United States Grow Light Market Expected to Reach USD 2,862.7 Million by 2033 - IMARC Group

United States Grow Light Market Statistics, Outlook and Regional Analysis 2025-2033

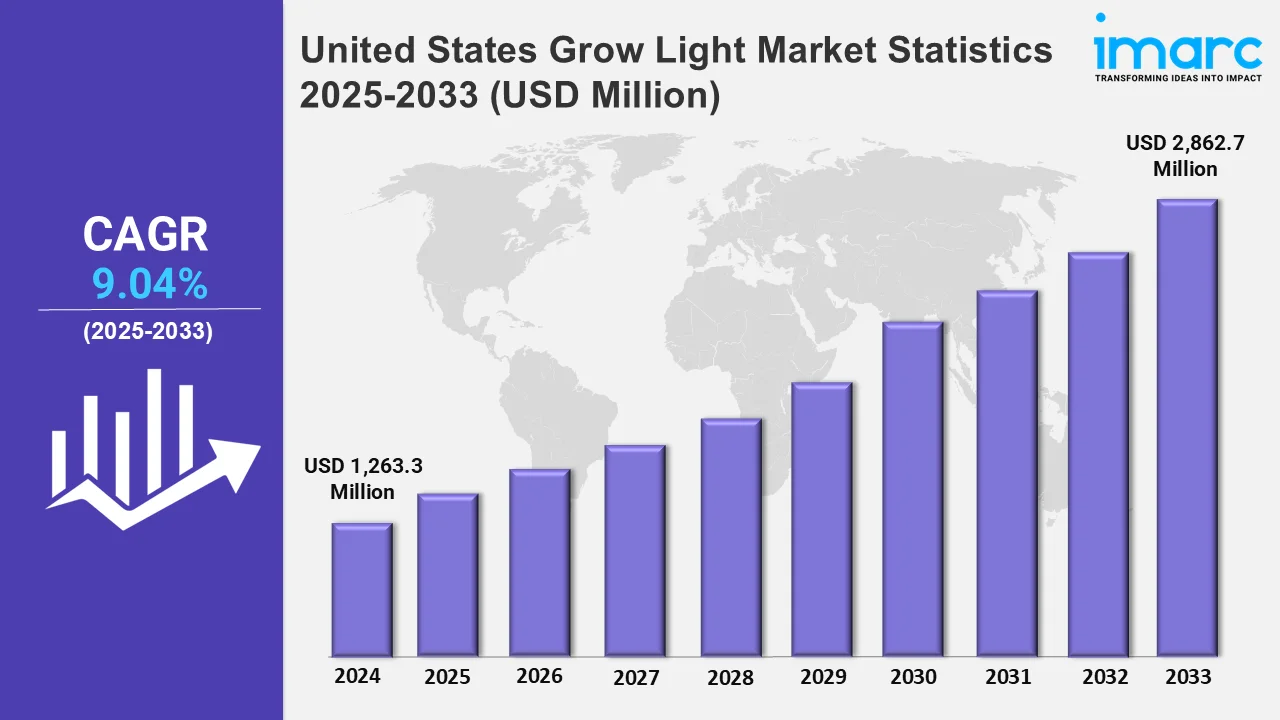

The United States grow light market size was valued at USD 1,263.3 Million in 2024, and it is expected to reach USD 2,862.7 Million by 2033, exhibiting a growth rate (CAGR) of 9.04% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing demand for energy-efficient horticultural lighting solutions is driving advancements in the United States grow light market. Industry players are developing LED solutions that enhance photosynthetic efficiency while reducing operational costs with the rising adoption of vertical farming and controlled environment agriculture. The shift toward customized light spectrums optimized for plant growth is encouraging manufacturers to invest in research and development. Moreover, government incentives promoting sustainable agriculture are encouraging farmers to adopt LED grow lights, leading to significant market expansion. For example, in June 2024, Cree LED launched Photophyll Select LEDs in Durham, improving chlorophyll absorption efficiency with a refined green/blue ratio. This development enhances energy savings and plant growth while reducing LED system costs, making it a valuable innovation for vertical farming. Furthermore, the growing integration of smart lighting technologies in horticulture is influencing market trends. Advanced spectrum control features allow growers to fine-tune light wavelengths to maximize plant health and yield.

Prominent companies are launching innovative lighting solutions designed for precision agriculture as indoor and greenhouse farming grow to cater to the rising need for fresh produce. GE Lighting, a Savant company based in East Cleveland, unveiled Cync Reveal HD+ Full Color Smart Undercabinet Fixtures in January 2024 to improve color spectrum control. This launch highlights the continuous improvements in LED customization, benefitting grow light spectrum engineering for optimized plant growth. Moreover, the rising focus on cost-effective, long-lasting LED solutions is shaping market dynamics, with manufacturers prioritizing high-efficiency designs to cater to commercial growers. In July 2023, Ledestar introduced Nova White LED in California, refining blue-light spectrum control to enhance photosynthesis efficiency. This advancement increases chlorophyll absorption, leading to higher crop yields and extended LED lifespan. With increasing investments in horticultural lighting technology, the United States grow light industry is poised for steady growth. The continuous development of advanced LED solutions, coupled with the expansion of sustainable farming practices, is creating new opportunities for industry players. Additionally, the need for reliable lighting solutions in commercial greenhouses and urban farming is pushing manufacturers to enhance spectral efficiency, durability, and cost-effectiveness, ensuring long-term market expansion.

United States Grow Light Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. Currently, the South dominates the overall market. The increasing demand for indoor farming and urban agriculture, driven by limited space and climate challenges, is fueling the adoption of grow lights across the country, especially in urban centers.

Northeast Grow Light Market Trends:

The Northeast US is seeing strong investment in dynamic LED grow lighting for controlled environments, particularly in academic and commercial greenhouse research. With rising demand for year-round crop cultivation, adaptive lighting systems are advancing efficiency and plant morphology studies. In September 2023, Sollum Technologies in New York launched S.E.A.R.C.H., a research partnership providing advanced LED grow lights to US universities. This initiative accelerates greenhouse innovation, optimizing spectral tuning for different crop needs while reducing energy consumption, thereby improving sustainability in urban and commercial farming operations.

Midwest Grow Light Market Trends:

The Midwest, known for large-scale indoor farms and greenhouse operations, is experiencing increased investment in LED technology for precision agriculture. The need for high-performance, energy-efficient lighting solutions is driving collaborations between industrial and horticultural sectors. Moreover, in February 2023, Methode Electronics in Chicago acquired Nordic Lights for EUR 132 million, reinforcing LED innovation for heavy-duty applications. While primarily industrial, this strengthens the United States horticultural LED supply chain, improving access to specialized grow lights that enhance Midwest greenhouse productivity for crops like tomatoes and leafy greens.

South Grow Light Market Trends:

The Southern region is leading the overall market, driven by rapid expansion in greenhouse-focused LED technology, particularly in large-scale commercial farming. With a favorable climate for year-round crop production, growers are shifting to high-performance LED solutions to optimize yield and energy use. In January 2024, Acuity Brands in Atlanta, Georgia, acquired Arize horticultural lighting from Current, enhancing its LED portfolio. This deal, supported by Hort Americas, strengthens advanced horticultural lighting solutions, helping Southern growers achieve better crop quality and efficiency, particularly in commercial vertical farms cultivating strawberries, lettuce, and microgreens.

West Grow Light Market Trends:

The Western US is driving innovation in proprietary grow light technologies, emphasizing energy-efficient cultivation for cannabis, leafy greens, and specialty crops. The market is seeing new product introductions that enhance plant health while reducing operational costs. In November 2024, GrowGeneration in Denver, Colorado, launched the ION 135W Under Canopy LED Light and Char Coir Crush Pots, expanding its product lineup. These innovations improve plant yield and efficiency in hydroponic and soil-based growing environments, solidifying the region’s role as a leader in horticultural LED advancements for commercial and specialty agriculture.

Top Companies Leading in the United States Grow Light Industry

The United States horticultural lighting market is advancing, with companies like FOHSE leading advancements. The report published in September 2024 highlights FOHSE’s PRO Series LED grow lights, featuring seven adjustable spectrum channels and real-time environmental sensors, optimizing cannabis yields and greenhouse efficiency. This development underscores the industry's focus on precision cultivation. The competitive landscape of the sector has also been examined, covering market structure, positioning of key players, and detailed portfolio of major companies shaping controlled-environment agriculture in the country.

United States Grow Light Market Segmentation Coverage

- On the basis of the technology, the market has been bifurcated into HID, LED, fluorescent, and others, wherein LED represents the most preferred segment. LED grow lights lead the market due to their energy efficiency, long lifespan, and ability to provide targeted light spectrums, making them ideal for indoor and vertical farming applications where precise lighting control is essential for optimal plant growth.

- Based on the installation type, the market is categorized into new installations and retrofit installations. Currently, new installations dominate the market, driven by the growing demand for sustainable agricultural solutions, advanced lighting technologies, and the expansion of controlled environment agriculture.

- On the basis of the spectrum, the market has been divided into full-spectrum and partial spectrum. Among these, full-spectrum exhibits a clear dominance in the market as they mimic natural sunlight, offering a balanced range of wavelengths that enhance photosynthesis and promote healthy plant growth.

- Based on the application, the market is bifurcated into indoor farming, vertical farming, commercial greenhouse, turf and landscaping, and others, wherein commercial greenhouse dominates the market. The commercial greenhouse sector leads the segment growth, driven by the increasing demand for year-round crop production, the need for optimized growing conditions, and the adoption of advanced lighting technologies.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,263.3 Million |

| Market Forecast in 2033 | USD 2,862.7 Million |

| Market Growth Rate 2025-2033 | 9.04% |

| Units | USD Million |

| Segment Coverage | Technology, Installation Type, Spectrum, Application, Region |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Grow Light Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)