Europe Baby Food and Infant Formula Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Country, 2025-2033

Europe Baby Food and Infant Formula Market Size and Share:

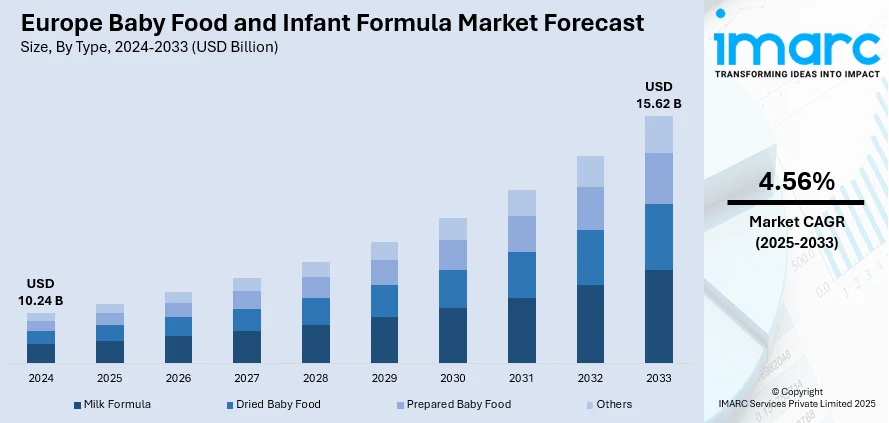

The Europe baby food and infant formula market size was valued at USD 10.24 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.62 Billion by 2033, exhibiting a CAGR of 4.56% during 2025-2033. United Kingdom currently dominates the market, holding a significant share in 2024. The market is influenced by rising awareness about infant nutrition, high demand for organic and clean-label products, and growing number of health-conscious parents. Strict food safety regulations in the region provide confidence in packaged baby food, while innovation in plant-based and allergen-free formulas addresses changing dietary requirements. City living and dual-earner families further drive the need for convenient, ready-to-eat choices that save time while maintaining quality. Companies are capitalizing on these factors by offering tailored solutions and sustainable packaging, which collectively contribute to the growing Europe baby food and infant formula market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.24 Billion |

|

Market Forecast in 2033

|

USD 15.62 Billion |

| Market Growth Rate 2025-2033 | 4.56% |

In Europe, one of the most dominant forces driving the baby food and infant formula industry is the increasing consumer desire for organic, natural, and additive-free offerings. European parents, especially in nations such as Germany, France, Italy, and the UK, are more health-conscious and highly value clean-label offerings that are free from artificial preservatives and GMOs. This cultural transition is further supported by the EU's very strict regulatory framework, which requires high standards of safety, quality, and ingredients, and instils confidence among parents. Parents rely on clear nutritional labels and certification and are attracted to brands that focus on nutrient-dense profiles and functional ingredients like probiotics, prebiotics, DHA, and calcium. This is mostly marked in Western Europe, where foods for newborns are perceived as safer and more in line with long-term child health goals, promoting Europe baby food and infant formula market growth throughout the region.

To get more information on this market, Request Sample

A second significant growth driver in Europe's baby food and infant formula market originates from changing family forms and parental lifestyles. Dual-income households and working mothers throughout Europe increasingly demand convenient, ready-to-use feeding options that balance nutritional value with ease. Urbanization and the shift toward smaller family sizes have increased demands for packaged foods with minimal preparation. Parents prioritize time saving without compromising on nutritional value, and the sector has aligned with ready-meal formats, single-serve packages, and infant and toddler meal kits. Such convenience-driven behavior is particularly palpable in urban cities such as Paris, Milan, and London, where parents prefer well-known shelf-stable formulas and pre-prepared meals that provide both infant wellbeing and convenience in keeping up with contemporary lifestyles.

Europe Baby Food and Infant Formula Market Trends:

Hectic Lifestyles and the Demand for Convenient, Healthy Choices

In Europe, women's rising labor-force participation has fueled demand for convenient formats of infant formula and baby food, optimized to fit busy lifestyles. For instance, from February to April 2025, 16.51 million women were reported to be in employment. Most European city-dwelling mothers in Paris, Berlin, and Madrid now juggle motherhood with full-time employment, fostering a trend toward ready-to-feed formulas, pouch purees in single servings, and pre-prepared toddler snacks with minimal prep time. Busy parents anticipate these items to provide a high level of nutritional value without the time required for self-prepare meals. Responding, market participants have provided on-the-go packaging and meal kits specifically suited for traveling families, use in daycare, and late nights. These innovations address working parents' convenience needs without sacrificing safety or quality. This trend has reconfigured retail strategies, and supermarkets, pharmacies, and internet sites have been increasing offerings of reliable, speedy-prep baby food and packaged infant formula to complement the time-pressured life of contemporary European consumers, further contributing to the Europe baby food and infant formula market demand.

Increased Spending Power on Premium and Diverse Products

In tandem with demographics, Europe's expanding consumer spending power is shaping baby food and infant formula trends. For example, in Europe, nations such as the Netherlands and Portugal exhibit significant engagement, with users dedicating an average of 2 hours and 18 minutes and 2 hours and 23 minutes each day on social media, respectively. As disposable incomes increase in Western and Northern Europe, parents are happy to invest on high-end, specialist nutrition brands. Products bearing the labels organic, hypoallergenic, lactose-free, or containing functional ingredients such as probiotics and plant proteins are becoming mainstream. Consumers demand transparency, clean label attributes, and sustainable packaging, which are qualities they link to higher-priced products. Regionally grown fruit and vegetable premium purees, imported dairy-based formula from Alpine regions of the world, and upscale glass jar packaging are some examples of products which are targeted by families with higher purchasing power. Such premium lines are marketed through gift sets or subscription plans by upscale online retailers and neighborhood-based retailers who cater to wealthier neighborhoods. As more and more families are spending more in early childhood nutrition, the market is showing growing evidence of a premiumization as observed through the Europe baby food and infant formula market trends.

Increasing Demand for Plant-Based and Green Alternatives

A new trend in the Europe baby food and infant formula market is the increasing demand for plant-based, vegan-friendly, and environmentally friendly alternatives. Both health and environmental awareness have spurred many European parents to turn to dairy-free infant foods and plant-based baby food that caters to vegetarian or flexitarian home diets. The trend is especially found among countries like Scandinavia, the Netherlands, and certain parts of Germany, where consumers are actively looking to minimize their carbon footprint and opt for sustainable food choices. Brands are reacting with novel formulations based on oat, soy, or almonds, combined with recyclable or biodegradable packaging to boost eco-credibility. Parents are also turning towards organic cultivation methods and cruelty-free products, particularly those assuring biodiversity and ethically sourced products. As mainstream plant-based cultures continue to take hold, the need for such alternatives within infant nutrition will increase, broadening product range and supporting greater sustainable practices throughout the Europe baby food and formula market outlook.

Europe Baby Food and Infant Formula Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe baby food and infant formula market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

Milk formula stands as the largest component in 2024. According to the Europe baby milk and infant formula market analysis, milk formula is the dominant segment based on its widespread popularity, central position in infant diet, and ongoing innovation among the biggest brands. Milk formula is heavily depended upon by European parents as a primary or complementary source of nutrition, especially in the initial stages of infancy. It provides a convenient solution for working mothers, lactation-struggling mothers, or families desiring flexible feeding schedules. The region's product diversity including lactose-free, hypoallergenic, goat milk-based, and organic versions, serves specific dietary requirements and tastes. Moreover, the region's stringent quality and safety standards strengthen consumer confidence in milk formula products. Germany, France, and the UK are among the countries where premium and functional milk formulas supplemented with essential nutrients are gaining popularity. The dominance of the segment is also supported by high product visibility in pharmacies, supermarkets, and online channels, hence easily available across European homes.

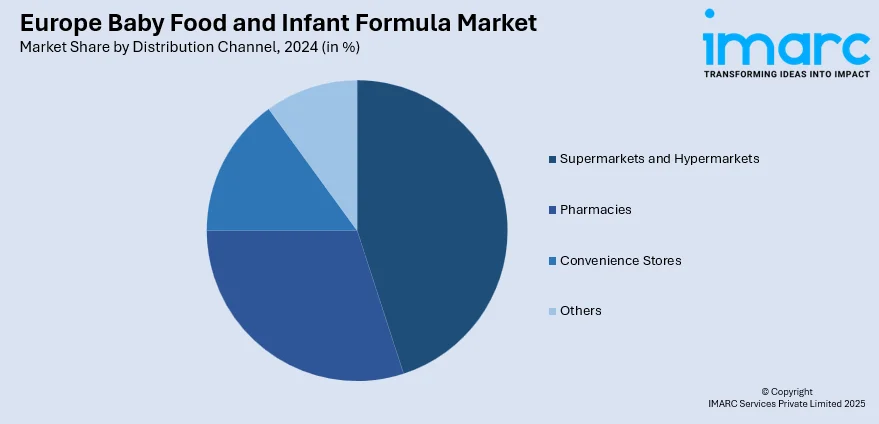

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

Supermarkets and hypermarkets lead the market share in 2024. Supermarkets and hypermarkets are the most popular distribution channel in the Europe infant formula and baby food market based on their extensive presence, convenience, and capacity to provide a wide range of products under one single roof. These formats appeal to busy parents who like to shop for household products and baby products at the same time. European supermarket retailers like Tesco, Carrefour, Lidl, and E.Leclerc usually carry a vast range of infant food and formula brands, from low-cost to high-end lines, to suit different consumer tastes and pocketbooks. In-store promotions, loyalty cards, and bulk discounts further induce parents to purchase through these mediums. Moreover, physical retail enables customers to read packaging, compare foodstuffs, and obtain in-store advice from shopworkers, which is a vital factor for first-time parents or new product triers. Besides the advantage of urban and rural accessibility, supermarkets and hypermarkets are still the most valued and chosen shopping channel throughout Europe.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, United Kingdom accounted for the largest market share. United Kingdom is the strongest regional segment of the Europe baby food and infant formula market due to high infant nutrition awareness, robust retail infrastructure, and changing parent preferences. UK consumers are extremely quality-conscious, preferring organic, clean-label, and fortified formulas with specific health requirements. The availability of many prominent local and foreign brands guarantees stable supply in both town and country areas. Furthermore, the UK has experienced growth in dual-income households where convenience is an important factor in shopping decisions, leading to increased demand for prepared meals and packaged baby food. Supermarkets, chemists, and online retailers such as Boots, Tesco, and Amazon UK support strong distribution courtesy of consumer confidence and accessibility. Furthermore, expanding multicultural influences mold varied dietary needs, and this spurs innovation in baby foods. These factors place the United Kingdom as a major growth point in the competitive Europe baby food and infant formula market space.

Competitive Landscape:

As per the Europe baby food and infant formula market forecast, several key players are essentially driving growth through a blend of product innovation, strategic collaborations, and sustainability efforts. Large players like Danone, Nestlé, HiPP, and Abbott are also emphasizing the creation of sophisticated formulas meeting changing consumer demands, including organic, lactose-free, hypoallergenic, and plant-based products. Brands are also pushing into functional ingredients such as probiotics, DHA, and key vitamins, promoting infant growth and meeting specific dietary needs. To address the increasing need for convenience, businesses are introducing single-serve packaging and ready-to-feed formats in accordance with the hectic lives of contemporary parents. Sustainability is another top priority, with major companies investing in environmentally friendly packaging, lowering carbon footprints, and promoting fair-sourcing practices. Several brands are also strengthening their online presence by way of e-commerce platforms and mobile apps, using subscription models and personal recommendation. Partnerships with infant specialists, nutritionists, and regulatory agencies further enhance customer confidence and product safety and conformity. With these collaborative initiatives, market leaders are not only gaining market share but also influencing consumer expectations in Europe, solidifying their positions as credible suppliers of superior quality baby food and infant formula in a highly competitive and health-driven market environment.

The report provides a comprehensive analysis of the competitive landscape in the Europe baby food and infant formula market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Else Nutrition launched its plant-based, dairy-free Toddler formula in the UK through distributor partnerships, marking its first entry into the European market. The BABY brand expanded its presence as part of its strategic global growth initiatives.

- July 2025: Kraft Heinz announced it had entered into an agreement to sell its Italian baby and specialty food business, including Plasmon, Nipiol, and Dieterba, to NewPrinces Group. The transaction, which included its Latina production facility, was expected to close by the end of 2025, pending regulatory approval.

- June 2025: Nestlé launched its new super premium baby formula, NAN Sinergity, containing six HMOs and B. infantis probiotics, positioning it as a major growth driver for 2025. The company described the baby product as groundbreaking, claiming it offered six clinically backed benefits inspired by breastmilk.

- May 2025: Organic baby food brand Little Freddie launched an exclusive 20‑strong product range—featuring puffs, biscuits, cereals and rice teethers—for the Middle East market as it marked its first anniversary there, and unveiled refreshed packaging by London’s Lewis Moberly to help parents shopping for their baby make informed choices.

- April 2025: Stonyfield Organic partnered with Ms. Rachel to launch the "O is for Organic" program and introduced YoBaby® No Added Sweeteners yogurt pouches for baby nutrition. The initiative promoted organic foods to support baby development through fun, educational content.

Europe Baby Food and Infant Formula Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe baby food and infant formula market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe baby food and infant formula market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the baby food and infant formula industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The baby food and infant formula market in Europe was valued at USD 10.24 Billion in 2024.

The Europe baby food and infant formula market is projected to exhibit a CAGR of 4.56% during 2025-2033, reaching a value of USD 15.6 Billion by 2033.

The Europe baby food and infant formula market is driven by rising health awareness, growing demand for organic and specialized nutrition, increased female workforce participation, and evolving parental preferences for convenience. Regulatory support and innovations in clean-label, functional, and allergen-free products further contribute to the market’s sustained growth and consumer trust.

United Kingdom accounts for the largest share in the Europe baby food and infant formula market, driven by growing parental focus on nutrition, rising demand for organic and allergen-free products, and the increasing number of working parents. Strong retail presence, health-conscious consumer behavior, and innovation in convenient feeding solutions further support consistent market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)