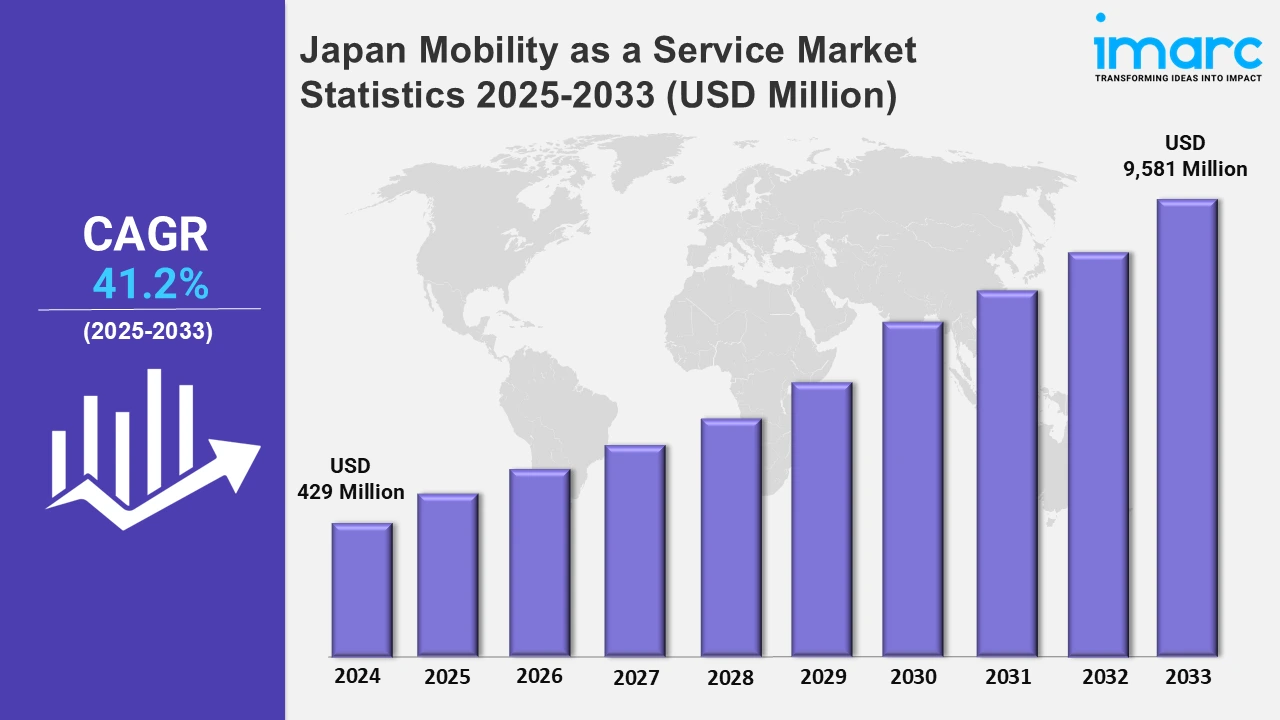

The Japan mobility as a service market size was valued at USD 429 Million in 2024, and it is expected to reach USD 9,581 Million by 2033, exhibiting a growth rate (CAGR) of 41.2% from 2025 to 2033.

To get more information on this market, Request Sample

The market in Japan is seeing rapid expansion, driven by technological advancements and a collective push towards sustainable urban mobility. The demand for alternative and eco-friendly transportation solutions is a major force in this shift. In August 2024, Lime introduced its electric scooter-sharing service in Tokyo, launching a fleet of 200 scooters spread across 40 ports in six districts. This development offers a seamless and eco-friendly transport alternative, enhancing the MaaS ecosystem by reducing reliance on private cars and contributing to the reduction of urban traffic congestion. Such services are part of a growing trend toward integrating micro-mobility options into urban transport networks, offering more flexible and sustainable mobility choices. These initiatives also align with Japan's broader objectives of lowering carbon emissions and promoting more efficient, on-demand transportation options. Simultaneously, Japan is making strides in autonomous vehicle technology, which is shaping the future of MaaS in the country. In September 2024, MONET Technologies, a collaboration between SoftBank and Toyota, launched trials of autonomous mobility services in Tokyo Waterfront City. Using Level 2 autonomous Toyota Sienna minivans, this initiative is an important step in introducing autonomous, on-demand transportation.

The autonomous vehicle trials are designed to alleviate congestion, enhance transport accessibility, and address the challenges posed by driver shortages. Nissan also announced plans in February 2024 to commercialize autonomous drive services by 2027, with initial trials taking place in the Minato Mirai area. The introduction of such services will boost the MaaS market by integrating self-driving vehicles into public transport systems, enabling greater mobility, especially for rural areas and those with limited access to traditional transportation options. In August 2024, Japan introduced an integrated transport system combining buses, trains, and subways with real-time tracking and automated ticketing. This new platform gives users a one-stop shop for all of their travel needs while also improving connectivity and the overall MaaS experience. Japan is making urban mobility simpler and more effective for its citizens by improving the convenience of public transportation and providing a variety of choices through a single system.

Japan Mobility as a Service Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Japan's mobility-as-a-service market is growing, driven by technological infrastructure, government support, EV integration, green mobility, multimodal networks, and the adoption of autonomous vehicles.

Kanto Region Mobility as a Service Market Trends:

The Kanto region, centered around Tokyo, is seeing a surge in mobility as a service integration with a focus on convenience and cashless services. In April 2024, Nihon Kotsu introduced ride-hailing services across Tokyo's 23 wards and neighboring cities, enabling cashless payments at standard taxi prices. This is contributing to a more seamless urban mobility experience. This region is leading Japan in MaaS adoption, aiming for sustainable, efficient transport options for its densely populated urban areas.

Kansai/Kinki Region Mobility as a Service Market Trends:

In the Kansai/Kinki region, MaaS is evolving with a focus on expanding accessibility, particularly for younger passengers. In December 2024, Uber Japan launched Uber Teens, a service for children aged 13-17, with real-time location tracking and audio recordings. This service is available across 11 prefectures, including Osaka and Kyoto, responding to the growing demand for safe and reliable transport for teens in busy urban areas. Kansai is embracing innovations to cater to diverse mobility needs.

Central/Chubu Region Mobility as a Service Market Trends

Mobility as a service is used by the Central/Chubu region, which includes cities like Nagoya, to increase communication between rural and urban areas. Moreover, the Meitetsu MaaS software makes it easy to switch between buses and trains. Accordingly, the goal is to extend mobility as a service outside of urban areas to meet the needs of senior citizens living in suburban and rural regions. In Aichi prefecture, services like carpooling and on-demand buses are becoming popular to provide mobility options in less populous areas.

Kyushu-Okinawa Region Mobility as a Service Market Trends:

The Kyushu-Okinawa region is implementing autonomous vehicle technology to improve regional mobility. Aligned with this trend, May Mobility introduced an autonomous car service using Toyota's e-Palette platform at Toyota Motor Kyushu's Miyata plant in Fukuoka, Japan, in December 2024. The service is planned to move workers and visitors across the plant grounds in an efficient manner. This shift toward autonomous mobility is helping Kyushu leverage cutting-edge technology for streamlining transit, particularly in less densely populated areas.

Tohoku Region Mobility as a Service Market Trends:

In Tohoku, a largely rural region, MaaS is focused on improving mobility for older residents. The Miyagi MaaS platform enables easy access to buses, taxis, and even volunteer-driven transportation. Regional authorities are focusing on addressing depopulation by offering on-demand services that connect small towns with larger urban hubs. ‘Limo Sendai’ combines multiple transport modes to support rural communities, ensuring inclusive mobility options for all.

Chugoku Region Mobility as a Service Market Trends:

In the Chugoku region, MaaS is addressing mobility in coastal cities like Hiroshima and Okayama, where public transport integration is key. These platforms are being used to improve efficiency, as demonstrated by Hiroshima’s mobility as a service hub. This service combines trains, buses, and ferries, facilitating easier access to both local and regional transport. The region is also experimenting with autonomous vehicles for urban travel, integrating them into existing transport networks for better connectivity.

Hokkaido Region Mobility as a Service Market Trends:

Hokkaido, with its expansive rural landscape, is focusing on MaaS to connect remote areas to cities like Sapporo. The region has integrated winter-specific services like snowplow-equipped vehicles into the MaaS platforms to ensure year-round mobility. A notable example is the ‘Sapporo Mobility App’ combining buses, taxis, and even ski resorts into one interface. Hokkaido is also leading in sustainable MaaS models, thereby promoting electric buses and car-sharing services for eco-tourism in scenic areas.

Shikoku Region Mobility as a Service Market Trends:

Shikoku, known for its scenic routes and rural areas, focuses on MaaS to improve long-distance travel options. The Shikoku tourism mobility as a service combines trains, ferries, and buses, offering tourists flexible travel plans. As an example, in Kochi Prefecture, MaaS is enabling seamless integration for eco-friendly travel, including electric bike-sharing and local transport. The region is also focusing on MaaS as a tool for local revitalization, helping underserved areas stay connected to major cities.

Top Companies Leading in the Japan Mobility as a Service Industry

Competition among traditional transport giants, technology firms, and innovative startups characterizes Japan’s mobility as a service market. Key players integrate multiple services, such as trains, buses, and taxis, into MaaS platforms. For instance, JR East plans to introduce driverless trains on the Joetsu Shinkansen by 2030, with testing starting in 2029 on the Nagaoka-Niigata section, initially under supervision. This development enhances the service ecosystem by offering more seamless, automated transportation. Additionally, in October 2024, Mitsubishi Motors, MC Retail Energy, Kaluza Japan, and Mitsubishi Corporation launched Japan’s first EV smart-charging service, utilizing connected technologies to refine service quality and app precision. Strong government support further intensifies competition, fostering innovation in the sector.

Japan Mobility as a Service Market Segmentation Coverage

- On the basis of the service type, the market has been bifurcated into ride-hailing, ride-sharing, car-sharing, bus/shuttle service, and others. These services enhance urban mobility by offering flexible, on-demand travel options, reducing the need for personal vehicle ownership while promoting sustainability and improved transportation efficiency.

- Based on the transportation type, the market is categorized into private and public. Private and public transportation models each offer distinct advantages, with private services prioritizing convenience and flexibility, while public options emphasize affordability, sustainability, and mass accessibility for urban populations.

- On the basis of the application platform, the market has been divided into Android, iOS, and others. These platforms support innovative mobility solutions through user-friendly apps, enabling real-time booking, payment, and route optimization, ensuring diverse transportation options are easily accessible to a wide range of users.

- Based on the propulsion type, the market is categorized into electric vehicle, internal combustion engine, and others. These types provide varied transportation choices, shaping future mobility trends by influencing fuel efficiency, sustainability, and the reduction of emissions across urban and intercity travel systems.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 429 Million |

| Market Forecast in 2033 | USD 9,581 Million |

| Market Growth Rate 2025-2033 | 41.2% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Ride-Hailing, Ride-Sharing, Car-Sharing, Bus/Shuttle Service, Others |

| Transportation Types Covered | Private, Public |

| Application Platforms Covered | Android, iOS, Others |

| Propulsion Types Covered | Electric Vehicle, Internal Combustion Engine, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Mobility as a Service Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)