High Density Polyethylene (HDPE) Price in the USA Holds at USD 1,170/MT Amid Steady Packaging Demand

03-Feb-2026

High-density polyethylene (HDPE) is a thermoplastic polymer characterized by its exceptional strength-to-density ratio and strong resistance to chemical solvents. This versatile material finds extensive applications across packaging, piping systems, construction, automotive components, and consumer goods manufacturing. HDPE's durability, flexibility, and recyclability make it highly desirable for industrial purposes. Given its widespread use in packaging containers, infrastructure piping, and injection molding products, HDPE pricing responds significantly to feedstock ethylene costs, downstream sector activity, and regional supply-demand balances.

Global Market Overview:

Globally, the high-density polyethylene (HDPE) industry was valued at USD 87.27 Billion in 2025. Market projections indicate growth, with the industry expected to reach USD 117.29 Billion by 2034, representing a compound annual growth rate (CAGR) of 3.34% during 2026-2034. Growth momentum stems from expanding applications in the packaging and construction sectors, heightened emphasis on sustainable materials and recycled content integration, infrastructure development across emerging economies, and regulatory frameworks promoting circular plastics utilization. Technological advancements in polymer processing and material performance are further enhancing HDPE’s adoption across pipes, containers, and geomembranes. Additionally, rising urbanization and increasing demand for lightweight, durable materials are reinforcing long-term consumption growth across both developed and developing markets.

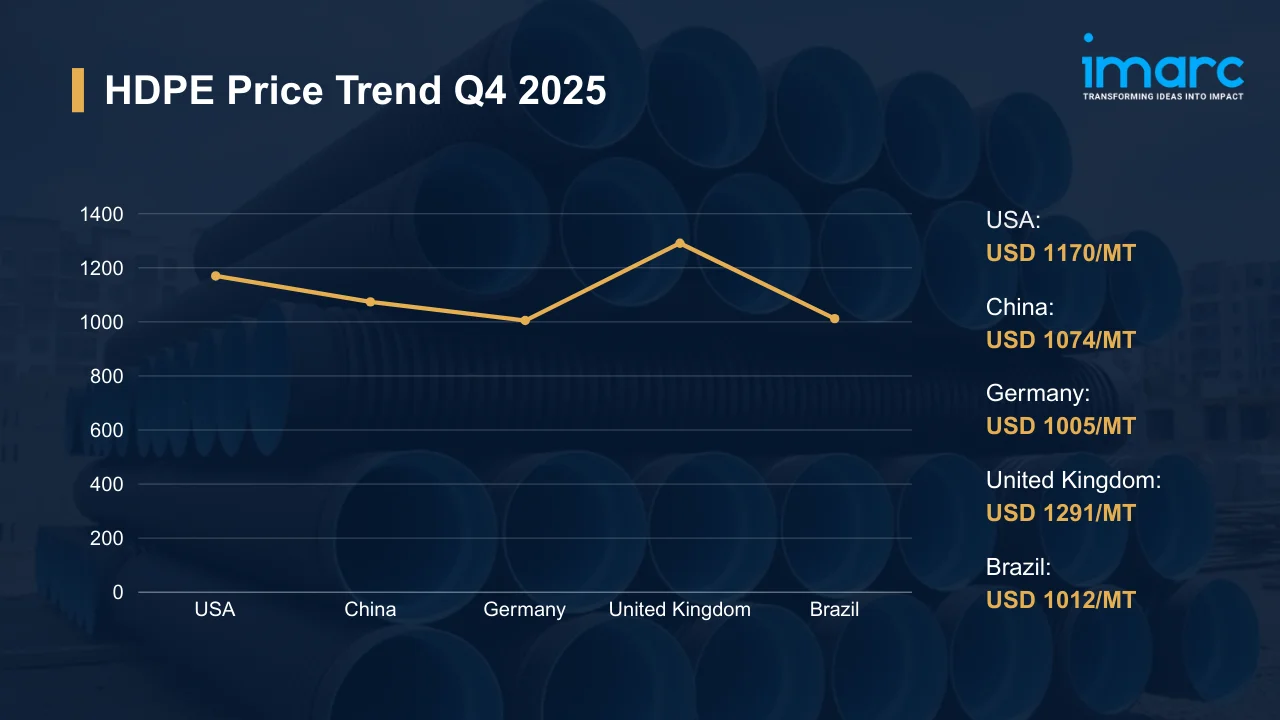

HDPE Price Trend Q4 2025:

Regional prices (USD per MT) and QoQ changes vs Q3 2025:

| Region | Price (USD/MT) | QoQ Change | Direction |

|---|---|---|---|

| USA | 1170 | -2.5% | ↓ |

| China | 1074 | -3.2% | ↓ |

| Germany | 1005 | -2.2% | ↓ |

| United Kingdom | 1291 | -2.8% | ↓ |

| Brazil | 1012 | -1.7% | ↓ |

To access real-time prices Request Sample

What Moved Prices:

- USA: In Q4 2025, HDPE prices decreased from the previous quarter, settling at USD 1170/MT. Packaging converters and building material suppliers scaled back on procurement volumes as end-market activity slowed heading towards year-end. Over the course of time, domestic producers maintained consistent operating rates, guaranteeing adequate material supply across distribution channels. There was no desire among buyers to increase inventory positions beyond what was immediately needed. Contract volumes took precedent over spot purchases, with most procurement teams choosing to work through existing obligations before making additional orders. As cracker profits decreased, ethylene feedstock costs provided little assistance.

- China: Prices hit USD 1074/MT in Q4 2025 as the market struggled with weak demand from important consumer sectors. Slower infrastructure project clearances caused pipe manufacturers to reduce their production schedules, and weak export orders caused packaging film makers to operate below capacity. Due to the lack of growth in consumer goods demand, injection molding grades were particularly under strain. Because domestic resin production remained stable, procurement teams were able to wait for better terms in a buyer's market. Purchasing behavior was determined by short-term production planning, and because demand visibility was uncertain, few players were willing to commit to forward positions.

- Germany: In Q4 2025, prices dropped to USD 1005/MT as European industrial activity continued to be muted. Lower resin consumption was linked by automotive suppliers to output reductions at a number of significant auto assembly facilities. Packaging converters were careful in their operations, limiting purchases to meet short-term obligations rather than accumulating safety stock. The availability of imports from Asian and Middle Eastern suppliers increased competition and gave purchasers bargaining power. Customers pushed back on prices, making it difficult for regional producers to protect their margins. Procurement time was determined by manufacturing schedules, with confirmed production runs accounting for the majority of activity.

- United Kingdom: Prices declined to USD 1291/MT during Q4 2025, though the market retained its premium positioning relative to continental Europe. Construction sector weakness weighed on pipe and fitting demand, while packaging applications saw mixed results across different product categories. Import flows from European and international sources remained consistent, preventing any supply tightness that might have supported pricing. Sterling fluctuations against the euro and dollar added complexity to import cost calculations. Procurement teams emphasized inventory control and short-cycle ordering, preferring to manage working capital tightly rather than accumulate excess stock.

- Brazil: During Q4 2025, Brazilian HDPE prices softened to USD 1012/MT as consumption patterns failed to build momentum through the quarter. Packaging demand, typically a reliable source of offtake, showed signs of fatigue as consumer spending remained constrained by macroeconomic pressures. Infrastructure-related applications saw uneven activity depending on project timelines and funding availability. Import competition from North American and Asian suppliers kept domestic producers on the defensive. Local resin output continued at normal rates, contributing to balanced supply conditions. Buyers approached the market methodically, aligning purchase volumes with confirmed downstream orders rather than speculative requirements.

Drivers Influencing the Market:

Several factors continue to shape high-density polyethylene (HDPE) pricing and market behavior:

- Feedstock Cost Dynamics: Ethylene feedstock pricing continues to influence HDPE production economics, as fluctuations in naphtha and gas costs shape cracker margins. Producers monitor pass-through capability carefully, adjusting pricing strategies to balance cost recovery with demand conditions across global markets.

- Packaging Sector Consumption: Packaging applications, such as bottles, containers, and films, represent major HDPE consumption streams. Consumer demand trends and retail inventory cycles influence converter operating rates, which directly affect resin procurement volumes and purchasing behavior across key regional markets.

- Construction and Infrastructure Activity: Construction and infrastructure sectors remain critical end use segments for HDPE, particularly in pipes and building materials. Project approvals, funding flows, and seasonal construction activity shape demand visibility, influencing order patterns and consumption levels throughout different geographic markets.

- Regional Supply Balances: Regional HDPE supply balances are shaped by capacity utilization rates and import-export flows. Areas with ample availability encourage cautious buying, while tighter markets support firmer pricing, shorter lead times, and selective spot premiums for prompt material delivery.

- International Trade Patterns: International HDPE trade flows respond to arbitrage opportunities, freight economics, and tariff structures. Export-focused producers adjust offers to maintain competitiveness, while import-dependent regions closely evaluate landed costs, currency movements, and sourcing flexibility when planning procurement strategies globally.

- Inventory Management Approaches: HDPE buyers increasingly prioritize lean inventory management to optimize working capital efficiency. Just-in-time procurement models gain preference over buffer stocking, reducing spot market liquidity and concentrating transaction activity around contract volumes and scheduled deliveries across supply chains.

Recent Highlights & Strategic Developments:

Recent strategic moves within the industry further illustrate evolving dynamics:

- In January 2025, LyondellBasell (LYB), a provider of polyolefin technologies, revealed that Indian Oil Corporation Limited (IOCL) selected its Hostalen Advanced Cascade Process (Hostalen ACP) technology for the development of a new HDPE facility in Paradip, India. The plant would utilize LYB's catalysts to manufacture multi-modal HDPE resins for uses, ranging from infrastructure pipes to films and blow molding, strengthening the enduring collaboration between the firms.

Outlook & Strategic Takeaways:

Looking ahead, the high-density polyethylene (HDPE) market is expected to maintain gradual demand recovery, as the packaging and construction sectors regain momentum. Infrastructure investments, steady consumer goods demand, and improving industrial activity are likely to support balanced growth and stable consumption trends across major regions.

To navigate this complex landscape, stakeholders should:

- Monitor Regional Price Differentials: Track price spreads between producing and consuming regions to identify procurement optimization opportunities. Benchmark regularly against published indices to support more informed contract negotiations and spot purchasing decisions.

- Track Upstream Feedstock Movements: Review ethylene and naphtha price trends as they provide early signals for HDPE cost direction. Build visibility into cracker economics to anticipate margin-driven pricing adjustments from resin producers.

- Assess End-Market Demand Indicators: Examine packaging order books, construction permits, and automotive production schedules as leading indicators for HDPE consumption trends. Align procurement timing with demand cycles to improve inventory efficiency.

- Diversify Geographic Sourcing: Spread supplier relationships across multiple regions to reduce exposure to localized disruptions or policy changes. Strengthen negotiating positions through multi-source strategies when market conditions shift.

- Evaluate Trade Policy Developments: Stay current on tariff adjustments and import regulations as they can alter competitive dynamics quickly. Anticipate changes that may affect sourcing costs or supplier viability through regular policy monitoring.

- Monitor Capacity Changes: Track new plant startups and scheduled turnarounds as they affect regional supply availability. Plan around potential availability constraints by following producer announcements and maintenance calendars.

- Position for Sustainability Requirements: Prepare for expanding recycled content mandates and circular economy regulations. Build supply chain capabilities around post-consumer resin and mechanical recycling to gain competitive advantages as specifications evolve.

Subscription Plans & Customization:

IMARC offers flexible subscription models to suit varying needs:

- Monthly Updates - 12 deliverables/year

- Quarterly Updates - 4 deliverables/year

- Biannual Updates - 2 deliverables/year

Each includes detailed datasets (Excel + PDF) and post-report analyst support.

.webp)

.webp)