Japan Transportation Infrastructure Construction Market Expected to Reach USD 14.6 Billion by 2033 - IMARC Group

Japan Transportation Infrastructure Construction Market Statistics, Outlook and Regional Analysis 2025-2033

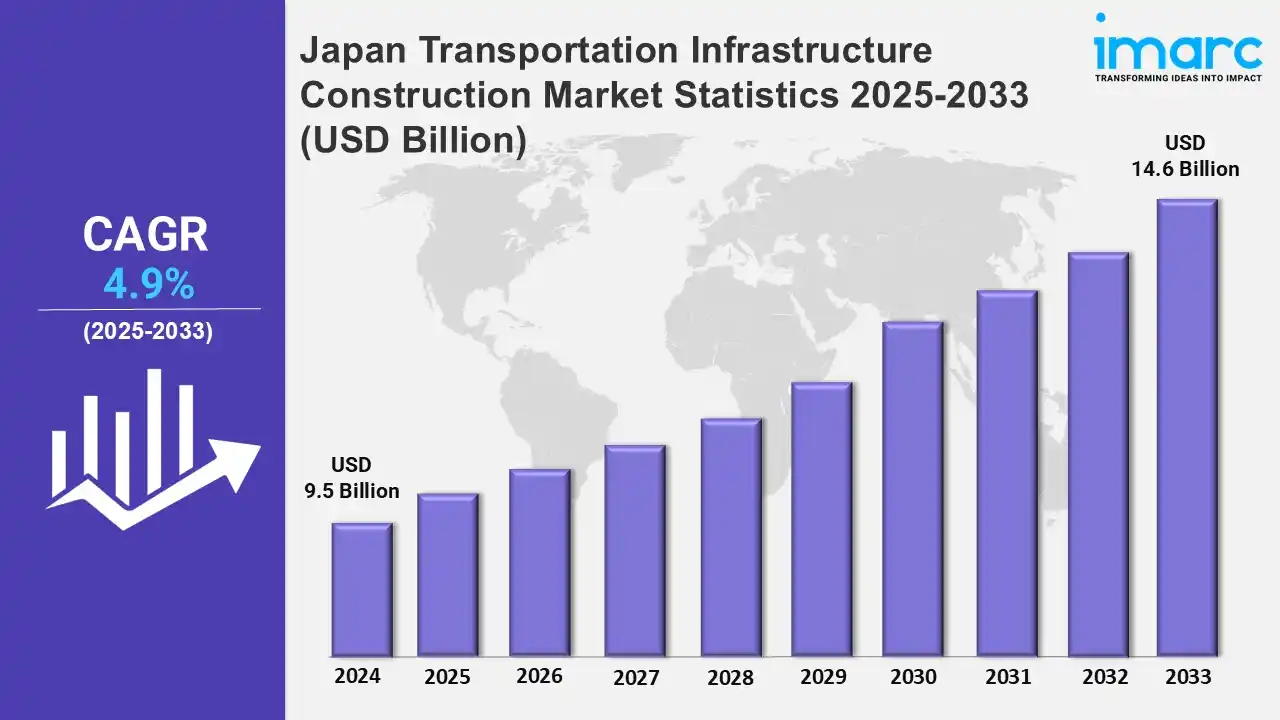

The Japan transportation infrastructure construction market size was valued at USD 9.5 Billion in 2024, and it is expected to reach USD 14.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.9% from 2025 to 2033.

To get more information on this market, Request Sample

Automated freight routes are being proposed as a solution to manpower shortages and environmental problems. Industries want to increase efficiency, reduce carbon emissions, and modernize logistics by integrating self-operating transportation networks along important routes, with progressive adoption anticipated over the next few years. For example, in November 2024, Japan disclosed plans for an automated cargo transportation network called the "conveyor belt road," which will connect Tokyo and Osaka. This initiative seeks to address the truck driver shortage and reduce carbon emissions by using automated freight movement within a defined highway corridor. A trial phase is planned between 2027 and early 2028, with full-scale operations expected in the mid-2030s.

Moreover, seamless mobility solutions are redefining urban transportation by combining advanced technologies to improve connection. Automated ticketing, real-time tracking, and multimodal networks increase efficiency and convenience. As mobility services grow, innovative approaches establish new benchmarks, propelling worldwide progress in smart and sustainable urban transportation experiences. For instance, in August 2024, Japan revealed its new multimodal transportation innovations. Intelligent transportation technologies, real-time tracking, and computerized ticketing are being used on buses, trains, and subways around the country. Japan's mobility as a service (MaaS) industry is expected to reach JPY 6.3 Trillion by 2030, establishing a benchmark for smart urban transportation. Furthermore, the Japan transportation infrastructure construction industry is growing to fulfill the rising demand for efficient, robust, and sustainable connectivity. Investments in upgraded highways, high-speed rail, updated airports, and improved maritime logistics are being made by both the government and private sectors. Smart infrastructure solutions, earthquake-resistant designs, and ecological efforts are driving the sector's expansion. For example, Japan's Ministry of Land, Infrastructure, Transport and Tourism (MLIT) is investing in the Shin-Meishin Expressway to improve intercity road connectivity and alleviate traffic congestion. JR Central is developing the Chūō Shinkansen maglev, which aims to revolutionize high-speed train travel. In aviation, Narita and Haneda airports are extending terminals to meet increased air traffic, while Yokohama Port is being upgraded to boost international trade capacity. These initiatives demonstrate Japan's commitment to advanced and sustainable infrastructure that ensures long-term efficiency, safety, and economic growth in domestic and international transportation networks.

Japan Transportation Infrastructure Construction Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The government's push for regional revival in various regions of Japan is significantly driving the growth of the market.

Kanto Region Transportation Infrastructure Construction Market Trends:

The Kanto region prioritizes urban railway growth, owing to rising commuter demand. The Tokyo Metro Line 8 expansion and JR East's Takanawa Gateway construction are prime examples of congestion-reduction measures. Companies such as Tokyo Metro Co., Ltd. make significant investments in earthquake-resistant infrastructure. With the rebuilding of the Yamanote Line station in 2027, Kanto will remain Japan's hub for high-density, high-tech transportation projects that incorporate AI-driven scheduling and automated train operations.

Kansai/Kinki Region Transportation Infrastructure Construction Market Trends:

The Kansai/Kinki region focuses on rail-airport connection and tourism-based transportation. The Naniwasuji Line, a joint venture between JR West and Nankai Electric Railway, will increase connectivity between Osaka and Kansai International Airport. The Osaka Metro extension supports the 2025 Osaka Expo, which boosts economic activity. Kansai/Kinki focuses on infrastructure modernization with the Hanshin Expressway renovations, maintaining its position as a major participant in the industry.

Central/Chubu Region Transportation Infrastructure Construction Market Trends:

The Central/Chubu region, led by Nagoya, is a hub of high-speed rail research. The Chuo Shinkansen maglev project, managed by JR Central, intends to reduce the travel time between Tokyo and Nagoya to 40 minutes by 2027. Toyota's smart road technologies improve connectivity even further. Upgrades to the freight rail linkages at Nagoya Port further boost Chubu's position as a leader in Japan's high-speed transit and logistics infrastructure.

Kyushu-Okinawa Region Transportation Infrastructure Construction Market Trends:

The Kyushu-Okinawa region is concerned with Shinkansen expansion and monorail modifications. The Nishi-Kyushu Shinkansen, partially finished in 2022, improved Nagasaki's connectivity. Kyushu Railway Company (JR Kyushu) is investing in smart train technology. Okinawa's Yui Rail extension supports urban development, with plans for additional expansion by 2030. These initiatives demonstrate Kyushu-Okinawa's dedication to efficient regional transit, bolstering its position in industry.

Tohoku Region Transportation Infrastructure Construction Market Trends:

Given its earthquake and tsunami history, the Tohoku region emphasizes disaster-resilient infrastructure. The significance of this is evident in the repair of the Sanriku Railway, as well as seismic-resistant bridges on the Tohoku Expressway. JR East's Tohoku Shinkansen speed enhancements boost recovery efforts and promote economic resurgence. Tohoku is a pioneer in earthquake-proof transportation infrastructure in Japan's construction sector, with companies such as Obayashi Corporation establishing quake-resistant rail tunnels.

Chugoku Region Transportation Infrastructure Construction Market Trends:

The Chugoku region invests in multimodal transportation connectivity. Hiroden's Astram Line extension in Hiroshima combines rail, tram, and bus networks to improve commuters' experiences. The Setouchi Ferry Modernization Project improves regional marine linkages. The region stands out in Japan's transportation infrastructure industry for its flawless multimodal integration, owing to Mitsui E&S Holdings' development of advanced transport logistics in Hiroshima Port.

Hokkaido Region Transportation Infrastructure Construction Market Trends:

The Hokkaido region encourages cold-resistant transportation infrastructure to endure harsh winters. The Hokkaido Shinkansen expansion to Sapporo, driven by JR Hokkaido, features advanced tunnel designs. Sapporo's subway system, which uses rubber-tired trains from Kawasaki Heavy Industries, maintains stability in ice conditions. With significant investment in snow-resistant road networks, Hokkaido remains Japan's leader in winterproof transportation construction.

Shikoku Region Transportation Infrastructure Construction Market Trends:

The Shikoku region facilitates road and bridge advancements to improve accessibility. The Shimanami Kaido expressway, a collaborative endeavor by NEXCO West Japan, connects Shikoku to Honshu, increasing tourism and trade. The Dosan Line railway modernization, funded by JR Shikoku, increases rural connections. These initiatives demonstrate Shikoku's emphasis on overcoming geographical transportation hurdles.

Top Companies Leading in the Japan Transportation Infrastructure Construction Industry

Some of the leading Japan transportation infrastructure construction market companies have been included in the report. The market is experiencing significant growth, driven by various developments such as government initiatives, technological advancements, and strategic collaborations. For example, in March 2024, the Hokuriku Shinkansen was extended from Kanazawa to Tsuruga, enhancing high-speed rail connections in the region. Meanwhile, construction continues for the Chūō Shinkansen, a maglev train connecting Tokyo and Osaka. The Tokyo-Nagoya segment is expected to be completed by 2034, significantly reducing travel times between two vital urban regions.

Japan Transportation Infrastructure Construction Market Segmentation Coverage

- Based on the type, the market has been categorized into roadways, railways, airports, and ports and inland waterways. Roadway projects include expressways, tunnels, and bridges. Railways prioritize high-speed Shinkansen growth and urban transportation. Airport modifications improve terminals and runways. Ports and inland waterways aid marine logistics by providing cargo terminals, dredging, and inland navigation upgrades to boost commerce and connectivity.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 14.6 Billion |

| Market Growth Rate 2025-2033 | 4.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Roadways, Railways, Airports, Ports and Inland Waterways |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Transportation Infrastructure Construction Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)