November 2025 Sulfuric Acid Prices: Reflect Higher Demand from Mining and Manufacturing

26-Nov-2025

Sulfuric acid is a highly corrosive, dense, oily liquid chemical compound with the molecular formula H2SO4, representing one of the most important industrial chemicals in global manufacturing. This strong mineral acid serves as a critical input material for numerous industrial processes worldwide, with primary applications including fertilizer production where it processes phosphate rock into phosphoric acid for crop nutrients, battery manufacturing for lead-acid and lithium-ion applications, metal processing and mining operations for ore leaching and purification, petroleum refining for alkylation processes, chemical synthesis, textile processing, and wastewater treatment applications. Given its essential role across multiple industrial sectors, pricing remains highly sensitive to raw material costs, industrial production levels, fertilizer demand cycles, battery manufacturing growth, mining activity, and regional supply-demand dynamics. November 2025 witnessed mixed regional trends as varied industrial activity, supply conditions, and market sentiment created divergent pricing pressures across major global markets.

Global Market Overview:

Globally, the sulfuric acid industry reached USD 15.89 Billion in 2025. Projections suggest the market could grow to USD 22.89 Billion by 2034, with a compound annual growth rate (CAGR) of 4.14% during 2026-2034. The market is driven by expanding fertilizer production supporting global food security initiatives, increasing battery manufacturing demand from electric vehicle adoption, growing metal processing and mining activities requiring acid leaching processes, and rising chemical industry applications across pharmaceutical and specialty chemical sectors worldwide.

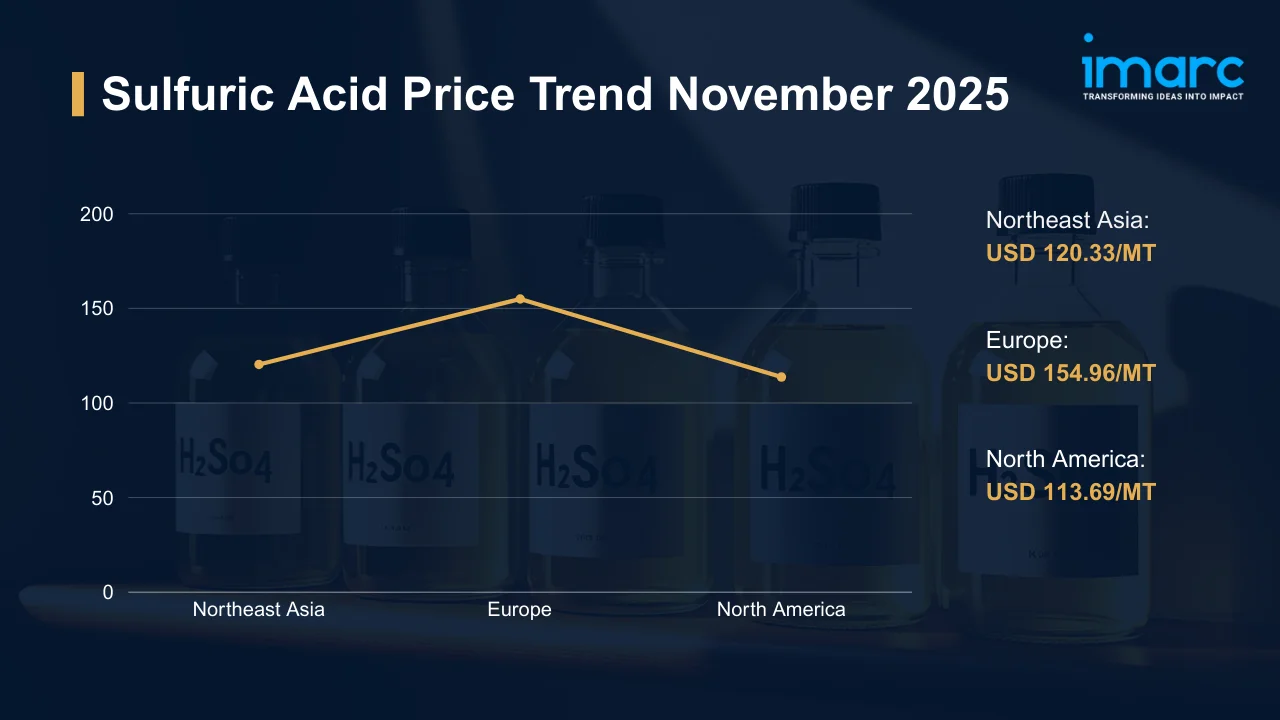

Sulfuric Acid Price Trend November 2025:

Regional prices (USD per metric ton) and month-over-month change:

| Region | Price (USD/MT) | MoM Change | Direction |

|---|---|---|---|

| Northeast Asia | 120.33 | +16.7% | ↑ |

| Europe | 154.96 | -1.7% | ↓ |

| North America | 113.69 | -0.7% | ↓ |

To access real-time prices Request Sample

What Moved Prices:

- Northeast Asia: Sulfuric acid prices surged significantly as robust demand growth from fertilizer manufacturing, particularly in China where agricultural sector requirements supported consistent consumption patterns, drove strong procurement activity. Industrial applications including metal processing and chemical manufacturing across Japan, South Korea, and Taiwan maintained steady demand levels. Raw material costs faced upward pressure from elevated sulfur prices influenced by global supply chain constraints and increased demand from multiple industrial sectors. Supply conditions showed balanced dynamics as regional producers operated at optimized capacity utilization rates, while international shipping costs from Middle Eastern and North American sulfur suppliers remained elevated due to vessel availability constraints.

- Europe: Prices declined modestly as the regional market faced headwinds from reduced industrial activity across key consuming sectors, particularly in Germany and France where chemical manufacturing and metal processing operations experienced seasonal slowdowns. Fertilizer demand showed mixed patterns, with agricultural applications maintaining steady consumption while industrial applications faced competitive pressure from alternative chemicals. Supply dynamics remained balanced as regional producers implemented strategic capacity management to align production with seasonal demand patterns, while cost structures benefited from improved energy price stability, particularly natural gas costs that previously created significant operational challenges.

- North America: Sulfuric acid prices edged down slightly as supply abundance and seasonal demand moderation created mild downward pressure. The regional market faced challenges from reduced consumption in key sectors including copper mining operations and phosphate fertilizer production, where operational adjustments affected acid requirements. Supply dynamics showed ample availability as regional producers maintained high capacity utilization rates while smelting operations generated substantial sulfuric acid as a byproduct of metal processing activities. The region's integrated production structure, where sulfuric acid is produced as a secondary product from copper and zinc smelting, created supply pressures when base metal production remained strong despite reduced acid demand.

Drivers Influencing the Market:

Several factors continue to shape sulfuric acid pricing and market behavior:

- Fertilizer Production and Agricultural Demand

Phosphate fertilizer manufacturing represents the largest consumption driver for sulfuric acid globally, accounting for over half of total demand. The compound processes phosphate rock into phosphoric acid, a critical nutrient for crop production supporting global food security. Agricultural sector activity, planting seasons, fertilizer application rates, and government agricultural support programs significantly influence regional consumption patterns. Food security initiatives, population growth driving agricultural intensification, and soil nutrient management practices create sustained long-term demand for phosphate-based fertilizers and consequently sulfuric acid.

- Battery Manufacturing and Electric Vehicle Growth

Expanding electric vehicle adoption drives increasing sulfuric acid demand for battery production, both for traditional lead-acid batteries and emerging lithium-ion battery technologies where acid is used in cathode material processing. Electric vehicle market growth, energy storage system installations, automotive industry electrification trends, and battery manufacturing capacity expansions directly influence sulfuric acid consumption patterns. Government clean energy policies, vehicle emission standards, and battery technology developments create structural demand growth supporting long-term market expansion.

- Metal Processing, Mining, and Ore Leaching

Copper, zinc, nickel, and other base metal production operations utilize sulfuric acid extensively for ore leaching, metal extraction, and refining processes. Mining industry activity, base metal commodity prices, ore processing volumes, and smelting operations significantly influence acid demand. Integrated production structures where smelting operations generate sulfuric acid as a byproduct create unique regional supply-demand dynamics. Mine development projects, metal production capacity utilization, and metallurgical processing technologies affect both sulfuric acid supply availability and consumption requirements across regional markets.

- Raw Material Costs and Sulfur Availability

Sulfuric acid production relies primarily on elemental sulfur, base metal smelter gases, and pyrite ore as feedstock sources. Global sulfur supply-demand balances, petroleum refining activity producing sulfur byproducts, natural gas processing operations, and smelting industry dynamics directly influence raw material costs and production economics. Sulfur price volatility, supply chain logistics, feedstock availability constraints, and transportation costs materially impact sulfuric acid production margins and market pricing across regions. Environmental regulations mandating sulfur capture from industrial processes affect supply availability and production cost structures.

- Chemical Industry Applications and Industrial Demand

Chemical manufacturing sectors utilize sulfuric acid extensively for organic and inorganic chemical synthesis, alkylation processes in petroleum refining, pharmaceutical production, specialty chemicals manufacturing, and industrial process applications. Industrial production activity, chemical sector capacity utilization, petroleum refining margins, and manufacturing economic conditions influence baseline consumption levels. Process chemical requirements, catalyst applications, and industrial chemical transformations create diversified demand sources beyond primary fertilizer and mining applications.

- Semiconductor and High-Purity Applications

Growing semiconductor manufacturing activity drives increasing demand for ultra-high-purity sulfuric acid used in chip fabrication processes including wafer cleaning, etching, and metal deposition. Advanced technology node production, semiconductor capacity expansions, electronics industry growth, and chip manufacturing investments create premium-grade sulfuric acid demand segments. Quality specifications, purity requirements, and semiconductor industry technological advances influence high-value specialty acid market dynamics and regional production capacity development.

Recent Highlights & Strategic Developments:

Recent strategic moves within the industry further illustrate evolving dynamics:

- In April 2025, BASF announced plans to build a new semiconductor-grade sulfuric acid plant at its Ludwigshafen site in Germany, targeting operations by 2027. The facility, representing a high double-digit million-euro investment, is designed to serve growing demand for ultra-pure chemicals in Europe's expanding chip-fabrication industry. The plant will feature cutting-edge purity capabilities necessary for advanced semiconductor manufacturing processes, supporting Europe's semiconductor supply chain development and technological sovereignty initiatives in chip production.

- In March 2025, Ecovyst Inc. agreed to acquire the sulfuric acid production assets of Cornerstone Chemical Company in Waggaman, Louisiana. The acquisition aims to increase Ecovyst's capacity to serve both regeneration and virgin sulfuric acid customers, offering greater flexibility within the company's existing plant network along the Gulf Coast. This strategic move enhances regional supply capabilities and strengthens market positioning in the North American sulfuric acid industry.

Outlook & Strategic Takeaways:

Looking ahead, the sulfuric acid market is expected to maintain steady growth at 4.18% CAGR through 2034, supported by expanding fertilizer production for global food security, increasing battery manufacturing from electric vehicle adoption, growing metal processing and mining activities, rising chemical industry applications, and emerging high-purity semiconductor demand. Regional dynamics will likely persist, with Asia Pacific maintaining dominant consumption driven by fertilizer production and industrial manufacturing, while developed markets focus on high-purity applications, circular economy practices, and sustainable production technologies. Electric vehicle market penetration, semiconductor capacity expansions, and agricultural intensification will continue reshaping demand patterns and application mix across global markets.

To navigate this complex landscape, stakeholders should:

- Track sulfuric acid prices monthly and regionally to identify inflection points or early signals of shifting supply-demand dynamics, particularly monitoring fertilizer production cycles, mining activity levels, battery manufacturing expansions, and industrial production trends that directly influence regional pricing trajectories and procurement opportunities across major consumption sectors.

- Benchmark procurement against regional price differentials to optimize sourcing strategies. The USD 41.27/MT spread between North America and Europe represents opportunity for strategic sourcing decisions, logistics optimization, and supply chain management across production hubs and consumption markets, particularly for large-scale industrial consumers with flexible sourcing capabilities and established supplier networks.

- Monitor upstream sulfur costs including elemental sulfur prices, base metal smelter gas availability, pyrite ore supply dynamics, and petroleum refining byproduct volumes, as these directly translate into sulfuric acid production economics and market pricing. Sulfur market volatility, supply chain disruptions, and feedstock availability constraints materially impact production costs and regional price competitiveness across global markets.

- Assess fertilizer industry activity including phosphate rock processing volumes, agricultural planting seasons, crop nutrient requirements, and government agricultural support programs as leading indicators of sulfuric acid consumption cycles. Fertilizer production capacity utilization, seasonal demand patterns, and agricultural commodity prices provide visibility into medium-term acid demand trajectories and market dynamics.

- Evaluate electric vehicle market growth including battery manufacturing capacity expansions, automotive industry electrification rates, energy storage system installations, and government clean energy policies as structural demand drivers. Electric vehicle adoption trends, battery technology developments, and manufacturing investment announcements signal long-term growth opportunities in battery-grade sulfuric acid applications.

- Monitor mining and metals industry dynamics including base metal commodity prices, ore processing volumes, copper and zinc production rates, and smelting activity levels. Mining project development pipelines, metal production capacity utilization, and metallurgical processing technologies influence both sulfuric acid supply from smelter byproducts and demand from ore leaching operations, creating complex regional supply-demand interactions.

- Track semiconductor industry developments including chip manufacturing capacity expansions, advanced technology node production, electronics industry growth, and high-purity chemical requirements. Semiconductor fab investments, particularly in Europe, North America, and Asia, drive premium-grade sulfuric acid demand growth and create opportunities for specialized high-purity production capacity development.

- Diversify supply sources across regions to mitigate feedstock availability risks, production capacity constraints, transportation logistics disruptions, and regional demand surges. Single-region sourcing strategies remain vulnerable to raw material supply variations, smelter maintenance cycles, and seasonal production patterns that create supply volatility and price fluctuations during peak demand periods.

Subscription Plans & Customization:

IMARC offers flexible subscription models to suit varying needs:

- Monthly Updates — 12 deliverables/year

- Quarterly Updates — 4 deliverables/year

- Biannual Updates — 2 deliverables/year

Each includes detailed datasets (Excel + PDF) and post-report analyst support.

.webp)

.webp)