Petroleum Coke Prices Vary Globally as US Market Records USD 390/MT

29-Jan-2026

Petroleum coke, commonly referred to as pet coke, represents a carbon-rich solid material generated through the thermal decomposition of heavy hydrocarbon residues during crude oil refining operations. This byproduct typically contains 80-90% carbon alongside trace quantities of sulfur and other elements. Industrial applications span power generation, cement manufacturing, aluminum smelting, and steel production, where it serves as both a fuel source and a reducing agent. Pricing sensitivity stems from crude oil market fluctuations, refinery output levels, environmental regulations, and downstream industrial consumption patterns across global markets.

Global Market Overview:

Globally, the petroleum coke industry was valued at USD 28.61 Billion in 2025. Market projections indicate steady growth, with the industry expected to reach USD 48.21 Billion by 2034, with a compound annual growth rate (CAGR) of 5.97% during 2026-2034. The market growth is driven by the increasing demand for petroleum coke in the developing nations due to the rising energy needs. The aluminum industry is also a major driving factor for the consumption of petroleum coke, as the increasing demand for aluminum in the global market is directly impacting the purchase of petroleum coke. Moreover, the increasing cement production capacity in the Asia-Pacific and Middle Eastern regions is also increasing the demand for petroleum coke as a high calorific value material.

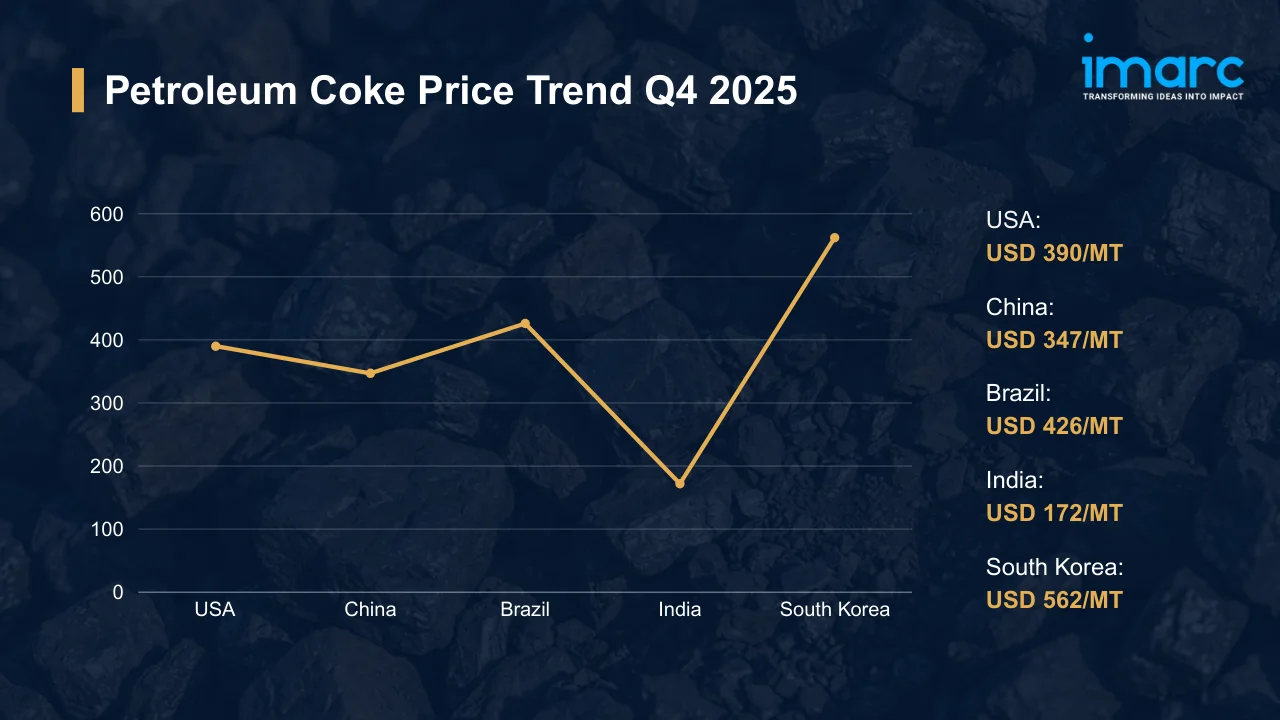

Petroleum Coke Price Trend Q4 2025:

Regional prices (USD per MT) and QoQ changes vs Q3 2025:

| Region | Price (USD/MT) | QoQ Change | Direction |

|---|---|---|---|

| USA | 390 | -2.0% | ↓ |

| China | 347 | +4.5% | ↑ |

| Brazil | 426 | +3.1% | ↑ |

| India | 172 | +3.6% | ↑ |

| South Korea | 562 | +2.2% | ↑ |

To access real-time prices Request Sample

What Moved Prices:

- USA: In the fourth quarter of 2025, petroleum coke prices fell to USD 390/MT, indicating a 2.0% quarterly decrease. Due to planned maintenance activities that momentarily limited output quantities, refinery utilization rates throughout the Gulf Coast corridor saw slight variations. Due to high freight costs and ongoing vessel scheduling issues, export demand from Asian markets remained somewhat muted. While competitive prices from other fuel sources restricted upward progress, domestic consumption from the cement manufacturing sector offered baseline support. Industrial consumers' purchase decisions were nevertheless influenced by regulatory discussions around emissions regulations for high-sulfur grades.

- China: During Q4 2025, petroleum coke prices increased by 4.5% to USD 347/MT. This trajectory was supported by robust consumption from the aluminum smelting and anode manufacturing segments, as production facilities increased operations ahead of seasonal inventory accumulation. Following import limitations on several high-sulfur versions, supply availability reduced significantly, forcing customers to look for other sourcing arrangements. Procurement difficulties were made worse by logistical constraints at important receiving ports, and policy changes that supported domestic industrial growth increased demand for a variety of end use applications.

- Brazil: In the fourth quarter of 2025, the price of petroleum coke surged by 3.1% to USD 426/MT in Brazil. As global trade patterns changed and Asian consumers became more competitive, the increasing trajectory indicated a tightening of worldwide supply availability. For buyers who relied on imports, currency volatility created pricing uncertainty because changes in exchange rates affected landing cost estimates over time. Throughout the quarter, the cement industry's consumption remained strong, sustaining demand support. Intermittent logistical difficulties brought on by port congestion at Santos and Paranaguá increased spot rates and put importers under cost pressure from demurrage.

- India: In the fourth quarter of 2025, the price of petroleum coke rose to USD 172/MT. During the post-monsoon construction season, consistent purchases from cement manufacturers and power plants strengthened the foundations of demand. Intermittent spot market constraint was caused by delayed cargo deliveries from usual supplying locations, such as the Middle East and the United States. The Indian rupee's decline in value relative to other major currencies increased importers' landed costs, which raised domestic price realizations. Import grade preferences and sourcing choices were still influenced by regulatory limitations that restricted the use of high-sulfur versions in specific industrial uses.

- South Korea: Petroleum coke prices rose to USD 562/MT during the fourth quarter of 2025, representing a 2.2% quarterly appreciation. This moderate advancement stemmed from tightening supply conditions as traditional exporting nations navigated shifting trade flow patterns and logistical constraints. The domestic steel and aluminum industries maintained steady procurement activities to secure feedstock requirements, providing consistent demand support throughout the quarter. Elevated shipping costs on transpacific routes compounded import expenses, while limited spot market liquidity contributed to pricing firmness. Contracted supply arrangements adequately met baseline industrial consumption levels amid stable operating conditions.

Drivers Influencing the Market:

Several factors continue to shape petroleum coke pricing and market behavior:

- Refinery Output Fluctuations: Scheduled and unscheduled maintenance activities at major refining complexes directly influence petroleum coke availability, with capacity utilization rates across key producing regions determining supply volumes for domestic and export markets.

- Aluminum Sector Demand: Calcined petroleum coke consumption for anode production in aluminum smelters represents a critical demand driver, with expanding global aluminum manufacturing capacity continuously strengthening procurement requirements from this industrial segment.

- Environmental Regulatory Frameworks: Evolving emissions standards and restrictions on high-sulfur fuel utilization shape grade preferences and sourcing patterns, with compliance requirements influencing both production specifications and end user procurement decisions. This increases demand for lower-sulfur and upgraded petroleum coke grades.

- Maritime Freight Dynamics: Shipping cost volatility and vessel availability significantly impact delivered prices for importing nations, with route-specific freight rate movements and port congestion levels affecting supply chain economics and delivery timing. Freight trends often drive short-term price fluctuations.

- Currency Exchange Movements: Exchange rate fluctuations between major currencies influence import competitiveness and landed cost calculations, with currency depreciation in importing countries typically elevating domestic price realizations for internationally sourced material. Favorable currency trends can also improve export attractiveness and strengthen the competitive position of local suppliers.

Recent Highlights & Strategic Developments:

Recent strategic moves within the industry further illustrate evolving dynamics:

- In October 2025, ExxonMobil initiated its initial deep-water oil production in Brazil at the Bacalhau field, signifying its upstream entry in the nation after over 110 years of activity. Although this milestone focused on oil production, it also enhanced a supply chain that could ultimately generate by-products like petroleum coke, thus bolstering ExxonMobil’s role in the global petroleum coke value chain.

Outlook & Strategic Takeaways:

Looking ahead, the petroleum coke market is expected to maintain steady growth, supported by rising energy demand in developing economies and sustained consumption from the cement, power generation, and metals sectors across global markets. Continued infrastructure development is likely to reinforce demand momentum.

To navigate this complex landscape, stakeholders should:

- Track Regional Demand Growth Trends: Closely monitor industrial expansion patterns across Asia, the Middle East, and Africa, as these regions will drive incremental petroleum coke demand and influence trade flows, pricing benchmarks, and long-term consumption visibility.

- Optimize Sourcing and Procurement Strategies: Evaluate domestic versus imported petroleum coke options based on quality requirements, logistics costs, and price stability. Flexible sourcing strategies can help buyers manage volatility while ensuring consistent supply for cement, power, and metals applications.

- Align Product Mix with End Use Requirements: Focus on securing suitable grades for fuel and calcined applications, as varying sulfur and calorific specifications directly impact usability. Tailoring procurement to specific industrial needs can improve efficiency and reduce operational adjustments.

- Strengthen Logistics and Storage Planning: Invest in efficient transportation, port handling, and storage infrastructure to minimize delivery disruptions. Reliable logistics capabilities can enhance cost control, improve supply continuity, and support scalability as consumption volumes rise.

- Enhance Long-Term Market Visibility: Use scenario planning and market intelligence to anticipate shifts in energy usage patterns and industrial output. Improved forecasting supports informed investment decisions, stable procurement planning, and stronger resilience against cyclical market fluctuations.

- Pursue Strategic Partnerships with Key Consumers: Engage closely with cement producers, power utilities, and metal manufacturers to align supply planning with demand outlooks. Long-term collaborations can improve volume predictability, strengthen customer retention, and support more stable revenue streams.

Subscription Plans & Customization:

IMARC offers flexible subscription models to suit varying needs:

- Monthly Updates - 12 deliverables/year

- Quarterly Updates - 4 deliverables/year

- Biannual Updates - 2 deliverables/year

Each includes detailed datasets (Excel + PDF) and post-report analyst support.

.webp)

.webp)