Brazil Hair Care Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Brazil Hair Care Market Size and Share:

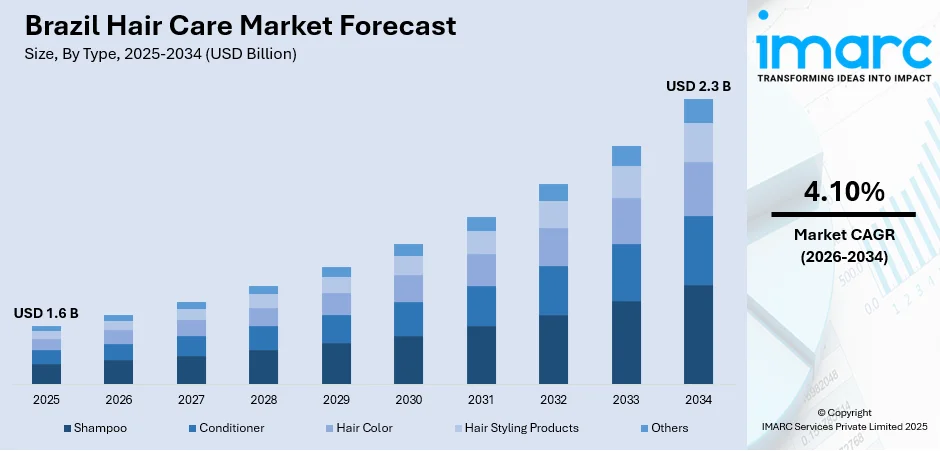

The Brazil hair care market size was valued at USD 1.6 Billion in 2025. Looking forward, the market is expected to reach USD 2.3 Billion by 2034, exhibiting a CAGR of 4.10% during 2026-2034. Southeast currently dominates the market share in 2025. The market is fueled by the nation's variance of hair types and high cultural focus on beauty in hair, driving demand for targeted products such as anti-frizz, moisturizing, and scalp care. The dynamic salon culture prompts the usage of professional-grade product, and growing consumer demand for natural and sustainable ingredients like native botanical extracts drives market innovation. Growing digital access and e-commerce growth make hair care products more pervasive in urban and regional markets, further propelling the expansion and competitiveness of the overall Brazil hair care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.6 Billion |

|

Market Forecast in 2034

|

USD 2.3 Billion |

| Market Growth Rate 2026-2034 | 4.10% |

With one of the highest levels of diversity in hair types and textures in the world, going from straight to wavy hair to curly and tightly coiled hair, the world of hair care in Brazil is its most compelling driver. This diversity generates a high demand for a broad range of specialist hair care products designed to meet different needs, ranging from anti-frizz treatments, hydration, scalp care, and curl definition. Hair in Brazil is not only a beauty feature but also a potent cultural symbol that has strong associations with identity, self-expression, and social acceptance. This cultural significance compels consumers to make significant investments in hair care treatments and products that promote healthy, vibrant hair. Furthermore, the ubiquitous salon culture in Brazil supports high demand for professional strength shampoos, conditioners, and styling products since many consumers look to experts for advice and treatment to find salon-quality results in the comfort of home. This combination of diversity and cultural significance provides a dynamic market in which innovation and personalization are important, further propelling the Brazil hair care market growth.

To get more information on this market, Request Sample

Rising awareness about natural ingredients and sustainable practices is another crucial driving force in Brazil's hair care market. Brazilian consumers are increasingly attracted to products containing local botanical extracts like açaí, cupuaçu, babassu, and Brazil nut oil, which offer effective hair care benefits and benefit local communities and preserve biodiversity. This attempt at using native ingredients resonates with a national pride and green consciousness on the part of consumers. In addition, the worldwide trend towards sustainability challenges Brazilian brands and multinationals doing business there to implement earth-friendly measures, including biodegradable packaging, cruelty-free testing, and water-conserving formulas. This is consistent with the emerging generation of consumers who insist on transparency and ethical production. As sustainability moves beyond a niche in Brazil, it serves as a driver for product and market growth, pushing brands to keep up with changing consumer demands in the competitive hair care industry in Brazil.

Brazil Hair Care Market Trends:

Gen Z’s Influence on E-Commerce

Gen Z is influencing the future of the Brazil haircare market, accounting for 40% of e-commerce sales, mostly via Instagram. They follow influencers and interact with businesses on social media, which influences their purchasing decisions significantly. This generation loves authenticity and sustainability; thus, Brazilian hair care firms must create products that reflect their ideals. As Generation Z demands seamless digital buying experiences, firms are being driven to improve their online presence. Instagram has emerged as the dominant sales channel in hair care market in Brazil, showing a shift in purchasing habits. This increased digital influence is driving the development of Brazil hair care market outlook, with online sales anticipated to rise further.

Surge in Male Grooming

Male grooming in Brazil has increased dramatically, by 18% year on year. This rise is altering the Brazilian hair products sector, as men grow more discriminating about their grooming habits. Products like specialist shampoos, conditioners, and styling lotions created for men's specific requirements are in high demand. Brazilian men are seeking premium quality, particularly in the Brazil hair and beauty sector, as self-care becomes an increasingly important element of their lifestyle. The desire for individualized grooming solutions is influencing how firms create and sell their goods. As the male grooming segment grows, the market benefits from this trend, with a greater emphasis on individualized and high-quality services for males, which further contributes to the increasing Brazil hair care market demand.

E-Commerce and Door-to-Door Sales

The combination of e-commerce and door-to-door sales is transforming the way Brazilian consumers purchase Brazil hair products. Brazil is witnessing rapid growth in e-commerce, with the market expanding at a rate of 14.3%. It is projected to surpass USD 200 Billion by 2026. While online shopping offers convenience and accessibility, the door-to-door model still provides a more personalized shopping experience, particularly in smaller towns. By using both channels, companies can meet consumer demands for ease and personalized service. This strategy has become key in the hair care industry statistics for Brazil, as it helps brands ensure they are accessible to a wider audience. From high-end salons to rural areas, the ability to access hair products through multiple channels continues to expand the market, catering to both urban and more remote customers.

Skinification Trend Reshaping the Hair Care Market

One of the popular Brazil hair care market trends is the skinification of hair, which is reshaping the industry, as customers want solutions that care for their scalp as much as they do their skin. Products containing skincare components such as hyaluronic acid, antioxidants, and vitamins are becoming increasingly popular. The need for multifunctional hair products is increasing, as customers prioritize scalp health alongside hair care. As this trend spreads, Brazilian firms include nourishing and moisturizing elements into their formulas, fueling innovation in the Brazilian hair care industry. This transition is seen in the popularity of scalp serums, moisturizing shampoos, and restorative treatments, which are boosting the market for hair products from Brazil while also addressing customer demand for wellness-oriented hair care solutions.

Brazil Hair Care Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil hair care market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Shampoo

- Conditioner

- Hair Color

- Hair Styling Products

- Others

Shampoo stands as the largest component in 2025, holding around 38.7% of the market. Shampoo is the dominant segment, according to the Brazil hair care market forecast, due to a special blend of cultural, consumer, and product factors. The strong cultural bond of Brazilian women with hair care turns shampoo from an ordinary cleansing product into an essential component of everyday beauty routine, similar to obligatory grooming habits. This higher state is sustained by the nation's deep history of salon culture, and hence shampoos are designed for cleansing and for rebalancing textures, setting curls, and preserving chemical treatments. The varied palette of Brazilian hair textures, ranging from tightly coiled curls to straightened locks, drives companies to experiment throughout subsegments—such as anti-frizz, color-protecting, moisturizing, and sulfate-free shampoos—designed to suit local requirements and consumer demands. Also, the proliferation of natural and organic ingredient trends, fueled by Brazil's rich botanical heritage, further galvanizes shampoo products that contain native oils and plant extracts. All these trends contribute to making shampoo the most dynamic and expressive segment in the hair care market of Brazil.

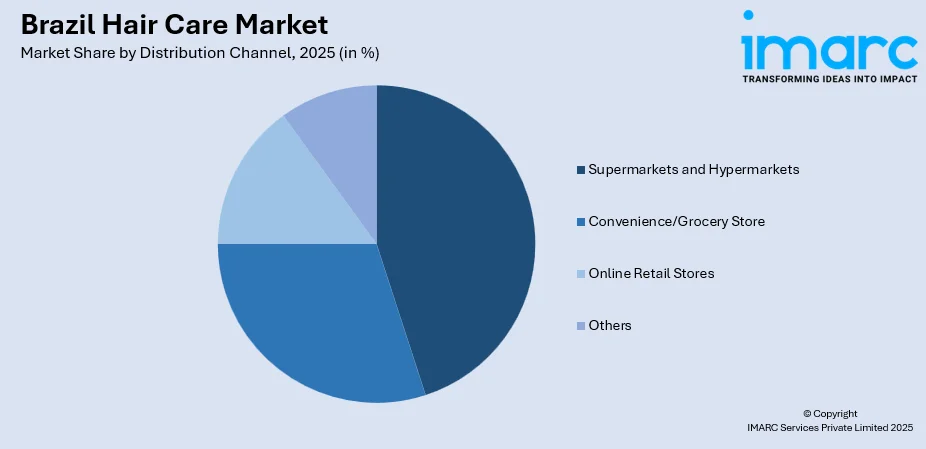

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience/Grocery Store

- Online Retail Stores

- Others

Supermarkets and hypermarkets lead the market share in 2025. Supermarkets and hypermarkets account for the majority of hair care distribution in Brazil, acting as the entry point for both product discovery, purchase, and promotion. These huge, multi-aisle retail settings provide consumers with a broad array of hair care brands ranging from high-end salon-quality lines to low-priced drugstore products under a single roof. Their locations in city shopping malls and community nodes provide convenient access points for urban Brazilian consumers, especially those juggling busy city lifestyles and regular beauty maintenance. Widespread availability of loyalty programs, holiday promotions, and in-store sampling complement further consumer interaction and sampling, sustaining supermarkets and hypermarkets as routine choice destinations for hair care needs. Convenient and diverse as they are, these large-format stores have also become venues for retail experimentation. Brazilian food stores typically dedicate prominent "hair care islands" with carefully curated selections for textured hair, natural ingredients, and color care to mirror the population's rich multicultural preferences. They commonly work directly with vendors on private-label or co-branded products, allowing for competitive pricing with differentiated features. Loyalty information allows for assortments to be optimized by region based on types of hair - frizz fighting in coastal regions of high humidity or moisturizing shampoos in urban areas with greater altitudes. All of these make supermarkets and hypermarkets the prime distribution channel in Brazil's dynamic hair care industry.

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

In 2025, Southeast accounted for the largest market share. According to the Brazil hair care market analysis, the Southeast of Brazil is the prime segment of the nation's hair care industry, mostly due to its intense population density, economic progress, and cultural diversity. With the likes of São Paulo and Rio de Janeiro forming its core states, this region harbors a huge population of urban dwellers with robust purchasing power and an active desire for personal grooming. Trend-conscious consumers in the Southeast are eager to experiment with a vast array of hair care products, ranging from run-of-the-mill shampoos to advanced treatments such as keratin masks and anti-frizz serums. The area's climate, featuring humid coastal regions, also fuels demand for specific solutions to fight frizz, dryness, and scalp health. The Southeast also enjoys a solid retail infrastructure, with supermarkets, pharmacies, and beauty stores readily selling hair care products. The density of beauty salons and professional services also stimulates product use, further cementing the Southeast as Brazil's core hair care market.

Competitive Landscape:

Major players in the Brazilian hair care market are propelling growth through innovation, localization, and strategic partnerships specifically addressing the distinctive requirements of Brazilian consumers. Players are investing significantly in research and development to develop products responding to varied hair textures, climatic conditions, and beauty regimens. Several have launched sulfate-free, paraben-free, and vegan-friendly product lines as the demand for clean and natural beauty continues to escalate. Brands are also using native Brazilian ingredients like açaí, cupuaçu, and Brazil nut oil to attract consumers looking for authenticity and effectiveness. Furthermore, leading players are consolidating their digital footprint through influencer partnerships, targeted social media campaigns, and e-commerce platforms to connect with a wider, technology-driven audience. Retail collaborations with supermarkets, pharmacies, and beauty chains make products widely available across the country. Furthermore, top firms are introducing professional product ranges for salons, riding the momentum of Brazil's vigorous salon culture. Sustainability is also on the agenda, with developments such as recyclable packages, water-conserving formulations, and socially responsible procurement catching on. Locally established production sites minimize costs and enhance responsiveness to market trends. By balancing global norms with local tastes and values, these industry leaders are not only building brand loyalty but also broadening their presence in one of the world's most vibrant hair care markets.

The report provides a comprehensive analysis of the competitive landscape in the Brazil hair care market with detailed profiles of all major companies, including:

- Colgate-Palmolive Company

- L'Oréal Brazil

- Moroccanoil

- Natura & Co

Latest News and Developments:

- June 2025: Skala and Lola From Rio, two major brands in Brazil hair care market, merged to form one of the largest groups in the beauty sector. With combined revenues of BRL 2 Billion and a presence in 54% of Brazilian households, the group operates in over 80 countries. Both brands focus on vegan hair care products and sustainable beauty, reinforcing their commitment to eco-conscious solutions in the hair care industry.

- In February 2025: Brazilian Professionals, the exclusive distributor of Brazilian Blowout professional hair treatments, partnered with SalonCentric to expand its reach in the US. While this marks a significant move into the US market, the brand continues to dominate in Brazil, where its innovative products and treatments are a staple in salons nationwide. Brazilian Blowout’s cutting-edge services, including the NEW Brazilian Blowout FREE, would be accessible to US salon professionals through SalonCentric’s extensive network.

- In December 2024: BEOX Professional, a leading Brazilian hair care brand, launched in India, introducing its premium salon-quality products to the vibrant market. Known for blending cutting-edge technology with natural ingredients, BEOX is expanding its global footprint while strengthening Brazil’s position in the beauty industry. The launch aligns with shared cultural values between Brazil and India, offering an opportunity for growth and collaboration between the two flourishing beauty markets.

Brazil Hair Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Shampoo, Conditioner, Hair Color, Hair Styling Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience/Grocery Store, Online Retail Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Colgate-Palmolive Company, L'Oréal Brazil, Moroccanoil, Natura & Co, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil hair care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil hair care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil hair care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hair care market in the Brazil was valued at USD 1.6 Billion in 2025.

The Brazil hair care market is projected to exhibit a CAGR of 4.10% during 2026-2034, reaching a value of USD 2.3 Billion by 2034.

The Brazil hair care market is driven by a strong cultural emphasis on hair beauty, diverse hair types, and increasing demand for specialized products like anti-frizz and hydration treatments. Rising consumer awareness of natural ingredients, growing salon culture, and expanding e-commerce channels also fuel market growth across urban and regional areas.

Southeast accounted for the largest market share, driven by its high urbanization, strong purchasing power, and well-established salon culture. Consumers demand premium, diverse hair care solutions tailored to various textures. Robust retail infrastructure, beauty-conscious lifestyles, and frequent salon visits drive continued growth in this influential regional segment.

Some of the major players in the Brazil hair care market include Colgate-Palmolive Company, L'Oréal Brazil, Moroccanoil, Natura & Co, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)