Natural Gas Prices in the USA Hold at USD 4.14/MMBtu Amid Stable Domestic Demand

03-Feb-2026

Commodity Introduction:

Natural gas is a fossil fuel primarily composed of methane, along with trace amounts of other hydrocarbons. This colorless, odorless energy source is extracted from underground reservoirs and serves as a critical input for power generation, residential heating, industrial manufacturing, and transportation applications. Compared to coal and petroleum, natural gas produces fewer carbon emissions during combustion, positioning it as a transitional fuel in global decarbonization efforts. Pricing sensitivity stems from weather fluctuations, storage levels, geopolitical developments, and shifts in industrial consumption patterns.

Global Market Overview:

Globally, the natural gas industry was valued at USD 1,227.3 Billion in 2025. Industry projections indicate the market will expand to reach USD 2,573.1 Billion by 2034, representing a compound annual growth rate (CAGR) of 8.40% during 2026-2034. Market expansion is underpinned by accelerating demand for cleaner energy alternatives, growing consumption from industrial and power generation sectors, and substantial investments in liquified natural gas (LNG) infrastructure development. The transition towards low-carbon energy systems continues to position natural gas as a key bridging fuel between conventional fossil fuels and renewable sources. Furthermore, the growing emphasis on energy security among major importing nations has prompted significant capital allocation towards regasification terminal construction and cross-border pipeline networks.

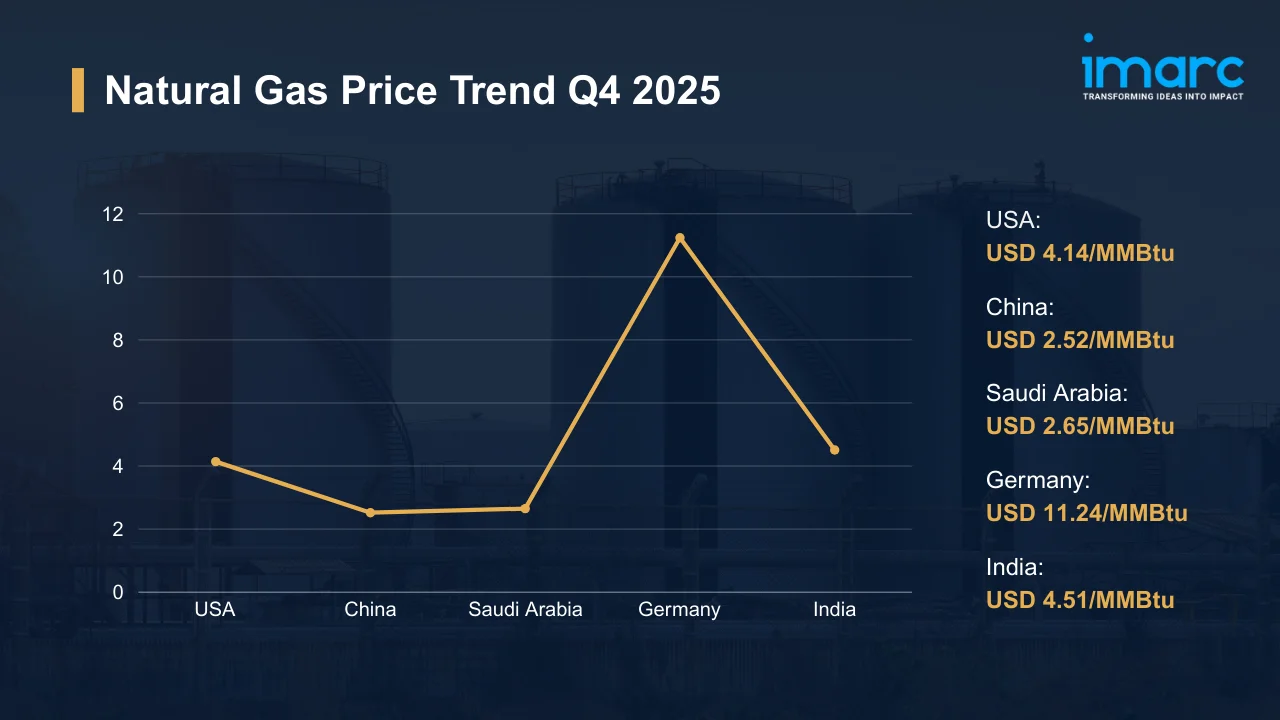

Natural Gas Price Trend Q4 2025:

Regional prices (USD/MMBtu) and QoQ changes vs Q3 2025:

| Region | Price (USD/MMBtu) | QoQ Change | Direction |

|---|---|---|---|

| USA | 4.14 | +8.7% | ↑ |

| China | 2.52 | -7.4% | ↓ |

| Saudi Arabia | 2.65 | -3.6% | ↓ |

| Germany | 11.24 | -3.1% | ↓ |

| India | 4.51 | -4.0% | ↓ |

To access real-time prices Request Sample

What Moved Prices:

- USA: Natural gas prices rose to USD 4.14/MMBtu during Q4 2025. The onset of colder weather across many areas of the country brought about a notable rise in heating demand from households and commercial establishments. Storage facilities recorded higher withdrawal rates as distributors worked to meet consumption needs. Pipeline operators reported stronger throughput volumes during the quarter. The power generation sector contributed to buying interest as utilities sought to secure adequate fuel supplies. Upstream producers responded by maintaining steady output while balancing operational commitments against the backdrop of rising consumption requirements.

- China: Natural gas prices declined to USD 2.52/MMBtu during Q4 2025. Manufacturing activity across several provinces showed signs of moderation, which in turn reduced industrial gas consumption. The electricity generation sector also exhibited softer demand patterns compared to previous quarters. Domestic production from major fields remained consistent, while pipeline deliveries from Central Asian suppliers continued without interruption. LNG terminal operators maintained regular import schedules. Buyers took a cautious approach to procurement as inventory levels at key storage sites remained comfortable. Utilities and industrial consumers adjusted their purchasing volumes to reflect near-term operational requirements.

- Saudi Arabia: Natural gas prices eased to USD 2.65/MMBtu during Q4 2025. Domestic consumption patterns remained largely unchanged from previous months, with industrial users maintaining their regular offtake schedules. Power generation facilities operated within their allocated supply arrangements and did not seek additional volumes. Upstream production from non-associated gas fields proceeded according to plan, ensuring that supply remained adequate. The government continued to apply regulated pricing structures that shielded the domestic market from external volatility. Buyers focused their attention on maintaining operational continuity rather than building additional inventory positions during the quarter.

- Germany: Natural gas prices fell to USD 11.24/MMBtu during Q4 2025. Storage facilities across the country reported comfortable fill levels heading into the winter season. Industrial demand showed signs of softening as several energy-intensive sectors scaled back operations. Import flows from Norway and through LNG terminals remained stable throughout the quarter. Utility companies and large commercial consumers chose to draw upon existing inventories rather than pursue aggressive spot market purchases. Procurement teams at major buyers optimized their sourcing schedules to take advantage of favorable market conditions. The overall supply situation remained well balanced against consumption needs.

- India: Natural gas prices dropped to USD 4.51/MMBtu during Q4 2025. The fertilizer manufacturing sector, which accounted for a significant share of domestic gas consumption, recorded lower offtake volumes during the quarter. Power generation demand also moderated as grid operators balanced their fuel mix. LNG cargoes arrived at import terminals on schedule, providing adequate supply coverage for downstream buyers. City gas distribution networks continued their regular operations without reporting any supply constraints. Procurement managers aligned their purchasing activities with short-term consumption forecasts and current inventory holdings at their respective facilities.

Drivers Influencing the Market:

Several factors continue to shape natural gas pricing and market behavior:

- Seasonal Demand Fluctuations: Temperature changes have a direct bearing on consumption levels. Colder months bring higher heating requirements from residential and commercial users. Milder conditions tend to reduce overall demand across key markets.

- Storage Inventory Dynamics: Reserve levels and withdrawal patterns shape pricing behavior throughout the year. Comfortable stockpiles offer stability to the market. Rapid drawdowns during periods of high demand can create upward price pressure.

- Industrial Consumption Patterns: Manufacturing activity and petrochemical sector requirements influence demand levels significantly. Economic conditions in major consuming nations determine how much gas industrial facilities need for their operations. Expanding industrial capacity acts as a key driver supporting sustained demand growth.

- LNG Infrastructure Expansion: Investments in liquefaction plants, regasification terminals, and shipping capacity continue to reshape global trade flows. These developments improve market connectivity and affect regional price differences through better trade options.

- Power Generation Requirements: Gas consumption for electricity production remains a key demand driver in many countries. Utilities make fuel switching decisions based on relative pricing levels and environmental compliance considerations in their regions.

- Geopolitical Supply Considerations: Pipeline arrangements, transit agreements, and regional tensions affect supply route reliability, thus influencing the market trajectory. Importing nations pursue diversification strategies to reduce their exposure to concentration risks from single source dependence.

Recent Highlights & Strategic Developments:

Recent strategic moves within the industry further illustrate evolving dynamics:

- In October 2025, L&T Energy Hydrocarbon's Onshore division received an ultra-mega contract to build a natural gas liquids (NGL) processing plant and associated infrastructure in the Middle East region. The agreement included complete engineering, procurement, and construction services for sophisticated NGL processing and management capabilities.

Outlook & Strategic Takeaways:

Looking ahead, the natural gas market is expected to maintain steady growth, supported by rising power generation needs, expanding industrial activity, and increasing reliance on gas as a transition fuel. Global trade flows are likely to enhance supply flexibility and market resilience.

To navigate this complex landscape, stakeholders should:

- Monitor Weather Patterns Closely: Track temperature forecasts across major consuming regions to anticipate demand shifts. Adjust procurement timing based on expected weather developments. Recognize that cold snaps can rapidly alter market fundamentals and create short-term price volatility.

- Evaluate Storage Position Strategies: Assess inventory levels relative to seasonal norms and consider optimal withdrawal timing. Use comfortable storage positions to gain negotiating leverage. Prepare for premium spot purchases if reserves become depleted during high demand periods.

- Diversify Supply Sources: Expand sourcing options across pipeline and LNG channels to reduce concentration risks. Build relationships with multiple suppliers in different geographic regions. Enhance procurement flexibility to respond to changing market conditions.

- Review Contract Structure Flexibility: Balance long-term agreements that provide price stability against spot market exposure that allows opportunistic purchasing. Adopt hybrid procurement approaches to optimize outcomes across different market conditions.

- Track Regulatory and Policy Developments: Monitor changes in energy policies, emissions regulations, and pricing frameworks across key markets. Policy shifts can influence gas demand patterns, infrastructure investment decisions, and cross-border trade flows impacting long-term market dynamics.

- Strengthen Risk Management and Forecasting: Utilize advanced analytics, scenario planning, and market intelligence to anticipate demand variability and price movements. Improved forecasting supports more informed procurement decisions and enhances resilience against short-term volatility.

Subscription Plans & Customization:

IMARC offers flexible subscription models to suit varying needs:

- Monthly Updates - 12 deliverables/year

- Quarterly Updates - 4 deliverables/year

- Biannual Updates - 2 deliverables/year

Each includes detailed datasets (Excel + PDF) and post-report analyst support.

.webp)

.webp)