Brazil Telecom Market Size, Share, Trends and Forecast by Service, and Region, 2026-2034

Brazil Telecom Market Summary:

The Brazil telecom market size was valued at USD 24,229.64 Million in 2025 and is projected to reach USD 37,888.19 Million by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

Brazil's telecommunications sector is experiencing transformative growth driven by accelerated infrastructure modernization, government-led digital inclusion initiatives, and surging enterprise demand for connectivity solutions. The nationwide deployment of standalone 5G networks, aggressive fiber-optic expansion into underserved municipalities, and growing integration of Internet of Things (IoT) technologies across industrial and smart city applications position the market for sustained growth, thereby expanding the Brazil telecom market share.

Key Takeaways and Insights:

-

By Service: Data and messaging service dominates the market with a share of 72.01% in 2025, driven by explosive mobile data consumption exceeding 12 GB monthly per smartphone user and enterprise adoption of cloud connectivity solutions.

-

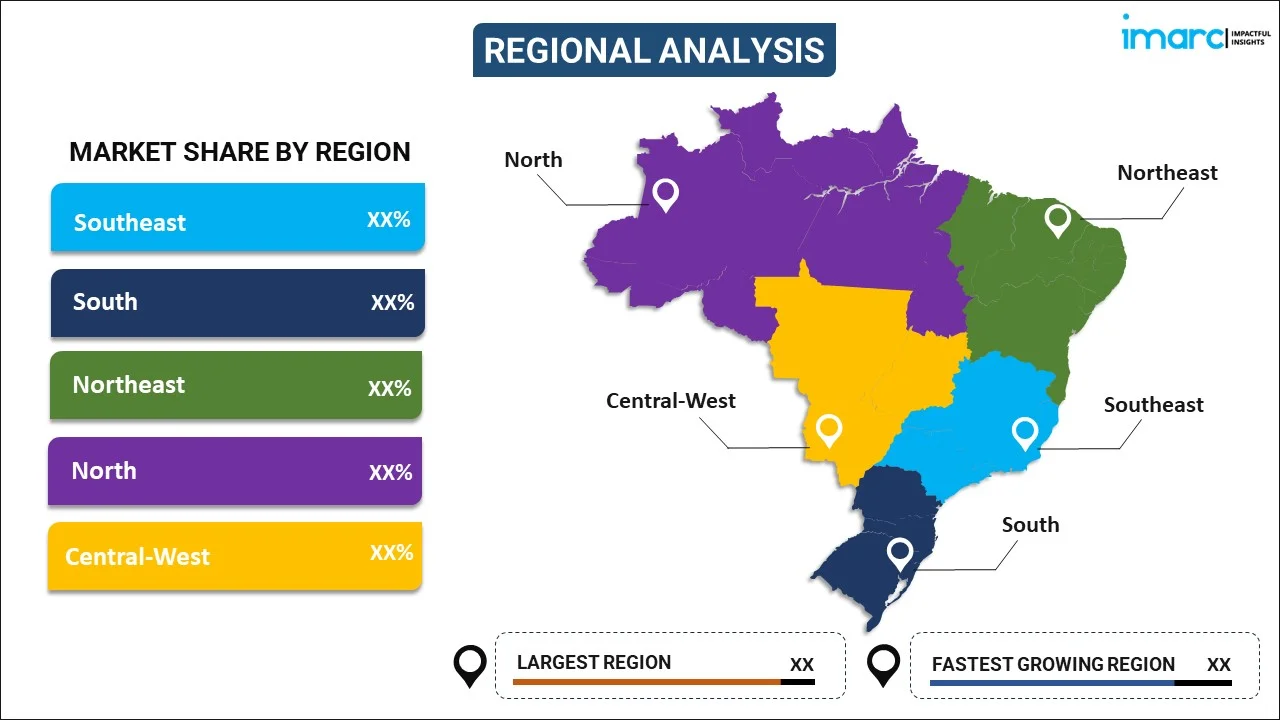

By Region: Southeast leads the market with 42% share in 2025, reflecting concentration of Brazil's population and economic activity in São Paulo and Rio de Janeiro metropolitan areas with superior digital infrastructure deployment.

-

Key Players: Major telecom providers in Brazil are focusing on expanding 5G and fiber networks, enhancing digital services, and diversifying their offerings. They are also investing in strategic acquisitions and technological upgrades to strengthen their market position and attract more customers. Some of the key players are Algar Telecom, AT&T GNS Brazil (AT&T), Comcast Corporation, Embratel, Oi, Telefonaktiebolaget LM Ericsson, Telefônica Brasil SA (Telefónica), TIM Brasil (TIM S.p.A.), and Verizon.

Brazil's telecommunications landscape is undergoing rapid digital transformation as operators pivot from traditional voice services toward data-centric revenue models. The clearance of 3.5 GHz spectrum across municipalities by late 2024 accelerated standalone 5G deployment ahead of regulatory schedules, with major carriers collectively serving over 35 million 5G subscribers. Government-backed fiber expansion programs and Universal Service Fund subsidies are bridging the urban-rural connectivity divide, while enterprise segments drive premium revenue growth through private network deployments, edge computing integration, and managed IoT services. The sector benefits from supportive regulatory frameworks balancing infrastructure investment incentives with market competition, positioning Brazil as a regional connectivity leader despite challenges from high taxation and geographic complexity.

Brazil Telecom Market Trends:

Accelerated Nationwide 5G Network Deployment

Brazil's standalone 5G infrastructure expansion achieved significant milestones with the National Telecommunications Agency completing 3.5 GHz spectrum clearance across municipalities 14 months ahead of schedule in December 2024. Major operators collectively deployed a massive number of cell sites providing coverage to more than 60% of the population by mid-2025, with Vivo operating 17,184 sites across 562 cities. Enhanced network capacity enables ultra-low latency applications supporting enterprise automation, smart city initiatives, and mobile broadband services while operators leverage superior 5G speeds to upsell premium post-paid packages that increased TIM's mobile average revenue per user 5% year-over-year in early 2025.

Fiber Optic Network Proliferation to Underserved Areas

Fixed broadband infrastructure transformation accelerated with fiber connections exceeding of total subscriptions by late 2024. From January to June 2025, the nation acquired US$3.32 billion in foreign investment within the telecommunications, computing, and information technology sectors, amounting to R$18.6 billion, based on data from the Central Bank reviewed by the Ministry of Communications. This volume is 6.5% greater than what was noted during the same timeframe in 2024, when the sector obtained US$3.11 billion. 5G coverage increased from 352 municipalities in December 2023 to 1,504 cities by June 2024. By the end of 2024, fixed broadband connections hit 52 million, showing a 13.5% rise in fiber optic links, particularly a 15.7% growth in the Northeast.

Growing Integration of IoT and Smart City Solutions

The growing integration of Internet of Things (IoT) and smart city solutions is transforming urban living, driving innovation across various sectors. IoT enables real-time data collection and analysis, optimizing traffic management, energy use, waste management, and public safety. Smart city solutions leverage these capabilities to create more efficient, sustainable environments, improving the quality of life for residents. By integrating sensors, connected devices, and cloud computing, cities can streamline services, enhance infrastructure, and reduce costs. This shift is paving the way for smarter, more responsive urban areas, attracting investments and fostering economic growth in global markets. According to IMARC Group, Brazil Internet of Things (IoT) market is projected to reach USD 100.7 Billion by 2034.

Market Outlook 2026-2034:

Brazil's telecom sector is poised for robust expansion driven by sustained infrastructure investments, accelerating enterprise digitalization, and government initiatives bridging urban-rural connectivity gaps. The market generated a revenue of USD 24,229.64 Million in 2025 and is projected to reach a revenue of USD 37,888.19 Million by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034. The completion of nationwide 5G spectrum clearance by late 2024 unlocks deployment opportunities across all municipalities, while fiber penetration approaching 80% of fixed broadband subscriptions establishes foundation for multi-gigabit service tiers.

Brazil Telecom Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Service |

Data and Messaging Service |

72.01% |

|

Region |

Southeast |

42% |

Service Insights:

To get more information on this market, Request Sample

- Voice Service

- Wired

- Wireless

- Data and Messaging Service (Coverage to Include Internet and Handset Data Packages and Package Discounts)

- OTT and Pay-TV Service

Data and messaging service dominates with a market share of 72.01% of the total Brazil telecom market in 2025.

The data and messaging services segment maintain overwhelming market dominance reflecting fundamental shifts in consumer behavior and enterprise requirements toward bandwidth-intensive applications. Mobile data consumption surpassing 12 gigabytes monthly per smartphone user in major cities drives network capacity upgrades and infrastructure densification programs across urban centers. Operators capitalize on growing demand through tiered data packages, unlimited streaming bundles, and premium 5G service offerings that command higher average revenue per user compared to legacy voice products.

Enterprise adoption of cloud-based collaboration platforms, remote work infrastructure, and real-time data analytics applications accelerates demand for managed connectivity solutions with guaranteed service levels. The proliferation of over-the-top communication services and social media platforms sustains messaging traffic growth while fixed wireless access installations exceeding by 2025 demonstrate alternatives to traditional wireline broadband capturing suburban and rural markets. Operators leverage network modernization investments in standalone 5G and fiber-to-the-premises infrastructure to monetize superior throughput and reduced latency characteristics supporting emerging use cases in augmented reality, cloud gaming, and Internet of Things deployments across residential and commercial segments.

Regional Insights:

To get more information on this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast leads with a share of 42% of the total Brazil telecom market in 2025.

The Southeast region commands market leadership concentration reflecting Brazil's demographic and economic gravity centered in São Paulo and Rio de Janeiro metropolitan areas with superior per capita income levels and digital service adoption rates. Infrastructure deployment prioritization by major operators delivers advanced network coverage with dense 5G cell site installations, extensive fiber-to-the-home availability, and comprehensive mobile broadband footprint supporting high-bandwidth applications. Enterprise headquarters concentration in the region generates substantial business services revenue through dedicated connectivity solutions, private network installations, and managed IT services contracts.

Competitive intensity among the three national carriers and thousands of independent internet service providers maintains aggressive pricing while driving service quality improvements benefiting both residential and commercial customers. The region hosts primary data center hubs, content delivery network infrastructure, and international submarine cable landing stations establishing Southeast as Brazil's digital connectivity gateway. Government smart city initiatives in São Paulo, Rio de Janeiro, and smaller municipalities accelerate Internet of Things deployment across traffic management, public safety, and utility automation applications, while established telecommunications tower infrastructure supports rapid 5G expansion with minimal greenfield construction requirements facilitating faster time-to-market for next-generation mobile services.

Market Dynamics:

Growth Drivers:

Why is the Brazil Telecom Market Growing?

Government-Led Digital Inclusion Initiatives and Infrastructure Investments

Federal and state government programs substantially accelerate telecommunications infrastructure deployment through direct subsidies, regulatory incentives, and public-private partnerships targeting connectivity gaps. Nokia has announced that TIM Brasil (TIM) has chosen it to enhance its 5G radio access network (RAN) coverage in 15 Brazilian states starting from January 2025. This collaboration will expand the count of municipalities with 5G access, providing the advantages of secure, ultra-fast connectivity to a larger population. The growth will similarly allow companies in these areas to digitize their processes, promoting innovation and stimulating economic development. Smart infrastructure programs including smart city developments channel demand toward Internet of Things connectivity, cloud integration, and edge computing nodes expanding addressable spend beyond traditional telecommunications services, with long-term public capital allocation insulating rural connectivity projects against electoral spending cycle volatility.

Surging Demand for High-Speed Data Services and Mobile Broadband

User and enterprise appetite for bandwidth-intensive applications drives sustained network capacity investments and premium service tier adoption across fixed and mobile segments. Standalone 5G networks delivering superior throughput and ultra-low latency enable carriers to upsell post-paid packages that lifted TIM's mobile average revenue per user 5.4% year-over-year in early 2025, while private 5G licenses granted to 35 enterprises facilitate tailored campus network deployments for ports, mines, and manufacturing facilities opening incremental revenue streams without relying on traditional subscriber growth. Video streaming services and online content consumption popularity contributes to sustained fixed broadband demand with fiber-to-the-home installations, while fixed wireless access connections projected to exceed by 2025 demonstrate alternative connectivity solutions capturing suburban markets.

Enterprise Digital Transformation and Cloud Services Adoption

Corporate sector migration toward cloud-based operations, distributed workforce models, and data-driven business intelligence platforms generates accelerating demand for managed connectivity solutions with guaranteed performance characteristics. Enterprise accounts contributed a major percentage to telecommunications turnover, outpacing consumer segment expansion reflecting businesses prioritizing reliability and service quality over price optimization. Organizations deploy cloud-connect, software-defined wide area networks, and fully managed smart building installations tied to stringent service level agreements that command premium pricing while locking predictable revenue streams through multi-year capacity contracts. In 2024, Microsoft declared its biggest individual investment in Brazil, aiming to allocate 14.7 billion Reais toward cloud and artificial intelligence (AI) infrastructure over a span of three years. This initiative intends to promote the growth of the AI ecosystem in Brazil, speeding up the nation’s AI advancements. Microsoft will further enhance the nation’s enduring competitiveness through the ConectAI initiative, equipping 5 million individuals with AI skills over the next three years, fostering lasting advantages for the Brazilian economy.

Market Restraints:

What Challenges the Brazil Telecom Market is Facing?

Heavy Taxation Burden on Telecommunications Services

Brazil imposes combined tax burden approaching 40.2% of telecommunications service revenue according to the Brazilian Telecommunications Association (Telebrasil), representing among the highest rates globally within the sector. This excessive taxation structure increases operational expenditures for carriers while constraining capital available for infrastructure modernization and network expansion initiatives. Higher service prices resulting from tax pass-through reduce affordability particularly among lower income segments, limiting broadband adoption rates and slowing advanced connectivity penetration across underserved populations.

Infrastructure Deployment Challenges in Remote and Rural Regions

Geographic complexity across Brazil's vast territory presents substantial logistical and technical obstacles for telecommunications infrastructure rollout beyond established urban centers. Riverine environments in Amazonia and Pantanal wetlands require specialized construction methodologies with equipment transport limited to seasonal water navigation windows, while environmental protection regulations governing high-biodiversity zones mandate extensive approval processes delaying site activation timelines. Sparse population density in interior regions generates sub-scale tenancy economics for tower infrastructure, with many rural sites supporting single-carrier deployment unable to achieve commercial viability without government subsidy programs. Remote locations face power grid reliability constraints necessitating renewable micro-grid installations and satellite backhaul connectivity increasing per-site capital expenditure relative to urban deployments. The complex regulatory framework surrounding environmental permits for protected biomes creates uncertainty around project execution schedules, while skilled labor availability for technical installations remains concentrated in metropolitan areas requiring costly workforce mobilization for remote site construction and maintenance activities.

Intense Price Competition and Market Saturation Pressures

A major percentage of mobile penetration limits fresh subscriber acquisition opportunities forcing operators toward aggressive pricing competition for unlimited data packages and prepaid service offerings. Consumer segment revenues grow at slower compound annual growth rate compared to enterprise expansion reflecting price compression across residential market tiers as carriers compete for share in saturated mobile markets. Unlimited data tier proliferation and slowing prepaid top-up volumes constrain average revenue per user growth while network operating costs continue rising with 5G deployment and fiber expansion initiatives, compressing profit margins across consumer-facing business units.

Competitive Landscape:

Brazil's telecommunications market exhibits concentrated competition among three major national operators collectively commanding dominant market positions across mobile and fixed services. This consolidation strengthened the incumbents' network footprints while regulatory oversight maintains competitive balance through spectrum allocation policies and service quality mandates. The fixed broadband segment demonstrates unique fragmentation with approximately 20,000 independent internet service providers capturing 64% of infrastructure investment, particularly aggressive in deploying fiber-to-the-home networks to secondary cities and suburban markets overlooked by national carriers. Tower infrastructure providers operate extensive passive infrastructure portfolios with sale-leaseback transactions enabling operators to monetize tower assets while redirecting capital toward core network modernization and 5G deployment initiatives. Vendors such as Nokia, Ericsson, and Huawei maintain strategic equipment supply partnerships supporting multi-billion dollar radio access network buildouts. Some of the key players include:

- Algar Telecom

- AT&T GNS Brazil (AT&T)

- Comcast Corporation

- Embratel

- Oi

- Telefonaktiebolaget LM Ericsson

- Telefônica Brasil SA (Telefónica)

- TIM Brasil (TIM S.p.A.)

- Verizon

Recent Developments:

-

In October 2025, IHS Brazil, a member of the IHS Towers group, revealed on Wednesday that it has entered into a new site agreement with TIM S.A., which enhances the ongoing collaboration between the two companies in the Brazilian market. IHS Brazil states that the collaboration seeks to establish up to 3,000 locations, starting with a minimum of 500 sites. The locations will be spread across various areas of Brazil.

-

In April 2025, Brazil’s National Telecommunications Agency (ANATEL) authorized a significant reform initiative intended to update the nation’s telecommunications regulations. The effort, named the Regulatory Simplification Project, merges outdated regulations, encourages innovation, and establishes a more adaptable, future-oriented structure for telecom services. The proposal was influenced by more than 700 public comments received during Consultation No. 41 in 2022 and demonstrates ANATEL’s aim of enhancing transparency and public participation in the regulatory process.

Brazil Telecom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Algar Telecom, AT&T GNS Brazil (AT&T), Comcast Corporation, Embratel, Oi, Telefonaktiebolaget LM Ericsson, Telefônica Brasil SA (Telefónica), TIM Brasil (TIM S.p.A.), Verizon, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil telecom market size was valued at USD 24,229.64 Million in 2025.

The Brazil telecom market is expected to grow at a compound annual growth rate of 5.09% from 2026-2034 to reach USD 37,888.19 Million by 2034.

Data and messaging service dominated the market with 72.01% share, driven by surging mobile data consumption averaging over 12 GB monthly per smartphone user, enterprise cloud connectivity adoption, and proliferation of bandwidth-intensive applications including video streaming, over-the-top messaging platforms, and Internet of Things integrations across residential and commercial segments.

Key factors driving the Brazil Telecom market include government-led digital inclusion initiatives allocating Universal Service Fund subsidies for rural connectivity infrastructure, surging demand for high-speed data services with mobile average revenue per user growth through premium 5G package upselling, and enterprise digital transformation accelerating managed connectivity solutions adoption with private network deployments and cloud service integration commanding premium pricing while outpacing consumer segment growth rates.

Major challenges include heavy taxation imposing combined burden on telecommunications service revenues limiting affordability and constraining infrastructure investment capacity, complex logistics and environmental regulations delaying remote region infrastructure deployments in riverine and protected biodiversity zones, mobile penetration creating subscriber saturation pressures with intense price competition compressing consumer segment margins, and tripling of fiber optic equipment import tariffs escalating network expansion costs for operators and independent service providers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)