Europe Lactic Acid Market Size, Share, Trends and Forecast by Raw Material, Form, Application, and Region, 2025-2033

Europe Lactic Acid Market Overview:

The Europe lactic acid market size reached 0.45 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 0.88 Million Tons by 2033, exhibiting a growth rate (CAGR) of 7.70% during 2025-2033. The market is witnessing significant growth, driven by rising demand in food and beverages, personal care, and bio-based lactic acid. Expanding applications in bioplastics and packaging are also fueling this trend, supported by consumer preference for sustainable products and increased industrial use across multiple sectors.

Key Market Trends & Insights:

- The Europe lactic acid market is projected to grow at a CAGR of 7.70% from 2025-2033.

- By application, the market is segmented into industrial, food and beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others.

Market Size & Forecast:

- 2024 Market Size: 0.45 Million Tons

- 2033 Projected Market Size: 0.88 Million Tons

- CAGR (2025-2033): 7.70%

Europe Lactic Acid Market Trends:

Increasing Demand for Bio-Based Lactic Acid

An increased demand for bio-based lactic acid represents one of the key factors driving the European lactic acid market growth. With the growing significance of sustainability in industries, there's an observable shift towards renewable and green production methods. Bio-based lactic acid is produced from renewable raw materials such as corn and sugarcane; hence, it is seen to have a low environmental impact as compared to petrochemical-derived lactic acid. More so, the European Union has introduced encouraging policies for bio-based products, such as the Green Deal and the Circular Economy Action Plan. These policies enforce conditions that promote biobased and renewable materials in various sectors like pack food like textiles. For instance, in May 2024, CBE JU announced that it has awarded €215 million to 396 beneficiaries for circular bio-based project implementation, such as bio-based lactic acid. Such projects replaced fossil-based products and encouraged innovative ways of less reliance or imports and ring jobs, as ring jobs are high in rural areas.Increasingly, manufacturers have been working on greener methods of production by working with renewable resources and waste. The increased pressure to meet carbon footprints and sustainability goals has also increased the requests for lactic acid sourced from natural resources. Such demands have also received support from advances in fermentation technology as ways to increase the efficiency of bio-based lactic acid production. There will be increasing future potentials in the demand of bio-based lactic acid as firms and customers will continuously prefer sustainable ways of carrying out their activities in various industries; thus, resulting in many eco-conscious formulations in products.

Expanding Application in Bioplastics and Packaging

Another key trend affecting the European lactic acid industry is the increased usage of lactic acid in bioplastics and packaging applications. Lactic acid bio-based material, polylactic acid (PLA), helps consumers to adopt the biodegradable form of plastic due to its environmentally friendly characteristics. For example, in 2024, Emigrates Biotech announced that it has awarded Sulzer, the Swiss industrial and manufacturing firm, the technology for the implementation of the forthcoming plant to produce 160,000 tonnes of PLA in the UAE, indicative of the venture being the largest worldwide. The plant intends to utilize feedstock from plant sources to produce bioplastics sustainably. The growing trend confirms that the industry is utilizing more PLA in its packaging materials. PLA has many advantages, one of which is that it is compostable and does not leave any harmful residues, promoting its use in applications like packaging. Most noticeable is demand from both sectors, food and beverage, as these companies are slowly shifting toward compostable and recyclable packaging solutions. European legislation, like the EU's single-use plastic ban, and the Circular Economy Action Plan, push companies to search for alternatives to plastic packaging. Lactic acid-based bioplastics, like PLA, can be positioned as a key solution to control plastic waste and increase recycling rates. These regulatory frameworks are expected to continue driving growth in lactic acid applications in packaging. New improvements in the material properties, including high thermal endurance and enhanced mechanical strength, broaden the usage potential of PLA in many more applications outside packaging, for example, in the automotive and textile sectors. This expanding application range continues to reinforce the importance of lactate and lactic acid as key building blocks in the development of future sustainable polymers across Europe.

Increasing Application in Food & Beverage Industry

The expansion of the lactic acid market in Europe is still primarily driven by the food and beverage industry. In processed foods, dairy products, baked goods, and drinks, lactic acid is frequently employed as a flavoring agent, pH regulator, and preservative. Lactic acid is now positioned as a desirable substitute for synthetic chemicals as a result of manufacturers' adoption of organically derived additives prompted by consumers' growing desire for clean-label products. In many formulations, maintaining lactic acid normal levels is essential to ensure product stability, safety, and consistent taste. Its use in fermented foods and beverages has gained traction due to growing consumer awareness of gut health and probiotics. Furthermore, the use of lactic acid as a food additive (E270) is approved by EU regulatory organizations, guaranteeing its safe incorporation into a number of product categories. Consumption of lactic acid has also increased due to the demand for organic and plant-based foods, especially in vegan cheeses, yogurts, and meat alternatives. Lactic acid is essential in contemporary food compositions because it can prolong shelf life without sacrificing flavor or nutritional content. The food and beverage industry's reliance on lactic acid is predicted to continue to be strong throughout the region as consumer behavior gradually shifts towards sustainable and health-conscious consumption.

Expansion of Personal Care and Pharmaceutical Applications

The European lactic acid market is benefiting significantly from rising demand in the personal care and pharmaceutical sectors. Lactic acid’s exfoliating and moisturizing properties make it a key active ingredient in skincare products such as creams, serums, lotions, and chemical peels. With the shift toward natural, biodegradable ingredients in cosmetics, formulators across Europe are increasingly opting for bio-based lactic acid over synthetic alternatives. It is particularly favored in anti-aging and sensitive skin formulations due to its gentle and effective profile. From a regulatory standpoint, the European Chemicals Agency (ECHA) recognizes lactic acid as safe for use in personal care, further reinforcing its adoption. In pharmaceuticals, lactic acid is used in intravenous solutions, drug delivery systems, and biodegradable polymers for implants and controlled-release formulations. The growing emphasis on patient safety and product sustainability aligns well with the advantages lactic acid offers. Consumer trends favoring clean beauty and eco-conscious pharmaceuticals continue to influence product innovation across the region. This has driven interest in biologically compatible ingredients like lactate lactic acid, further expanding lactic acid's role in these sectors and creating a stable, long-term growth path for suppliers and manufacturers within the European market.

Shift Towards Green Chemistry Solutions

Sustainability has become a central theme in European industrial strategy, and the shift toward green chemistry is a major driver for lactic acid market expansion. Derived through fermentation of renewable resources like corn and sugarcane, lactic acid aligns well with Europe’s low-carbon and circular economy goals. Industries are under increasing pressure to reduce dependence on petrochemical-based inputs and adopt environmentally friendly production processes. These efforts are expected to significantly contribute to the growth of the lactic acid European market size 2025, reflecting strong demand across multiple sectors. Lactic acid is also a critical precursor in the synthesis of polylactic acid (PLA), a biodegradable bioplastic. With stringent EU regulations on single-use plastics and growing public demand for sustainable packaging, PLA adoption is on the rise—indirectly boosting lactic acid consumption. The chemical’s low toxicity and biodegradability make it an ideal component for use in green manufacturing practices across sectors including food processing, agriculture, textiles, and industrial cleaning. Government-backed initiatives and funding programs to support bioeconomy projects are further encouraging the use of renewable chemicals like lactic acid. Based on Europe lactic acid market forecast, the push for decarbonization in Europe’s industrial sector has created a favorable environment for companies investing in green chemistry. This transition supports long-term demand for bio-based lactic acid, positioning it as a central element in the region’s evolving materials and sustainability landscape.

Europe Lactic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on raw material, form, and application.

Raw Material Insights:

To get more information on this market, Request Sample

- Corn

- Sugarcane

- Cassava

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes corn, sugarcane, cassava, and others.

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

Application Insights:

- Industrial

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, food and beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others.

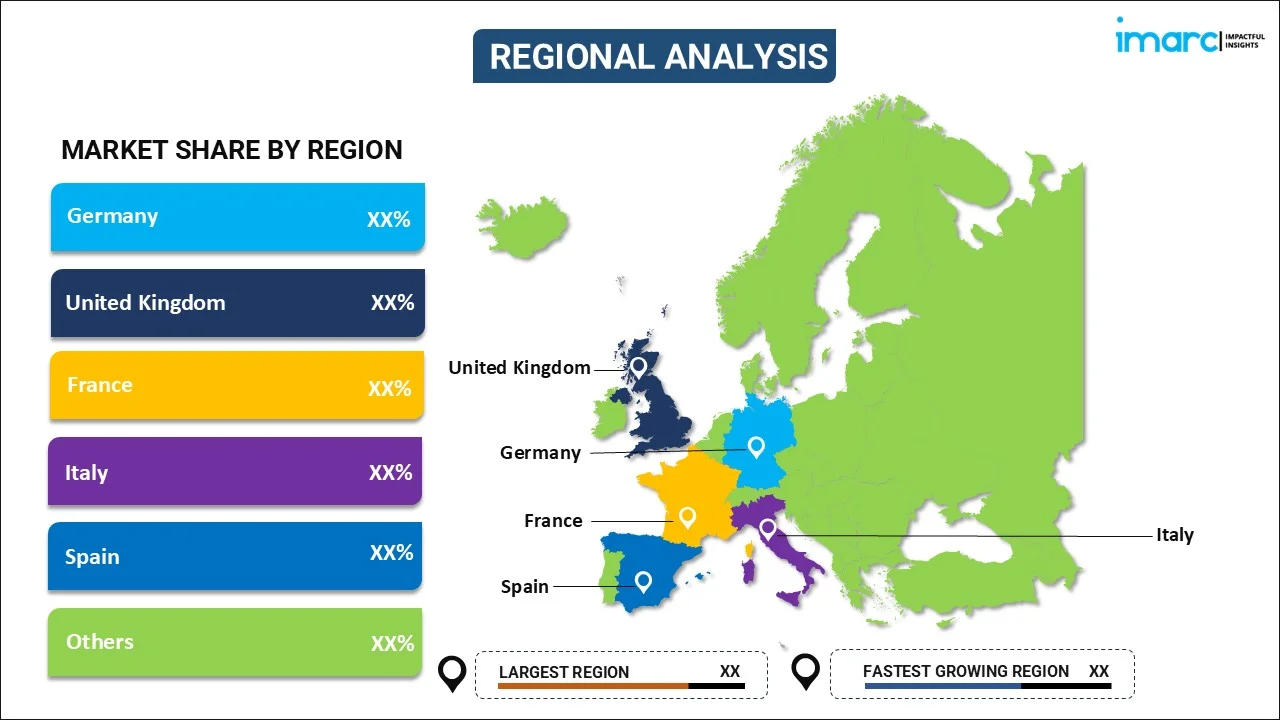

Regional Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, United Kingdom, Italy, Spain, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Europe Lactic Acid Market News:

- March 2025: Futerro began engineering its European biorefinery in Saint-Jean-de-Folleville, France, focusing on lactic acid, lactide, and PLA production. This project advanced green chemistry efforts, supported bio-based material demand, and strengthened Europe’s lactic acid supply chain, driving regional market growth and sustainability adoption.

- November 2024: Corbion showcased its lactic acid-based preservative solutions at Fi Europe in Frankfurt. Targeting meat, poultry, and plant-based sectors, the innovations supported food safety, shelf-life extension, and waste reduction, reinforcing lactic acid’s role in sustainable food preservation across the European market.

- November 2024, TripleW, a pioneer in circular chemistry, relocated its demonstration plant to the NextGen Demo site at the Port of Antwerp. The project, focused on producing lactic acid from food waste, supports the transition to a circular, climate-neutral economy. The port also launched a call for innovative companies.

- December 2023, Sulzer launched SULAC™, a new technology for lactide production, completing its portfolio for manufacturing PLA, an eco-friendly bioplastic. SULAC™ converts lactic acid to lactide, addressing supply limitations. The technology enhances operational efficiency and enables PLA producers to create high-quality, sustainable biopolymer grades, supporting circular plastics.

Europe Lactic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Corn, Sugarcane, Cassava, Others |

| Forms Covered | Liquid, Solid |

| Applications Covered | Industrial, Food and Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), Others. |

| Regions Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe lactic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe lactic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe lactic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lactic acid market in Europe was valued at 0.45 Million Tons in 2024.

The Europe lactic acid market is projected to exhibit a CAGR of 7.70% during 2025-2033, reaching a value of 0.88 Million Tons by 2033.

Key factors driving the Europe lactic acid market include rising demand for natural food preservatives, growth in bioplastics like PLA, expansion in personal care and pharmaceutical applications, regulatory support for sustainable products, and increasing focus on green chemistry and bio-based manufacturing across multiple industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)