Global Low Voltage Electric Motor Market Expected to Reach USD 21.6 Billion by 2033 - IMARC Group

Global Low Voltage Electric Motor Market Statistics, Outlook and Regional Analysis 2025-2033

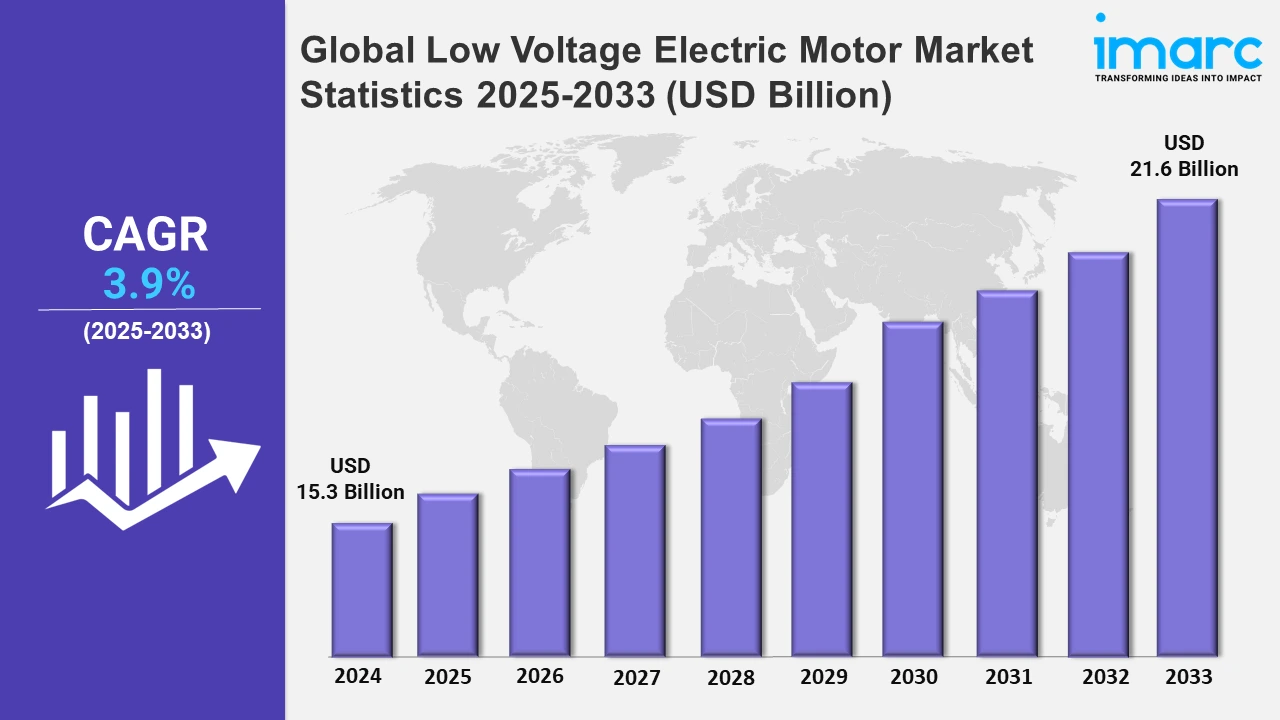

The global low voltage electric motor market size was valued at USD 15.3 Billion in 2024, and it is expected to reach USD 21.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% from 2025 to 2033.

To get more information on this market, Request Sample

In the low-voltage electric motor industry, growing urbanization, green transportation-promoting government regulations, and the global uptake of electric vehicles (EVs) are key contributing factors in the market. Moreover, the necessity to improve motor efficiency, lower energy losses, and satisfy the performance requirements of contemporary EVs is another factor driving these advances. In addition, businesses are responding with improvements that address these issues, such as improved torque density, lower harmonic losses, and increased versatility for a range of applications. In support of this trend, ABB unveiled an energy-efficient motor-inverter package in May 2024 featuring the AMXE250 motor and HES580 3-level inverter. This package boosts the efficiency of low-voltage electric motors, which is especially beneficial for electric bus applications by increasing torque density and lowering harmonic losses by up to 70%.

In line with these advancements, in November 2024, Danfoss Power Solutions introduced the Editron EM-PMI540B electric motor, featuring a small design with 96% efficiency and continuous power around the clock. This motor is designed for electric and hybrid applications in harsh situations with improved altitude capabilities and a variety of mounting options. Furthermore, these advancements emphasize the need for high-efficiency motors capable of supporting environmentally friendly transportation systems while addressing the operational and operational issues faced by the EV sector. Concurrently, regional market expansion and joint ventures are important factors propelling the low-voltage electric motor industry. In order to address the increasing demand in unexplored regions, especially in Asia, manufacturers are utilizing partnerships and joint ventures. For example, in May 2024, DG Innovate partnered with EVage Motors to establish a joint venture in India focused on manufacturing the Pareta electric drive system. Approximately 98.2% of efficient motors will be produced, significantly improving EV performance and lowering operating expenses. These programs demonstrate the commitment to developing EV technology and increasing access to energy-efficient solutions in developing nations. Overall, the low-voltage electric motor sector is influenced by the combination of technological advances and business alliances, which positions it as a vital component of cleaner energy use and sustainable mobility.

Global Low Voltage Electric Motor Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North and South America, Europe, the Middle East and Africa, China, and others. According to the report, Europe, the Middle East and Africa are the largest market, driven by their advanced manufacturing, growing industrial automation, strong infrastructure, rising need for energy-efficient solutions, etc.

North and South America Low Voltage Electric Motor Market Trends:

The growing need for energy-efficient motors in North and South America is driven by regulations such as the U.S. Energy Policy Act, which is contributing to the market growth. Additionally, in countries like Canada, Brazil, and Columbia, low-voltage electric motors are being used in oil and gas industries to enhance operational efficiency. Aligned with this trend, Brazilian petrochemical companies have incorporated IE3 motors to cut energy expenses. The demand for these motors has also increased across the Americas as a result of the shift to alternative energy sources like wind power.

Europe, Middle East, and Africa Low Voltage Electric Motor Market Trends:

Europe, the Middle East, and Africa are leading the overall market due to an increased focus on automation and renewable energy sources. Germany’s robust manufacturing sector increasingly uses low-voltage electric motors in advanced robotics. Meanwhile, in the Middle East, motors power water desalination plants, as seen in Saudi Arabia. The emphasis on meeting EU energy-efficiency standards, such as IE4 motors, strengthens demand, particularly in industrial automation and environmental sustainability projects.

China Low Voltage Electric Motor Market Trends:

China’s rapid industrialization and investments in manufacturing automation drive the low-voltage electric motor market. Policies like "Made in China 2025" encourage advanced motor adoption for energy-saving goals. For example, electric motors in Shenzhen's electronics factories enhance productivity while reducing power consumption. The government’s focus on electric vehicles further amplifies motor demand, positioning China as a global leader in low-voltage electric motor usage and production.

Other Regions Low Voltage Electric Motor Market Trends:

In regions like Southeast Asia and Australia, infrastructure development and mining industries dominate low-voltage motor applications. Australia, for instance, utilizes these motors in mining operations to ensure energy efficiency and reliability. Southeast Asian countries, such as Vietnam, increasingly use these motors in small-scale manufacturing to support local economic growth. Besides this, the increasing awareness of cost-effective and efficient energy solutions is consistent with these region’s growing industrialization trends.

Top Companies Leading in the Low Voltage Electric Motor Industry

Some of the leading low voltage electric motor market companies include ABB Group, CG Power & Industrial Solutions Ltd (Murugappa Group), HD Hyundai Electric Co., Ltd., Hyosung Heavy Industries, Innomotics (Siemens AG), Nidec Conversion, Regal Rexnord Corporation, TECO-Westinghouse, and WEG S.A., among many others. For instance, Regal Beloit unveiled the SyMAX motor series in 2023, designed as a line of low-voltage electric motors. These motors are appropriate for a variety of industrial applications as they prioritize increasing energy economy and offering a longer operational lifespan.

Global Low Voltage Electric Motor Market Segmentation Coverage

- On the basis of efficiency, the market has been bifurcated into standard efficiency, high efficiency, premium efficiency, and super premium efficiency, wherein high efficiency represents the most preferred segment. Low-voltage electric motors with high efficiency ensure lower energy consumption, lower running costs, and less heat loss, thereby improving performance and sustainability for applications in industrial and commercial settings.

- Based on the end-use industry, the market is categorized into commercial HVAC industry, food, beverage, and tobacco industry, mining industry, utilities, and others. Currently, the commercial HVAC industry exhibits a clear dominance in the market. The commercial HVAC industry relies on low-voltage electric motors for energy-efficient operation, driving fans, compressors, and pumps, ensuring dependable climate management and lower power usage in a variety of building applications.

- On the basis of the application, the market has been divided into pumps and fans, compressors, and others. Among these, pumps and fans exhibit a clear dominance in the market. Pumps and fans are essential components in industrial, agricultural, and commercial applications, where efficiency and durability are critical for operational success and energy cost reduction.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 15.3 Billion |

| Market Forecast in 2033 | USD 21.6 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

| Units | Billion USD |

| Segment Coverage | Efficiency, End-Use Industry, Application, Region |

| Region Covered | North and South America, Europe, Middle East and Africa, China, Others |

| Companies Covered | ABB Group, CG Power & Industrial Solutions Ltd (Murugappa Group), HD Hyundai Electric Co., Ltd., Hyosung Heavy Industries, Innomotics (Siemens AG), Nidec Conversion, Regal Rexnord Corporation, TECO-Westinghouse, WEG S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)