Global Vegan Supplements Market Expected to Reach USD 14.2 Billion by 2033 – IMARC Group

Global Vegan Supplements Market Statistics, Outlook and Regional Analysis 2025-2033

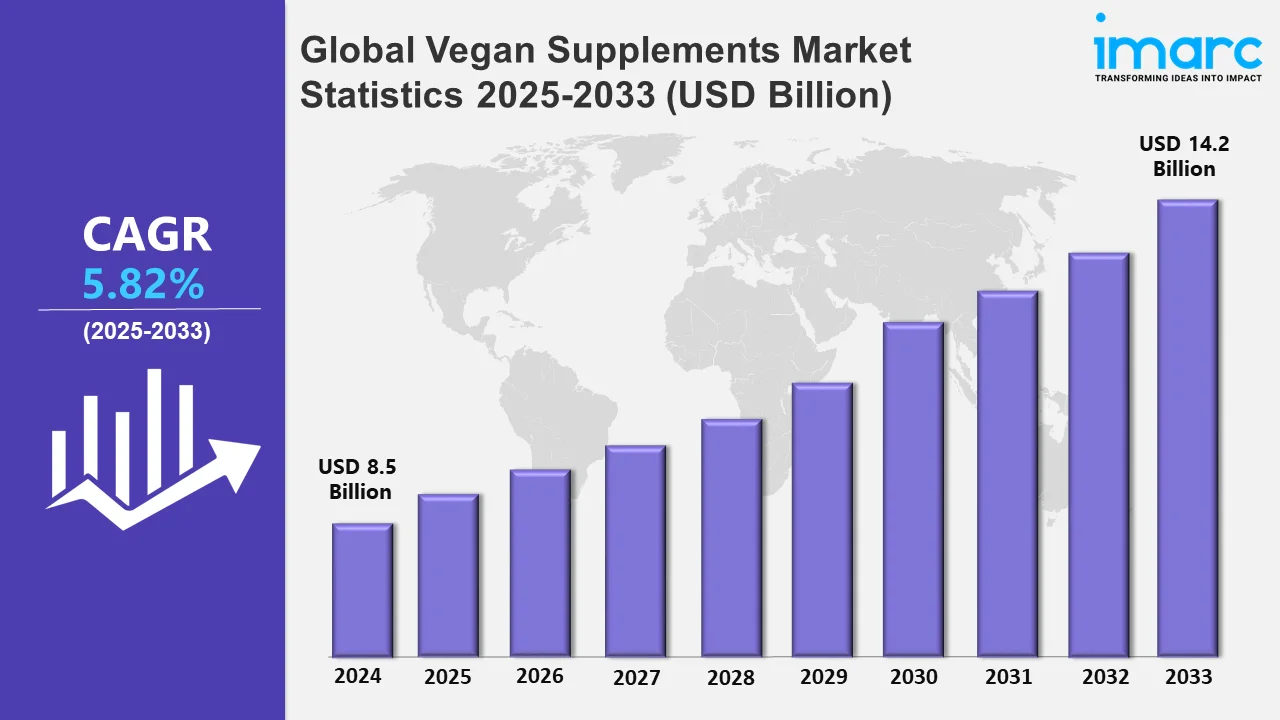

The global vegan supplements market size was valued at USD 8.5 Billion in 2024, and it is expected to reach USD 14.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.82% from 2025 to 2033.

To get more information on this market, Request Sample

The rising adoption of plant-based products is impelling the market growth. As more people are gradually shifting towards plant-based diets for health and ethical reasons, the demand for vegan supplements is increasing. These products cater to the growing population seeking alternatives to animal-based proteins, vitamins, and minerals. Plant-based supplements are often perceived as healthier, eco-friendly, and free from allergens like lactose, which appeals to a broader consumer base. Additionally, the increasing awareness among the masses about the environmental impact of animal farming creates the need for plant-based products. Vegan supplements are chosen as a sustainable choice, aligning with consumers' values for green living. Companies produce a wide variety of options, including protein powders, multivitamins, and omega-3 supplements derived from plants, ensuring higher appeal. In May 2024, Good Fettle Private Limited, a well-known clean snacking brand, unveiled its vegan protein brand ‘PodNutrition’ in India. With this initiative, the company seeks to establish a new benchmark in plant-based supplements while redefining taste, purity, and nutritional quality.

The improvements in product variety are fueling the market growth. Manufacturers are innovating with a wide range of vegan supplements, including capsules, gummies, and vegan liquid vitamins, which are preferred for their easy consumption and rapid absorption. This variety facilitates people to opt for formats that are best suited for their preferences and lifestyles. The inclusion of plant-based proteins and probiotics ensures that vegan supplements meet a broad spectrum of dietary requirements. Companies are also focusing on flavor enhancement and the incorporation of trending ingredients like spirulina, ashwagandha, and turmeric, appealing to both taste and health benefits. The high need for tailored products for specific groups, such as athletes, seniors, and children, further strengthens the market growth. Moreover, key players are developing vegan liquid vitamins that are free from common allergens like dairy, gluten, and soy, ensuring broader accessibility. In January 2024, Vedji, a new liquid vegan-friendly supplement company founded by Amythest Rawls, declared its official launch. It unveiled its two new vegan liquid vitamin supplements- the ‘Supreme Liquid Daily Multivitamin’, in tart berry flavor and a limited edition ‘Vegan Vitamin D3’ in lemon pie flavor.

Global Vegan Supplements Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounts for the largest market share driven by the increasing health awareness, the growing plant-based food trends, and the expansion of e-commerce platforms.

North America Vegan Supplements Market Trends:

North America is enjoying the leading position in the market due to its growing health-conscious population and increasing adoption of plant-based diets. People in the US and Canada are becoming more conscious about their health and opting for vegan lifestyles, which has increased the demand for high-quality vegan supplements. Retail chains and online platforms in the region offer a wide variety of plant-based vitamins, protein powders, and omega-3 supplements. This trend is supported by endorsements by celebrity and social media influencers and awareness campaigns highlighting veganism’s health and environmental benefits. North America also has a robust infrastructure for producing and distributing supplements, making these products widely accessible. Additionally, in the US, companies focus on creating nutrient-rich vegan products without compromising on flavors. In February 2024, Herbalife, a prominent company that develops and sells dietary supplements, launched its new ‘glucagon-like peptide-1 (GLP-1) nutrition companion’ that offers a wide selection of food and supplement product combos. These items are crafted to support the nutritional needs of individuals on GLP-1 and other weight-loss medications. It is available in classic and vegan options in the United States and Puerto Rico in a range of flavors, including ‘Healthy Meal Nutritional Shake Mix’, ‘Protein Drink Mix’, and ‘Active Fiber Complex’.

Asia-Pacific Vegan Supplements Market Trends:

Asia-Pacific accounts for a sizeable portion of the vegan supplements industry owing to the rising awareness among people about health and wellness. Countries like India, China, and Australia are experiencing a shift towards plant-based eating, driven by health concerns and ethical values. Traditional Asian diets, which already rely heavily on plant-based ingredients, make the transition to veganism easier for consumers. Apart from this, social media campaigns and the influence of Western health trends promote the use of vegan supplements. Asia-Pacific’s diversity in food cultures also encourages innovations in vegan supplement flavors and formulations.

Europe Vegan Supplements Market Trends:

The market for vegan supplements is expanding gradually in Europe, which can be attributed to countries like Germany, the UK, and France leading the charge. The region is known for its progressive preference for sustainability, which aligns perfectly with the vegan lifestyle. European consumers often prioritize organic and eco-friendly products, making vegan supplements a natural choice. The rise of flexitarian diets and veganism as a cultural trend further drives the demand for vegan items. In addition, strict regulations on product labeling and quality ensure that European customers can trust vegan supplements as safe and effective. With an increasing number of vegan cafes, health stores, and fitness enthusiasts, Europe remains a significant area.

Latin America Vegan Supplements Market Trends:

On account of the growing health awareness among the masses, Latin America is experiencing vegan supplements market expansion. People in nations like Brazil and Argentina adopt plant-based diets, which encourage the use of vegan supplements. Individuals also choose vegan supplement products due to their environmental benefits. Younger generations are particularly attracted to plant-based nutrition, creating the need for vegan protein powders, vitamins, and other supplements. Local companies are also stepping up by offering affordable vegan supplement options tailored to regional tastes. Additionally, Latin America’s abundant plant resources make it a strategic hub for producing and exporting vegan supplements.

Middle East and Africa Vegan Supplements Market Trends:

The market for vegan supplements in the Middle East and Africa region is distinguished by the rising consumption of vegan supplements, especially in urban centers like Dubai and Johannesburg. In this region, people focus on fitness and wellness and hence purchase nutrient dense vegan supplement products. Moreover, health-conscious consumers explore plant-based options to complement their active lifestyles. The market is also supported by expatriate communities and the increasing availability of vegan products in premium supermarkets and online stores.

Top Companies Leading in the Vegan Supplements Industry

Some of the leading Vegan Supplements market companies include Aloha Inc., Amway Corp., Deva Nutrition LLC, DuPont de Nemours Inc., Eversea Inc., HTC Health, Jarrow Formulas Inc., Nestlé S.A., NOW Foods, Nutrazee, Ora Organic, and PepsiCo Inc., among many others. In March 2024, ALOHA, a prominent plant-based protein brand that manufactures protein bars, protein powder, and protein drinks, announced that it secured an investment of USD 68 Million financed by SEMCAP Food & Nutrition, a growth equity funding firm. The company intends to grow its range of plant-based protein items via traditional retail outlets and digital platforms.

Global Vegan Supplements Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into protein, minerals, vitamins, and others, wherein protein represents the leading segment. It is the favored option for fitness lovers, athletes, and health-aware individuals seeking plant-based substitutes. Featuring choices, such as pea, soy, and rice protein, these supplements accommodate various dietary preferences and nutritional requirements. They are ideal for muscle recovery, maintaining weight, and enhancing overall health. People adopt plant-based diets that include protein, as they seek cruelty-free and sustainable protein sources. Easy availability and versatile usage in shakes, smoothies, and recipes also make vegan protein the go-to option.

- Based on the form, the market has been classified into powder, capsules/tablets, and others, amongst which powder dominates the market. It is favored, as it is very adaptable and has a long shelf life. Whether incorporating it into smoothies, shakes, or baking recipes, it integrates effortlessly into everyday habits. Powder also permits adjustable serving sizes, which makes it favored by fitness lovers and health-aware individuals. Furthermore, it typically comes in bigger quantities, providing enhanced cost-effectiveness. It offers a broad range of tastes and nutrient-dense choices, such as protein, vitamins, and superfood products.

- On the basis of the distribution channel, the market has been divided into pharmacies/drug stores, supermarkets and hypermarkets, specialty stores, and online stores. Among these, pharmacies/drug stores account for the majority of the market share since they are trusted, convenient, and easily accessible. People often visit these stores for health-related products and to buy their favorite vegan supplements. Many pharmacies also have knowledgeable staff to guide customers on the best products for their needs. They also stock a variety of options, ranging from protein powders to vitamins, which making them a one-stop shop for people who are health conscious.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 14.2 Billion |

| Market Growth Rate 2025-2033 | 5.82% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Protein, Minerals, Vitamins, Others |

| Forms Covered | Powder, Capsules/Tablets, Others |

| Distribution Channels Covered | Pharmacies/Drug Stores, Supermarkets and Hypermarkets, Specialty Stores, Online Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aloha Inc., Amway Corp., Deva Nutrition LLC, DuPont de Nemours Inc., Eversea Inc., HTC Health, Jarrow Formulas Inc., Nestlé S.A., NOW Foods, Nutrazee, Ora Organic, PepsiCo Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)