Australia Furniture Retail Market Size, Share, Trends, and Forecast by Type, Distribution Channel, Application, and Region, 2025-2033

Australia Furniture Retail Market Size and Share:

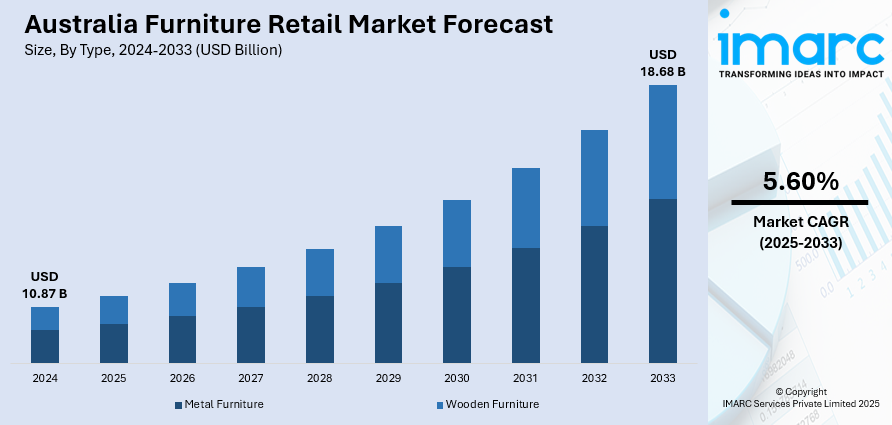

The Australia furniture retail market size reached USD 10.87 Billion in 2024. Looking forward, the market is projected to reach USD 18.68 Billion by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The growing preference for eco-friendly materials, sustainable manufacturing processes, and ethical labor practices, rising number of e-commerce platforms offering enhanced user experience, and an increasing demand for customization and personalization are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.87 Billion |

| Market Forecast in 2033 | USD 18.68 Billion |

| Market Growth Rate (2025-2033) | 5.60% |

Key Trends of Australia Furniture Retail Market:

Sustainability and Ethical Sourcing Trends

Consumers in Australia are seeking furniture brands that value the use of environmentally friendly materials, fair labor practices, and sustainable production methods. This movement is leading to the popularity of furniture made from recycled, renewable, or certified wood products, as well as brands that focus on minimizing their environmental impact. Retailers are responding to this movement by offering more environment-friendly product choices and highlighting their commitment to sustainability. The increasing demand for quality and long-lasting over quick, disposable furniture is consistent with this shift, propelling the market for high-end, green products. For instance, in 2023, Valiant, an Australian furniture rental and styling firm, announced the launch of a new range of sustainable rental furniture made from post-consumer recycled plastics. The range included pieces, such as the ReforaStone, Selena lounging, Chloe dining chairs, and bar stools, made using sustainable materials. The company aimed to create a circular economy by repurposing or donating products when they reach the end of their lifecycle.

To get more information on this market, Request Sample

Rise of E-commerce and Online Furniture Sales

The ease of online shopping, combined with sophisticated digital technologies, such as virtual showrooms, augmented reality (AR), and 3D product visualization, is transforming the way consumers engage with furniture brands. Consumers in the nation are increasingly relying on online shopping for their home decor requirements, enjoying the convenience of browsing, comparing, and buying products from home. This transformation is persuading most conventional brick-and-mortar stores to develop their online presence and go for omnichannel strategies. Stores are investing in improved user experience, offering top-notch client service, and delivering speedy delivery options, which are major drivers for success in the burgeoning online marketplace. In 2024, Aria Wigneswaran and Thibault Henry introduced Bazaa, a premier online platform in Australia for vintage and antique home goods, providing a carefully curated assortment of secondhand furniture and decorations. Bazaa intends to promote sustainability through the provision of a sustainable alternative to mass-produced furniture.

Demand for Modular and Multi-Functional Furniture

The Australian furniture retail market is witnessing an increasing inclination toward modular and multi-functional furniture, driven by urbanization and the trend of smaller living spaces. Consumers are on the lookout for items that maximize functionality while fitting seamlessly into compact apartments or contemporary homes. Products like foldable tables, sofa beds, extendable storage units, and modular shelving systems provide flexibility and adaptability, enabling homeowners to make the most of their space without sacrificing style. This trend is further enhanced by the rise of remote work, which necessitates home offices and versatile furniture arrangements. Retailers are responding by creating innovative, customizable solutions that address changing lifestyle needs. The heightened interest in functional yet aesthetically pleasing furniture is contributing significantly to the increasing Australia furniture retail market demand in both physical stores and online platforms.

Growth Drivers of Australia Furniture Retail Market:

Rising Urbanization and Smaller Living Spaces

Australia's rapid urban growth has resulted in more compact apartments and living environments, which has heightened the demand for space-efficient furniture solutions. Consumers are increasingly seeking modular, foldable, and multifunctional pieces that optimize utility while preserving aesthetic charm. Items like sofa beds, extendable tables, and modular storage units are becoming more popular due to their versatility and efficient space usage. This trend is particularly noticeable in urban areas where real estate prices are steep and living spaces are limited. In response, furniture retailers are broadening their lines of compact and multifunctional products, catering to urban residents and young professionals alike. These trends are crucial in shaping the Australia furniture retail market share across both physical and online retail channels.

Focus on Home Renovation and Interior Design

An increasing enthusiasm for home renovations and interior design is significantly boosting furniture demand across Australia. Homeowners are investing in stylish, functional, and premium furniture to enhance modern interiors and express their personal styles. Renovation projects focused on updating kitchens, living areas, and outdoor environments are driving the acquisition of both eye-catching and practical furniture items. Influences from interior designers and DIY enthusiasts are encouraging retailers to provide varied, customizable, and designer-inspired collections. Seasonal home improvement campaigns and marketing efforts further encourage consumer engagement. As the emphasis on home aesthetics continues to grow, retailers are expanding product ranges and improving the shopping experience, thus supporting ongoing Australia furniture retail market growth in both urban and suburban areas.

Technological Integration

The integration of technology is emerging as a significant trend in Australia’s furniture retail sector, with smart and IoT-enabled furniture gaining popularity among tech-savvy consumers. Products such as smart beds, chairs with integrated charging options, connected storage units, and app-controlled adjustable furniture offer enhanced convenience, comfort, and functionality. Retailers are utilizing digital showrooms, augmented reality tools, and online configurators to display these innovations, enabling customers to envision how the furniture would look in their homes. This technological adoption also encompasses warehouse automation and supply chain enhancements, boosting operational efficiency. According to Australia furniture retail market analysis, by merging innovation with practical design, furniture brands are appealing to contemporary lifestyles and tech-oriented buyers, influencing product development and retail strategies.

Australia Furniture Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, distribution channel, and application.

Type Insights:

- Metal Furniture

- Wooden Furniture

The report has provided a detailed breakup and analysis of the market based on the type. This includes metal furniture and wooden furniture.

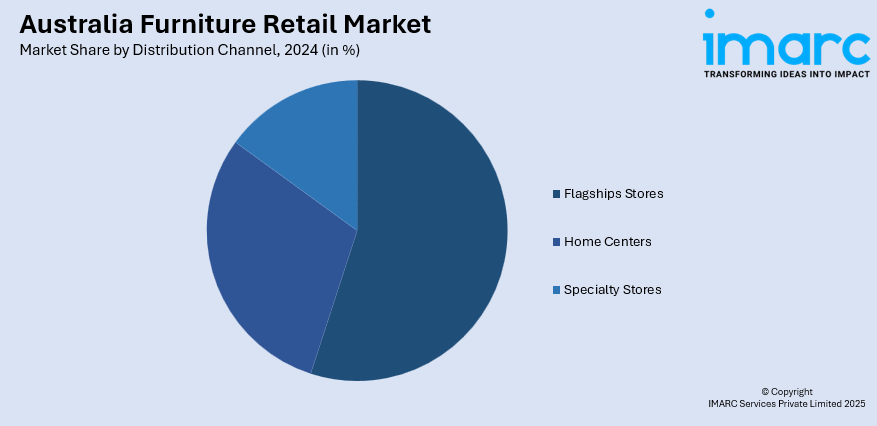

Distribution Channel Insights:

- Flagships Stores

- Home Centers

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes flagships stores, home centers, and specialty stores.

Application Insights:

- Home Furniture

- Hospitality Furniture

- Office Furniture

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes home furniture, hospitality furniture, and office furniture.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Furniture Retail Market News:

- In June 2024, Bolia, a Scandinavian furniture retailer, announced its plans to launch in Australia by opening a flagship store in Melbourne, where buyers can personalize Scandinavian-style furniture in a design studio. The company is recognized for its emphasis on eco-friendly, enduring styles.

- In November 2023, James Lane announced the launch of a new store in Geelong, expanding its portfolio to over 20 stores across Australia. This new branch introduced James Lane's designer furniture to a wider audience, emphasizing both style and comfort.

Australia Furniture Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Metal Furniture, Wooden Furniture |

| Distribution Channels Covered | Flagships Stores, Home Centers, Specialty Stores |

| Applications Covered | Home Furniture, Hospitality Furniture, Office Furniture |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia furniture retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia furniture retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia furniture retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The furniture retail market in Australia was valued at USD 10.87 Billion in 2024.

The Australia furniture retail market is projected to exhibit a compound annual growth rate (CAGR) of 5.60% during 2025-2033.

The Australia furniture retail market is expected to reach a value of USD 18.68 Billion by 2033.

The market is witnessing trends such as growing online furniture sales, increased demand for modular and multi-functional designs, and a focus on eco-friendly and sustainable products. Smart furniture, personalized designs, and smaller-format convenience stores are also emerging as significant trends shaping the retail landscape.

Growth is driven by rising urbanization and smaller living spaces, increasing disposable incomes, and strong demand for home renovation and interior design. Technological integration, sustainability, customization, and the expansion of online and offline retail channels further support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)