Europe Construction Market Size, Share, Trends and Forecast by Sector and Country, 2026-2034

Europe Construction Market Summary:

The Europe construction market size was valued at USD 3.72 Trillion in 2025 and is projected to reach USD 5.63 Trillion by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

The Europe construction market is experiencing steady growth driven by rapid urbanization, substantial infrastructure investments, and escalating demand for sustainable building practices. Government initiatives focused on green building standards and energy-efficient construction methods are reshaping industry dynamics across the region. Rising residential and commercial real estate demand, particularly in major economies, combined with ambitious transportation infrastructure projects, is propelling the Europe construction market share.

Key Takeaways and Insights:

-

By Sector: Residential construction dominates the market with a share of 38% in 2025, driven by persistent housing shortages across major urban centers and government initiatives aimed at increasing housing supply and improving energy efficiency in residential buildings.

-

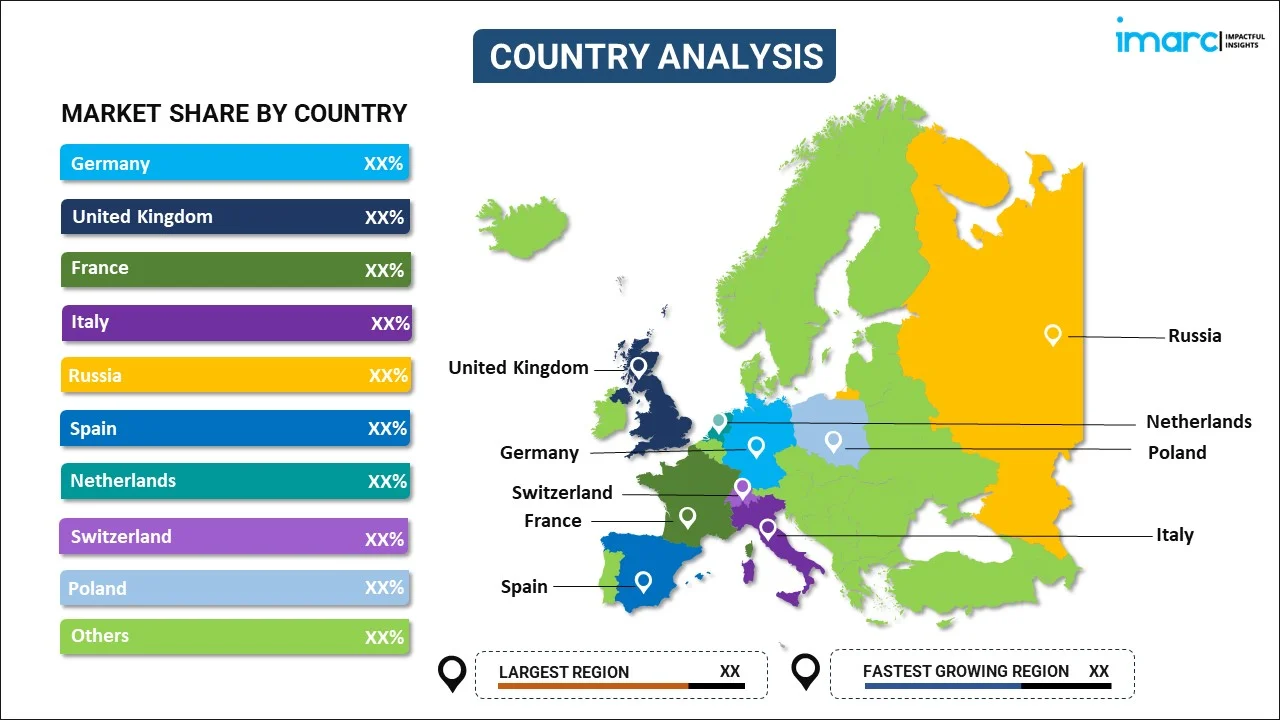

By Country: Germany leads the market with a share of 25% in 2025, supported by substantial investments in transport infrastructure, renewable energy projects, and the nation's strategic energy transition initiatives.

-

Key Players: The Europe construction market exhibits high competitive intensity, characterized by multinational corporations and regional contractors competing across residential, commercial, and infrastructure segments. Leading companies are focusing on digital transformation, sustainable construction practices, and strategic acquisitions to strengthen market positioning.

The Europe construction market represents a critical pillar of the regional economy, directly influencing employment, urbanization, and overall economic development. The sector is undergoing transformative changes driven by technological advancements, including Building Information Modeling adoption and prefabricated construction methods. In December 2025, the European Commission introduced a Construction Observatory report and a new Construction Products Regulation working plan to strengthen skills development, competitiveness, and sustainability across Europe’s construction sector. Environmental sustainability has emerged as a central focus, with substantial European Union investments directed toward building energy efficiency initiatives aligned with climate neutrality objectives. Major transportation infrastructure projects across the region demonstrate continued commitment to modernizing connectivity networks and enhancing cross-border mobility solutions.

Europe Construction Market Trends:

Accelerating Adoption of Sustainable and Green Building Practices

Environmental sustainability is becoming central to European construction as companies adopt eco-friendly materials, energy-efficient designs, and carbon-reduction strategies. In 2024, Wienerberger opened a modernized brick plant in Austria featuring the world’s largest electric kiln, cutting production emissions by around 90% while reducing energy use. Growing emphasis on green building certifications, renewable energy integration, and stricter EU efficiency directives is accelerating the shift toward low-impact construction and supporting Europe’s construction market growth.

Digital Transformation and Technology Integration

Construction companies across Europe are embracing digital technologies to enhance project efficiency, coordination, and long-term infrastructure management. Building Information Modeling implementation is becoming standard practice, enabling improved collaboration between architects, engineers, and contractors. In May 2025, Swiss startup Scalera.ai raised $6.5 million to scale its AI construction platform, automating procurement, supplier assessment, and subcontractor coordination. Advanced technologies including artificial intelligence, Internet of Things sensors, and cloud computing platforms are transforming project delivery processes, reducing costs, and minimizing construction timelines while improving overall quality outcomes.

Rising Prominence of Modular and Prefabricated Construction

Modular construction is gaining strong momentum across Europe as builders seek to address labor shortages, shorten project timelines, and improve quality control. According to reports, MBI’s World of Modular Europe conference in Madrid brought together nearly 200 industry leaders from 29 countries and launched its first European chapter in Italy, underscoring rising collaboration in off-site construction. Factory-based manufacturing cuts waste, boosts precision, and supports faster, more sustainable residential and commercial development.

Market Outlook 2026-2034:

The Europe construction market outlook remains positive, supported by continued government investment in infrastructure modernization, residential housing development, and renewable energy integration projects. Industry participants are expected to prioritize sustainability initiatives, digital innovation, and workforce development to address evolving market demands. The transition toward net-zero emissions buildings and climate-resilient infrastructure will drive significant capital allocation across the forecast period. The market generated a revenue of USD 3.72 Trillion in 2025 and is projected to reach a revenue of USD 5.63 Trillion by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

Europe Construction Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Sector | Residential Construction | 38% |

| Country | Germany | 25% |

Breakup by Sector:

To get detailed segment analysis of this market Request Sample

- Commercial Construction

- Residential Construction

- Industrial Construction

- Infrastructure (Transportation) Construction

- Energy and Utility Construction

The residential construction dominates with a market share of 38% of the total Europe construction market in 2025.

Residential construction represents the largest sector within the European construction market, driven by persistent housing shortages across major urban centers and government initiatives aimed at increasing housing supply. The segment benefits from sustained demand for multi-family housing developments as urbanization accelerates across the region. In March 2025, the EIB and European Commission launched a pan-European investment platform planning €10 billion to fund affordable, sustainable housing, energy-efficient construction, and innovative building projects across member states.

Energy efficiency requirements are transforming residential construction practices, with minimum energy-performance mandates driving deep-retrofit works across existing housing stock. Several national governments have restarted climate-friendly loan programs to boost green residential construction and support sustainable development objectives. Modular construction techniques are increasingly being integrated into residential developments across major European cities to expedite housing delivery while maintaining quality standards. The elevation of housing affordability as a core European policy priority signals continued focus on expanding residential construction activity across member states.

Breakup by Country:

To get detailed regional analysis of this marketRequest Sample

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

Germany exhibits a clear dominance with a 25% share of the total Europe construction market in 2025.

Germany represents Europe's largest construction market, benefiting from substantial infrastructure modernization investments and ambitious energy transition initiatives. The construction and infrastructure sector accounts for a significant portion of Germany's GDP, surpassing contributions from several other European nations. The federal government has committed to substantial investments in transport infrastructure and renewable energy projects, including ambitious offshore wind power installation targets. Multiple offshore wind projects have been awarded to develop installations in coastal regions, demonstrating commitment to renewable energy infrastructure development.

Despite facing challenges including declining building permits and rising insolvency proceedings within the construction sector, Germany's infrastructure needs remain substantial, driving continued investment in roads, railways, and digital infrastructure. European investment institutions have committed significant funding to support local renewable energy component manufacturers within Germany. Transportation infrastructure projects, including railway modernization and highway upgrades, continue receiving priority funding as the nation addresses its significant infrastructure investment requirements through sustained public and private sector collaboration.

Market Dynamics:

Growth Drivers:

Why is the Europe Construction Market Growing?

Substantial Government Investment in Infrastructure Development

European governments are allocating unprecedented resources toward infrastructure modernization, transportation network enhancement, and renewable energy integration. The European Commission has announced plans to invest substantial funding in selected transport infrastructure projects through EU grants from the Connecting Europe Facility. In September 2025, Cobra IS and Elecnor won a €1.77 billion Rail Baltica contract to electrify 870 km across the Baltics, marking Europe’s largest ongoing rail electrification project. The majority of allocated funds are directed toward projects improving sustainability and efficiency of key transportation networks, including railroads, inland waterways, and marine routes of the trans-European transport network. National infrastructure investment plans spanning multiple years emphasize transportation network modernization and railway expansion projects across member states.

Rising Focus on Sustainable Construction and Green Building Initiatives

The European Union's commitment to achieving climate neutrality is driving massive investments in sustainable construction practices and green building certifications. Climate action initiatives require substantial annual investments for greenhouse gas reduction, with significant allocations directed toward upgrading building stocks and reducing carbon emissions. In November 2025, Skanska started Nowy Rynek C in Poznań, Poland’s first net-zero office, fully renewable-powered and LEED Platinum–certified, showcasing large-scale energy-neutral construction by leading firms. Countries across Europe are implementing stringent energy efficiency regulations that mandate adoption of renewable energy systems and sustainable materials in new construction. Net-zero energy consumption requirements for new buildings are significantly influencing architectural design and material selection across the construction industry.

Persistent Housing Demand and Urban Development Requirements

Continued urbanization and population growth across European metropolitan areas are generating sustained demand for residential and commercial construction. Major cities face significant housing shortages, prompting governments to implement stimulus packages and affordability initiatives. In December 2025, the European Commission launched the European Affordable Housing Plan to expand sustainable, high-quality homes across the EU through simplified aid, increased construction, and public-private investment. European investment institutions have pledged substantial funding for affordable housing projects targeting housing units across the region. Urban regeneration projects are transforming post-industrial zones, while mixed-use developments combining residential, commercial, and recreational facilities are reshaping city centers and driving construction activity.

Market Restraints:

What Challenges the Europe Construction Market is Facing?

Persistent Labor Shortages and Skills Gaps

The European construction industry faces chronic workforce shortages, with labor costs and availability ranking as the sector's most pressing challenges. Rising wages are compressing contractor margins while limiting project execution capacity. Governments are addressing gaps through reskilling initiatives and relaxed visa regimes, but demographic trends continue constraining labor supply across the region.

Elevated Material Costs and Supply Chain Disruptions

Construction material prices remain elevated following global supply chain disruptions, impacting project budgets and profit margins. Increased costs for steel, concrete, timber, and specialized building materials are creating financial pressures across the value chain. Companies are adapting through long-term supplier agreements and alternative material sourcing strategies.

Complex Regulatory Environment and Permitting Delays

Stringent regulatory requirements and lengthy permitting processes are extending project timelines and increasing development costs. Evolving environmental regulations require continuous adaptation of construction practices and compliance investments. Complex permit processes and shifting policies pose challenges for project planning and execution across multiple jurisdictions.

Competitive Landscape:

The Europe construction market demonstrates high competitive fragmentation, with large multinational corporations, mid-sized national firms, and numerous small local contractors competing across residential, commercial, industrial, and infrastructure segments. Leading market participants dominate large-scale public and private projects through diversified portfolios spanning construction, concessions, and energy services. The industry is characterized by intense bidding processes, particularly for publicly funded infrastructure initiatives, where technical expertise, cost-efficiency, and sustainability credentials play decisive roles. Companies are increasingly investing in digital construction technologies, sustainable building solutions, and strategic acquisitions to enhance competitive positioning and market share.

Recent Developments:

-

In December, STRABAG SE announced its order backlog exceeded €30 billion for the first time in 9M 2025, driven by major infrastructure and energy projects across Europe, signaling strong demand despite mixed regional markets and ongoing challenges. The company also reported a 6% increase in output, underscoring robust growth prospects for its core business units.

Europe Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Commercial Construction, Residential Construction, Industrial Construction, Infrastructure (Transportation) Construction, Energy and Utility Construction |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe construction market size was valued at USD 3.72 Trillion in 2025.

The Europe construction market is expected to grow at a compound annual growth rate of 4.70% from 2026-2034 to reach USD 5.63 Trillion by 2034.

Residential construction holds the largest share of 38% in the Europe construction market due to persistent housing shortages, government stimulus packages, urban regeneration initiatives, and energy efficiency mandates driving renovation and new development activities.

Key factors driving the Europe construction market include substantial government infrastructure investments, rising focus on sustainable construction practices, persistent housing demand, technological advancement adoption, and ambitious renewable energy integration projects.

Major challenges include persistent labor shortages and skills gaps, elevated material costs, complex regulatory environments, lengthy permitting processes, and economic uncertainties affecting private sector investment across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)