5G Equipment Market Report by Technology (Network Function Virtualization (NFV), Software Defined Networking (SDN), Multi-access Edge Computing (MEC)), Equipment (Macrocell, Small Cell, and Others), Architecture (5G Standalone (NR + Core), 5G NR Non-Standalone (LTE Combined)), Frequency (Sub 6 GHz, Above 6 GHz), Application (Automotive, Consumer Electronics, Commercial, Industrial), and Region 2025-2033

5G Equipment Market Size:

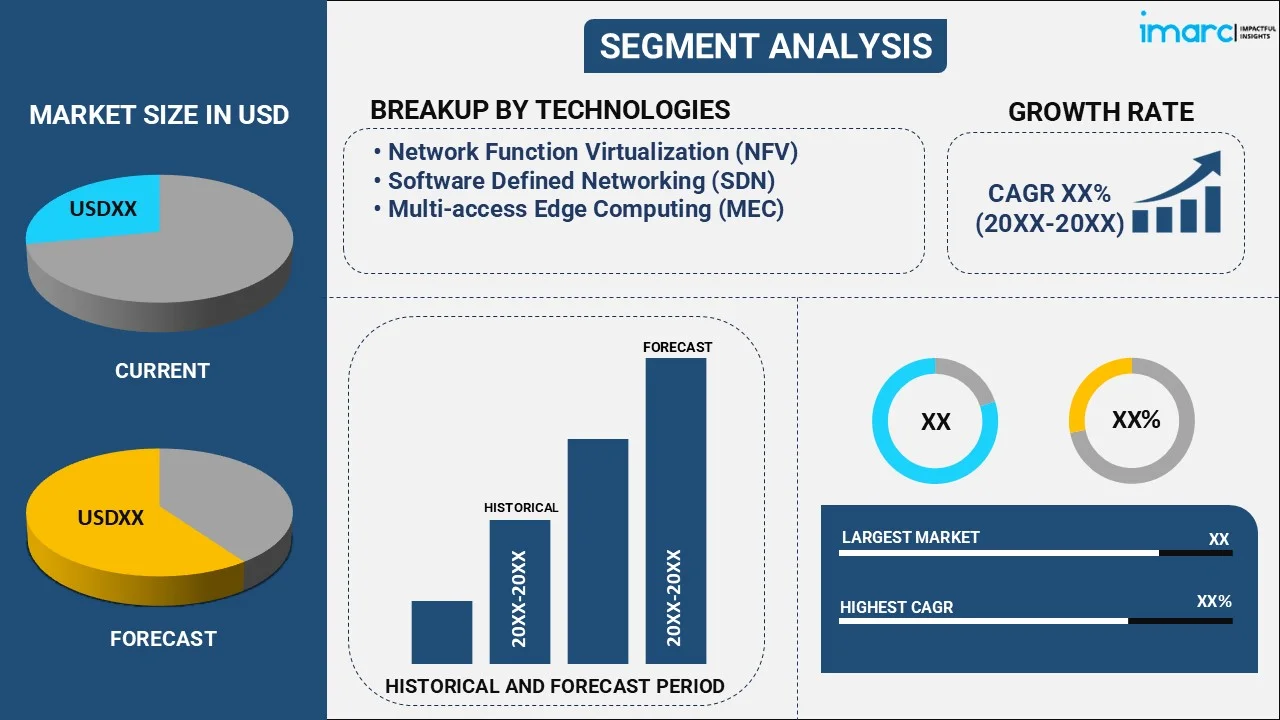

The global 5G equipment market size reached USD 23.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 277.0 Billion by 2033, exhibiting a growth rate (CAGR) of 30.01% during 2025-2033. The market is experiencing steady growth driven by the rising utilization of data-intensive applications, low latency requirements in applications like autonomous vehicles, remote surgery, and augmented reality (AR), and increasing adoption of the Internet of Things (IoT) devices. At present, North America holds the largest market share owing to a robust technological ecosystem and presence of significant manufacturers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.4 Billion |

|

Market Forecast in 2033

|

USD 277.0 Billion |

| Market Growth Rate 2025-2033 | 30.01% |

5G Equipment Market Analysis:

- Market Growth and Size: The market is witnessing robust growth due to the increasing data usage, along with the rising focus on smart city initiatives.

- Technological Advancements: The introduction of improved fifth generation (5G) equipment with higher efficiency, lower energy consumption, and enhanced performance is facilitating the market growth.

- Industry Applications: 5G equipment finds applications across various industries, including telecommunications, automotive, healthcare, manufacturing, and entertainment.

- Geographical Trends: North America leads the market, driven by the presence of highly developed telecommunications infrastructure. However, Asia Pacific is emerging as a fast-growing market due to the escalating demand for high-speed and reliable connectivity.

- Competitive Landscape: Key players are working on enhancing the performance, efficiency, and capabilities of 5G hardware and software.

- Challenges and Opportunities: While the market faces challenges, such as security concerns, it also encounters opportunities in addressing sustainability concerns.

- Future Outlook: The 5G equipment market outlook looks promising, with the increasing development of 5G infrastructure. In addition, the rising focus on cost-effective solutions is expected to bolster the market growth.

5G Equipment Market Trends:

Growing utilization in data-intensive applications

The escalating demand for 5G equipment due to the rising usage of data-intensive applications is propelling the market growth. In line with this, the increasing utilization of smartphones, tablets, and other connected devices is impelling the market growth. Moreover, individuals and organizations are relying on data-driven services. Besides this, streaming high-definition videos, cloud-based applications, and online gaming all require substantial bandwidth. Furthermore, the growing need for robust and fast connectivity on account of the rising remote work culture, online learning, and telemedicine is offering a positive market outlook. Apart from this, 5G can deliver higher data rates and lower latency that enables users to experience smoother and more responsive interactions with their devices and applications. Additionally, the increasing adoption of 5G equipment among telecom operators and organizations looking to enhance their connectivity infrastructure is contributing to the 5G equipment market growth. Data-intensive applications running in the cloud require high-speed connections for optimal performance.

Low latency requirements

Low latency is the minimal delay or lag in transmitting data between a source and a destination in a network or communication system. In addition, low latency plays a crucial role in applications that require real-time communication, such as autonomous vehicles, remote surgery, and augmented reality (AR). Apart from this, 5G has ultra-low latency capabilities, which makes it the ideal choice for several applications. In autonomous vehicles, 5G enables near-instantaneous communication between vehicles and infrastructure, enhancing safety and efficiency. Moreover, in telemedicine, surgeons can perform remote procedures with minimal delay, potentially saving lives. In line with this, AR and virtual reality (VR) applications are becoming more immersive and responsive with 5G, enhancing the experiences of users. Furthermore, industries are seeking to utilize the full potential of this technology to enable innovative and time-sensitive applications. Additionally, in the financial industry, low latency is critical for high-frequency trading (HFT) and algorithmic trading systems. Traders rely on split-second decisions, and a slight delay can result in financial losses.

Increasing adoption of the Internet of Things (IoT) devices

The increasing utilization of the Internet of Things (IoT) devices among the masses across the globe is supporting the growth of the market. In addition, these devices range from smart home appliances and wearable fitness trackers to industrial sensors and smart city infrastructure. Besides this, 5G assists in supporting a massive number of connections simultaneously. IoT applications often require low-power and wide-area connectivity, which 5G provides through various technologies. This enables efficient and cost-effective deployment of IoT devices across various industries, such as agriculture, healthcare, logistics, and utilities. Furthermore, 5G has lower energy consumption and offers increased capacity and improved coverage, making it an attractive choice for IoT deployments. In line with this, IoT devices generate vast amounts of data. Organizations can gain valuable insights into the behavior of individuals, equipment performance, and operational efficiency by analyzing this data. As a result, these insights assist in providing informed decision-making and driving innovation.

5G Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology, equipment, architecture, frequency, and application.

Breakup by Technology:

- Network Function Virtualization (NFV)

- Software Defined Networking (SDN)

- Multi-access Edge Computing (MEC)

Network function visualization (NFV) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology. This includes network function virtualization (NFV), software defined networking (SDN), and multi-access edge computing (MEC). According to the report, network function virtualization (NFV)represented the largest segment.

Network function virtualization (NFV) is a technology that virtualizes network functions traditionally performed by hardware appliances. In addition, NFV plays a crucial role in enabling the flexibility and scalability required for virtualized network services. NFV reduces the need for specialized hardware, making networks more agile and cost-effective.

Software defined networking (SDN) is a technology that separates the control plane from the data plane in network architecture, enabling centralized control and programmability of network resources. SDN enhances network management, optimization, and resource allocation. SDN enables dynamic network configuration, allowing operators to adapt to changing traffic patterns and service requirements efficiently.

Multi-access edge computing (MEC) extends cloud computing capabilities to the edge of the network, closer to the end-users or devices. MEC is essential for low-latency applications like augmented reality (AR), autonomous vehicles, and IoT. MEC enables real-time processing and data analytics at the edge, reducing latency and improving user experiences.

Breakup by Equipment:

- Macrocell

- Small Cell

- Others

Macrocell holds the largest market share

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes macrocell, small cell, and others. According to the report, macrocell accounted for the largest market share.

Macrocell is a large-scale cellular base station that covers a wide geographic area, often referred to as macro cell sites. It is crucial for providing broad coverage in urban, suburban, and rural areas. It is used to deliver 5G services in outdoor environments and is essential for supporting high-density areas with a large number of users.

A small cell is a compact and low-power cellular base station that is designed to provide coverage and capacity in specific localized areas. It plays a critical role in densifying the network and filling coverage gaps. It is deployed in urban settings, indoor environments, and areas with high user density, such as stadiums, shopping malls, and transportation hubs.

Breakup by Architecture:

- 5G Standalone (NR + Core)

- 5G NR Non-Standalone (LTE Combined)

5G standalone (NR + core) represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the architecture. This includes 5G standalone (NR + core) and 5G NR non-standalone (LTE combined). According to the report, 5G standalone (NR + core) represented the largest segment.

5G standalone (NR + core) architecture is a fully independent 5G network that operates without relying on the existing fourth generation (4G) long-term evolution (LTE) infrastructure. It includes both 5G new radio (NR) and a dedicated 5G core network. 5G NR serves as the radio access technology, while the 5G core network provides advanced features and capabilities tailored specifically to 5G services. 5G standalone is designed to unlock the full potential of 5G, offering lower latency, increased capacity, and support for a wide range of use cases, including IoT and ultra-reliable communication.

5G NR non-standalone (LTE combined) architecture combines 5G NR with the existing LTE network infrastructure. 5G NR operates alongside LTE, sharing some network functions and resources. It provides an initial step towards 5G deployment, allowing for faster adoption by leveraging the existing LTE infrastructure. In contrast, 5G NR non-standalone offers enhanced mobile broadband capabilities.

Breakup by Frequency:

- Sub 6 GHz

- Above 6 GHz

Sub 6 GHz exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the frequency. This includes sub 6 GHz and above 6 GHz. According to the report, sub 6 GHz represented the largest segment.

Sub 6 gigahertz (GHz) is a frequency below 6 GHz in the radio spectrum. This frequency range is often referred to as the mid-band and includes frequencies used by existing 4G LTE networks, such as 2.4 GHz and 3.5 GHz. Besides this, sub-6 GHz 5G offers a balance between coverage and capacity. It can provide wider coverage areas as compared to higher-frequency bands and is suitable for urban and suburban areas.

Above 6 GHz includes the higher-frequency spectrum bands, often referred to as millimeter wave (mmWave). It includes bands, such as 28 GHz and 39 GHz, that offer significantly higher data rates but have a limited coverage range and can be affected by obstacles like buildings and trees. Above 6 GHz 5G is ideal for dense urban environments and applications requiring ultra-high data speeds, such as fixed wireless access and AR.

Breakup by Application:

- Automotive

- Consumer Electronics

- Commercial

- Industrial

Consumer electronics represent the biggest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, consumer electronics, commercial, and industrial. According to the report, consumer electronics represented the largest segment.

Consumer electronics encompass a wide range of devices, including smartphones, tablets, smart televisions (TVs), and wearable devices. 5G in consumer electronics delivers faster download and streaming speeds, improved online gaming experiences, and enhanced connectivity for IoT devices. Furthermore, the growing demand for higher performance and connectivity in devices is offering a positive market outlook.

The automotive sector leverages 5G technology for various applications, including connected vehicles, autonomous driving, and vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. 5G enables low-latency communication, real-time data exchange, and enhanced safety features in automotive systems. It supports features like advanced driver assistance systems (ADAS), vehicle telematics, and in-car entertainment, making vehicles smarter and safer.

The commercial sector includes companies of all sizes that utilize 5G technology for improved connectivity, productivity, and experiences of individuals. 5G enables faster and more reliable data transfer for organizations, supporting applications like video conferencing, cloud computing, and remote work. It also facilitates the deployment of private 5G networks in commercial settings for enhanced security and tailored connectivity solutions.

Industrial segment covers various industries, such as manufacturing, logistics, energy, and healthcare. 5G is used in industrial automation for applications like remote monitoring, predictive maintenance, and robotics. It supports the Industrial Internet of Things (IIoT) by providing low-latency and high-reliability connectivity to enable smart factories and efficient production processes.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest 5G equipment market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to the presence of highly developed telecommunications infrastructure, with established players, such as telecom operators, equipment manufacturers, and technology giants. In addition, favorable government initiatives are propelling the market growth. Apart from this, the rising adoption of digital services and IoT applications among individuals is supporting the growth of the market.

Asia Pacific stands as another key region in the market, as governing agencies in the region are investing in 5G infrastructure. Apart from this, the escalating demand for high-speed and reliable connectivity is contributing to the growth of the market. Moreover, the presence of telecommunications equipment manufacturers in the region is bolstering the market growth.

Europe maintains a strong presence in the market, with the increasing development of advanced 5G solutions. In line with this, the rising adoption of 5G technology is supporting the market growth.

Latin America exhibits growing potential in the 5G equipment market on account of the highly developed telecommunications infrastructure and technology giants. In addition, the increasing utilization of 5G in various industries, including healthcare and agriculture, is impelling the market growth in the region.

The Middle East and Africa region shows a developing market for 5G equipment, primarily driven by the escalating demand for high-speed connectivity. In line with this, the rising focus on 5G infrastructure development is bolstering the market growth.

Leading Key Players in the 5G Equipment Industry:

Key players are working on enhancing the performance, efficiency, and capabilities of 5G hardware and software. They are also actively participating in standardization bodies and industry associations to help establish 5G standards, ensuring interoperability and seamless integration of 5G equipment. Besides this, the 5G equipment manufacturers are introducing new 5G solutions, including antennas, routers, modems, and network components. In addition, they are focusing on rigorous testing and certification of 5G equipment for compliance with industry standards and regulatory requirements to ensure network reliability and security. Furthermore, companies are working with enterprises to deploy private 5G networks tailored as per specific industry needs, such as manufacturing, logistics, and healthcare.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Airspan Networks

- Cisco Systems Inc.

- CommScope

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- NEC Corporation (AT&T Inc.)

- Nokia Corporation

- Qualcomm Inc.

- Samsung Electronics Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

5G Equipment Market News:

- October 2024: T-Mobile introduced 5G on Demand, a portable, comprehensive 5G private network and services solution offering installation, teardown, and network management.

- September 2024: Vodafone Idea Limited awarded a three-year deal to Nokia for deploying 4G and 5G equipment. The agreement comprises the planned modernization and expansion of VIL’s 4G network and implementation of Nokia’s industry-leading 5G AirScale portfolio.

5G Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Network Function Virtualization (NFV), Software Defined Networking (SDN), Multi-access Edge Computing (MEC) |

| Equipments Covered | Macrocell, Small Cell, Others |

| Architectures Covered | 5G Standalone (NR + Core), 5G NR Non-Standalone (LTE Combined) |

| Frequencies Covered | Sub 6 GHz, Above 6 GHz |

| Applications Covered | Automotive, Consumer Electronics, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airspan Networks, Cisco Systems Inc, CommScope, Fujitsu Limited, Huawei Technologies Co. Ltd., NEC Corporation (AT&T Inc.), Nokia Corporation, Qualcomm Inc., Samsung Electronics Co. Ltd., Telefonaktiebolaget LM Ericsson, ZTE Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, 5G equipment market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global 5G equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 5G equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global 5G equipment market was valued at USD 23.4 Billion in 2024.

We expect the global 5G equipment market to exhibit a CAGR of 30.01% during 2025-2033.

The increasing adoption of 5G equipment in various industrial equipment to enhance performance, as it offers high-multi-Gbps peak data speed, ultra-low latency, better accessibility, and a new identical user experience, is primarily driving the global 5G equipment market.

The sudden outbreak of the COVID-19 pandemic has led to the rising integration of Machine-To-Machine (M2M) communication, device-to-device solutions, and the Internet of Things (IoT) technologies with 5G equipment to allow convenient sharing of data, during the remote working scenario.

Based on the technology, the global 5G equipment market can be segmented into Network Function Virtualization (NFV), Software Defined Networking (SDN), and Multi-access Edge Computing (MEC). Currently, Network Function Virtualization (NFV) holds the majority of the total market share.

Based on the equipment, the global 5G equipment market has been divided into macrocell, small cell, and others. Among these, macrocell currently exhibits a clear dominance in the market.

Based on the architecture, the global 5G equipment market can be categorized into 5G standalone (NR + core) and 5G NR non-standalone (LTE combined). Currently, 5G standalone (NR + core) accounts for the majority of the global market share.

Based on the frequency, the global 5G equipment market has been segregated into sub 6 GHz and above 6 GHz, where sub 6 GHz currently holds the largest market share.

Based on the application, the global 5G equipment market can be bifurcated into automotive, consumer electronics, commercial, and industrial. Currently, consumer electronics exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global 5G equipment market include Airspan Networks, Cisco Systems Inc, CommScope, Fujitsu Limited, Huawei Technologies Co. Ltd., NEC Corporation (AT&T Inc.), Nokia Corporation, Qualcomm Inc., Samsung Electronics Co. Ltd., Telefonaktiebolaget LM Ericsson, ZTE Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)